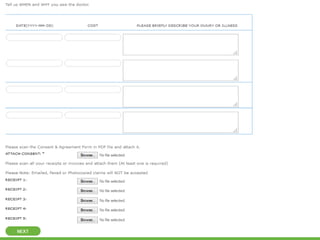

This document provides information about guard.me international health insurance. It discusses why comprehensive emergency health insurance is needed when traveling abroad, and outlines guard.me's unique features like worldwide coverage, speedy claims processing, and insured security evacuation. The document also reviews how to purchase guard.me coverage and what to do in case of a claim.