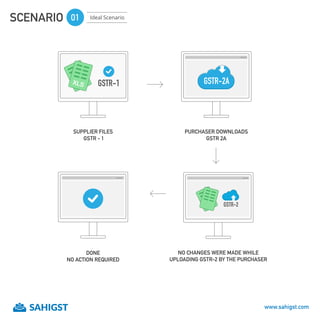

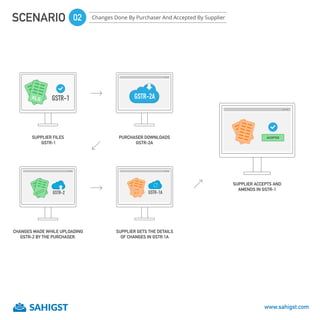

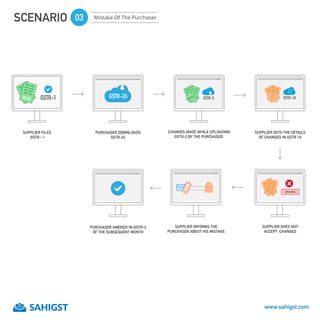

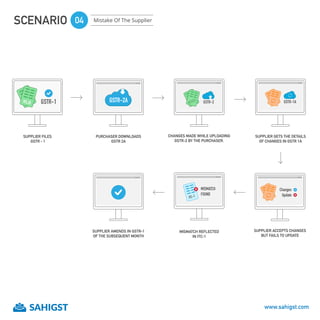

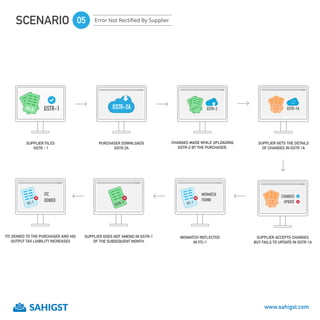

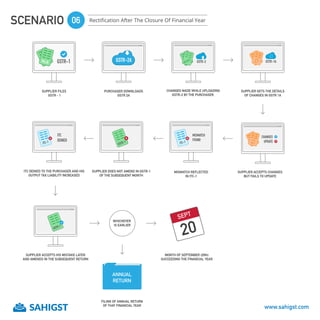

The document outlines various scenarios regarding the filing and amendment of GST returns, detailing the processes for suppliers and purchasers under different situations. Scenarios include ideal conditions, mistakes made by purchasers or suppliers, and the consequences of failing to rectify errors, such as ITC mismatches. It emphasizes the importance of timely amendments to ensure compliance and reduce tax liability.