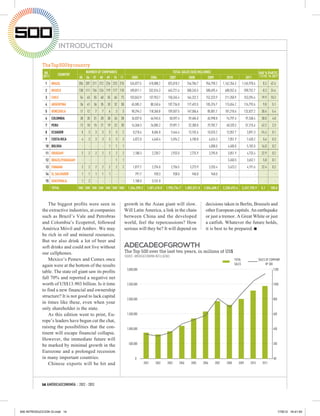

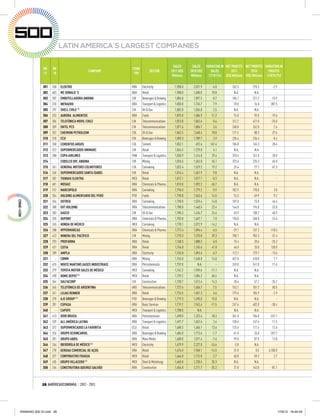

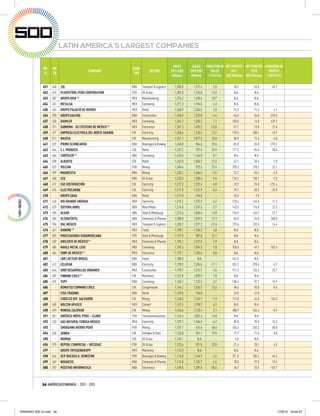

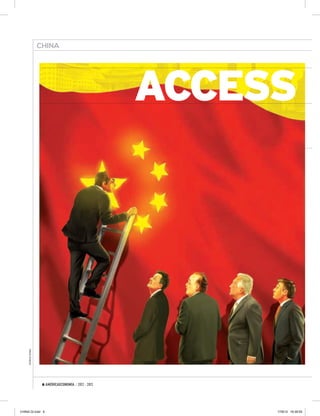

The document discusses the economic landscape in Latin America, highlighting the growth of major companies and the challenges they face in expanding into markets like China. It emphasizes the importance of innovation amid a commodity-driven boom and the need for Latin American businesses to adapt to changing consumer demands and regulatory environments. Additionally, it explores the complexities of building successful partnerships in international markets, particularly in relation to industrial production and technology transfer.

![CHINA

But trying to enter with more elaborate in China in the 1950s under Mao. Some Mexican firms fell into this

products and services can prove a head- Chilean businessman Andrónico trap. Cemex spent years announcing its

ache. “In China, it is often unclear how Luksic, whose family controls Madeco, expansion into China but instead wa-

one can make things work,” says BCG’s regrets the decision sell his business in gered on the US housing boom. Today

Michael David. “It is a huge and very China. “It´s a shame; if we had stayed it is licking its wounds. In February,

diverse country and it’s no use relying we´d have hit the jackpot”, he says. Lorenzo Zambrano announced that

on the support of one well-connected Impatience is leading mining firm the cement giant now has permits and

individual.” Vale and steelmaker Gerdau, both from a local partner. Leopoldo Cedillo, CEO

Embraer is an interesting example Brazil, to drop some investments in China. of auto-parts maker Metalsa recently

in this respect. Its Chinese operations Vale´s plans to become the world’s largest announced that the company will enter

were headed by Guan Dongyuan, an mining company ran into a Chinese Wall, in China within five years.

engineer with degrees from the Univer- when it tried, but failed, to open an iron Latin American impatience is com-

sity of Sao Paulo and the China Europe ore distribution center in China. “They pounded by Chinese ignorance. “Latin

International Business School. He was don’t say no, America lacks

previously a representative of the min- but they take visibility,”

ing company Vale in China. Will his a long time says David

Guanxi prove as strong as than that of to respond,” who opened

Jianwei Zhang, chairman of Canada’s says Jose Car- BCG’s Shang-

Bombardier, Embraer’s eternal rival los Martins, hai office in

in regional jets? An engineer from the Vale’s direc- 1992. “The

University of Tianjin, Zhang was a tor of mar- region would

municipal civil servant between 1975 keting, sales benefit greatly

and 1982. He completed an MBA at the and strategy. from student

University of Montreal and obtained a “Time passes exchanges

doctorate in administration from the and the mo- with China

same institution, before joining Bom- ment comes

bardier. Bombardier recently signed a when you just give

Pollo Campero and by send-

ing more cultural and

deal with Commercial Aircraft Corp of up.” wanted to open culinary products.”

China (COMAC) to enter the market for Marcelo Claure, But this has not

narrow-body aircraft with 100-149 seats, Brightstar´s Bolivian 500 restaurants been easy either. Pol-

similar to those its Brazilian rival was

not authorized to produce. The agree-

founder, has failed to

replicate its cellphone

in China. Today it lo Campero, Latin

America’s most in-

ment surprised many analysts. “It is a distribution business in has none. ternational fast-food

deal which does not make any sense the enormous Chinese chain, failed to break

[for Bombardier],” says Teal Group’s market. “He lacks the the Chinese market,

Abulafia. patience to deal with following the same

However, some interpret the agree- the red-tape,” says a colleague. recipe which has brought it success from

ment with Bombardier as pure Guanxi. David agrees that it is an error to think India to the United States. It opened its

The Canadians´ real interest in China of China as a market which “is waiting first restaurant in Shanghai in 2007, but

lies with its railroad division which has for you and your products.” Dozens of plans to open 500 restaurants within

signed juicy contacts for metro systems foreigners and local firms are compet- five years did not proper. Today Pollo

in Guanzhou and Shenzhen, a train line ing in an economy which is anything Campero has no restaurants in China

for Beijing airport and for high velocity but Third World. (see box on previous page).

trains. “Relations are crucial in China,” “China is not a backwater backward That’s bad news for Latin America’s

says Bombardier CEO Pierre Beadoin in market,” he warns. “Many companies industrial ambition: unless we change

a corporate video. “To achieve long-term made the mistake of delaying their strategy and become more patient, Latin

success, one must have patience.” plans to enter China, believing that it America’s relationship with China will

And the Canadians have been very was too early. Today they realize that continue to be based on exporting raw

patient: Bombardier struck its first deal it is too late.” materials. ■

10 AMÉRICAECONOMÍA / 2012 - 2013

CHINA GI.indd 10 17/8/12 16:40:30](https://image.slidesharecdn.com/globalissue2012-2013-121017083356-phpapp02/85/Global-issue-2012-2013-12-320.jpg)