Getting started with regression

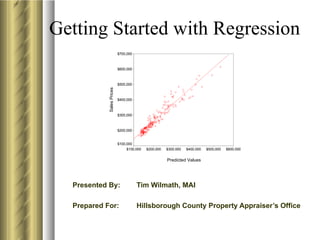

- 1. Getting Started with Regression $700,000 $600,000 $500,000 Sales Prices $400,000 $300,000 $200,000 $100,000 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 Predicted Values Presented By: Tim Wilmath, MAI Prepared For: Florida IAAO

- 2. History of Regression James Galton created Regression Analysis in 1885 when he was attempting to predict a person’s height based on the height of his or her parent.

- 3. History of Regression Galton found that children born to tall parents would be shorter than their parents - and children born to short parents would be taller than their parents. Both groups of children regressed toward the mean height of all children.

- 4. Uses of Regression Predicting the Weather

- 5. Uses of Regression Predicting Election Results

- 6. Uses of Regression Predicting Sales Prices

- 7. What is Regression? When Regression Analysis is used to predict sales prices or establish assessments it becomes an Automated Sales Comparison Approach

- 8. Steps in Regression 1. Data Exploration and cleanup 2. Specifying the model 3. Calibrating the model 4. Interpreting the results

- 9. Data Exploration & Cleanup Is there a pattern suggesting a relationship between variables? 800000 700000 Note the outliers. 600000 These will adversely SALES PRICE 500000 affect our final values 400000 if we don’t deal with 300000 200000 them now 100000 0 0 1000 2000 3000 4000 5000 6000 7000 HEATED AREA Because of the potential for extreme values to influence the mean, modelers often remove or “trim” extreme values.

- 10. Model Specification Specifying the model means picking the appropriate equation and which variables that will be used. Models can be: • Additive - Most common for residential properties • Multiplicative- Often used for land valuation • Hybrid - Most advanced We are going to use an Additive Model in this presentation

- 11. Regression Components Dependent Variable: • Sales Price Independent Variables: • Size • Age • Location • Condition • Lot size • Construction • Quality • Amenities

- 12. Simple Regression Simple Regression includes one Dependent Variable (sales price) and only one Independent Variable - such as Square Footage. 500000 400000 SALES PRICE 300000 200000 100000 Using this model, a 1,000 sf home would 0 0 1000 2000 3000 4000 5000 be valued at $75,000 HEATED AREA

- 13. Simple Regression Simple Regression using only size as the independent variable will predict sales prices, however, it will treat all homes with the same size equally. 1,000 square feet - $75,000 1,000 square feet - $75,000?

- 14. Multiple Regression We know square footage is an important variable but what other variables should we include and how do we decide? Effective Age Actual Age View

- 15. Correlation Analysis Pearson’s Correlation tells you the degree of relationships between variables. Correlations SALEPRICE BLDSIZE BEDROOMS DOCK SALEPRICE Pearson Correlation 1 0.855 0.557 0.142 Sig. (2-tailed) . 0 Notice the high 0 0 N 1367 1367 1367 1367 correlation between BLDSIZE Pearson Correlation 0.855 1 0.659 0.062 sales price and size Sig. (2-tailed) 0. 0 0.021 N 1367 1367 1367 1367 BEDROOMS Pearson Correlation 0.557 0.659 1 0.037 Sig. (2-tailed) 0 0. 0.176 N 1367 1367 1367 1367 DOCK Pearson Correlation 0.142 0.062 0.037 1 Sig. (2-tailed) 0 0.021 0.176 . little Very N 1367 1367 1367 1367 correlation between sales price and dock Correlation Analysis also helps identify “Collinearity”, which is a correlation between 2 independent variables. For example, the living area of a home is highly correlated to the number of bedrooms. It would only be necessary to have one of these variables in the model.

- 16. Regression Equations Y=mx+b Y = b0 + b1 X1 + b2 X2 + . . . + bK XK

- 17. Running Regression Statistical Software makes using Regression much easier, performing the necessary calculations quickly and accurately. Let’s Run This!

- 18. Regression Results Model 1 The Output tells us how good our model is working Model Summary The closer the Adjusted R Std. Error of the Model R R Square Square EstimateR-Square Adj. is to “1” 1 .855(a) .732 .731 25406.53266545 the better a Predictors: (Constant), BLDSIZE And - it gives us the coefficients (or adjustments) Coefficients(a) Unstandardized Coefficients Standardized Coefficients $6,838 Model B Std. Error Beta t + Bldsize x $75.07 Sig. 1 (Constant) 6838.585 2195.717 3.115 .002 BLDSIZE 75.068 1.231 .855 60.997 = Property Value .000 a Dependent Variable: SALEPRIC The adjusted R2 statistic measures the amount of total variation explained by the Regression Model. It ranges from 0.00 to 1.00 with 1.00 being the desired value. A high number, say 0.910 means that approximately 91% of the value can be explained by the model.

- 19. Regression Results The output includes the coefficient and the “Constant” Coefficients(a) Standardized Unstandardized Coefficients Coefficients Model B Std. Error Beta t Sig. 1 (Constant) 6838.585 2195.717 3.115 .002 BLDSIZE 75.068 1.231 .855 60.997 .000 a Dependent Variable: SALEPRIC The “Constant” represents the un-explained value that is not included in the model.

- 20. Running Regression Let’s add another variable to the model - Say Land Size Let’s run this model and see if results improve.

- 21. Regression Results Model 2 Our Adj. R2 went up from Model Summary .731 to .801! Adjusted R Std. Error of the Model R R Square Square Estimate 1 .895(a) .801 .801 21864.78975921 a Predictors: (Constant), LANDSF, BLDSIZE We also have new coefficients (or adjustments) Coefficients(a) $6,119 Standardized Unstandardized Coefficients Coefficients + Bldsize x $72.66 Model B Std. Error Beta t Sig. 1 (Constant) 6119.232 1889.914 3.238 .001 BLDSIZE 72.660 1.065 .828 68.237 .000 + Landsf x $0.382 LANDSF .382 .017 .266 21.887 .000 a Dependent Variable: SALEPRIC = Property Value

- 22. Running Regression Let’s add Age to the model If Age is significant to value, the model should improve. Let’s run it.

- 23. Regression Results Model 3 Model Summary Adjusted R Std. Error of the Model R R Square Square Estimate Adj. Our R2 went up from 1 .912(a) .832 .832 20114.04445033 a Predictors: (Constant), AGE, LANDSF, BLDSIZE .801 to .832! Notice the age coefficient is negative Coefficients(a) Unstandardized Coefficients Standardized Coefficients $22,855 Model B Std. Error Beta t Sig. + Bldsize x $67.28 1 (Constant) 22855.587 2036.809 11.221 .000 BLDSIZE 67.276 1.037 .767 64.856 .000 + Landsf x $0.44 LANDSF .444 .017 .309 26.868 .000 AGE -630.763 39.991 -.189 -15.773 .000 + Age x ($630.76) a Dependent Variable: SALEPRIC = Property Value

- 24. Running Regression Let’s add Building Quality to the model We may have a problem. Let’s run it and see.

- 25. Regression Results Model 4 Our Adj. R2 went up from Model Summary .832 to .854 after Adjusted R Std. Error of the adding quality, but Model R R Square Square Estimate 1 .924(a) .854 .853 18784.15717760 a Predictors: (Constant), QUAL, LANDSF, AGE, BLDSIZE Notice the constant is now negative - that’s not good! Coefficients(a) Standardized Unstandardized Coefficients Coefficients What do we do with this Model B Std. Error Beta t Sig. 1 (Constant) BLDSIZE -45723.503 5199.675 -8.794 .000 quality adjustment? 59.808 1.103 .681 54.234 .000 LANDSF .445 .015 .309 28.831 .000 AGE -605.886 37.388 -.182 -16.205 .000 QUAL 26110.420 1842.475 .171 14.171 .000 a Dependent Variable: SALEPRIC

- 26. Regression Results Coefficients(a) Standardized Unstandardized Coefficients Coefficients Model B Std. Error Beta t Sig. 1 (Constant) -45723.503 5199.675 -8.794 .000 BLDSIZE 59.808 1.103 .681 54.234 .000 LANDSF .445 .015 .309 28.831 .000 AGE -605.886 37.388 -.182 -16.205 .000 QUAL 26110.420 1842.475 .171 14.171 .000 a Dependent Variable: SALEPRIC Quality Resulting Adjustment This doesn’t make 1 - Fair = 1 x $26,110 = $26,110 sense because the 2 - Average = 2 x $26,110 = $52,220 3 - Good = 3 x $26,110 = $78,330 codes 1,2,3, etc. 4 - Excellent = 4 x $26,110 = $104,440 were not meant 5 - Superior = 5 x $26,110 = $130,550 to be a rank

- 27. A Note about Data Types There are 3 primary types of property Characteristics: • Continuous: Based on a size or measurement. Examples: Square Footage or Lot Size • Discrete: Specific pre-defined value. Examples: Roof Material, Building Quality • Binary: Either the item is present or not Examples: corner location, Lakefront Location

- 28. Transformations To solve the problem we need to convert the “discrete” variable Quality into individual “binary” variables which allows Regression to distinguish each type: Fair - Yes/No Average - Yes/No “Quality” BECOMES Good - Yes/No Excellent - Yes/No Superior - Yes/No

- 29. Running Regression Now that we have transformed the variable Quality we can put it back in the model Notice we left “Average” out

- 30. Regression Results Our Adj. R2 went up from Model Summary Model 5 .832 to .869. Adjusted R Std. Error of the Model R R Square Square Estimate 1 .933(a) .870 .869 17717.09739523 a Predictors: (Constant), SUPERIOR, EXCEL, AGE, FAIR, GOOD, LANDSF, BLDSIZE Coefficients(a) Standardized Unstandardized Coefficients Coefficients Model B Std. Error These Quality Beta t Sig. 1 (Constant) 35633.753 1922.792 18.532 .000 BLDSIZE 58.537 1.045 adjustments .667 56.031 .000 LANDSF .419 .016 .291 26.342 .000 AGE -625.742 35.363 -.188 -17.695 .000 FAIR -25511.289 8693.178 are all relative to -.031 -2.935 .003 GOOD 21095.623 1838.228 .127 11.476 .000 EXCEL SUPERIOR 75844.967 12720.934 “Average” .059 5.962 .000 305671.839 18494.059 .169 16.528 .000 a Dependent Variable: SALEPRIC

- 31. Running Regression Let’s transform Neighborhood into a binary and add it to the model Notice we left out the“Base” Neighborhood (the most typical)

- 32. Regression Results Model 6 Our Adj. R2 went up from Model Summary .869 to .874. Adjusted R Std. Error of the Model R R Square Square Estimate 1 .936(a) .875 .874 17391.93018134 a Predictors: (Constant), NB211006, BLDSIZE, EXCEL, FAIR, SUPERIOR, NB211002, NB211001, NB211005, AGE, LANDSF, GOOD, NB211003 Coefficients(a) Standardized Unstandardized Coefficients Coefficients Model 1 (Constant) B Std. Error Beta These Neighborhood t Sig. 40799.859 2299.668 17.742 .000 BLDSIZE 56.000 1.143 .638 48.980 .000 LANDSF AGE .423 -671.493 .016 37.221 .294 -.201 25.753 -18.041 adjustments .000 .000 FAIR -33476.331 8602.963 -.041 -3.891 .000 GOOD EXCEL 17371.495 72617.618 2023.937 12567.147 .105 .057 are all relative to 8.583 5.778 .000 .000 SUPERIOR 313444.055 18313.237 .173 17.116 .000 NB211001 NB211002 14199.881 -3514.034 2321.457 1657.862 .070 -.025 6.117 -2.120 our “Base” .000 .034 NB211003 -1483.623 1244.877 -.015 -1.192 .234 NB211005 NB211006 4044.357 1915.755 2266.186 2601.773 .021 .008 1.785 Neighborhood .736 .075 .462 a Dependent Variable: SALEPRIC

- 33. Running Regression Multiplicative Transformations combine two variables into one Square Footage x Quality = SQFT1 Reflects the fact that quality may contribute greater value in larger homes and less value in smaller homes. In other words, without combining these variables, all Good Quality homes get the same adjustment regardless of their size. Let’s add this new combined variable to the model. Since we combined SF and Quality, we remove them as stand-alone variables

- 34. Regression Results Our Adj. R2 went up from Model Summary Model 7 .874 to .879. Adjusted R Std. Error of the Model R R Square Square Estimate 1 .938(a) .880 .879 17065.96846831 a Predictors: (Constant), SQFT5, SQFT4, AGE, NB211002, SQFT2, SQFT1, NB211006, NB211001, NB211005, LANDSF, NB211003, SQFT3 Coefficients(a) Standardized Unstandardized Coefficients Coefficients Model B Std. Error Beta t Sig. 1 (Constant) 43999.158 2299.663 Notice the adjustments 19.133 .000 LANDSF .418 .016 .291 25.996 .000 AGE -660.473 36.505 -.198 -18.092 .000 NB211001 10975.273 2335.844 went from fixed dollar .054 4.699 .000 NB211002 -3611.418 1624.028 -.026 -2.224 .026 NB211003 NB211005 -1250.573 6350.688 1221.119 2243.206 -.013 .033 -1.024 2.831 amounts to .306 .005 NB211006 1923.311 2554.324 .008 .753 .452 SQFT1 SQFT2 21.119 53.673 8.533 1.169 .026 .723 “per square foot” 2.475 45.916 .013 .000 SQFT3 63.139 1.074 .964 58.806 .000 SQFT4 77.267 3.557 .210 21.720 .000 SQFT5 108.100 2.941 .356 36.759 .000 a Dependent Variable: SALEPRIC

- 35. Advanced Transformations Exponential transformations - Raise variable to a power Land Size x .75 = LAND75 Reflects the principle of diminishing returns. The unit price of land tends to decrease as size increases. Without this transformation land would get the same adjustment, regardless of size. Raising land size to the power of .75 reflects the curve shown below. SINGLE FAMILY LOT PRICES $2.85 $2.80 PRICE PER SF $2.75 $2.70 $2.65 $2.60 $2.55 $2.50 $2.45 $2.40 00 00 00 00 50 00 10 00 00 00 0 0 0 0 00 00 00 00 50 50 53 56 57 58 58 58 70 90 11 15 20 30 LOT SIZE

- 36. Running Regression Let’s add our new transformed land variable to the model

- 37. Regression Results Our Adj. R2 went up from Model 8 .879 to .881. Model Summary Adjusted R Std. Error of the Model R R Square Square Estimate 1 .939(a) .882 .881 16919.04533480 a Predictors: (Constant), LAND75, NB211005, NB211001, SQFT4, NB211002, SQFT5, SQFT1, AGE, SQFT2, NB211006, NB211003, SQFT3 Coefficients(a) Standardized Unstandardized Coefficients Coefficients Model B Std. Error Beta t Sig. 1 (Constant) 40782.649 2277.915 17.903 .000 AGE -731.178 36.549 -.219 -20.005 .000 NB211001 10061.900 2314.108 .050 4.348 .000 NB211002 -3196.888 1609.968 -.023 -1.986 .047 NB211003 -1646.847 1211.025 -.017 -1.360 .174 NB211005 6714.691 2224.018 .035 3.019 .003 NB211006 -5595.936 2625.622 -.024 -2.131 .033 SQFT1 30.298 8.324 .038 3.640 .000 SQFT2 51.834 1.167 .698 44.421 .000 SQFT3 60.732 1.081 .927 56.177 .000 SQFT4 71.516 3.559 .194 20.094 .000 SQFT5 104.644 2.937 .345 35.625 .000 LAND75 12.233 .459 .314 26.668 .000 a Dependent Variable: SALEPRIC

- 38. Running Regression Let’s add garages, pools, and baths just to round out our model.

- 39. Regression Results Our Adj. R2 went up from Model 9 .881 to .895. Model Summary(b) Adjusted R Std. Error of the Model R R Square Square Estimate 1 .947(a) .897 .895 15854.87728402 Coefficients(a) Standardized Unstandardized Coefficients Coefficients Model B Std. Error Beta t Sig. 1 (Constant) 29680.695 2885.532 10.286 .000 AGE -705.817 38.491 -.212 -18.337 .000 NB211001 12374.064 2176.815 .061 5.684 .000 NB211002 -1094.891 1527.977 -.008 -.717 .474 NB211003 -938.838 1136.671 -.010 -.826 .409 NB211005 12639.946 2139.489 .066 5.908 .000 NB211006 852.109 2535.266 .004 .336 .737 SQFT1 31.388 7.815 .039 4.016 .000 SQFT2 44.166 1.365 .595 32.349 .000 SQFT3 52.939 1.265 .808 41.857 .000 SQFT4 60.447 3.561 .164 16.974 .000 SQFT5 94.723 2.943 .312 32.186 .000 LAND75 11.788 .433 .303 27.240 .000 BATHS 7714.093 1338.204 .076 5.765 .000 POOL 13359.275 1184.469 .105 11.279 .000 GARAGE 10.750 3.137 .038 3.427 .001 a Dependent Variable: SALEPRIC

- 40. Regression Results Coefficients(a) Standardized Unstandardized Coefficients Coefficients Model B Std. Error Beta t Sig. 1 (Constant) 35633.753 1922.792 18.532 .000 BLDSIZE 58.537 1.045 .667 56.031 .000 LANDSF .419 .016 .291 26.342 .000 AGE -625.742 35.363 -.188 -17.695 .000 FAIR -25511.289 8693.178 -.031 -2.935 .003 GOOD 21095.623 1838.228 .127 11.476 .000 EXCEL 75844.967 12720.934 .059 5.962 .000 SUPERIOR 305671.839 18494.059 .169 16.528 .000 a Dependent Variable: SALEPRIC The “Beta” value in column 4 indicates the partial correlation of the variable. It is used in stepwise regression in deciding which variable to add next.

- 41. Regression Results The significance of each variable to the model can be determined by looking at the “t” values. Rule of Thumb: Coefficients(a) Standardized “t” scores should Unstandardized Coefficients Coefficients Model B Std. Error Beta t be 2.0 or greater Sig. 1 (Constant) 29680.695 2885.532 10.286 .000 AGE -705.817 38.491 -.212 -18.337 .000 NB211001 12374.064 2176.815 .061 5.684 .000 NB211002 -1094.891 1527.977 -.008 -.717 .474 NB211003 -938.838 1136.671 -.010 -.826 .409 NB211005 12639.946 2139.489 .066 5.908 .000 NB211006 852.109 2535.266 .004 .336 .737 SQFT1 31.388 7.815 .039 4.016 .000 SQFT2 44.166 1.365 .595 32.349 .000 SQFT3 52.939 1.265 .808 41.857 .000 SQFT4 NB211002 60.447 3.561 .164 16.974 .000 SQFT5 94.723 2.943 .312 32.186 .000 LAND75 NB211003 11.788 .433 .303 27.240 .000 BATHS 7714.093 1338.204 .076 5.765 .000 POOL NB211006 13359.275 1184.469 .105 11.279 .000 GARAGE 10.750 3.137 .038 3.427 .001 are insignificant a Dependent Variable: SALEPRIC

- 42. Regression Results Coefficients(a) Standardized Unstandardized Coefficients Coefficients Model B Std. Error Beta t Sig. 1 (Constant) 35633.753 1922.792 18.532 .000 BLDSIZE 58.537 1.045 .667 56.031 .000 LANDSF .419 .016 .291 26.342 .000 AGE -625.742 35.363 -.188 -17.695 .000 FAIR -25511.289 8693.178 -.031 -2.935 .003 GOOD 21095.623 1838.228 .127 11.476 .000 EXCEL 75844.967 12720.934 .059 5.962 .000 SUPERIOR 305671.839 18494.059 .169 16.528 .000 a Dependent Variable: SALEPRIC The “t-statistic” is calculated by dividing the coefficient of a variable by its standard error. For example: for the variable BLDSIZE, the “t-statistic” is calculated as follows: 58.537 / 1.045 = 56.0

- 43. Regression Results Model Summary(b) Adjusted R Std. Error of the Model R R Square Square Estimate 1 .947(a) .897 .895 15854.87728402 The “Standard Error of the Estimate” in the regression model tells us how much a sale estimate will vary from its actual value. This number alone is meaningless unless related to the average sales price in the sale sample. Dividing the Standard Error by the Average SalesPrice produces the Coefficient of Variation (COV) $15,854 / $134,043 = 11.82% COV

- 44. Regression Options “Enter” is the default regression method in most statistical software programs. This method includes all variables “entered” by the modeler. “Stepwise” multiple regression automatically eliminates redundant or insignificant variables. Coefficients(a) Model: 4 Notice that Stepwise Standardized Unstandardized Coefficients Coefficients B Std. Error Beta t Regression Sig. (Constant) 28624.283 2584.025 11.077 .000 AGE NB211001 -697.862 37.689 -.209 “kicked out” the -18.516 .000 12794.553 2071.093 .063 6.178 .000 NB211005 13302.885 1969.163 .069 6.756 .000 SQFT1 SQFT2 31.406 44.305 7.797 1.354 .039 .597 neighborhoods that had 4.028 32.723 .000 .000 SQFT3 53.134 1.249 .811 42.525 .000 SQFT4 60.544 3.557 .164 17.023 .000 SQFT5 94.884 2.924 .313 low “t-scores" 32.446 .000 LAND75 11.891 .393 .305 30.243 .000 BATHS 7732.836 1332.987 .076 5.801 .000 POOL 13317.394 1179.165 .105 11.294 .000 GARAGE 10.586 3.047 .037 3.474 .001 a Dependent Variable: SALEPRIC

- 45. Creating New Assessments Once you have calibrated your model, the Regression software allows you to predict the new values (or assessments) using the coefficients (or adjustments) you created.

- 46. Reviewing Ratio Statistics Once the new assessments are created using our final model, we can review the accuracy of our new values using traditional ratio statistics. Ratio Statistics for ASSESS Unstandardized Predicted Value / SALEPRIC Weighted Mean 1.000 Price Related Differential 1.008 Coefficient of Dispersion .079 Coefficient of Variation Mean Centered 11.1% Median Centered 11.2%

- 47. Valuing the Population Valuing the population requires transforming the same variables you used in the model, then applying the coefficients to those variables. This can be done internally within some CAMA systems, using Microsoft Excel or other spreadsheet software, or within the regression software. Valuing the population is one of the most difficult aspects of regression modeling because changes in the physical attributes of any one parcel often requires re-running the entire model and re-calculating values.

- 48. Conclusion Predicting assessments using Regression requires the appraiser to: • Explore data to determine relationships and cleanup outliers • Specify which model and variables will be used • transform variables and run regression • Review Results, modify or add variables • Create predicted assessments and review ratio statistics • Value Population using final coefficients

- 49. The End 500000 400000 SALE PRICES 300000 200000 100000 0 0 100000 200000 300000 400000 500000 Predicted Values

Editor's Notes

- * 07/16/96 * ##