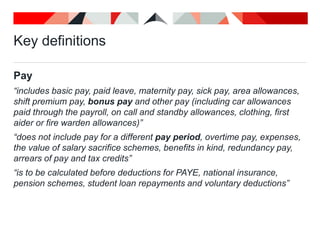

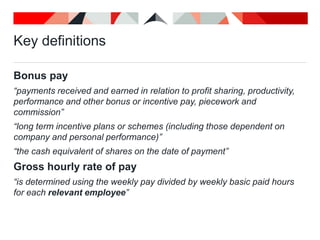

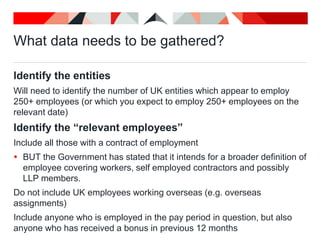

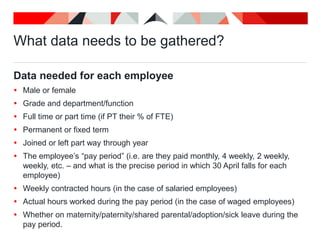

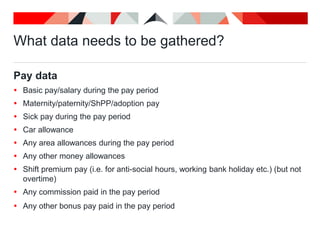

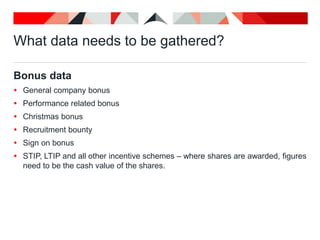

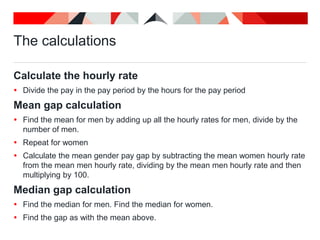

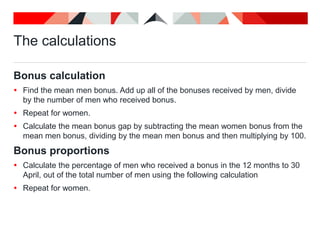

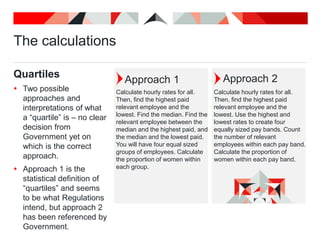

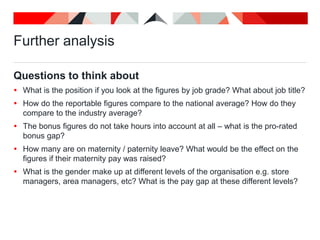

From October 2016, employers with 250 or more employees must report gender pay gap statistics including mean and median pay gaps, bonus gaps, and quartile data annually. Key definitions are outlined for relevant employers and employees, with specific data required for each employee concerning pay and bonuses. Additional analysis is advised to contextualize figures, and employers are encouraged to prepare by conducting preliminary assessments and clarifying employee classifications.