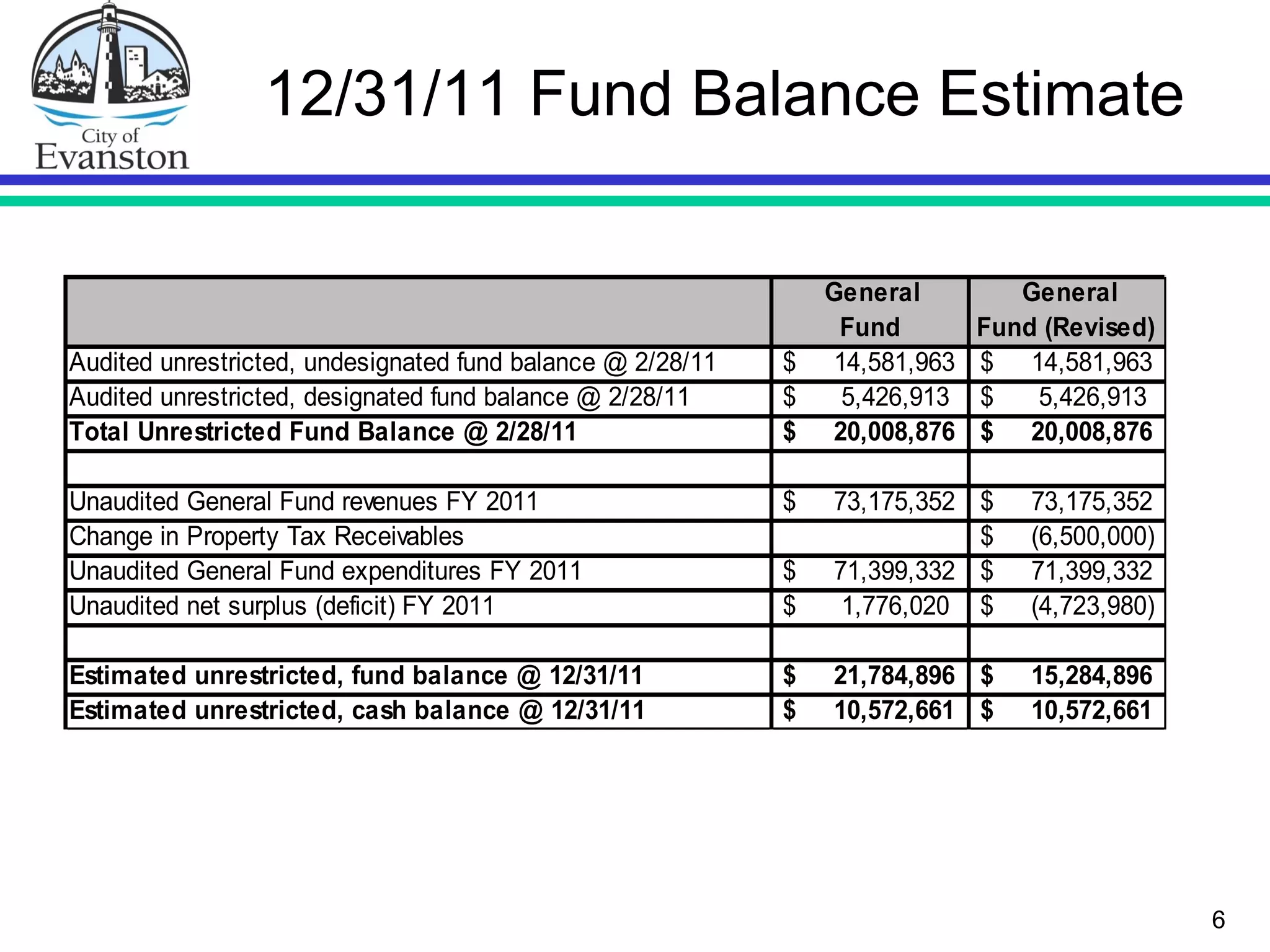

The document summarizes the city's financial performance for fiscal year 2011. It reports that while general fund revenues were slightly below budget, expenditures were below budget, resulting in a $1.8 million surplus. Several other funds also saw favorable variances. However, lower than expected grants negatively impacted some funds like capital improvement. Enterprise funds like parking, water and sewer saw surpluses, while solid waste had a deficit. Pension funding remains a concern going forward.