This document provides an analysis and valuation of Luk Fook Holdings (International) Limited (LF), a major Hong Kong and China jewelry retailer. Various valuation models are applied, including comparable companies analysis, discounted dividend model, residual income model, and abnormal earnings growth model. Key assumptions like long-term growth rate and dividend payout ratio are adjusted. The analysis identifies inventory level and gold price as primary business drivers for LF given its large inventory holdings. An ultimate target price of HK$16.93 is arrived at by synthesizing the different valuation results.

![2016-2017 Semester 1

ACCT3114 Report-Silver

5

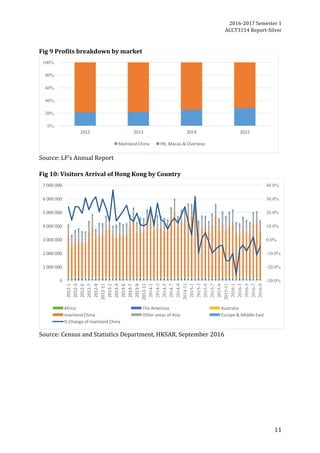

change is a result of the slow-down economy in mainland China and the decrease of

tourists to HK.

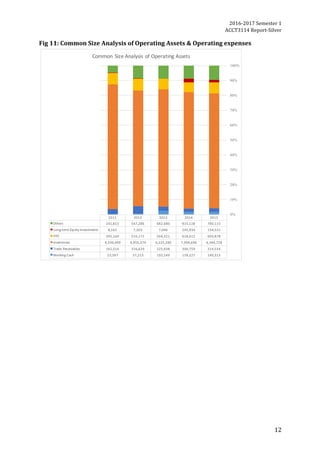

When we further decompose ROCE to investigate the impact of leverages, it is not

surprised to observe that those effects are relatively insignificant since LF has a very

small proportion of liabilities [Fig 11]. Change of financial leverage(“FLEV”) remains

stable and merely adds on small increase as 0.33%. Instead, return on net operating

assets(“RNOA”) and return on operating assets(“ROOA”) are the major drivers of ROCE.

Consequently, breaking down RNOA and ROOA are crucial to look for value drivers.

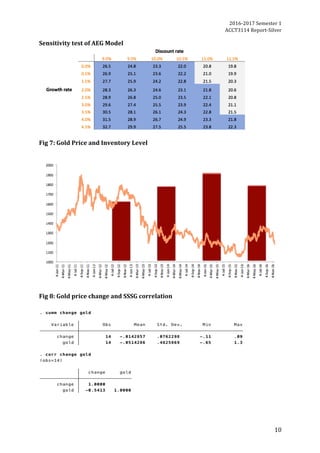

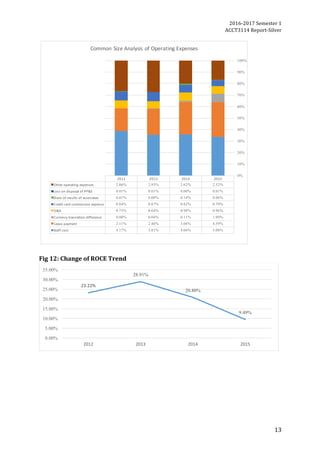

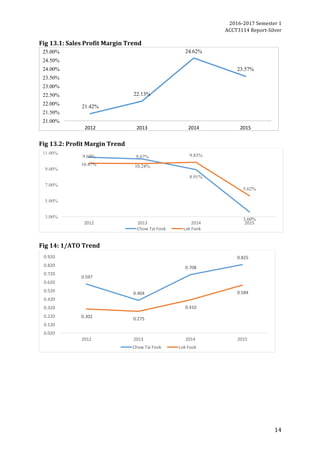

When it comes to RNOA, profit margin and asset turnover are decisive components,

particularly driven by core business. Within LF’s 13.37% decrease of RNOA in 2015,

drop from core income from sales takes up 11.66%. Decomposing profit margin, we

observe that the sales profit margin of the company is relatively stable, even slightly

increased in recent two years, probably caused by the rising sales of gem-set (Fig 12).

However, since the growing selling and administration costs, the bad performance of

the associate and the loss in hedging instruments, the profit margin of the most recent

year drops in year 2015 compared to a relatively stable rate at around 9.7% in previous

years (Fig 13). Further investigation into core income from sales shows that decrease in

core profit margins and asset turnover contribute 6.54% and 5.11% respectively. In

other words, assets used to generate same amount of core operating sales are rising

year by year, mostly caused by the climbing inventory turnover, which closely related to

the the number of visitors to HK and gold price (Fig14).

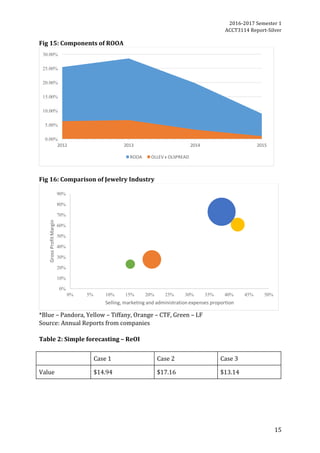

Besides, if breaking down RNOA to investigate the impact of ROOA, operating liability

leverage (“OLLEV”) and operating liability spread(“OLSPREAD”), ROOA is also the

dominant factor in determining RNOA (Fig 15). For one thing, operating income

decrease drives down the return. For the other thing, the rise in operating assets

enlarges the base. More specifically, the financial drag from associate accounts for the

growing amount in “interests in associates”, “loans to associates” and “amount due from

associates” which recorded as assets on the balance sheet of LF. Consequently, the

combination effect of both operating income and operating asset results in consecutive

decline of ROOA in recent years.

Residual earnings growth is also driven by the change in common share equity(“CSE”),

which can be explained by two components which are change in net operating

assets(“NOA”) and change in NFA. In 2015, growth of NOA turned negative after a two-

year increase. Previous analysis breaking down into profit margin and asset turnover

explained the change in sales growth that affect NOA. Moreover, it is also caused by

decrease of long-term investment and inventory. On the other hand, the growth of NFA

turned positive attributed to the sharp reduction on bank borrowing in 2015.

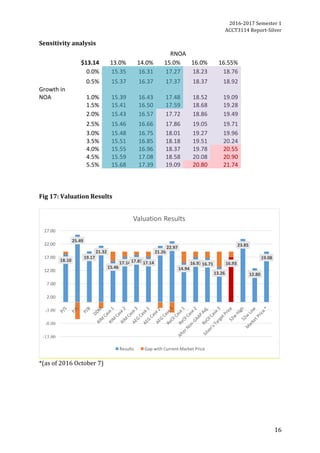

In addition, we further compare some key indicators with other well-known jewelry

brands in the world. In terms of gross profit margin, jewelry brands such as Pandora

and Tiffany that rely more on gem-sets are higher than brands like LF and CTF whose

main focus is gold products. Also, the high selling expenses which includes marketing

expenses are also high for these two brands, probably also contributes to a higher

margin (Fig 16).](https://image.slidesharecdn.com/78f82477-ef2a-4d72-a1d3-ae1f26b2baf1-170207144225/85/Full-Report_Silver-7-320.jpg)