The document is an application form for transferring an employee's provident fund (EPF) account between employers in India. [1] It requests that the EPF balance and family pension fund membership details be transferred from the previous employer's account to the present one. [2] The form collects information such as the employee and employers' names and addresses, EPF account numbers, dates of joining and leaving employment, and other details necessary to process the account transfer. [3]

![For Office Use only.

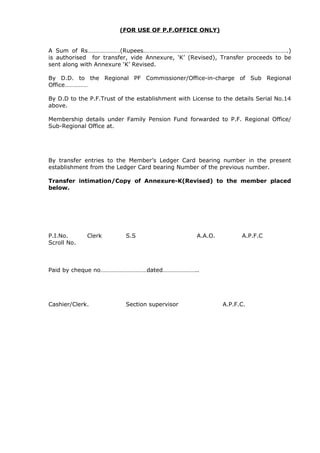

Date.Seal/Reg.No……….

FORM-13 (Revised)

THE EMPLOYEES’ PROVIDENT FUND SCHEME,1952

(Para 57)

[ Application for Transfer of EPF Account]

Note: (1) To be submitted by the member to the present employer for onward

transmission to the Commissioner, EPF by whom the transfer is to be effected.

(2) In case the P.F. transfer is due from the P.F. Trust of an exempted

establishment, the application should be sent direct by the employer to the

P.F.Trust of the exempted establishment with a copy to the RPFC concerned

for details of the Family Pension membership.

To To

The Commissioner, M/s

Employees’ Provident Fund,

(To be filled in, if Note(2) above is applicable)

Sir,

I request that my Provident Fund balance along with the Membership details in

Family Pension Fund may be please be transferred to my present account under

intimation to me. Necessary particulars are furnished below.

1. Name :

2. Father’s/Husband’s name :

(in case of married women)

3. Name & Address of previous

employer :

4. EPF account number with previous :

employer

5. By whom the P.F.Account of the Regional P.F.Commissioner Name of Trust.

previous is kept.

6. E.P.F. Account number with previous :

Employer (If allotted a separate one)

7. Date of joining with the previous :

employer.

(a) Date of leaving service with the

previous employer.

8. Date of joining the present employer :

(a) Date of birth of the member :

Date: Signature/Left Hand Thumb impression of the Member](https://image.slidesharecdn.com/form-13r-090731013936-phpapp01/75/Form-13-R-1-2048.jpg)