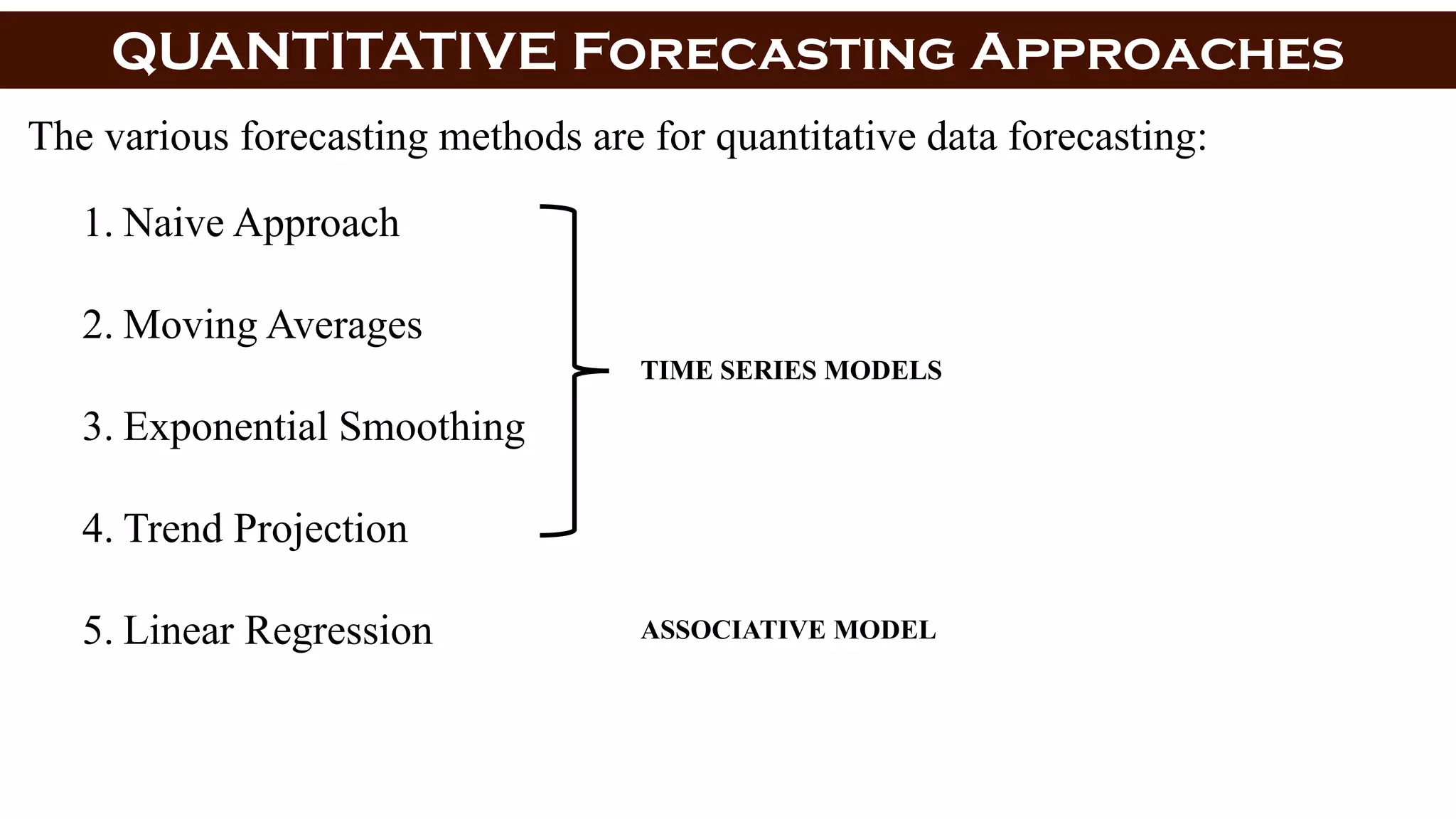

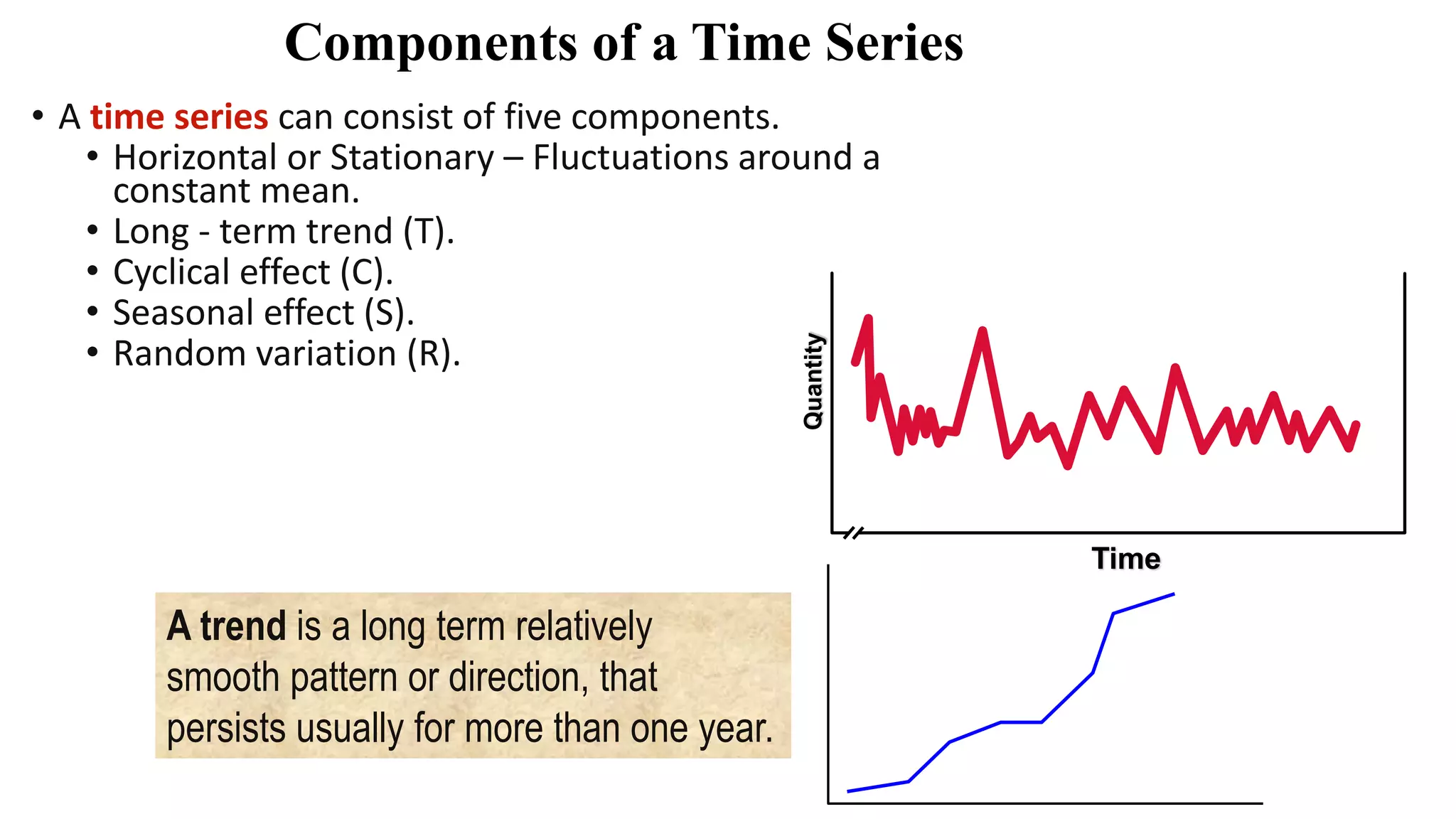

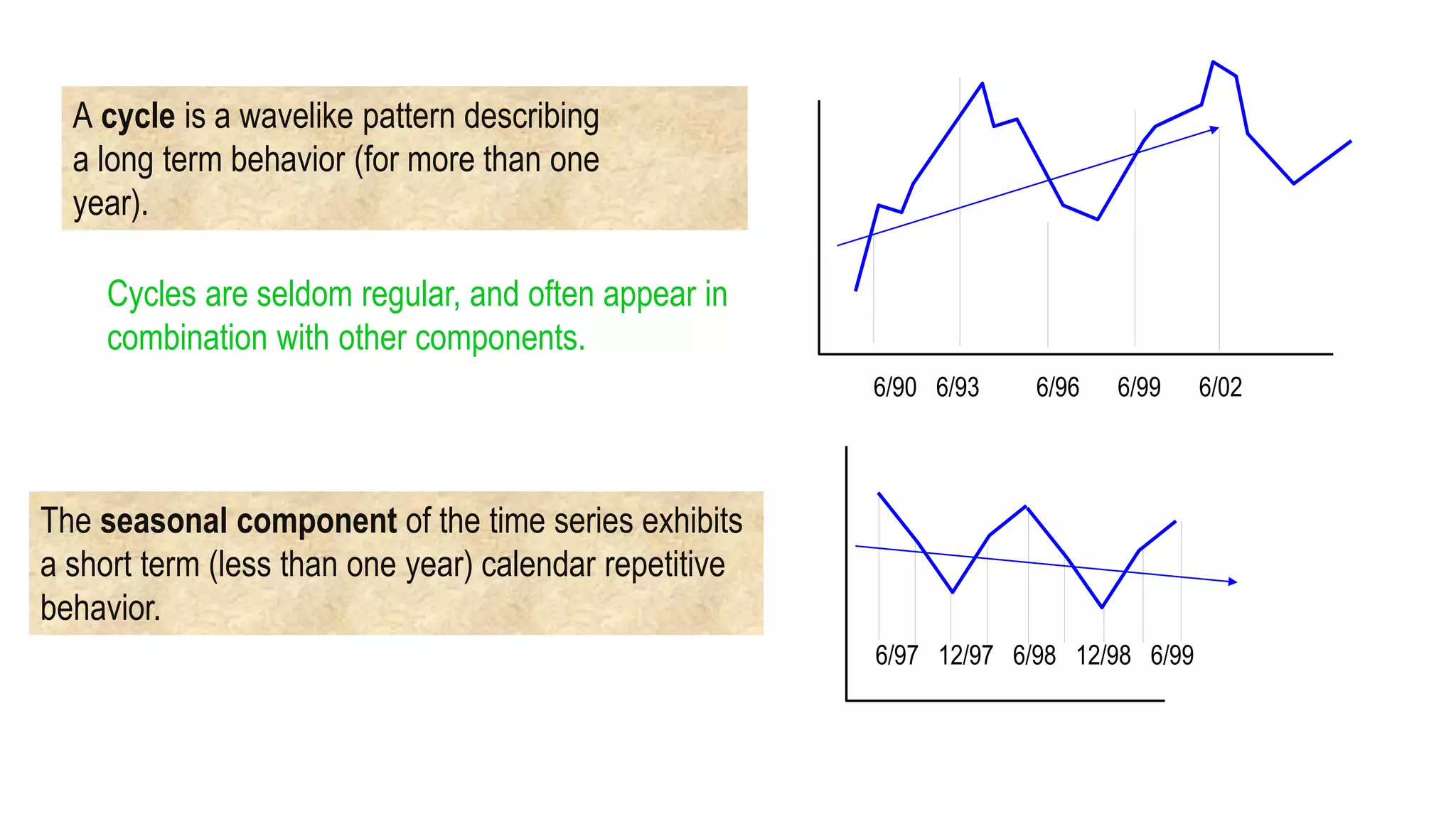

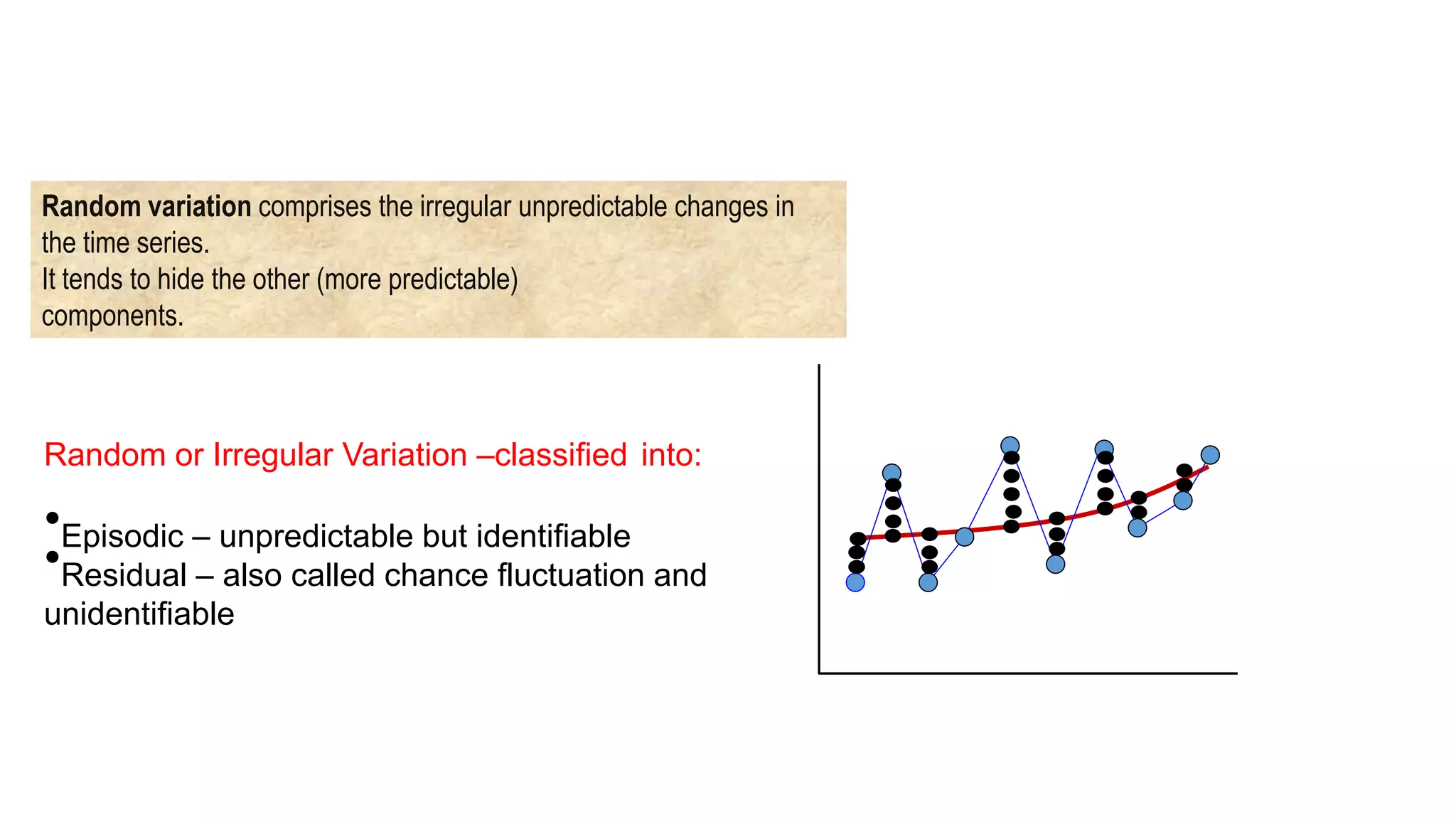

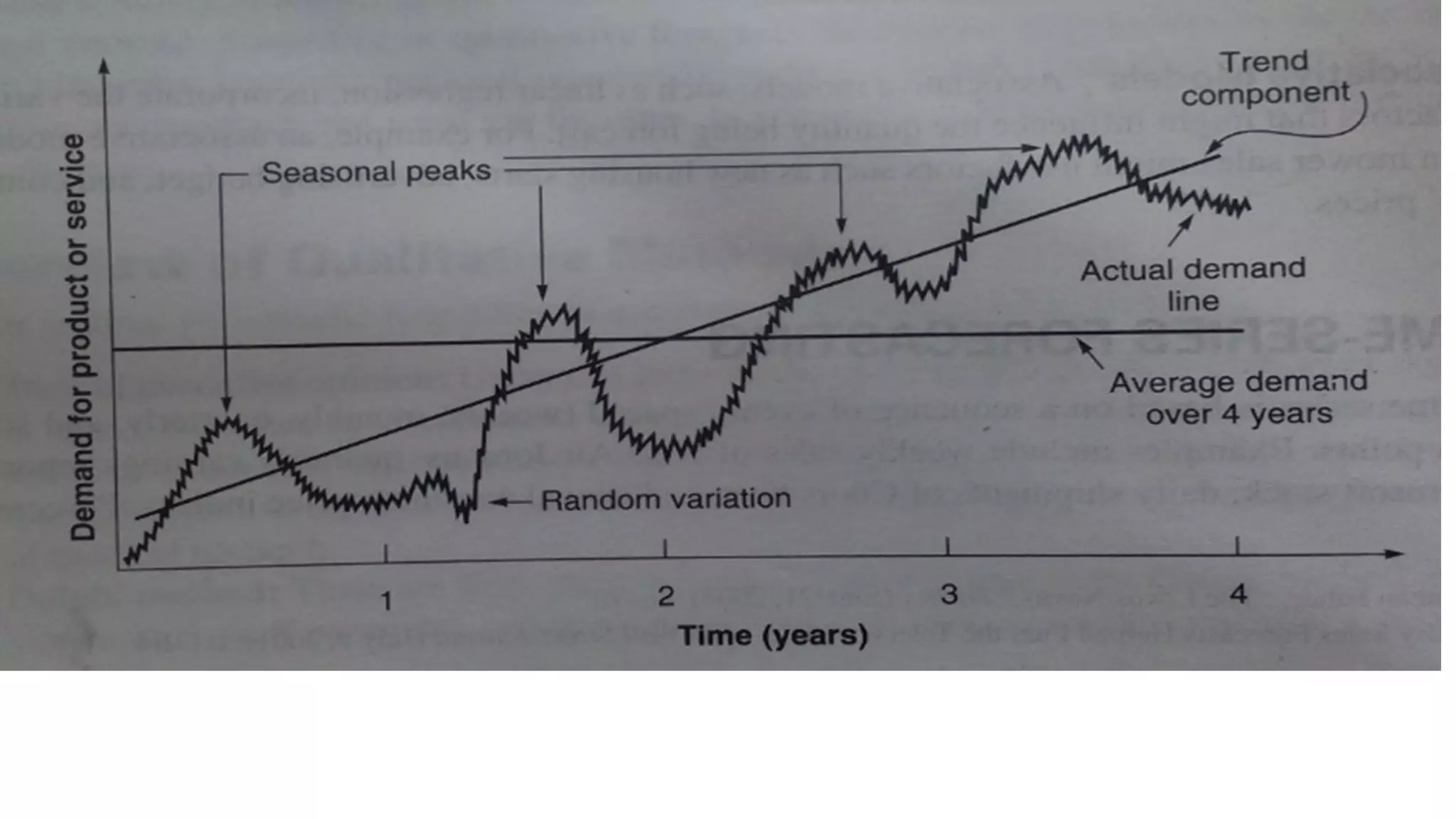

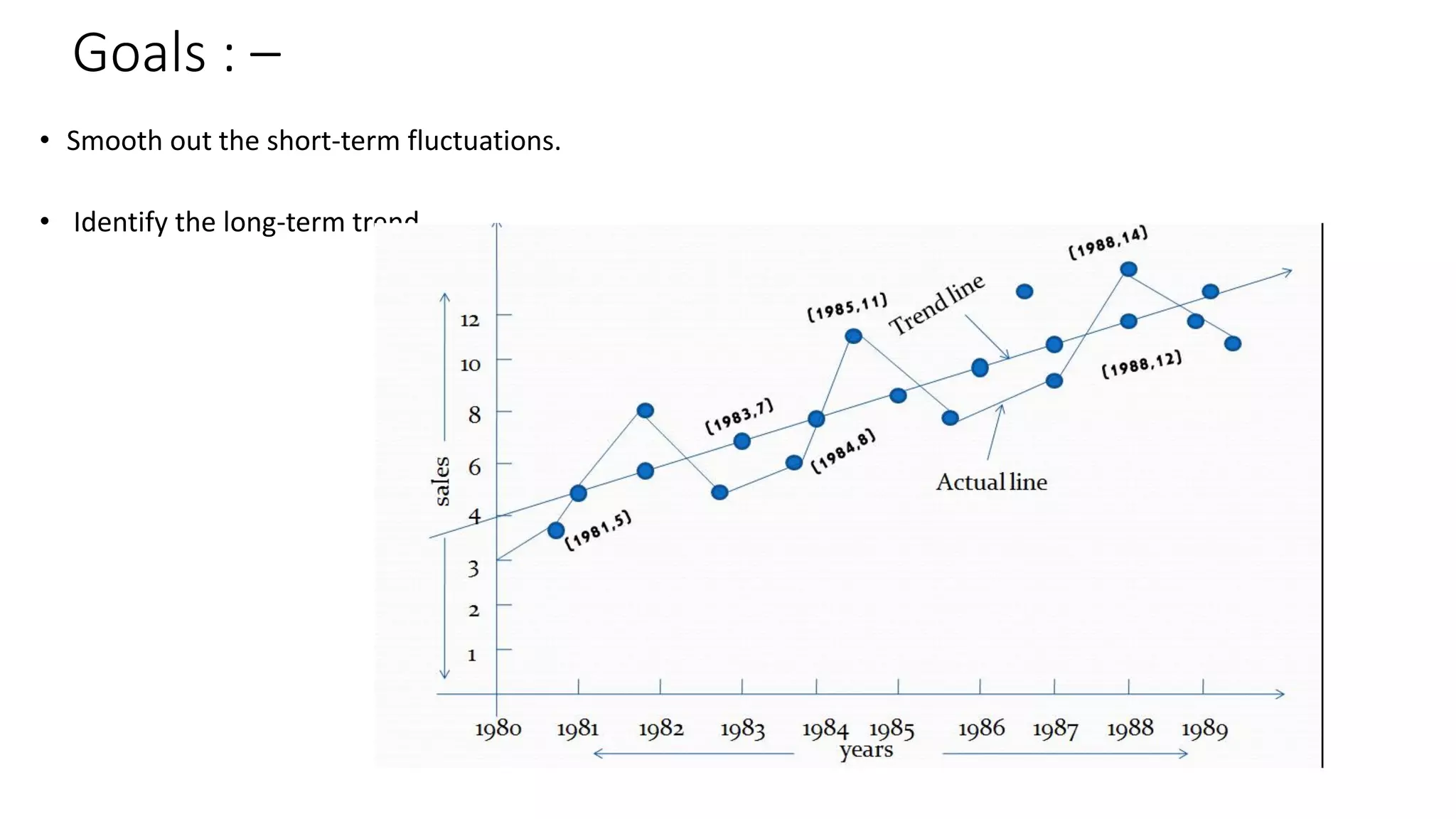

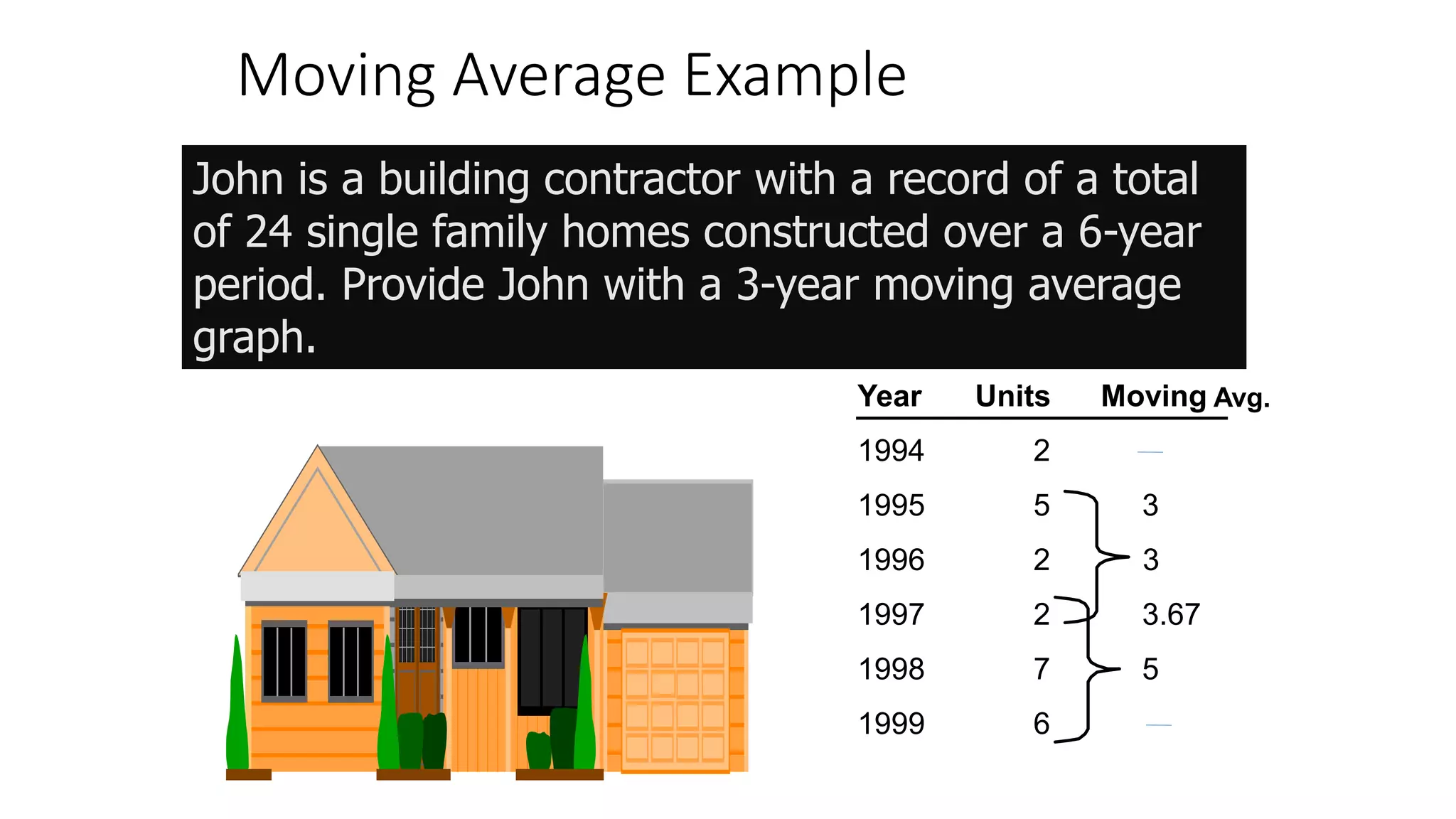

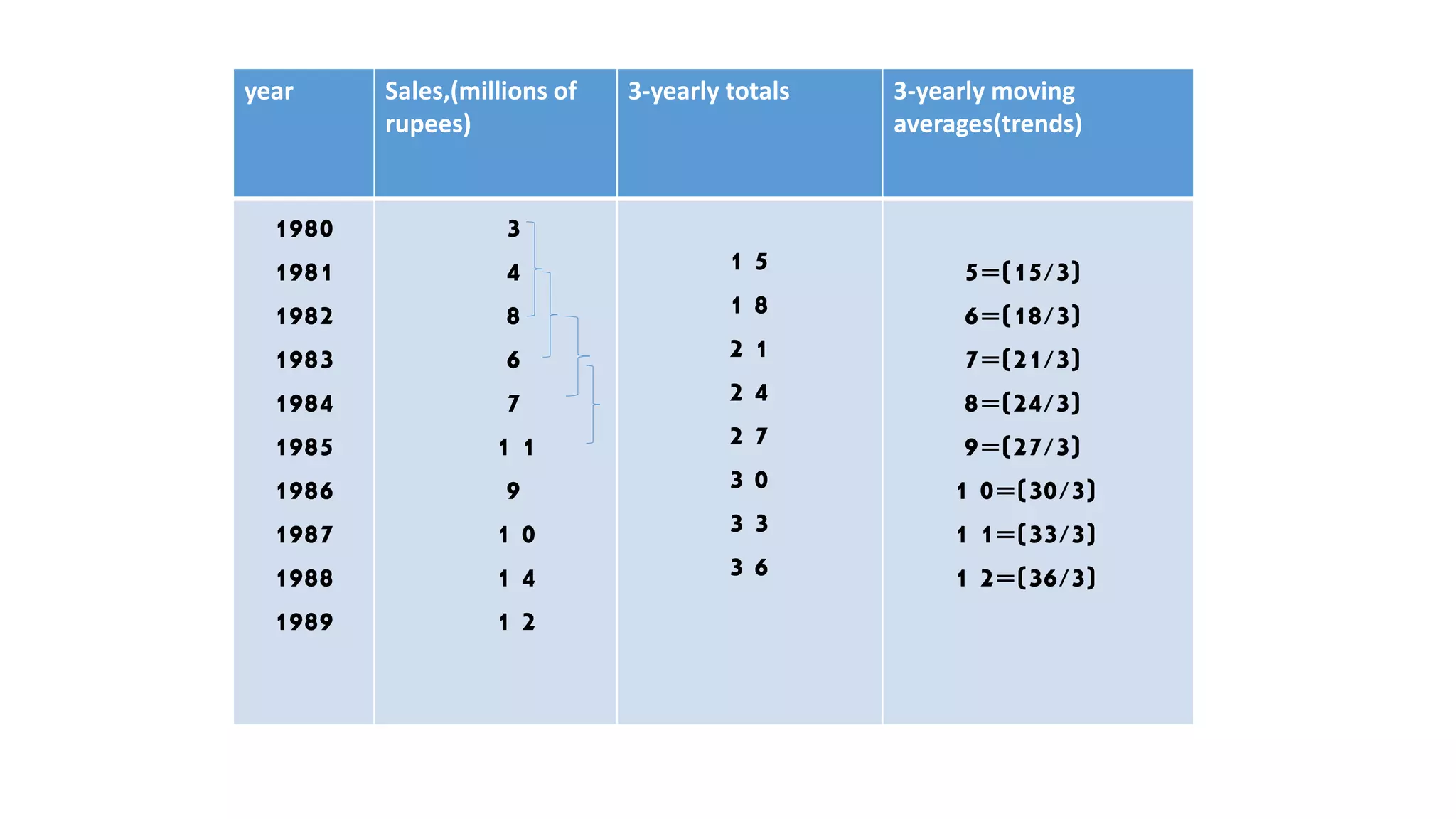

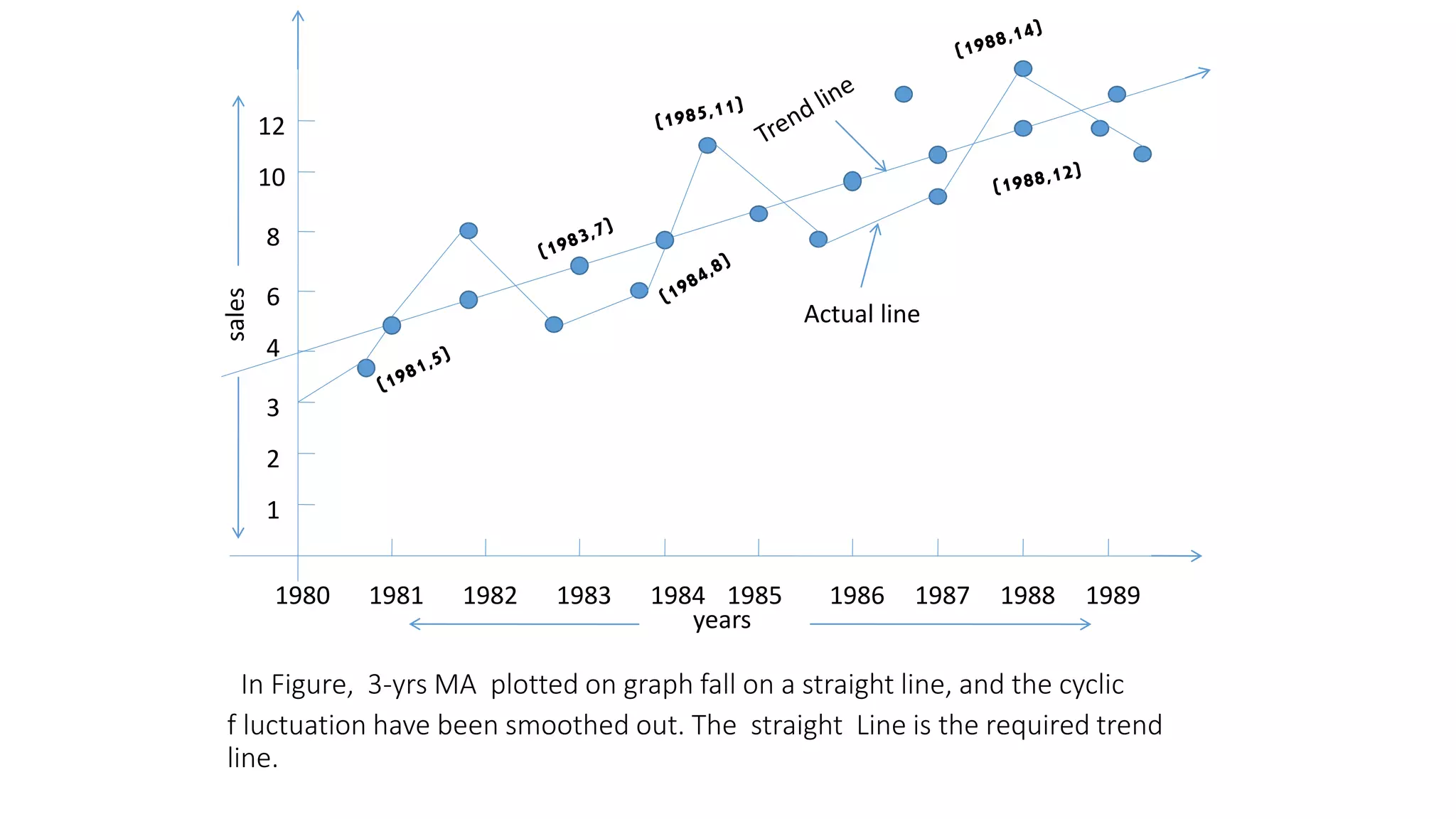

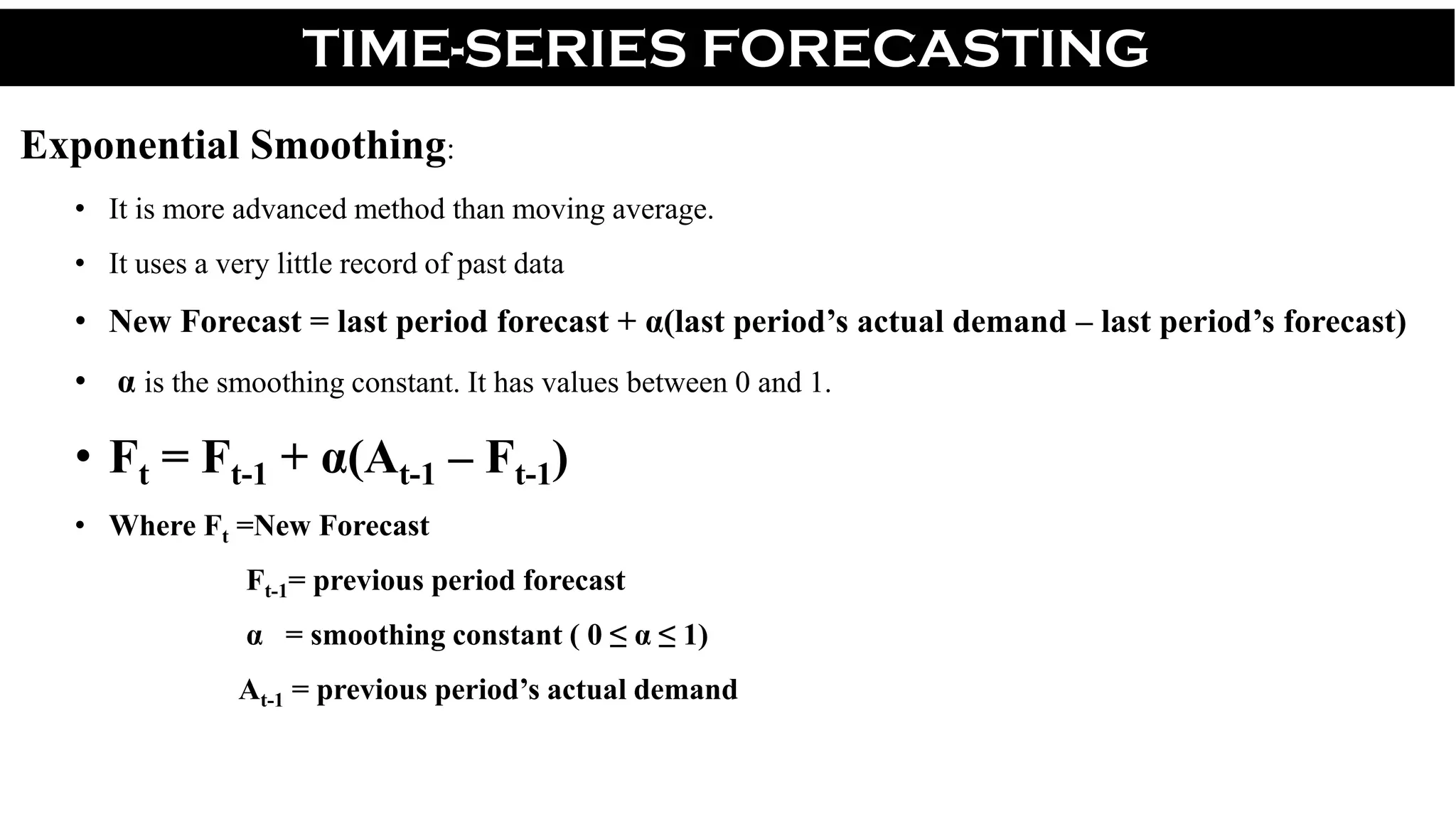

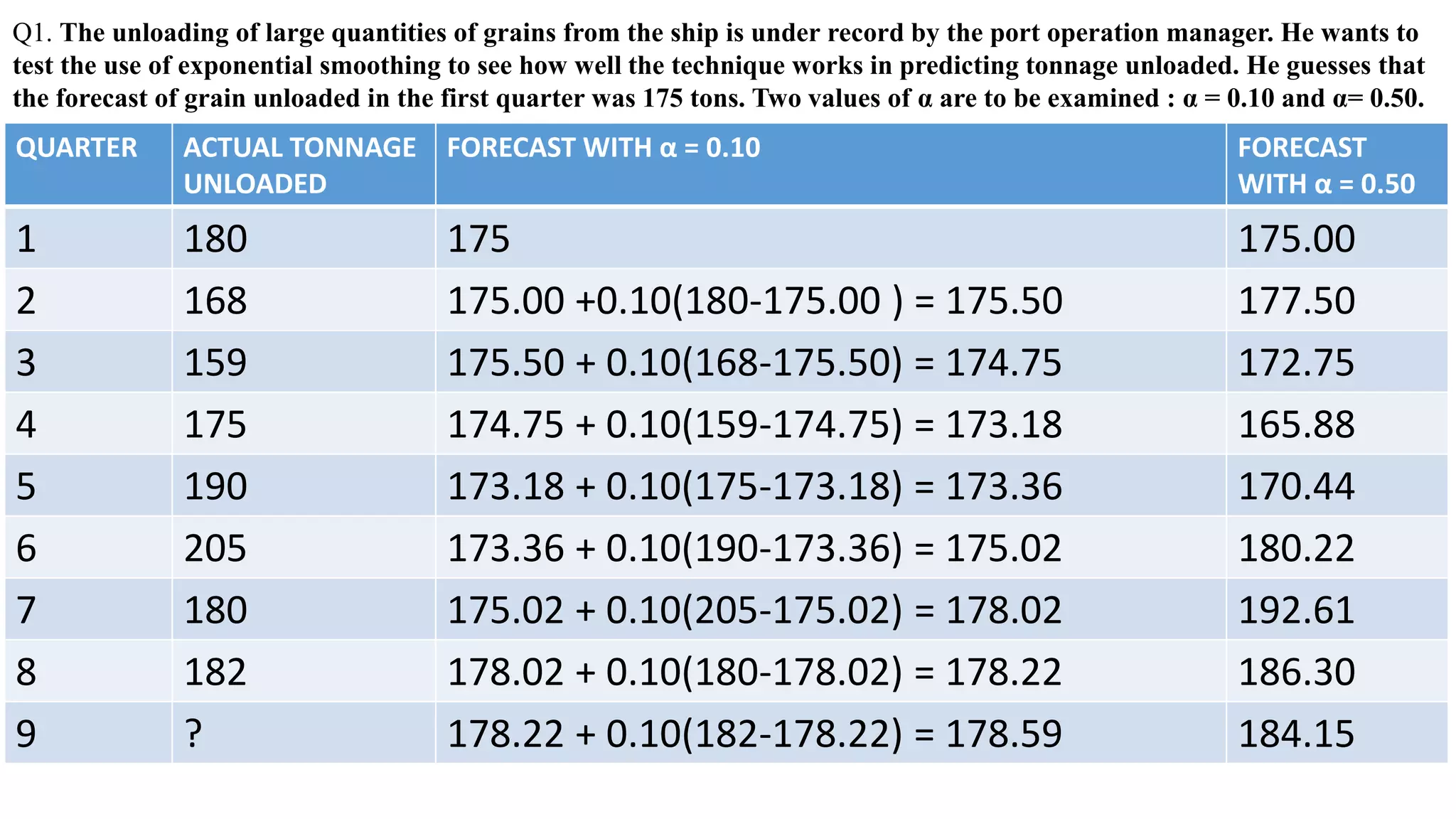

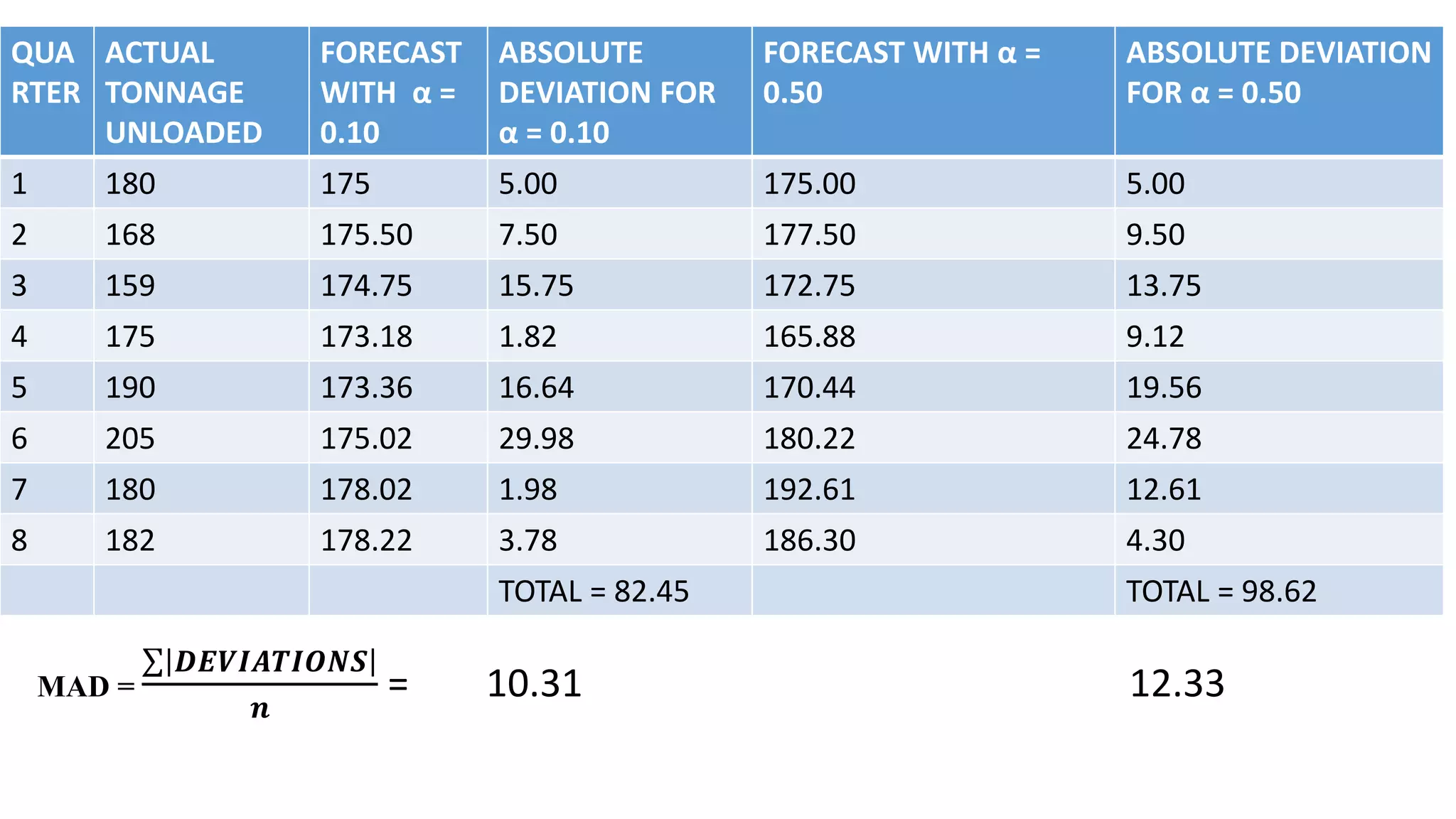

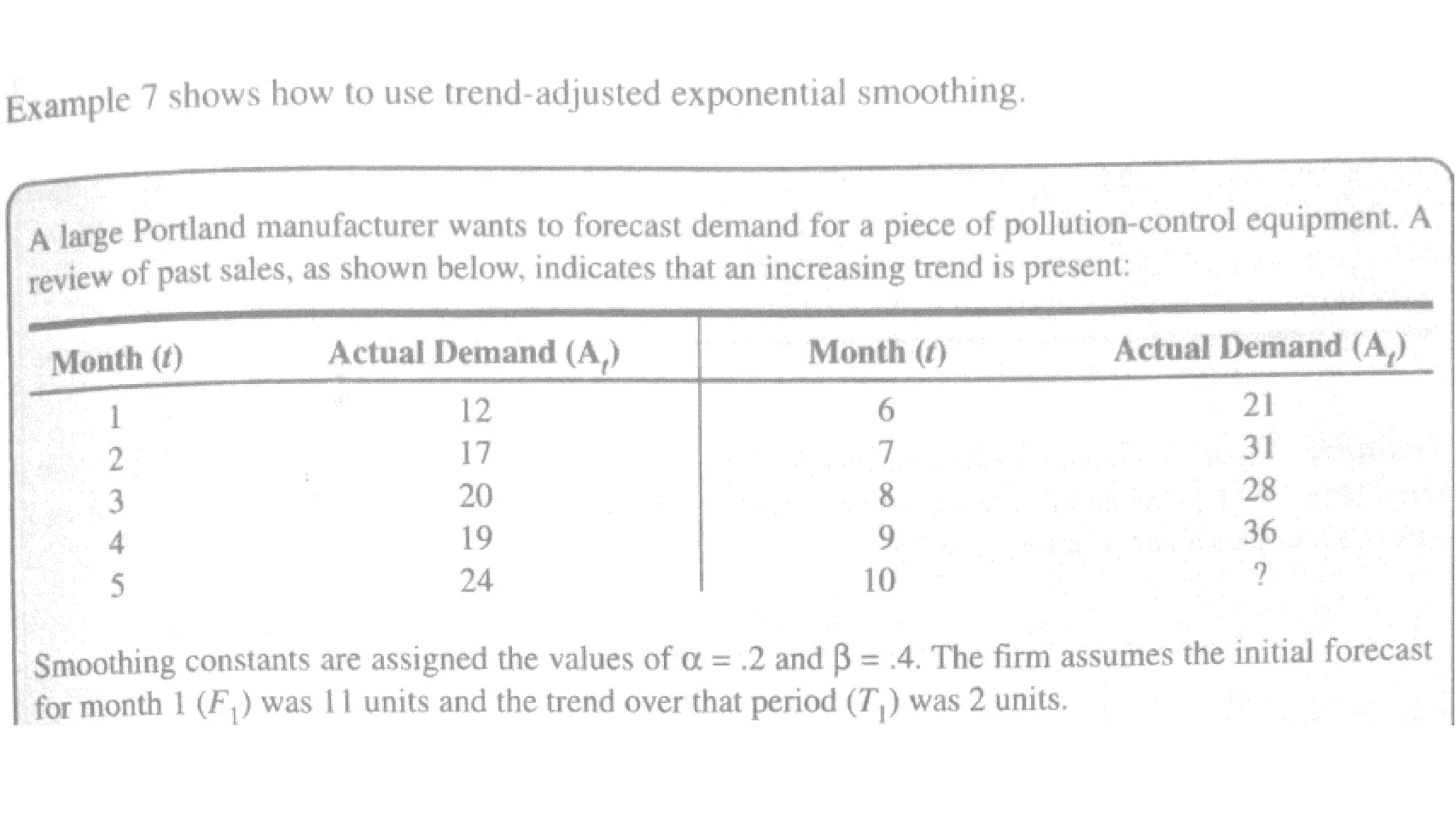

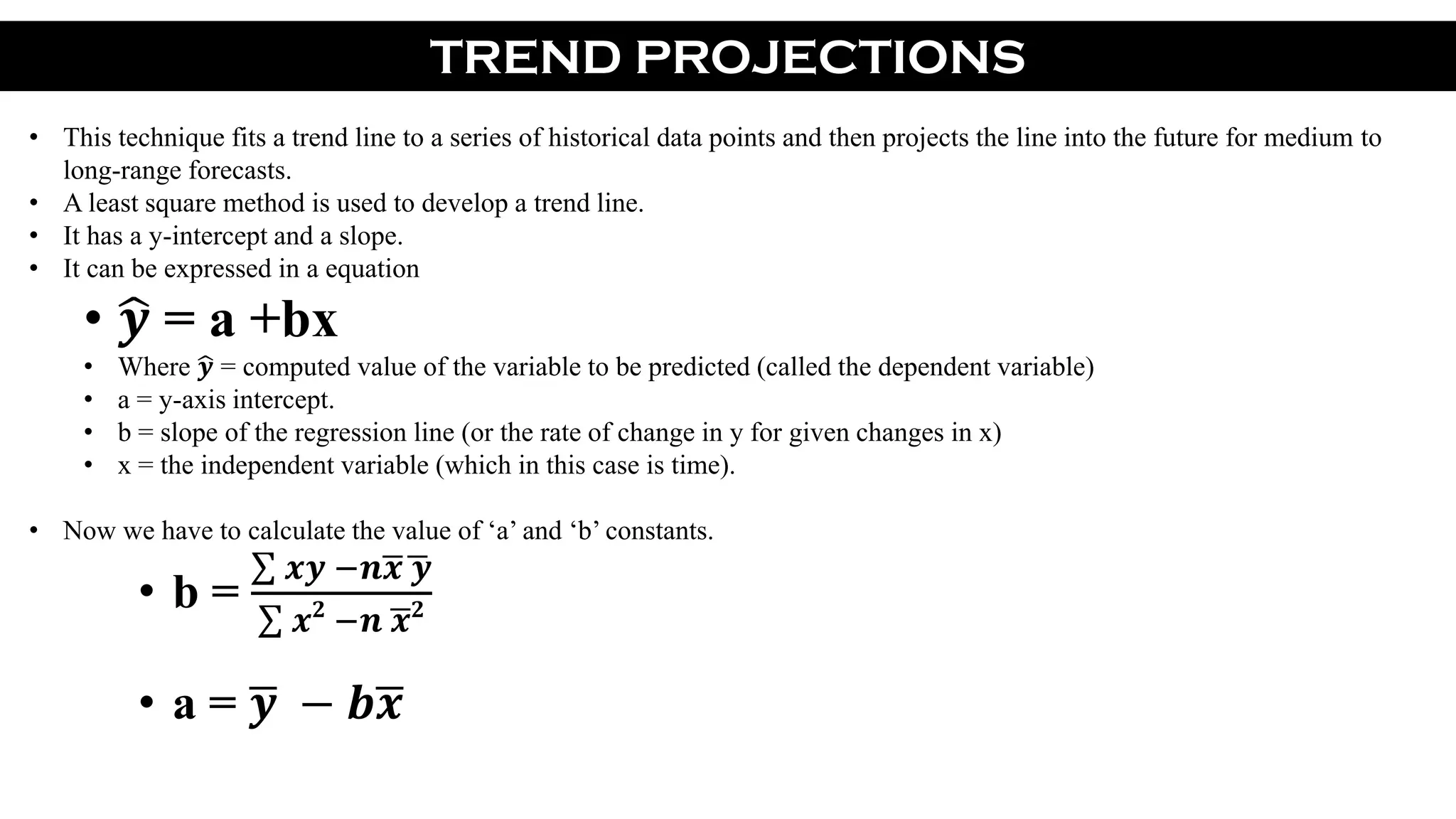

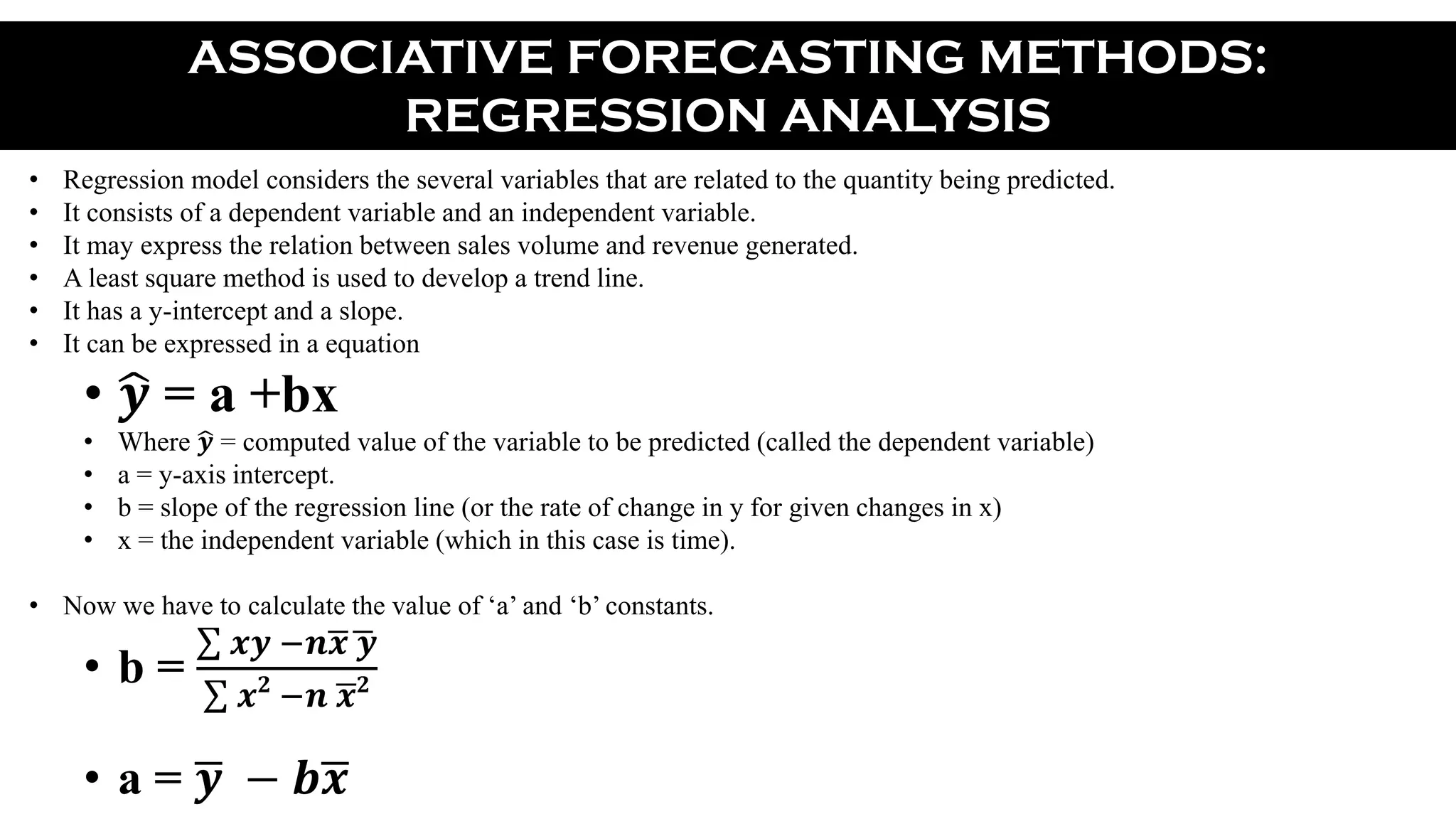

Forecasting is essential for business operations and involves estimating future events and trends. There are two main types of forecasting: quantitative and qualitative. Quantitative forecasting uses historical data and mathematical models, while qualitative forecasting relies on expert opinions. Common quantitative forecasting methods include moving averages, exponential smoothing, and time series models. Moving averages calculate the average demand over a set time period to smooth out fluctuations. Exponential smoothing places more emphasis on recent data by applying weighting factors. Qualitative methods include jury of executive opinion, Delphi method, and consumer surveys. Forecasting allows businesses to better plan operations and prepare for the future.