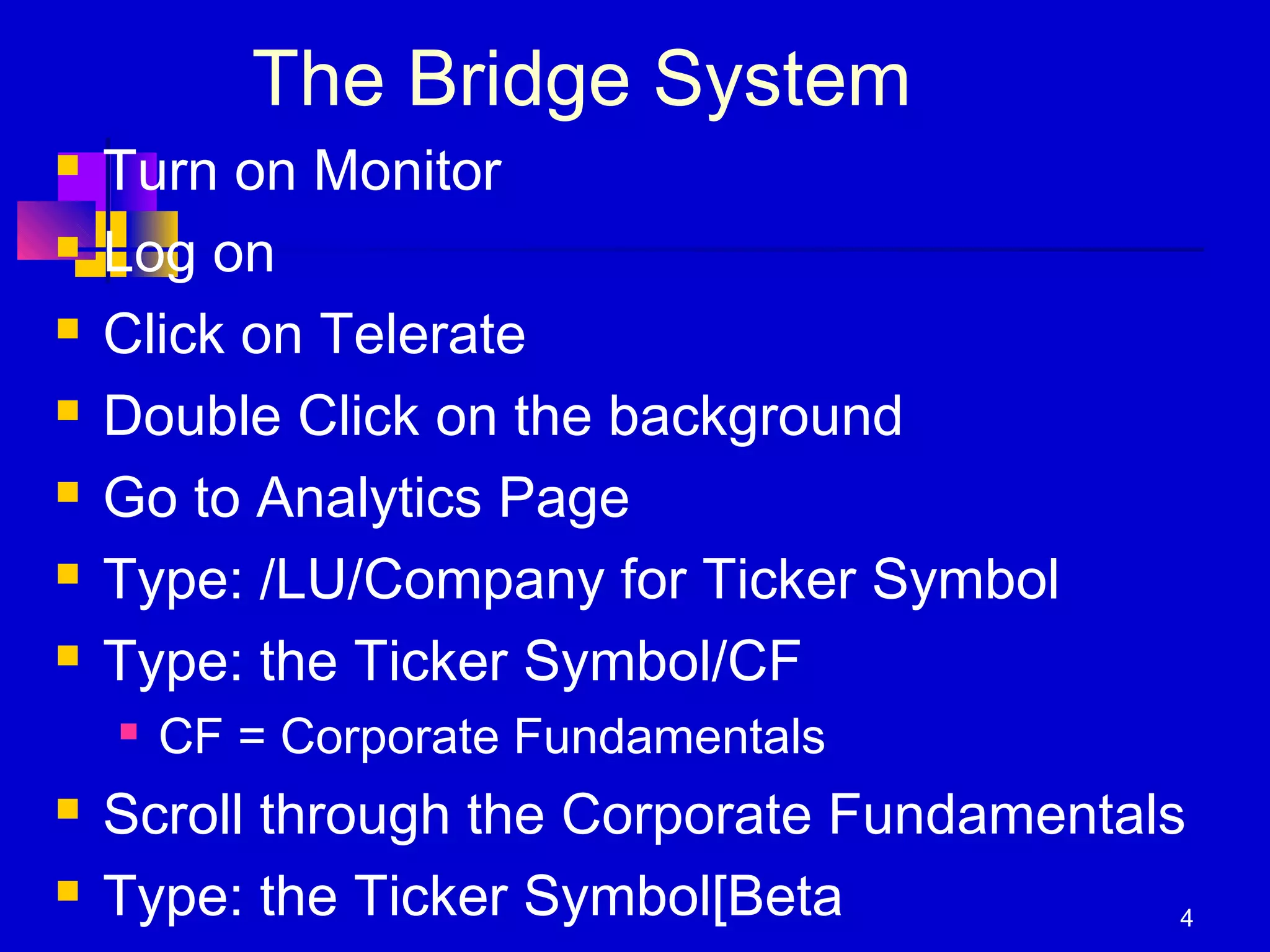

This document discusses key issues in financial reporting and analyzing financial statements. It covers topics like revenue recognition, accounting for pensions and intangible assets, off-balance sheet financing, how ratios can be misleading, obtaining corporate news and fundamentals, analyzing the market value and economic value added of firms, issues caused by inflation, the cash flow statement, international reporting complexities, and ensuring accuracy of financial statements. The conclusion summarizes the main components of financial statements and ratios used in analysis.

![7

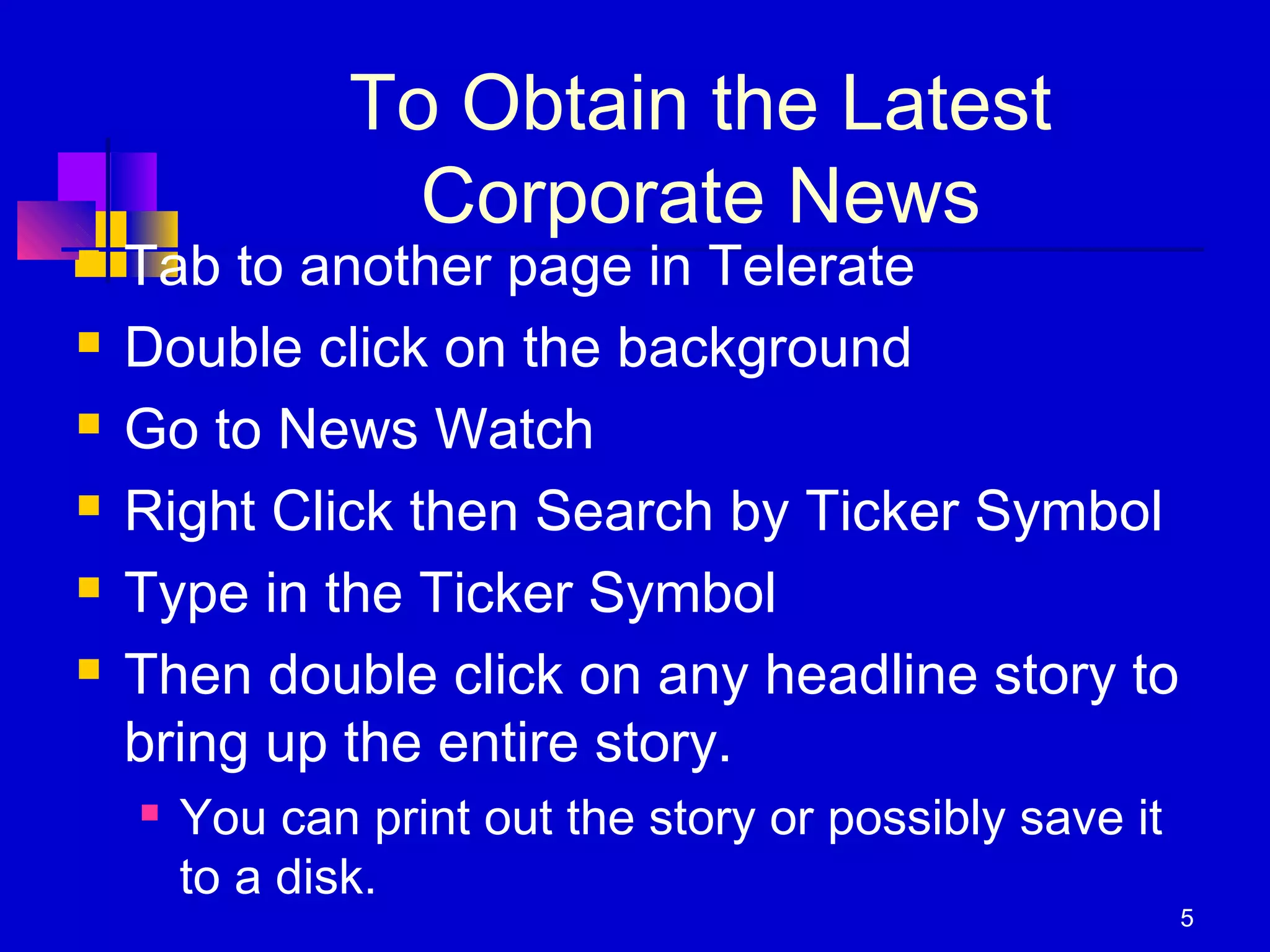

Economic Value Added (EVA)

Economic value added ( EVA ) = [ Return

on total capital (r) – Cost of Capital (k )] x

Capital

EVA = EBIT(1 – Corporate tax rate) –

(Operating Capital)(k)

r = net operating profits after taxes divided by

beginning of year capital (Return on Capital)

k = Weighted After-Tax Cost of Capital](https://image.slidesharecdn.com/fmchapter5-151201151956-lva1-app6891/75/Fm-chapter-5-7-2048.jpg)