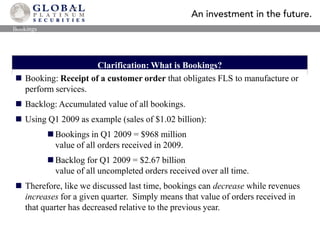

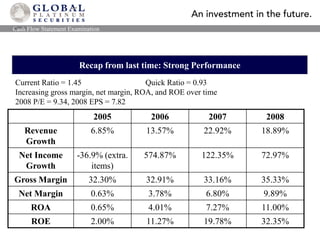

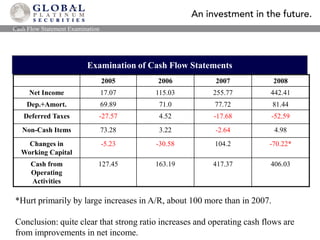

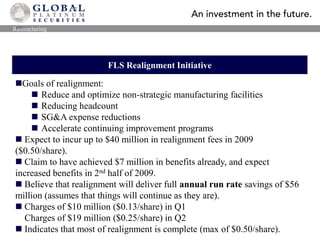

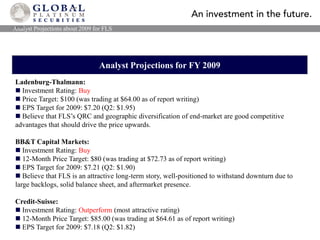

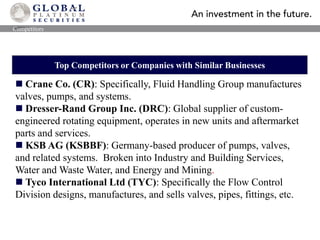

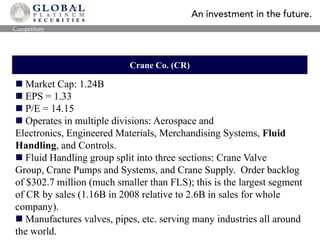

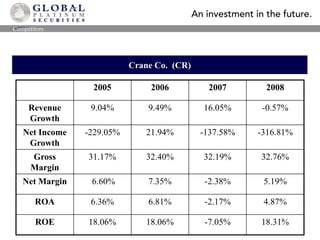

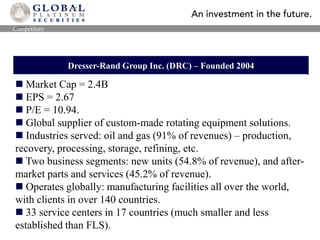

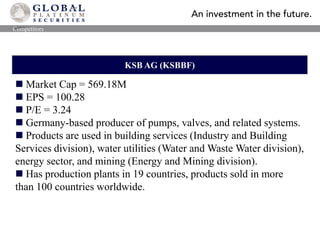

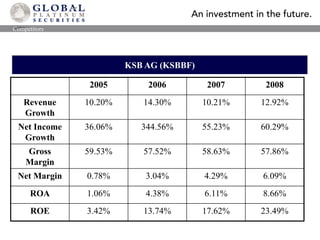

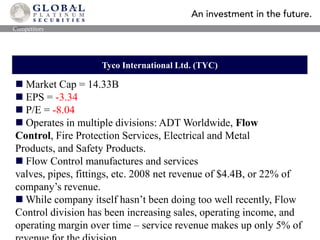

Flowserve Corporation (FLS) provides pumps, valves, seals and related services to industrial and municipal markets globally. Bookings in Q1 2009 were $968 million, with a backlog of $2.67 billion. FLS initiated a realignment to reduce costs through facility optimization and headcount reductions, expecting $40 million in charges but $56 million in annual savings. Q2 2009 results exceeded projections with EPS of $1.92, excluding $0.25 in realignment charges. Analysts project FLS will continue outperforming competitors due to its diversification and aftermarket services. Top competitors include Crane, Dresser-Rand, KSB and Tyco's flow control division.