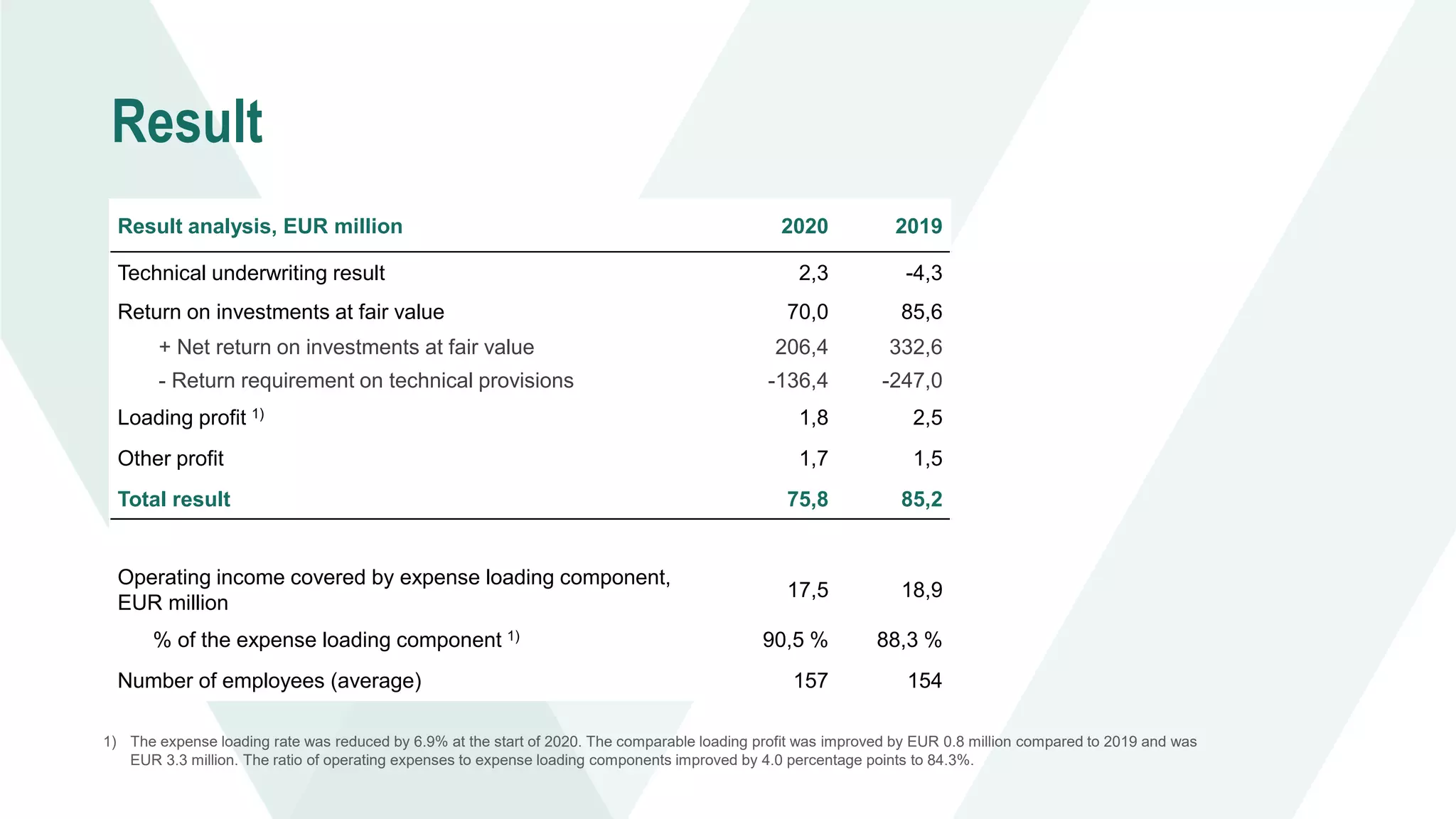

In 2020, Veritas reported an investment return of 5.6% for the year, with a notable increase in solvency to 128.8%. The extent of pandemic-related challenges was evident as premiums written declined, though the number of insurance policies increased. Veritas aims for a carbon-neutral investment portfolio by 2035 and has updated its investment principles to focus on sustainability.