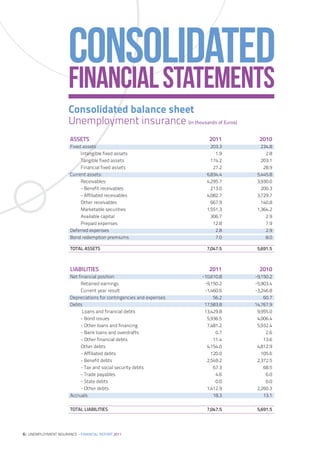

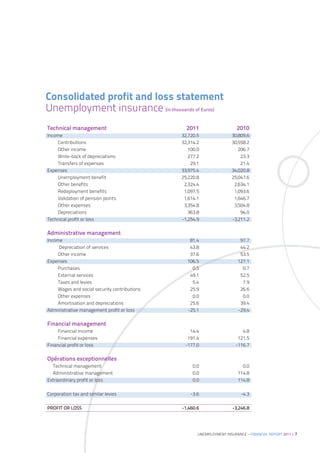

The 2011 Unemployment Insurance Financial Report highlights the financial performance and challenges faced by the unemployment insurance scheme in France, marked by a modest GDP growth of 1.7% and a rise in the number of unemployed benefit recipients to 2.2 million. Despite an increase in revenue from contributions, the scheme recorded a net accounting loss of €1.46 billion and a negative cash balance. Looking ahead to 2012, projected total revenue is €32.585 billion against total expenditure of €35.619 billion, leading to a forecasted increase in debt to €14.1 billion.