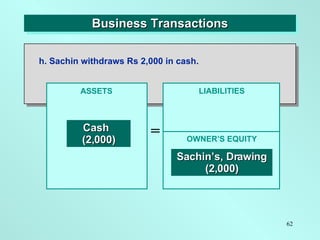

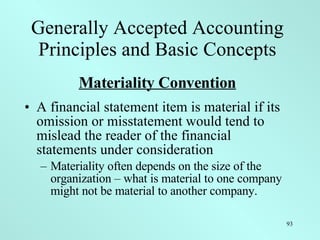

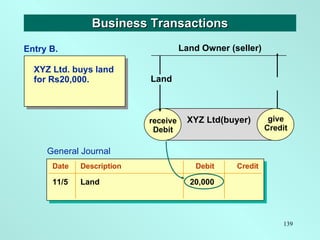

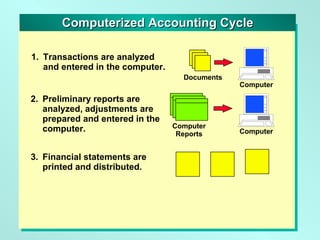

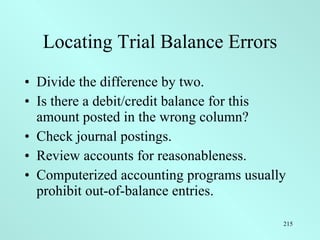

This document provides an extensive overview of accounting and financial management, detailing its role as an information system that measures, records, and communicates financial information essential for decision making. It outlines core concepts such as the accounting equation, GAAP (Generally Accepted Accounting Principles), and different types of accounting (financial, management, and cost accounting), along with their purposes and functions. Furthermore, it explains the importance of accurate reporting and internal controls to ensure financial integrity and decision-making support for various stakeholders.