Recommended

Recommended

More Related Content

Similar to Finance management

Similar to Finance management (20)

UOPFIN370 NEW Achievement Education--uopfin370.com

UOPFIN370 NEW Achievement Education--uopfin370.com

FIN 370 GENIUS new Become Exceptional--fin370genius.com

FIN 370 GENIUS new Become Exceptional--fin370genius.com

Chapter 2 on Valuation and Reporting in Organization

Chapter 2 on Valuation and Reporting in Organization

Visioning the Strategic Role of Development Finance Institutions

Visioning the Strategic Role of Development Finance Institutions

More from harshadevarkar

More from harshadevarkar (20)

Finance management

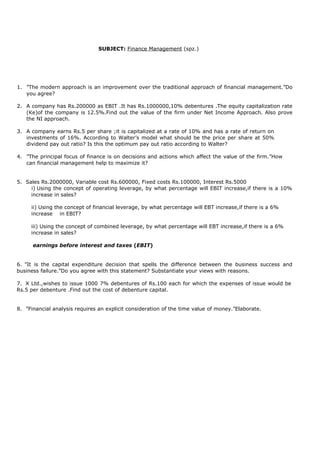

- 1. SUBJECT: Finance Management (spz.) 1. ”The modern approach is an improvement over the traditional approach of financial management.”Do you agree? 2. A company has Rs.200000 as EBIT .It has Rs.1000000,10% debentures .The equity capitalization rate (Ke)of the company is 12.5%.Find out the value of the firm under Net Income Approach. Also prove the NI approach. 3. A company earns Rs.5 per share ;it is capitalized at a rate of 10% and has a rate of return on investments of 16%. According to Walter’s model what should be the price per share at 50% dividend pay out ratio? Is this the optimum pay out ratio according to Walter? 4. ”The principal focus of finance is on decisions and actions which affect the value of the firm.”How can financial management help to maximize it? 5. Sales Rs.2000000, Variable cost Rs.600000, Fixed costs Rs.100000, Interest Rs.5000 i) Using the concept of operating leverage, by what percentage will EBIT increase,if there is a 10% increase in sales? ii) Using the concept of financial leverage, by what percentage will EBT increase,if there is a 6% increase in EBIT? iii) Using the concept of combined leverage, by what percentage will EBT increase,if there is a 6% increase in sales? earnings before interest and taxes (EBIT) 6. ”It is the capital expenditure decision that spells the difference between the business success and business failure.”Do you agree with this statement? Substantiate your views with reasons. 7. X Ltd.,wishes to issue 1000 7% debentures of Rs.100 each for which the expenses of issue would be Rs.5 per debenture .Find out the cost of debenture capital. 8. ”Financial analysis requires an explicit consideration of the time value of money.”Elaborate.