This document provides information about fixed rate bonds, including:

- Fixed rate bonds pay a predetermined coupon rate and return the principal at maturity. The coupon payments are known but the bond price fluctuates with interest rates.

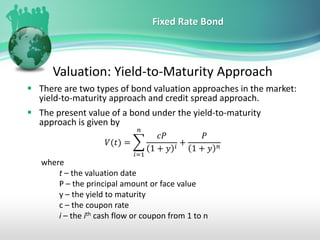

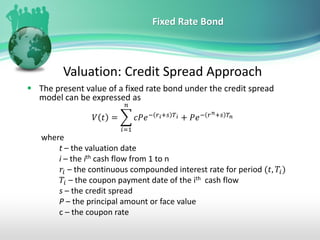

- Valuation of fixed rate bonds can be done using either a yield-to-maturity approach or a credit spread approach. The yield-to-maturity discounts future cash flows to calculate present value, while the credit spread approach uses a discount rate that includes the benchmark interest rate plus a credit spread.

- Practically, bonds are quoted based on their clean price rather than dirty price which includes accrued interest. The credit spread model allows calculating both fair value and risk measures like interest rate sensit