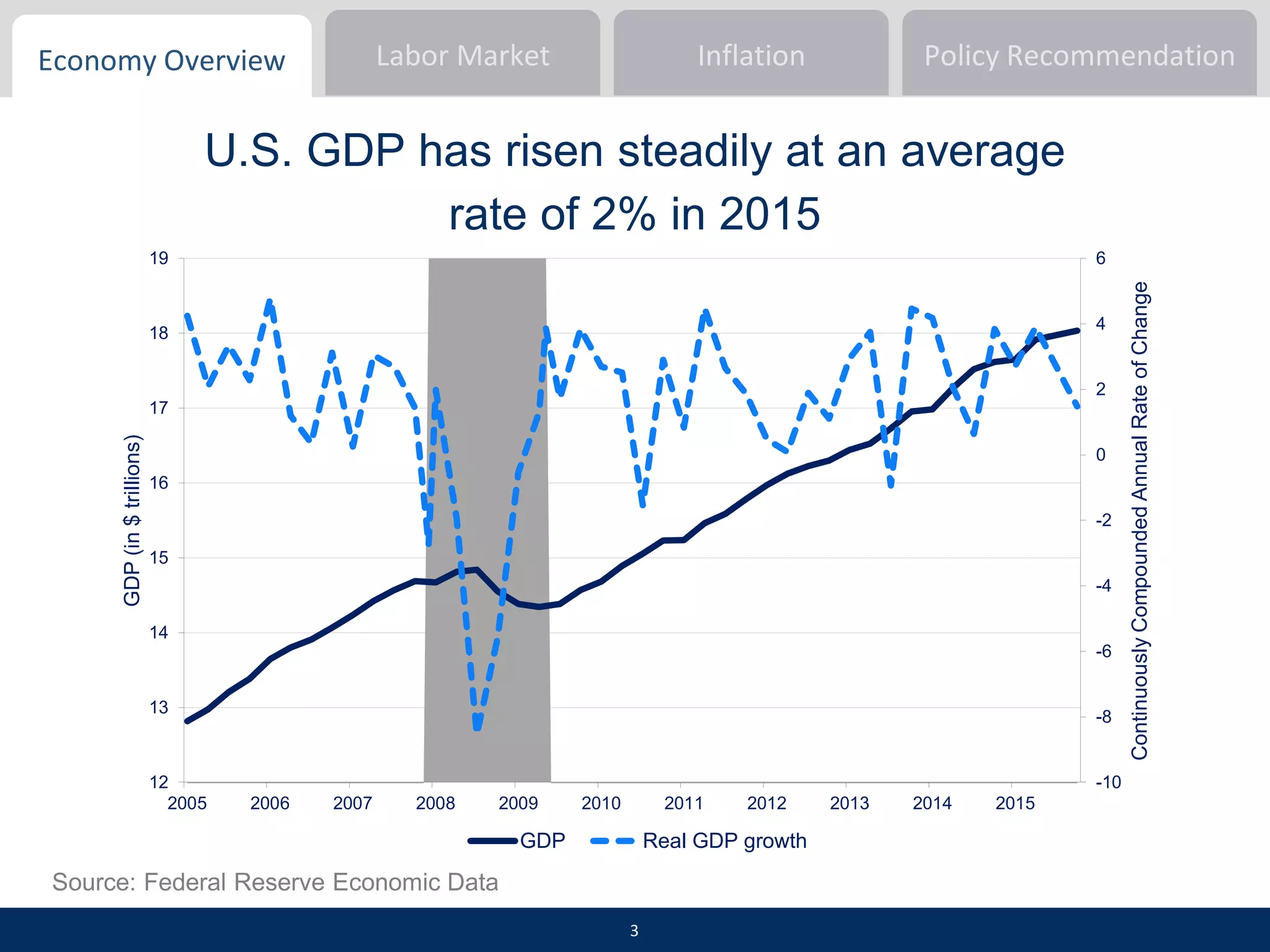

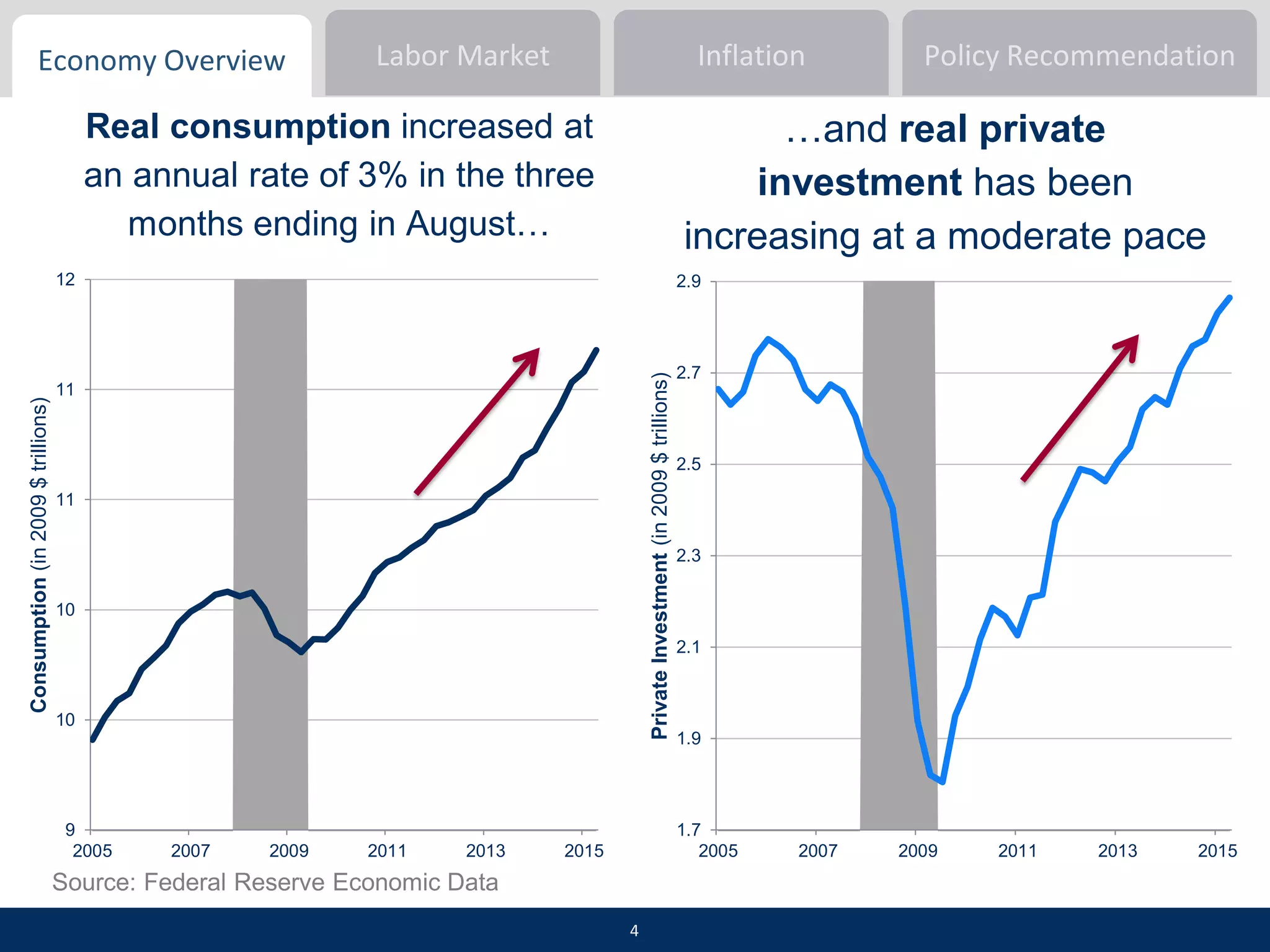

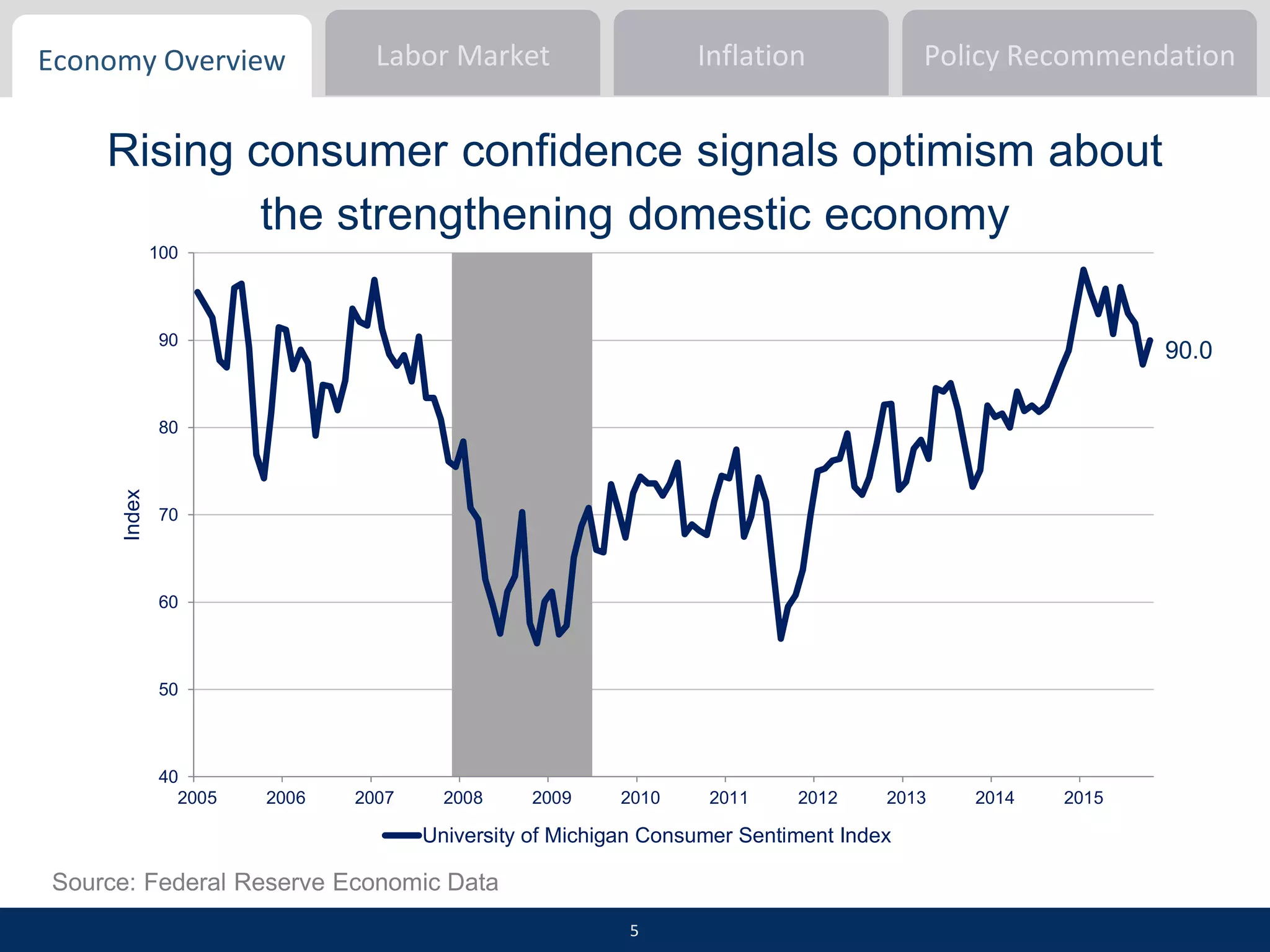

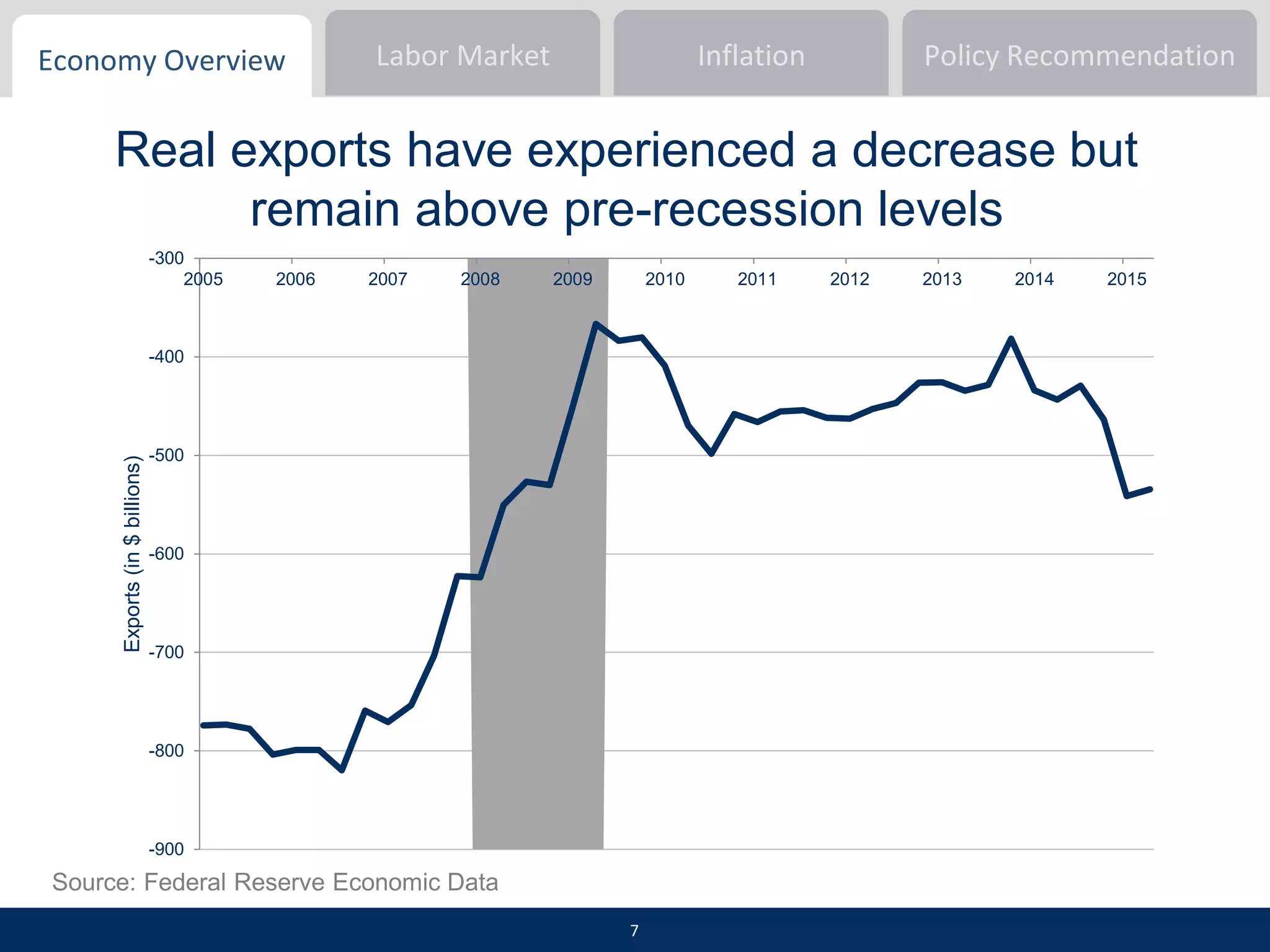

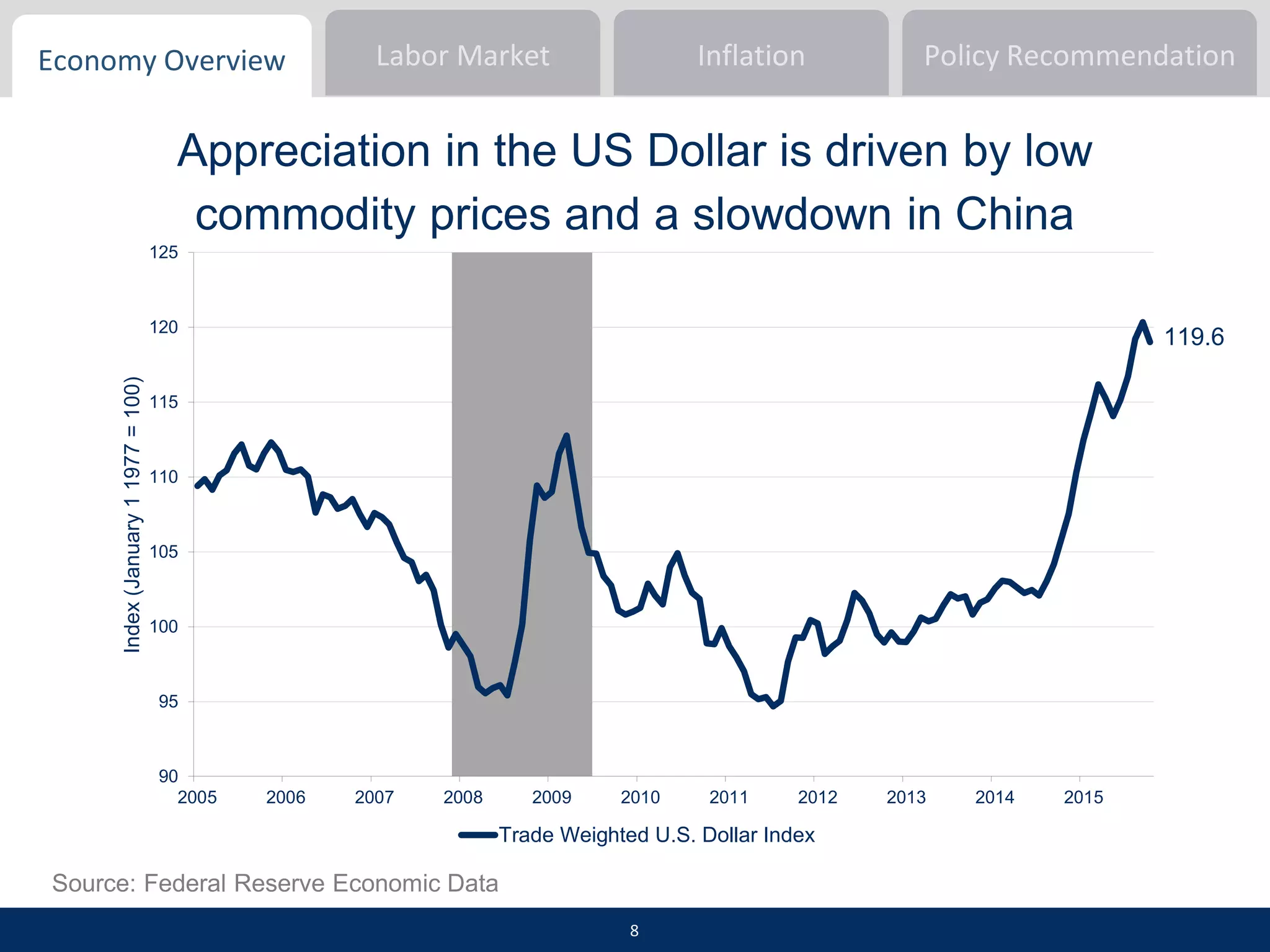

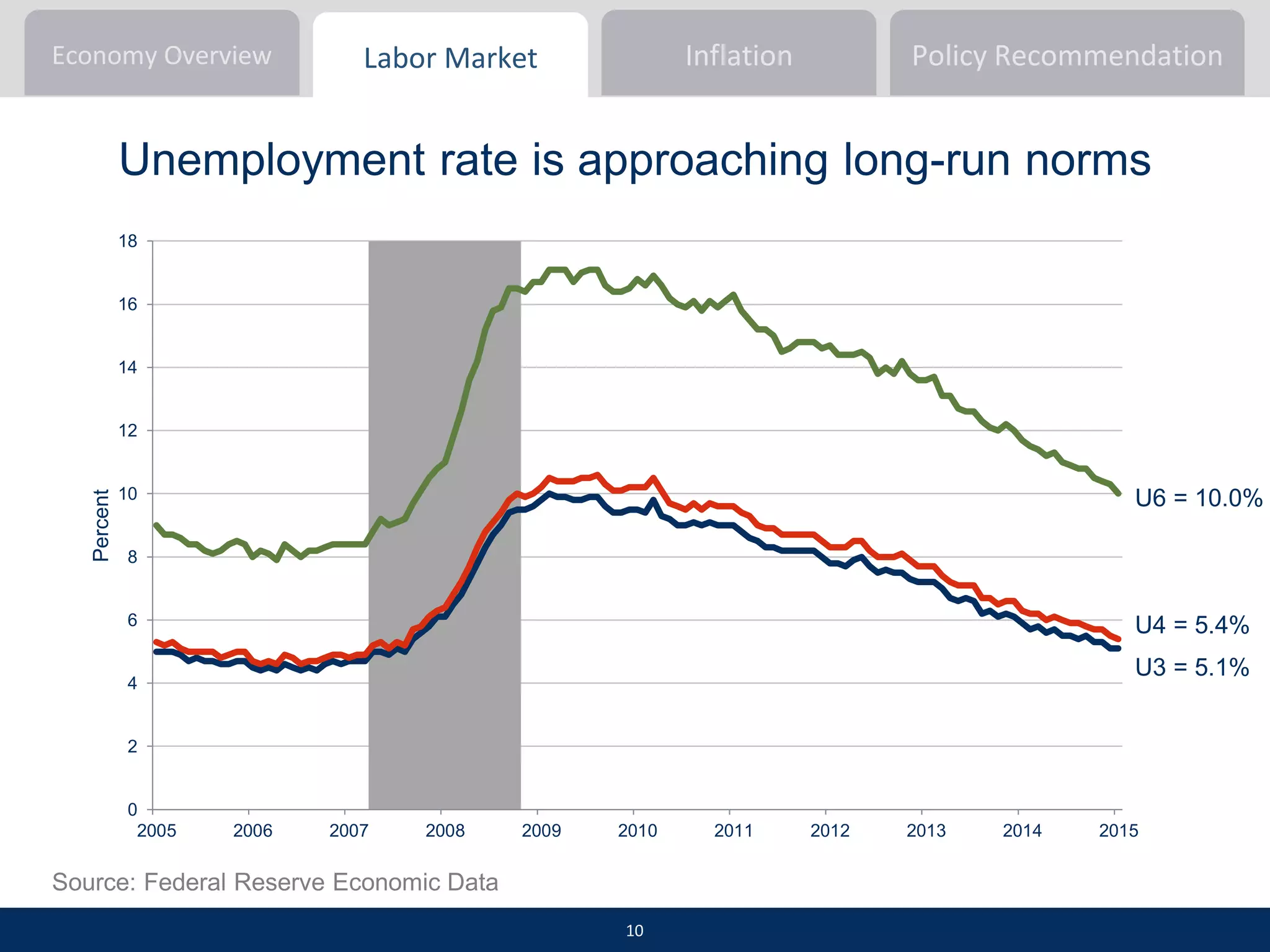

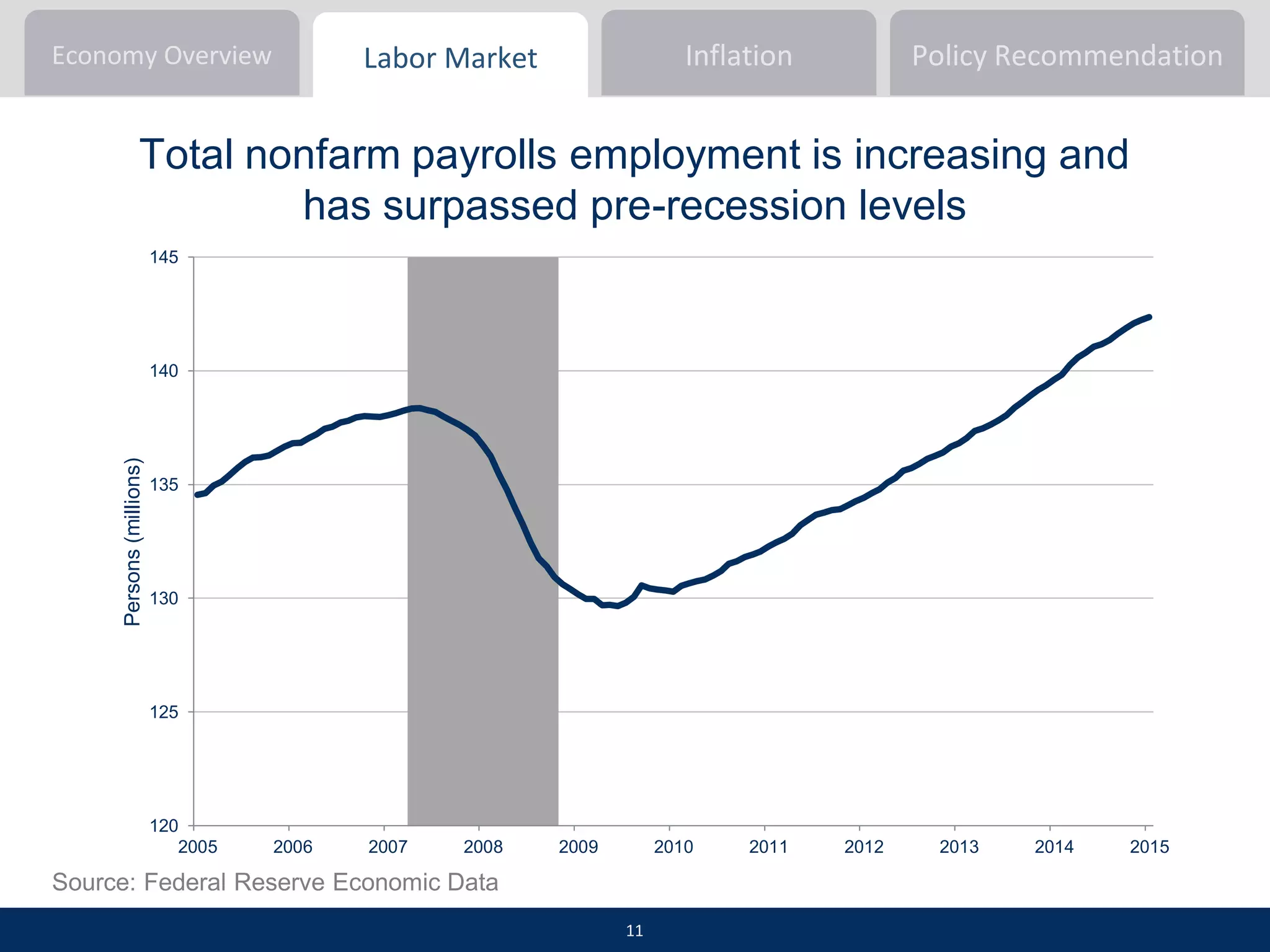

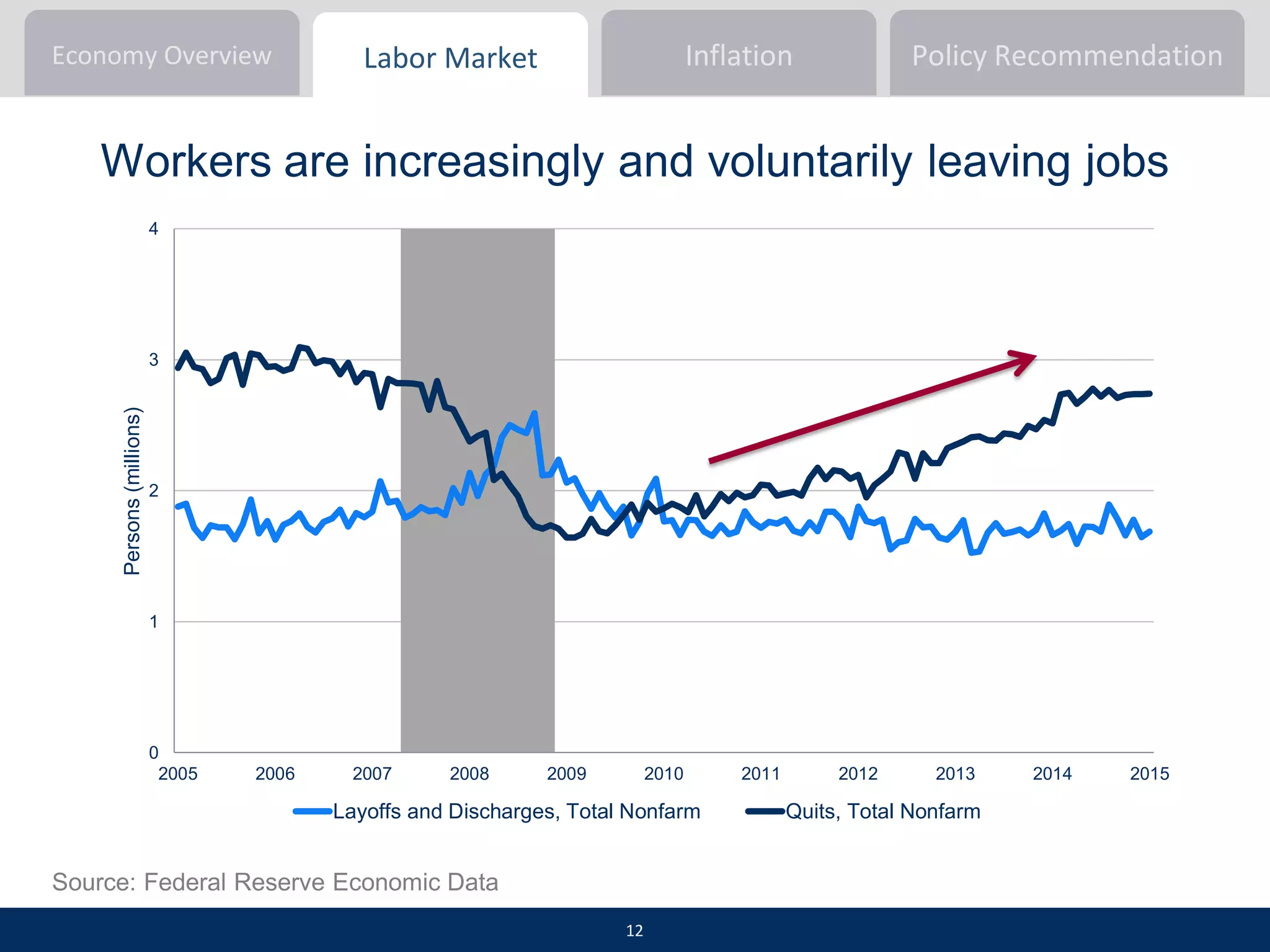

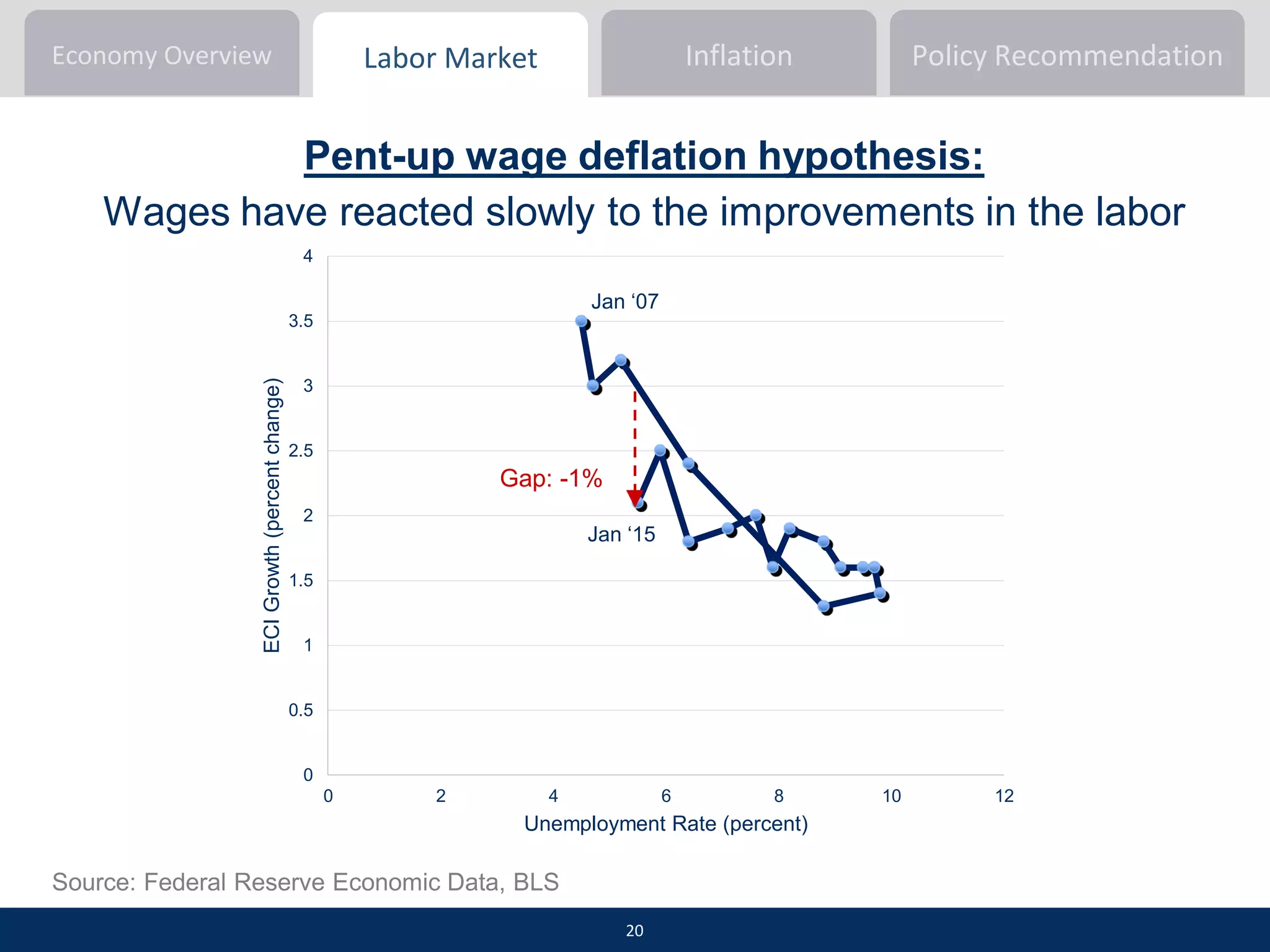

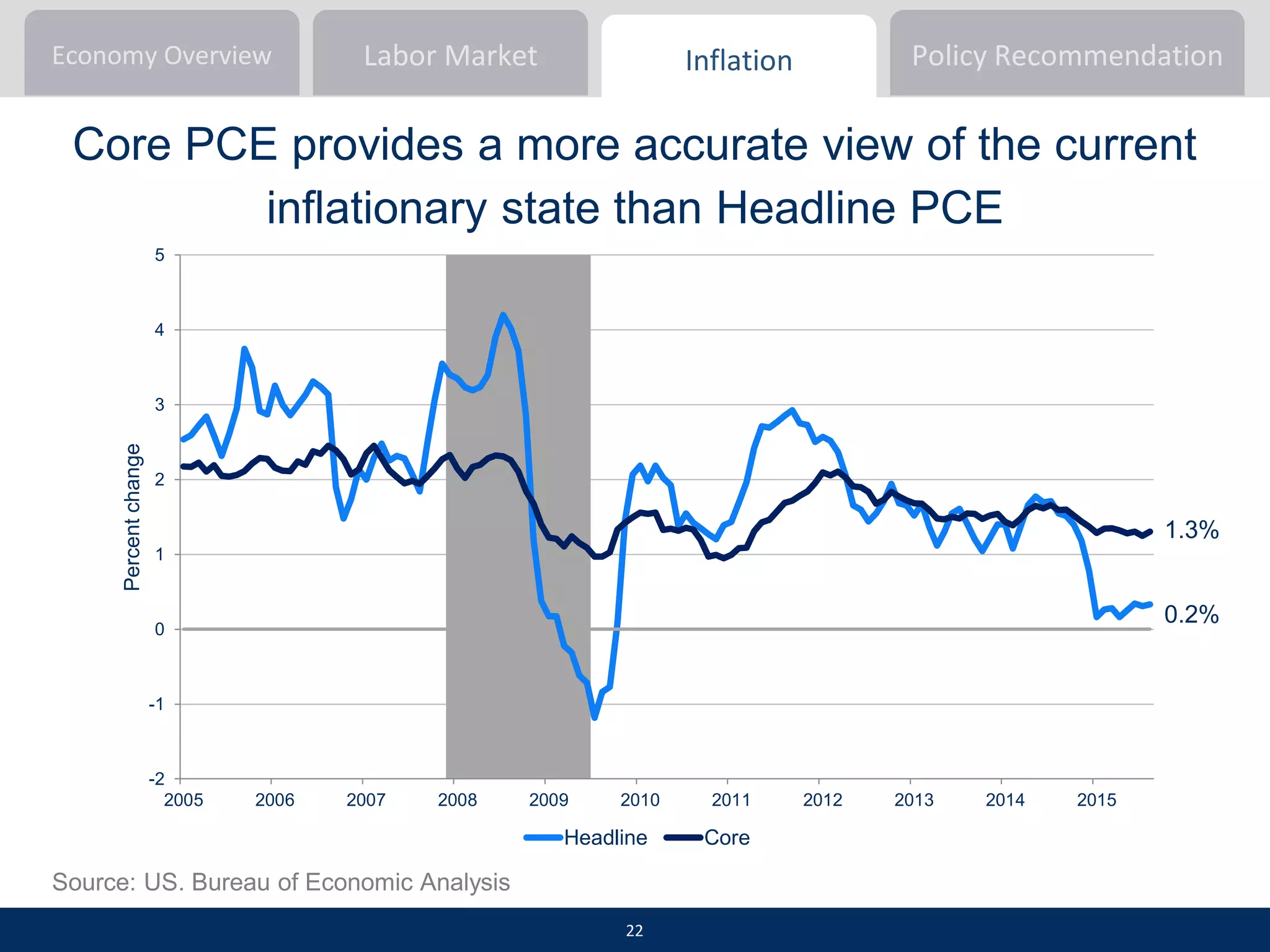

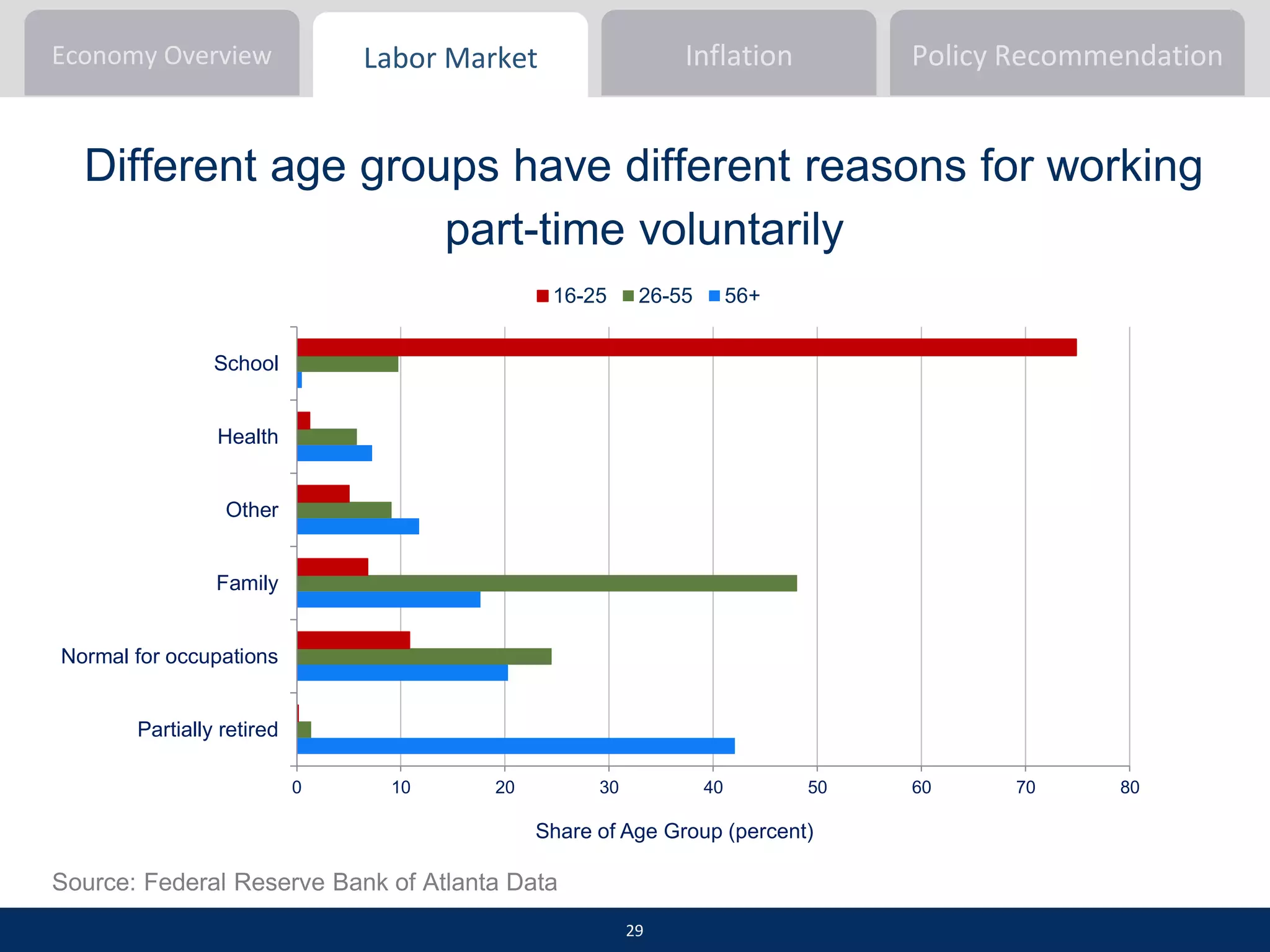

The document provides an economic overview and recommends raising the target federal funds rate by 25 basis points. It summarizes recent economic indicators including steady GDP growth, increased consumer spending and confidence, low unemployment and inflation near the 2% goal. While wage growth and labor force participation remain concerns, the fundamentals are deemed strong enough for a small interest rate increase to be warranted. Three sentences or less.