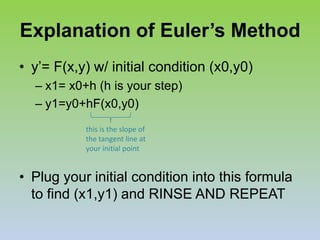

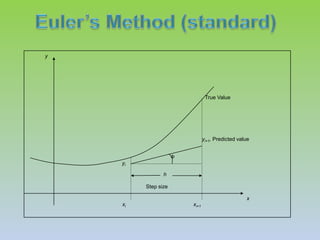

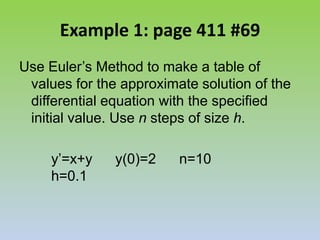

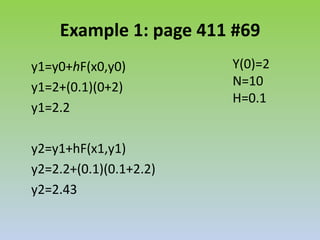

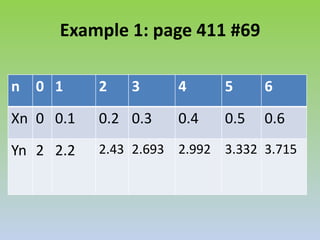

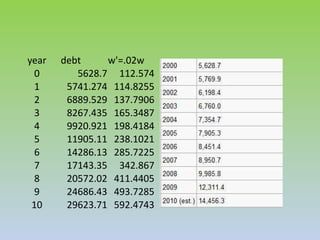

Euler's method is a numerical approach for approximating solutions to differential equations. It works by taking an initial condition and using the tangent line at that point to take a small step to a new point. This process is repeated, using the new point as the initial condition. The smaller the step size, the more accurate the approximation will be. An example walks through applying Euler's method to the differential equation y' = x + y with an initial condition of y(0) = 2 using 10 steps of size 0.1.

![What is Euler’s [OIL-er’s] Method?Numerical approach to approximating the particular solution of the differential equationy’=F(x,y)TRANSLATION: Essentially, you take an initial condition (a point), and use that condition as a starting point to take a small step h along the tangent line to get to a new point. Rinse and repeat using the new point as a starting point.*Note: The smaller the steps used, the more accurate your graph will be.](https://image.slidesharecdn.com/eulermethod3-100602001849-phpapp02/85/Eulermethod3-2-320.jpg)