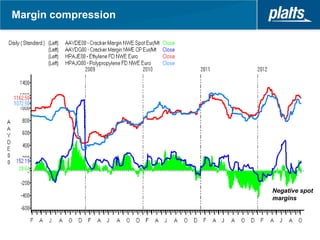

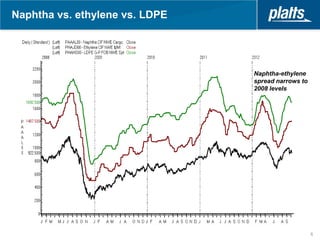

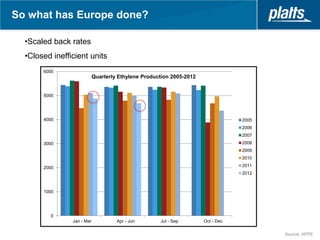

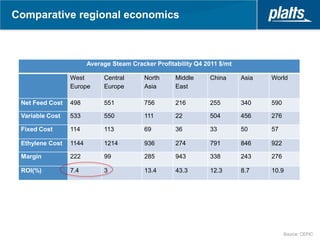

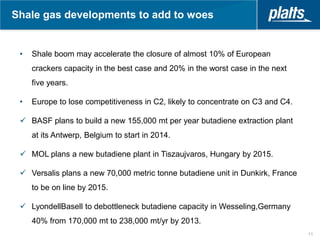

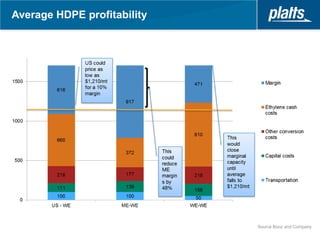

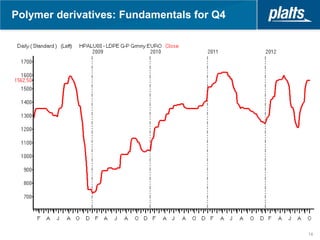

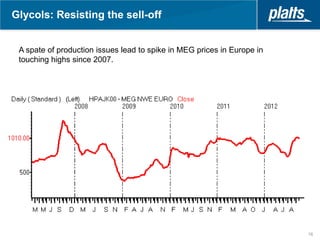

The document discusses the current state of the European ethylene market, highlighting issues such as margin compression, feedstock volatility, and a significant maintenance period impacting production. It details the effects of supply chain dynamics, including the reduction of inefficient units and the potential closure of European crackers due to the shale gas boom. Additionally, the document notes upcoming investments in new butadiene plants while presenting challenges from competitive products in other regions.