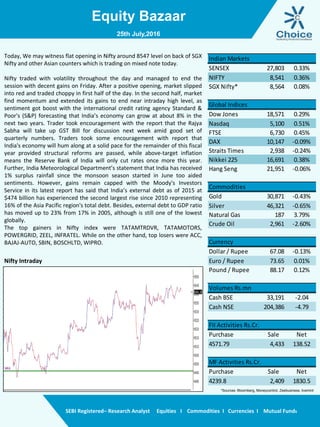

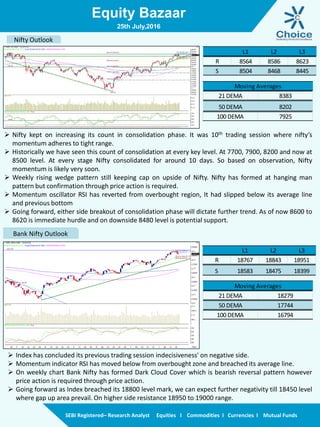

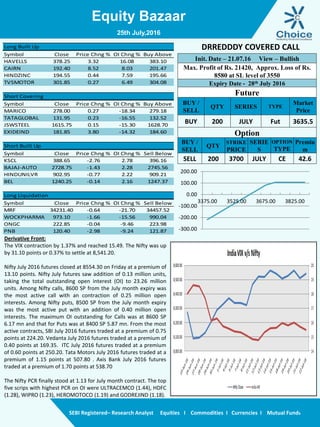

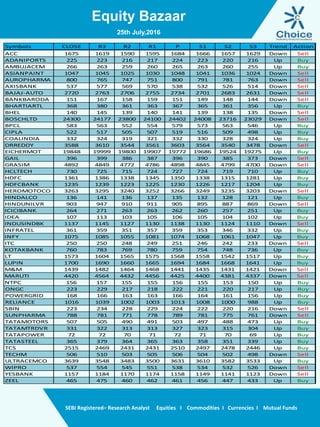

The document provides an analysis of the Indian equity market, indicating a flat opening for Nifty around the 8547 level, influenced by international factors and prospects of India's economic growth. It highlights recent market trends, top gainers and losers, and provides technical outlooks on Nifty and Bank Nifty, noting consolidations and potential breakouts in the near future. Additionally, it outlines derivative positions and details of the underlying stocks' movements in relation to open interest and trading volumes.