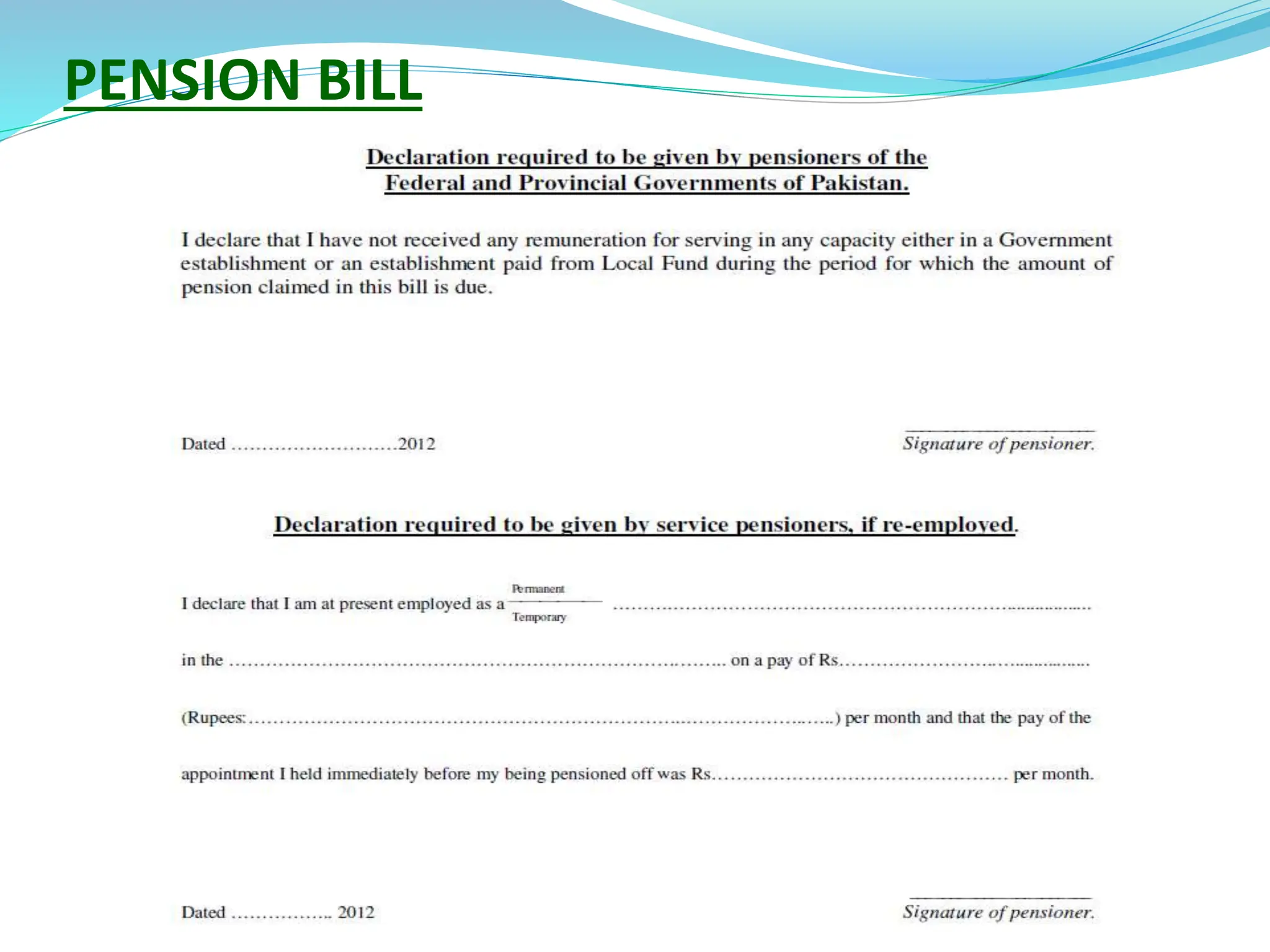

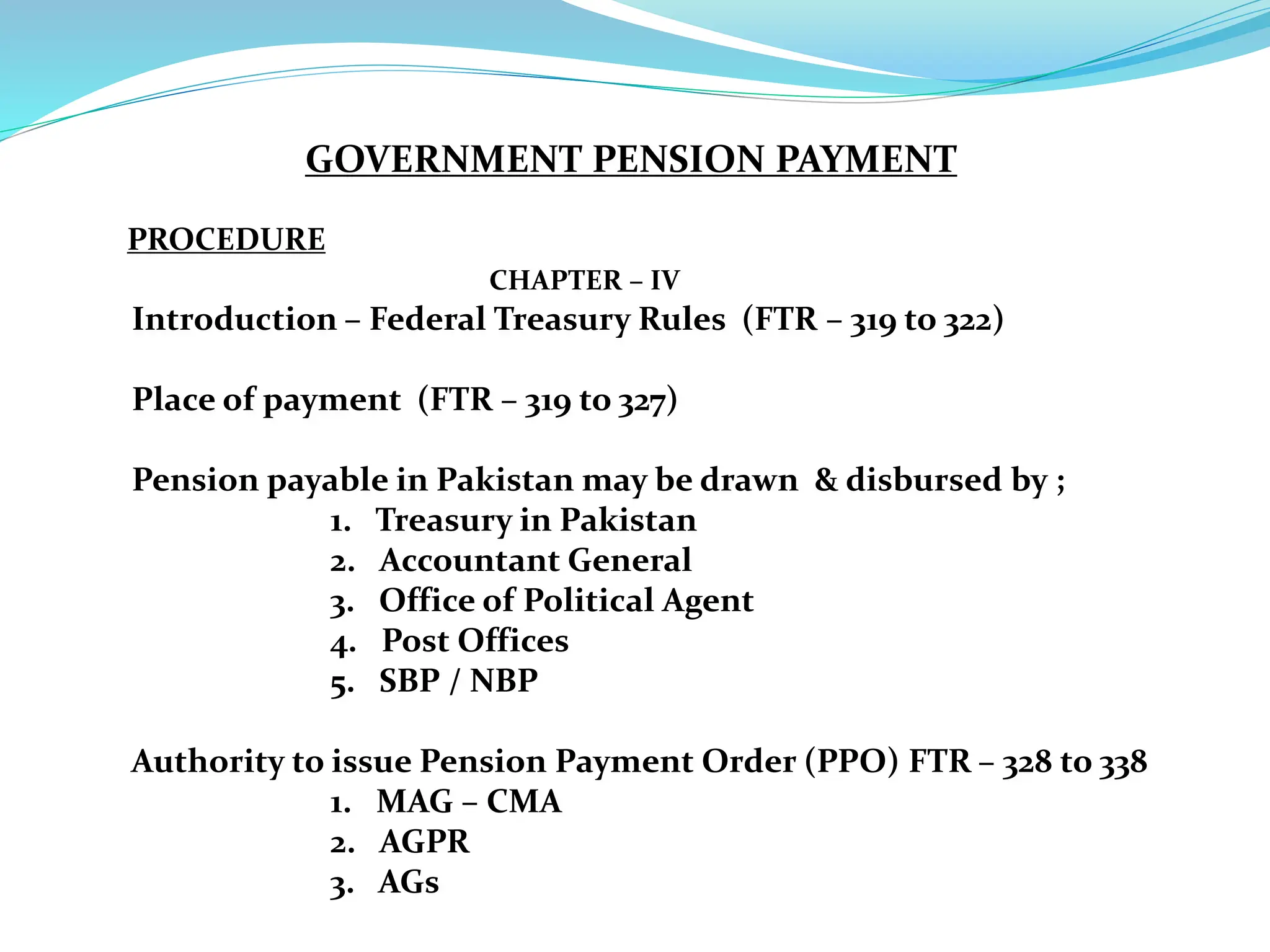

The document outlines the structure and rules governing the treasury system in Pakistan, differentiating between bank treasuries and non-bank treasuries. It details the federal consolidated fund and public fund accounts, including various types of funds and the procedures for pension payments. Additionally, it describes payment regulations, record-keeping, and audit processes pertinent to government finances.