Energy & Commodities, No. 2 - February 9, 2012

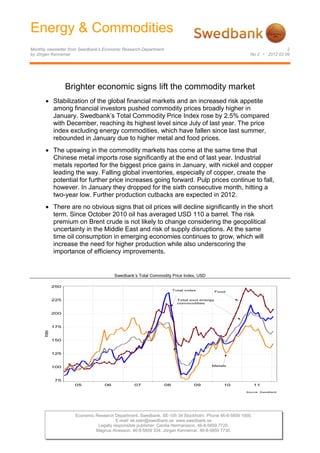

- 1. Energy & Commodities Monthly newsletter from Swedbank’s Economic Research Department 2 by Jörgen Kennemar No 2 • 2012 02 09 Brighter economic signs lift the commodity market Stabilization of the global financial markets and an increased risk appetite among financial investors pushed commodity prices broadly higher in January. Swedbank’s Total Commodity Price Index rose by 2.5% compared with December, reaching its highest level since July of last year. The price index excluding energy commodities, which have fallen since last summer, rebounded in January due to higher metal and food prices. The upswing in the commodity markets has come at the same time that Chinese metal imports rose significantly at the end of last year. Industrial metals reported for the biggest price gains in January, with nickel and copper leading the way. Falling global inventories, especially of copper, create the potential for further price increases going forward. Pulp prices continue to fall, however. In January they dropped for the sixth consecutive month, hitting a two-year low. Further production cutbacks are expected in 2012. There are no obvious signs that oil prices will decline significantly in the short term. Since October 2010 oil has averaged USD 110 a barrel. The risk premium on Brent crude is not likely to change considering the geopolitical uncertainty in the Middle East and risk of supply disruptions. At the same time oil consumption in emerging economies continues to grow, which will increase the need for higher production while also underscoring the importance of efficiency improvements. Energiråvaror Swedbank’s Total Commodity Price Index, USD 250 Total index Food Råvaruprisindex totalt 225 Total excl energy commodities 200 sive energiråvaror 175 Index 150 125 100 Metals 75 05 06 07 08 09Metaller 10 11 Source: Swedbank Economic Research Department. Swedbank. SE-105 34 Stockholm. Phone 46-8-5859 1000. E-mail: ek.sekr@swedbank.se www.swedbank.se Legally responsible publisher: Cecilia Hermansson. 46-8-5859 7720. Magnus Alvesson. 46-8-5859 334. Jörgen Kennemar. 46-8-5859 7730.

- 2. Energy & Commodities Monthly newsletter from Swedbank’s Economic Research Department, continue No 2 • 2012 02 09 U.S The downward trend in commodity prices since the its broad application in industry and construction, second half of 2011 has leveled off this year, which rose by an average of 6% and has again passed partly covaries with the improvement in global USD 8 000 a ton. Aluminum, which is used to industrial activity. The Global Purchasing Managers manufacture aircraft and machinery, among other Index (PMI) rose in January and is in the growth things, saw less of a price decline last fall compared zone for the second month in a row. Better growth with other base metals. In January aluminum rose numbers from the US are also pushing commodity by 5.7% after having steadily fallen during the fall. prices higher. At the same time investor interest in, Zinc and lead have also risen in price, but at a more and risk appetite for, commodities has returned modest pace. Iron ore and scrap rose a modest partly because central banks, especially the 1.8% compared with January 2011. European Central Bank (ECB), have taken aggressive monetary action to boost liquidity in the Price trend for industrial metals, January 2011=100 115 international financial markets after fiscal policies EMU were tightened. This created greater confidence in 110 the financial markets and led to lower TED spreads 105 in Europe. The stabilization of the financial markets rests on shaky ground, however, and could change 100 quickly, especially if the sovereign debt crisis in the Index, Jan 2011=100 95 euro zone worsens. Sweden 90 Interbanks interest rates minus government treasury, TED 85 spreads 80 1,50 75 70 1,25 65 EMU jan feb mar apr maj jun jul aug sep okt nov dec jan 11 12 1,00 Copper Lead Nickel Zinc Aluminium Source: Swedbank Sweden 0,75 The rebound in metal prices in the last month has UK happened at the same time that Chinese demand 0,50 has risen, as evident by December import data. Less concern about a hard landing for the Chinese economy and indications of a growing Chinese 0,25 USA inventory build-up are driving metal prices broadly Japan higher. Inventory changes will mean price volatility, 0,00 however, unless underlying demand strengthens. jan apr jul okt jan apr jul okt jan apr jul okt jan 09 10 11 12 There have also been signs that the Chinese will Source: Reuters EcoWin loosen their monetary policy, which is partly supported by a decline in inflation to a more Swedbank’s Total Commodity Price Index rose comfortable 4.1% in December. Temporarily lower by 2.5% in January in USD compared with metal extraction has tightened supply conditions December, reaching its highest level since July of during the fall and winter, especially for copper. last year. Measured in euro, the increase was 4.7%. Production by the largest mining companies such Excluding energy commodities, the index rose by as BHP Billiton, Xstrata, Anglo American and Rio 2.8% in USD after having fallen for eight Tinto fell by 273 000 tons or 8.2% in 2011. This has consecutive months by a total of 20%. Industrial led to rapidly shrinking copper inventories, which at metals saw the fastest price gain in January, the time of writing are at their lowest levels in over climbing as much as 6.1%, the largest monthly two years. Metal prices in coming quarters will change since August 2010. Nickel rose to nearly depend in large part on how much emerging USD 19 800 a ton in January, up almost 9% in one economies can keep growing when several OECD month. This is a significant increase compared with countries are in recession. This also applies to the last year, when nickel had the weakest price trend global financial markets. Additional liquidity- of any industrial metal. The price of copper, which is boosting measures by central banks raise the considered a reliable economic indicator because of likelihood of a further increase in metal prices,

- 3. Energy & Commodity Monthly newsletter from Swedbank’s Economic Research Department, continue No 2 • 2012 02 09 despite that global growth prospects are relatively projected to rise by 3.2% in emerging economies, modest. while continuing to fall, by 0.3%, in mature industrial countries. Although China is the world's second High oil prices are here to stay largest oil consumer, per capita it is significantly Despite that global oil consumption fell in the last below the OECD average, a gap that will gradually quarter of 2011, prices have been stuck at a high shrink. Higher oil prices also tend to drive up the level. Brent crude was an average of 2.4% higher in price of coal. In January coal rose by 3.4% in USD January, at USD 110 a barrel, which could hurt the from the previous month. This is the first time in already shaky global economy and thus demand for three months that the price of coal has risen. oil products. The cold weather in Europe contributed to a widening price difference between A cold winter is cutting into food supplies European Brent crude and US crude. Global food prices have fluctuated greatly in recent years. Increased speculation, production Brent crude price in USD disruptions owing to unfavorable weather conditions 150 and growing competition between food and energy 140 production are affecting the balance between 130 supply and demand. At the same time the world's 120 population and purchasing power are growing, so 110 demand is trending higher, especially in emerging economies. 100 USD/fat 90 Grain prices, index 80 500 70 60 450 50 Wheat 400 40 350 30 05 06 07 08 09 10 11 12 300 Cereals Källa: Swedbank, Reuters EcoWin 250 The rise in oil prices has also been driven by 200 uncertainty about supplies and geopolitical developments in the Middle East. The EU’s oil 150 embargo on Iran, which will have its full effect this Corn summer, and the Iranian threat to block or limit oil 100 shipments through the Strait of Hormuz have raised 50 oil’s risk premium. The embargo, which represents 05 06 07 08 09 10 11 12 600 000 fat barrels a day, is not expected to have a Source: Reuters EcoWin major impact on supplies, since Saudi Arabia has Increased global food production in 2011 and rising promised to raise its production. There could be a inventories contributed to a broad decline in prices bigger shortage of petroleum products, however, in the second half-year at the same time that especially in Italy and Spain, where refineries investors were seeking out safe harbors in the wake mainly process lighter, low-sulfur Iranian oil. Iran is of the fiscal crisis. After peaking in February 2011, the fifth largest oil producer at 3.6 million barrels a Swedbank’s Commodity Price Index fell by nearly day, most of which is exported to China, India and 20% in USD through last December. In January, Japan – economies with growing demand. In however, prices rose by an average of 2.3% in USD Japan, this is mainly due to the tsunami disaster after having fallen for four consecutive months. The and shutdown of a number of nuclear power plants. unusually cold weather in Russia and Ukraine and None of these countries is planning to cut back on speculation about Russian export restrictions on their imports from Iran, which should also reduce grain have driven prices higher. An extended cold the risk of increased imbalances in the global oil snap could also have a negative effect on market. At the same time there is a clear shift in production over the course of 2012. global oil consumption, where emerging economies led by Asia are taking a growing slice. This trend is Prices of forest commodities continued to fall during expected to continue. This year consumption is the first month of the year. Pulp prices fell in USD 3 (6)

- 4. Energy & Commodities Monthly newsletter from Swedbank’s Economic Research Department, continue No 2 • 2012 02 09 by 1.7% between December and January, which interest. Silver has risen in USD by slightly over was a smaller decline than in recent months. Weak 20% since the beginning of the year, against 13% global demand and overcapacity are contributing to for gold. This is also a sign of an increased risk the downward trend, because of which pulp has appetite in the financial markets. In addition to fallen by 18% since peaking in July 2011 at just greater speculation, the price rise is being driven by over USD 1 000 a ton. This is also a signal of higher industrial consumption of silver. The fiscal further production cutbacks going forward. crisis in the EMU countries and liquidity support from central banks suggest further price increases Price trend for various agricultural products, USD for precious metals. 1200 225 Gold and silver, index 1100 200 1000 Index, 2000=100 1000 175 900 900 150 800 USD/Ton (metric) USc/Pound 800 125 700 700 100 600 Index 500 600 75 400 500 50 300 400 25 00 01 02 03 04 05 06 07 08 09 10 11 200 Pulp Cotton Source: Reuters EcoWin 100 jan maj sep jan maj sep jan maj sep jan maj sep jan 08 09 10 11 12 Increased liquidity lifts precious metals Gold Silver Source: Reuters EcoWin The decline in the prices of gold and silver last fall has been followed this year by renewed investor Jörgen Kennemar

- 5. Energy & Commodities Monthly newsletter from Swedbank’s Economic Research Department 2 by Jörgen Kennemar No 2 • 2012 02 09 Swedbank Commodity Index - US$ - Swedbank Commodity Index - SKr - Basis 2000 = 1oo 10-02-12 Basis 2000 = 1oo 10-02-12 11.2011 12.2011 1.2012 11.2011 12.2011 1.2012 T otal index 365,0 359,7 368,7 T otal index 267,4 267,8 274,5 Per cent change month ago 2,5 -1,4 2,5 Per cent change month ago 3,9 0,2 2,5 Per cent change year ago 22,8 14,5 12,7 Per cent change year ago 21,4 14,6 15,8 T otal index exclusive energy 269,5 264,1 271,5 T otal index exclusive energy 197,4 196,6 202,2 Per cent change month ago -4,6 -2,0 2,8 Per cent change month ago -3,3 -0,4 2,8 Per cent change year ago -5,0 -9,8 -12,0 Per cent change year ago -6,2 -9,6 -9,7 Food, tropical beverages 268,6 258,7 264,8 Food, tropical beverages 196,8 192,6 197,2 Per cent change month ago -2,3 -3,7 2,4 Per cent change month ago -1,0 -2,1 2,4 Per cent change year ago -0,6 -9,6 -12,5 Per cent change year ago -1,7 -9,5 -10,1 Cereals 277,2 269,0 275,5 Cereals 203,1 200,3 205,1 Per cent change month ago -1,6 -3,0 2,4 Per cent change month ago -0,3 -1,4 2,4 Per cent change year ago 7,8 -3,5 -6,5 Per cent change year ago 6,6 -3,4 -4,0 T ropical beverages and tobacco 286,5 274,0 277,0 T ropical beverages and tobacco 209,9 204,0 206,2 Per cent change month ago -2,5 -4,4 1,1 Per cent change month ago -1,2 -2,8 1,1 Per cent change year ago 0,5 -9,1 -12,6 Per cent change year ago -0,7 -9,0 -10,3 Coffee 193,7 189,1 188,7 Coffee 141,9 140,8 140,5 Per cent change month ago -0,2 -2,4 -0,2 Per cent change month ago 1,1 -0,8 -0,2 Per cent change year ago 11,4 2,9 -4,4 Per cent change year ago 10,1 3,0 -1,8 Oilseeds and oil 224,2 218,8 231,3 Oilseeds and oil 164,3 162,9 172,2 Per cent change month ago -2,4 -2,4 5,7 Per cent change month ago -1,1 -0,8 5,7 Per cent change year ago -8,9 -15,2 -16,3 Per cent change year ago -10,0 -15,1 -14,1 Industrial raw materials 269,8 265,7 273,5 Industrial raw materials 197,6 197,8 203,6 Per cent change month ago -5,2 -1,5 2,9 Per cent change month ago -3,9 0,1 2,9 Per cent change year ago -6,3 -9,8 -11,9 Per cent change year ago -7,4 -9,7 -9,5 Agricultural raw materials 173,7 167,1 166,8 Agricultural raw materials 127,3 124,4 124,2 Per cent change month ago -7,1 -3,8 -0,2 Per cent change month ago -5,8 -2,2 -0,2 Per cent change year ago -8,9 -13,5 -16,9 Per cent change year ago -10,0 -13,4 -14,7 Cotton 96,2 89,1 96,3 Cotton 70,5 66,3 71,7 Per cent change month ago -4,9 -7,4 8,1 Per cent change month ago -3,7 -5,9 8,1 Per cent change year ago -27,1 -36,7 -36,5 Per cent change year ago -28,0 -36,6 -34,8 Softwood 138,3 132,3 129,7 Softwood 101,3 98,5 96,6 Per cent change month ago -4,4 -4,3 -2,0 Per cent change month ago -3,1 -2,8 -2,0 Per cent change year ago -7,4 -8,5 -10,1 Per cent change year ago -8,5 -8,4 -7,6 W oodpulp 887,3 846,0 831,6 W oodpulp 650,0 629,9 619,2 Per cent change month ago -4,6 -4,7 -1,7 Per cent change month ago -3,3 -3,1 -1,7 Per cent change year ago -7,3 -10,9 -12,4 Per cent change year ago -8,4 -10,8 -10,0 N on-ferrous metals 232,3 229,6 243,6 Non-ferrous metals 170,2 171,0 181,4 Per cent change month ago -1,9 -1,2 6,1 Per cent change month ago -0,5 0,5 6,1 Per cent change year ago -13,0 -16,6 -13,2 Per cent change year ago -12,0 -16,7 -15,5 Copper 5532,2 5635,0 5972,0 Copper 7551,4 7568,2 8020,8 Per cent change month ago 3,8 1,9 6,0 Per cent change month ago 2,4 0,2 6,0 Per cent change year ago -11,9 -17,0 -13,9 Per cent change year ago -10,8 -17,1 -16,1 Aluminium 1518,8 1504,0 1590,3 Aluminium 2073,2 2020,0 2135,9 Per cent change month ago -3,4 -1,0 5,7 Per cent change month ago -4,7 -2,6 5,7 Per cent change year ago -12,2 -13,8 -10,1 Per cent change year ago -11,1 -13,9 -12,5 Lead 1451,7 1501,8 1555,1 Lead 1981,6 2017,0 2088,6 Per cent change month ago 3,2 3,4 3,5 Per cent change month ago 1,8 1,8 3,5 Per cent change year ago -17,6 -16,0 -17,5 Per cent change year ago -16,6 -16,1 -19,7 Z inc 1403,5 1424,0 1469,3 Z inc 1915,7 1912,5 1973,4 Per cent change month ago 4,4 1,5 3,2 Per cent change month ago 3,0 -0,2 3,2 Per cent change year ago -17,4 -15,7 -14,6 Per cent change year ago -16,4 -15,8 -16,9 Nickel 13098,6 13530,0 14703,8 N ickel 17879,4 18171,7 19748,2 Per cent change month ago -4,2 3,3 8,7 Per cent change month ago -5,5 1,6 8,7 Per cent change year ago -22,9 -24,3 -20,8 Per cent change year ago -21,9 -24,5 -22,9 Iron ore, steel scrap 454,9 461,0 469,4 Iron ore, steel scrap 620,9 619,2 630,4 Per cent change month ago -6,0 1,4 1,8 Per cent change month ago -7,2 -0,3 1,8 Per cent change year ago 1,8 2,2 -0,9 Per cent change year ago 3,0 2,0 -3,5 Energy raw materials 298,4 299,4 306,6 Energy raw materials 407,4 402,1 411,8 Per cent change month ago 6,2 0,3 2,4 Per cent change month ago 4,8 -1,3 2,4 Per cent change year ago 32,8 24,4 26,2 Per cent change year ago 34,4 24,2 22,9 Coking coal 313,8 314,8 326,5 Coking coal 428,4 422,8 438,5 Per cent change month ago -3,3 0,3 3,7 Per cent change month ago -4,6 -1,3 3,7 Per cent change year ago 4,1 -6,9 -8,2 Per cent change year ago 5,3 -7,0 -10,6 Crude oil 297,7 298,7 305,7 Crude oil 406,4 401,2 410,6 Per cent change month ago 6,7 0,3 2,3 Per cent change month ago 5,3 -1,3 2,3 Per cent change year ago 34,6 26,4 28,5 Per cent change year ago 36,2 26,2 25,1 Source : SW ED BAN K and H W W A-Institute for Economic R esearch H amburg c Source : SW EDBANK and HW W A-Institute for Economic Research Hamburg Swedbank Swedbank’s monthly Energy & Commodities newsletter is published as s service to our Economic Research Department customers. We believe that we have used reliable sources and methods in the preparation of the analyses reported in this publication. However, we cannot guarantee the accuracy or SE-105 34 Stockholm, Sweden completeness of the report and cannot be held responsible for any error or omission in the Phone 46-8-5859 7740 underlying material or its use. Readers are encouraged to base any (investment) decisions ek.sekr@swedbank.se on otjer material as well. Neither Swedbank nor its employees may be held responsible for www.swedbank.se losses or damages, direct or indirect, owing to any errors or omissions in Swedbanks Legally responsible publisher monthly Energy & Commodities newsletter. Cecilia Hermansson, 46-8-5859 7720. Magnus Alvesson, 46-8-5859 3341 Jörgen Kennemar, 46-8-5859 7730 Economic Research Department. Swedbank. SE-105 34 Stockholm. Phone 46-8-5859 1000. E-mail: ek.sekr@swedbank.se www.swedbank.se Legally responsible publisher: Cecilia Hermansson. 46-8-5859 7720. Magnus Alvesson. 46-8-5859 334. Jörgen Kennemar. 46-8-5859 7730.