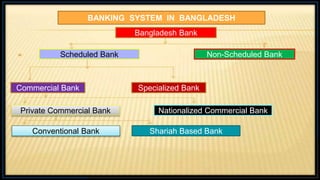

This document provides an overview of the money and banking system of Bangladesh. It begins with definitions of money and banks. It describes that the currency of Bangladesh is the Taka, controlled by the Central Bank of Bangladesh. It then discusses the classification of money into metal coins and paper notes. The document outlines the history and current structure of Bangladesh's banking system, including the Bangladesh Bank as the central bank, scheduled and non-scheduled banks, commercial and specialized banks, private and nationalized commercial banks, conventional and Shariah-based banks. It concludes with information about mobile banking services in Bangladesh.