Embed presentation

Download to read offline

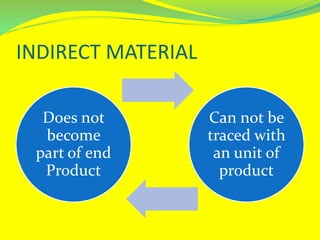

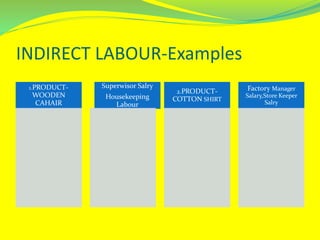

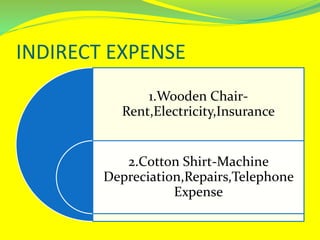

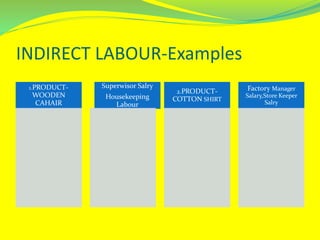

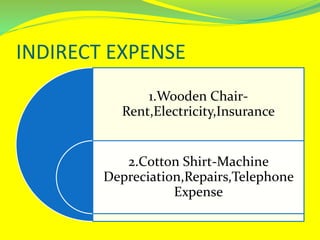

This document discusses the classification of indirect costs in manufacturing. It defines indirect materials as materials that do not become part of the final product and cannot be traced to a specific unit, giving examples like nails, oil, and printing supplies. Indirect labor is labor like supervision and housekeeping that supports overall production rather than a specific product. Indirect expenses are operational costs like rent, utilities, and depreciation. The document provides examples of indirect materials, labor, and expenses for manufacturing a wooden chair and cotton shirt.