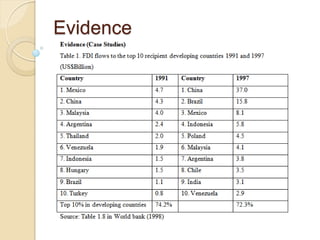

The document discusses the impacts of foreign direct investment (FDI) in developing countries. It notes that while FDI has grown significantly globally, most goes to developed not developing countries. Recent years have seen large FDI to Argentina, Brazil, and China. FDI can boost factors like capital investment, technology transfer, and productivity. However, it can also increase inequality, exploit workers, and harm tax revenues as countries compete for investment. The document concludes that FDI likely benefits growth if governments implement sound policies to manage impacts and avoid negative consequences.