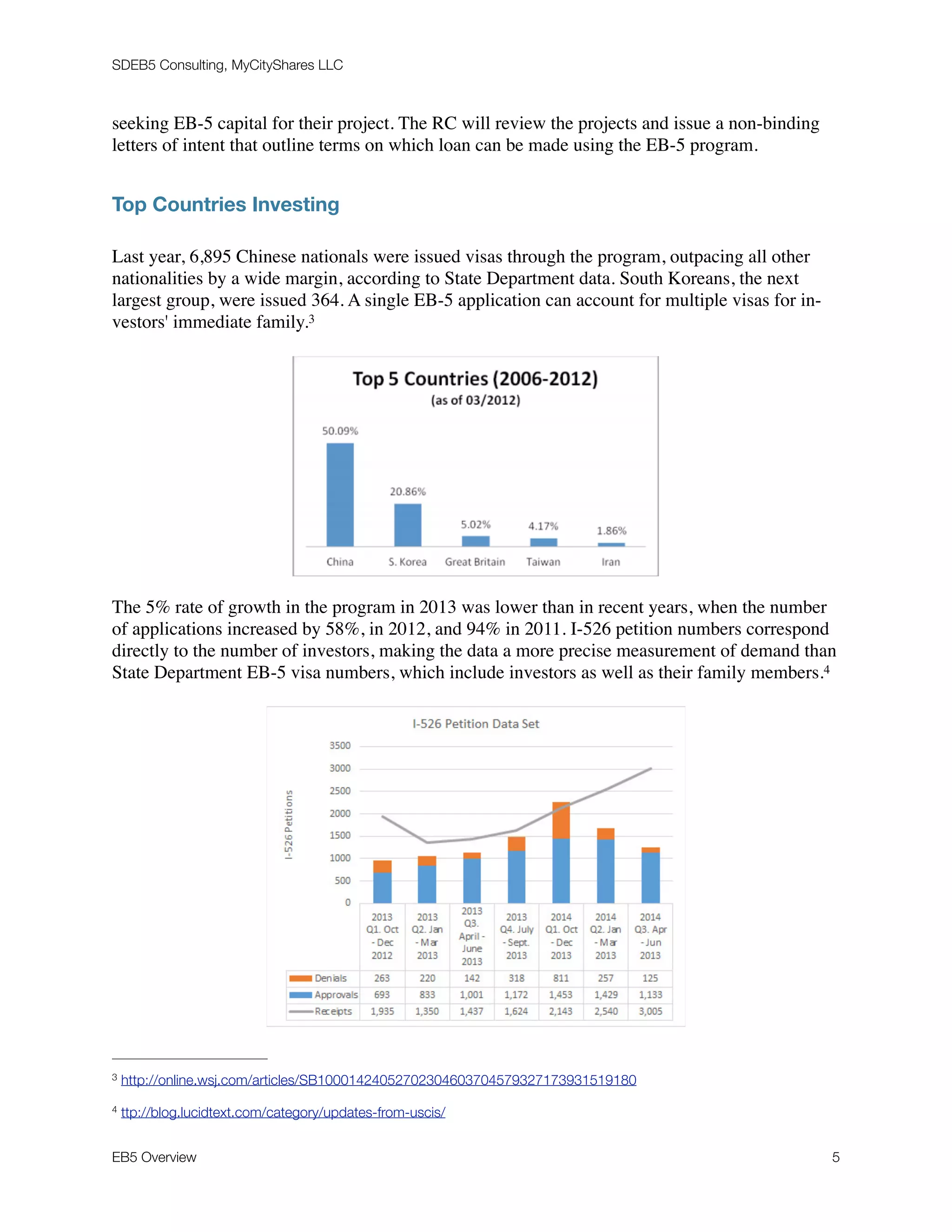

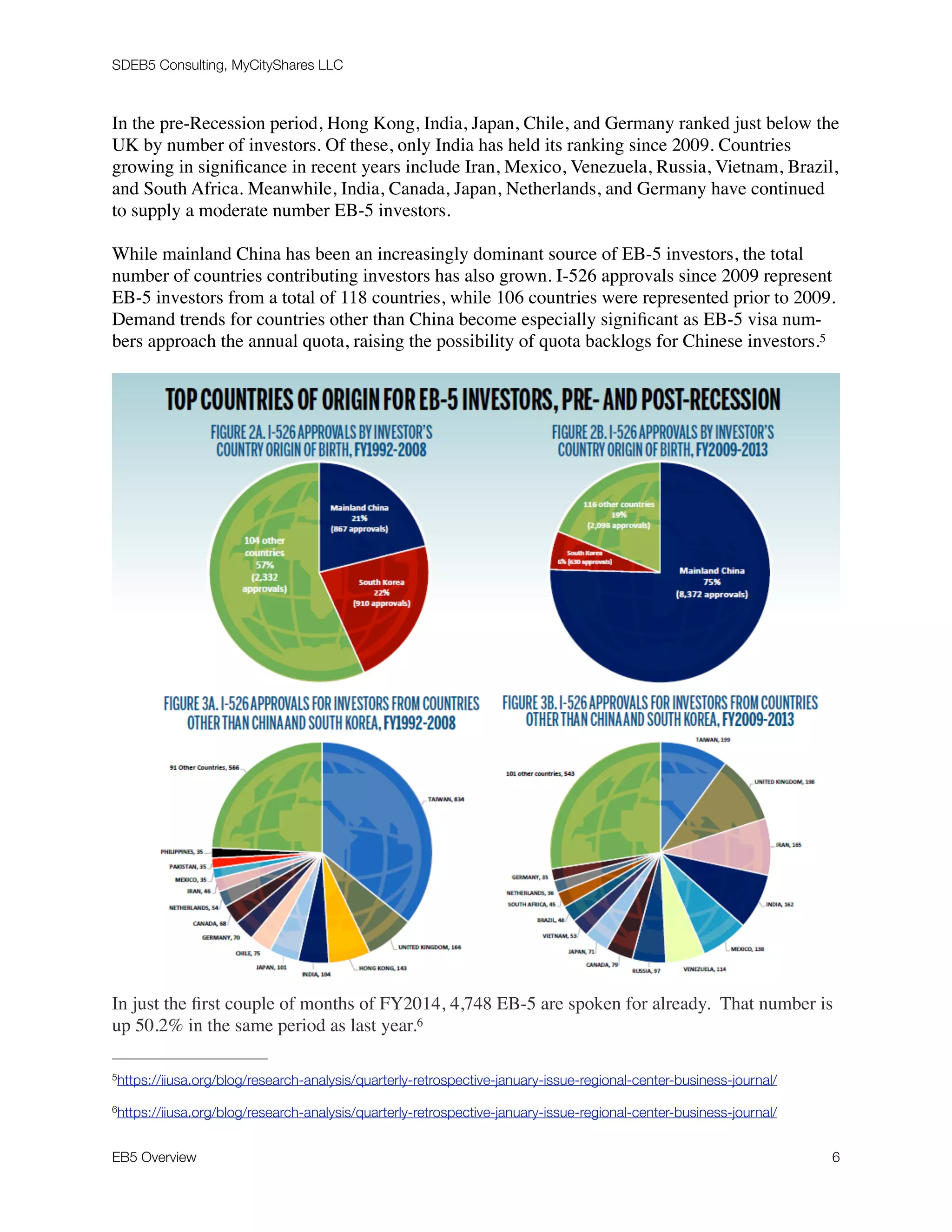

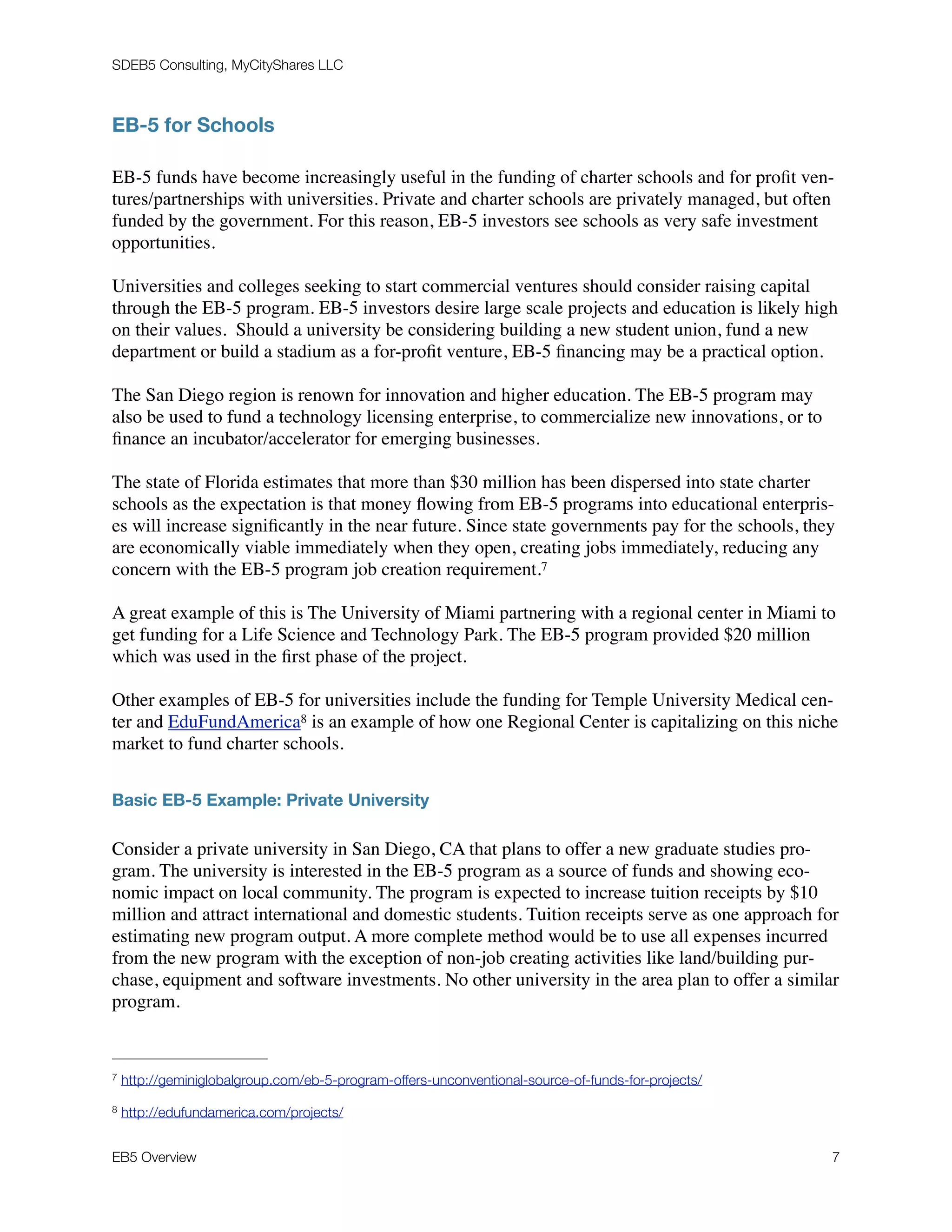

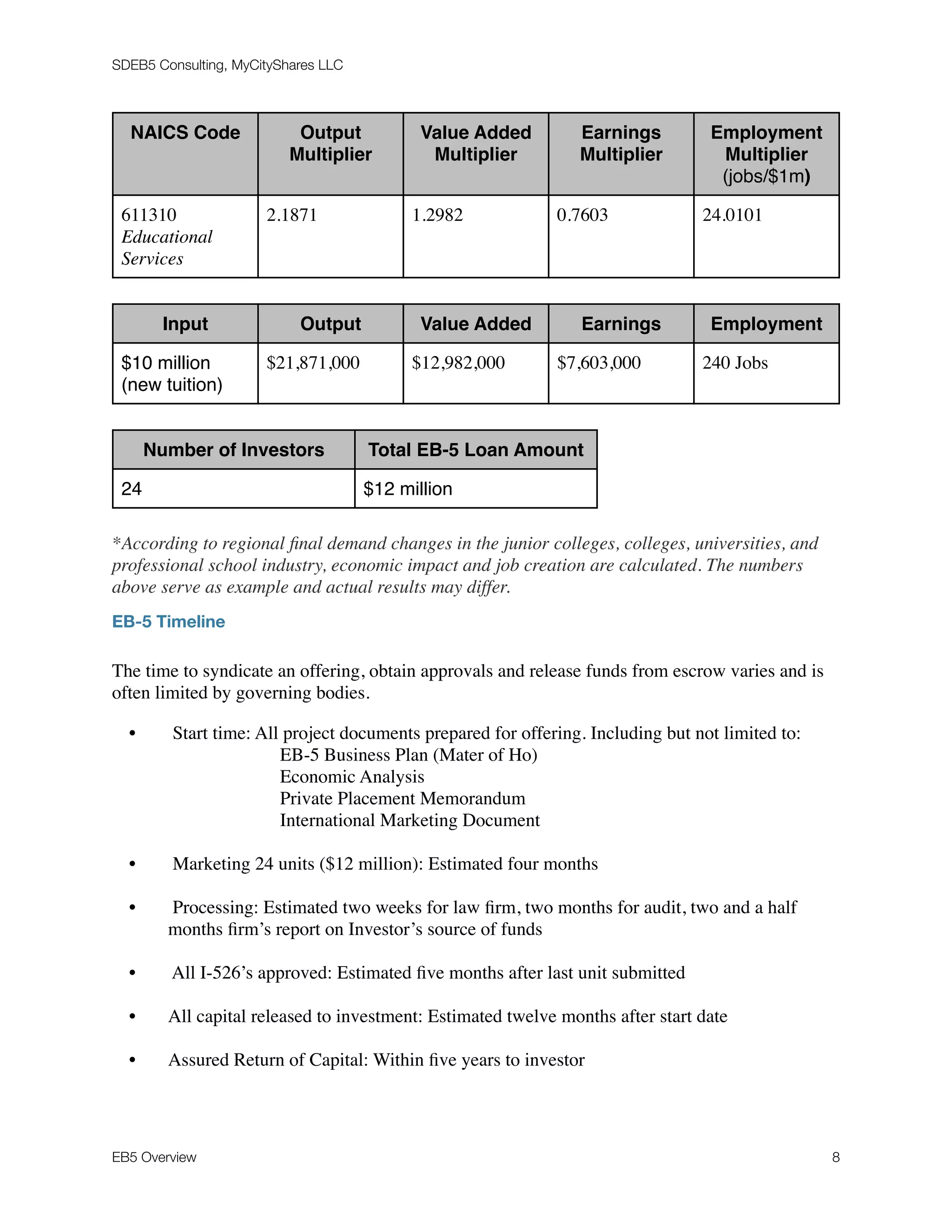

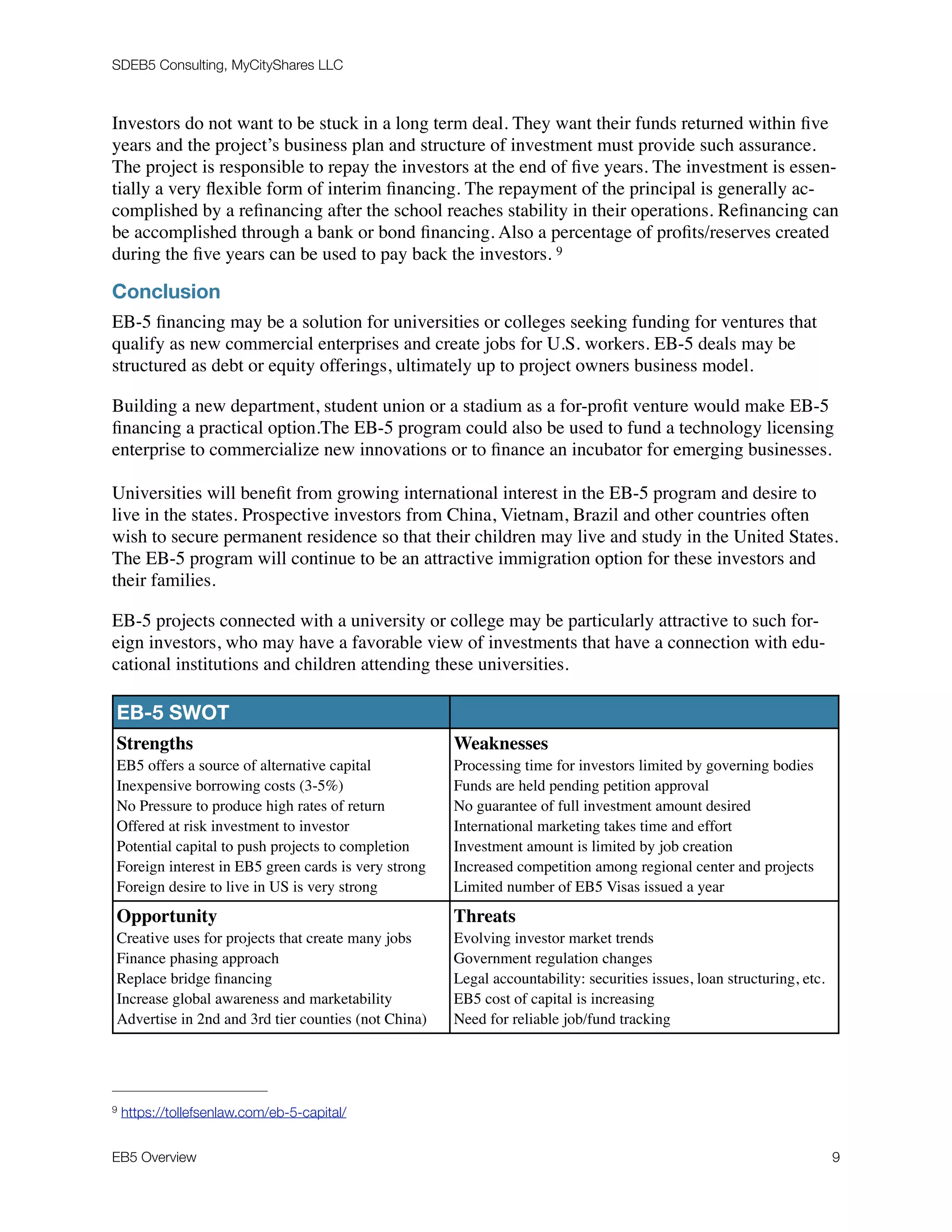

This document provides an overview of EB-5 financing for educational facilities. It describes how EB-5 works, the top countries investing, and gives an example of how EB-5 could fund a new graduate program at a private university. EB-5 investments must create a minimum of 10 jobs per investor. For a $10 million graduate program, 24 EB-5 investors could provide $12 million in funding. It would take an estimated 12 months to raise the capital, get I-526 approvals, and release funds to the university.