Embed presentation

Downloaded 11 times

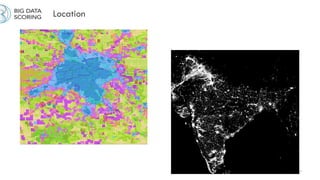

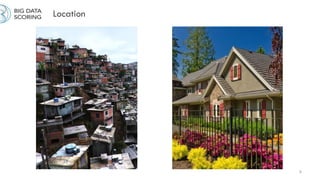

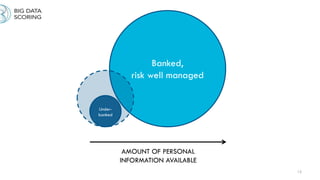

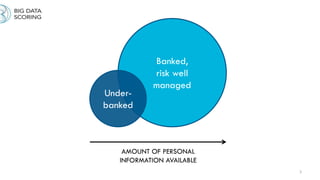

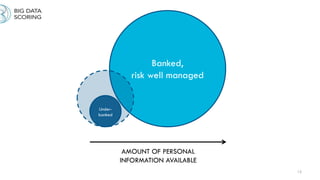

More customers can be approved for loans using Big Data Scoring's alternative credit scoring model. Their model analyzes more sources of personal information than traditional credit scores, including government data, device and location information, and public online data. This additional data allows them to better assess risk for underbanked individuals. In trials, Big Data Scoring's model improved loan approval quality and increased the number of approved loans by 26% compared to traditional credit scoring.