Draft Notification INCOME-TAX

•

0 likes•41 views

CBDT releases draft rules prescribing method of valuation of unquoted equity shares for the purpose of Sections 56(2)(x) and 50CA; CBDT invites comments and suggestions from stakeholders by May 19. Copy of Notification and draft rules are attached. Valuation of unquoted equity shares are to be calculated as per draft rules by taking into account the FMV of jewellery, artistic work, shares & securities and stamp duty value in case of immovable property and book value for the rest of the assets . As per existing 11UA rule the book value (and not the FMV / stamp duty value) is taken into consideration for determining the value of such shares.

Report

Share

Report

Share

Download to read offline

Recommended

31st GST Council Meeting Update

The 31st GST Council meeting made several recommendations including:

1. Extending the due dates for filing annual returns and reconciliations for FY 2017-18 to June 30, 2019.

2. Extending the due date for claiming input tax credit for invoices from FY 2017-18 to March 2019.

3. Waiving late fees for returns filed between July-September 2018 if filed by March 31, 2019.

4. Implementing a single cash ledger for each tax head and a new return filing system on a trial basis from April 2019.

The paymentofbonusrules1975

This document outlines rules related to the payment of bonuses according to the Payment of Bonus Act of 1965 in India. It defines key terms, specifies authorities for approving changes to accounting years, and outlines requirements for maintaining registers related to calculating allocable surplus, setting on/off amounts, and recording bonus payments to employees. Formats are provided for these registers to ensure compliance with the rules when distributing annual bonuses.

Gst rate reduced on covid converted

Notification 04/2021-Central Tax (Rate) reduced GST rate on COVID-19 related supplies

The length of the meta description is perfect. (543 pixels out of 1000 max pixel length)

Notification 11 of 2016

The notification amends the Income Tax Rules of 1962. It substitutes rule 45 regarding the form of appeal to the Commissioner (Appeals). Appeals must now be filed using Form 35, which must be electronically filed and verified depending on how the taxpayer files their return. Form 35 collects personal information, details of the appealed order, pending appeals, appeal details, tax payments, statement of facts/grounds for appeal and additional evidence. The amended rules also specify the procedure for electronic filing and verification of Form 35.

Corporate hights 5599 tower 4 (1)

This document outlines the payment plans and pricing for units in the Corporate Height Tower 4 development. There are three payment plans offered: a one-time down payment plan with a basic sale price of Rs. 5599 per square foot, a 12% monthly return plan with a basic sale price of Rs. 7199 per square foot, and a construction link plan priced at Rs. 6999 per square foot. The construction link plan involves 10% payments at various construction milestones. Additional charges include other charges of Rs. 250 per square foot, car parking prices starting at Rs. 500,000, and interest free maintenance security of Rs. 250 per square foot. Terms and conditions including price changes apply.

LPE1 with form fields

- The document defines key terms related to leasehold property such as ground rent, landlord, and service charge.

- It requests information from the seller about contact details for various parties involved in managing the property, details on transferring and registering the lease, payment of ground rent and service charges, building insurance, and any disputes.

- The seller is asked to provide documentation such as the last three years of service charge accounts and current building insurance policies. The information requested is intended to make the incoming lessee fully aware of their obligations regarding the leasehold property.

LPE2 with form fields

This document summarizes the key financial responsibilities of a leasehold property purchase. It outlines costs associated with the purchase, including notice fees and deed of covenant fees. It also details regular payments during ownership, such as ground rent and service charges. Additionally, it notes potential additional payments in the future, like excess service charges, planned maintenance contributions, and future fees when selling or subletting. More information on leaseholder responsibilities can be found online at www.lease-advice.org.

Revised Sales Tax 3 annexure

The revised ST3 service tax return form includes several new sections and disclosures. It separates information for the service provider and recipient regarding the partial reverse charge mechanism. It also requires separate disclosures for amounts received in advance, amounts taxable upon receipt, amounts for services provided but not yet invoiced, and other taxable amounts. Additionally, the form includes separate columns for export and exempted services, research and development cess deductions, other deductions from tax payable, payments received for imports and non-imports, and service tax, education cess, and secondary education cess amounts when deposited in advance.

Recommended

31st GST Council Meeting Update

The 31st GST Council meeting made several recommendations including:

1. Extending the due dates for filing annual returns and reconciliations for FY 2017-18 to June 30, 2019.

2. Extending the due date for claiming input tax credit for invoices from FY 2017-18 to March 2019.

3. Waiving late fees for returns filed between July-September 2018 if filed by March 31, 2019.

4. Implementing a single cash ledger for each tax head and a new return filing system on a trial basis from April 2019.

The paymentofbonusrules1975

This document outlines rules related to the payment of bonuses according to the Payment of Bonus Act of 1965 in India. It defines key terms, specifies authorities for approving changes to accounting years, and outlines requirements for maintaining registers related to calculating allocable surplus, setting on/off amounts, and recording bonus payments to employees. Formats are provided for these registers to ensure compliance with the rules when distributing annual bonuses.

Gst rate reduced on covid converted

Notification 04/2021-Central Tax (Rate) reduced GST rate on COVID-19 related supplies

The length of the meta description is perfect. (543 pixels out of 1000 max pixel length)

Notification 11 of 2016

The notification amends the Income Tax Rules of 1962. It substitutes rule 45 regarding the form of appeal to the Commissioner (Appeals). Appeals must now be filed using Form 35, which must be electronically filed and verified depending on how the taxpayer files their return. Form 35 collects personal information, details of the appealed order, pending appeals, appeal details, tax payments, statement of facts/grounds for appeal and additional evidence. The amended rules also specify the procedure for electronic filing and verification of Form 35.

Corporate hights 5599 tower 4 (1)

This document outlines the payment plans and pricing for units in the Corporate Height Tower 4 development. There are three payment plans offered: a one-time down payment plan with a basic sale price of Rs. 5599 per square foot, a 12% monthly return plan with a basic sale price of Rs. 7199 per square foot, and a construction link plan priced at Rs. 6999 per square foot. The construction link plan involves 10% payments at various construction milestones. Additional charges include other charges of Rs. 250 per square foot, car parking prices starting at Rs. 500,000, and interest free maintenance security of Rs. 250 per square foot. Terms and conditions including price changes apply.

LPE1 with form fields

- The document defines key terms related to leasehold property such as ground rent, landlord, and service charge.

- It requests information from the seller about contact details for various parties involved in managing the property, details on transferring and registering the lease, payment of ground rent and service charges, building insurance, and any disputes.

- The seller is asked to provide documentation such as the last three years of service charge accounts and current building insurance policies. The information requested is intended to make the incoming lessee fully aware of their obligations regarding the leasehold property.

LPE2 with form fields

This document summarizes the key financial responsibilities of a leasehold property purchase. It outlines costs associated with the purchase, including notice fees and deed of covenant fees. It also details regular payments during ownership, such as ground rent and service charges. Additionally, it notes potential additional payments in the future, like excess service charges, planned maintenance contributions, and future fees when selling or subletting. More information on leaseholder responsibilities can be found online at www.lease-advice.org.

Revised Sales Tax 3 annexure

The revised ST3 service tax return form includes several new sections and disclosures. It separates information for the service provider and recipient regarding the partial reverse charge mechanism. It also requires separate disclosures for amounts received in advance, amounts taxable upon receipt, amounts for services provided but not yet invoiced, and other taxable amounts. Additionally, the form includes separate columns for export and exempted services, research and development cess deductions, other deductions from tax payable, payments received for imports and non-imports, and service tax, education cess, and secondary education cess amounts when deposited in advance.

Krishi kalyan cess

Discussion regarding the applicability of Krishi Kalyan Cess and various pertinent issues regarding Krishi Kalyan Cess is discussed in the presentation.

Collection and recovery.bose

This document provides an overview of tax collection and recovery provisions under the Income Tax Act of India (Sections 190-234D). It discusses general principles of deduction at source, direct payment of tax, and various types of deductions including for salaries (Section 192), interest on securities (Section 193), and dividends (Section 194). The summary focuses on high-level topics covered rather than detailed legal provisions.

Sanjeev ghai income tax

The document discusses India's Income Tax Act. It states that the Act provides that income tax is charged annually on a person's total income from the previous year at rates determined by the Finance Act. It further states that the total income is classified under various heads including salaries, house property income, business/profession profits, capital gains, and other sources. The document also notes that it aims to discuss tax provisions relevant to salaried workers, pensioners, and senior citizens.

16 part b_vilas mohanrao sanase(5)_auhps0589h_2020-21

This document is a Form 16 issued by an employer. It provides salary and tax details for an employee named VILAS MOHANRAO SANASE PAN for AY 2021-22. Key details include:

1) The employee's gross salary and other income were nil for the year.

2) The employee was eligible for no exemptions or deductions.

3) The employee's total income was nil and no tax was payable.

4) TDS of nil was deducted by the employer.

Form27 a

This document is Form 27A which is used to furnish information for tax deducted at source statements filed on computer media. The form includes sections for:

1) Basic identifying information like tax deduction account number, PAN, financial year, etc.

2) Particulars of the deductor such as name, address and contact details.

3) Name and contact details of the person responsible for tax deduction.

4) Control totals including the number of deductee records, amounts paid and taxes deducted/collected.

5) Verification signed by the person responsible for tax deduction.

Gst compensation-to-states-act

This document is the Goods and Services Tax (Compensation to States) Act, 2017 from India. It provides compensation to States for loss of revenue due to the implementation of GST for a period of 5 years. The key points are:

1) It establishes the base year as 2016-2017 and projects a nominal growth rate of 14% per year to calculate projected revenue for States.

2) The compensation amount is calculated as the difference between the projected revenue and actual revenue collected by the State as certified by auditors.

3) A GST compensation cess is levied on certain goods and services to fund the compensation amount payable to States.

Procedues (collection and recovery)

This document outlines procedures for the collection and recovery of tax in Pakistan, including:

- Due dates for tax payment and options for installment plans or extensions.

- Recovery methods for unpaid taxes such as attaching and selling property, appointing receivers, or arresting the taxpayer for up to 6 months.

- Specific provisions for private companies, associations of persons, bankruptcies, non-residents, ships/aircrafts, and persons leaving the country to ensure taxes can still be recovered.

- Powers given to the Commissioner and District Officers to certify unpaid taxes and recover them as if they were civil debts or land revenue.

FORM GSTR-3 PPT

This document is a GSTR-3 form for monthly GST return filing. It requests information about a business's turnover, outward and inward supplies, input tax credit, tax liability, payments and refunds. The form is divided into sections for supply details, tax calculation, payments, refunds and declarations. It requires information about taxable supplies, exemptions, amendments and reverse charge supplies to accurately determine the tax liability and payments for the reporting period.

Tax alert employee taxation - tds

The document summarizes changes made by the CBDT to Income Tax Rules regarding employee taxation and TDS. Key changes include:

1) Employees must now furnish evidence of tax deductions claimed on Form 12BB instead of self-declaration, including PAN of landlord for HRA claims over Rs. 1 lakh and evidence of travel/investment expenditures.

2) Due dates for filing TDS statements have been amended, requiring filing within 30 days for Section 194IA deductions and by 30 April/15 days after quarter-end for other TDS.

3) Form 12BB collects employee name, address, PAN and details of claims and evidence for tax deductions.

Step by Step Guide to File GSTR 9A Annual Composition Form

Check out step by step guide to file GSTR 9A Annual Composition form for the composition scheme dealer for all quarterly transactions in the financial year.

sales act-government-of-pakistan-updated-up-to-july-2014

This document summarizes the Sales Tax Act of 1990 in Pakistan, which consolidates and amends laws relating to taxation on the sale, import, export, production, manufacture, or consumption of goods. Some key points:

- It establishes the legal framework for sales tax in Pakistan, including definitions, tax rates, penalties, and offences.

- Recent amendments have updated various definitions, such as expanding the definition of the term "Commissioner" and establishing the Appellate Tribunal for tax-related appeals.

- The Act aims to simplify and standardize sales tax laws in Pakistan through this consolidated legislation. It provides the primary legal basis for sales tax collection and administration in the country.

Brazil - Fiscal recovery regime (Item4b)

Presentation delivered during the 13th Annual Meeting of the OECD Network on Fiscal Relations Across Levels of Government, 23-24 November 2017, Paris, France.

Office 3499 bsp tower 1 & 3

The document outlines various payment plans and prices for units in Tower 1 and 3 of a residential development. It provides details of the basic sale price (BSP) and installment amounts and due dates for four payment plans: a down payment plan (BSP Rs. 3499/sqft), 12% monthly return plan (BSP Rs. 4899/sqft), construction link plan (BSP Rs. 4699/sqft), and flexi payment plan (BSP Rs. 4099/sqft). It also lists other charges such as parking, service tax, and interest free maintenance security.

Retail blcok b

This document outlines various payment plans and associated basic sale prices (BSP) for units in Retail Block B. The plans include a one-time down payment plan with a BSP of Rs. 7999/- per square foot, a 12% monthly return plan with a BSP of Rs. 10199/- per square foot, a construction link plan with a BSP of Rs. 9999/- per square foot, and a flexi payment plan with a BSP of Rs. 9199/- per square foot. The payment plans detail installment amounts and due dates. Other charges including maintenance, parking, interest-free security deposits, and service tax are also provided. Notes provide additional details on pricing, areas, plans, and

GST Series 1 by ourCAgang

This document provides an overview and history of Goods and Service Tax (GST) law in India. It discusses key points:

1) The Constitution (One Hundred and First) Amendment Act 2016 enabled the implementation of GST and amended various articles of the Constitution relating to tax powers.

2) GST is to be levied on supply of goods and services in the course of inter-state and intra-state trade or commerce. The GST Council was established to make recommendations on GST-related issues.

3) The document outlines the history of GST in India from 2000 when an empowered committee was set up through its passage in Parliament and implementation in 2016-2017. It also provides a

FORM GSTR-4 PPT

If you have any Query you can contact Us

Mail id:- ca.sanjiv.nanda@gmail.com

Youtube Channel :- https://www.youtube.com/channel/UCmmx2GFXeoF-DNtNjwnpYJA

Website :- http://www.sanjivnanda.com/

Facebook link :- https://www.facebook.com/ca.sanjivnanda919/

Twitter :- https://twitter.com/

Taxmann's Direct Taxes Manual (Set of 3 Volumes) - 2021

Taxmann’s Direct Taxes Manual is a compilation of annotated, amended and updated:

• Income-tax Act, 1961

• Income-tax Rules, 1962

• Circulars & Notifications

• Allied Laws

• Law Lexicon

• Gist of Landmark Rulings

The Present Publication is the 51st Edition, comes in a set of 3 volumes, that incorporates all changes made by the following:

• Volume 1 – The Finance Act, 2021 & the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020

• Volume 2 – The Income-tax (Eighth Amendment) Rules, 2021

• Volume 3 – Law stated is amended up to 1st March, 2021

Taxmann’s Direct Taxes Manual incorporates the following noteworthy features:

• [Bestseller Series] Taxmann's series of Bestseller Books for more than Five Decades

• [Zero Error] Follows the six-sigma approach, to achieve the benchmark of 'zero error'

Published in three volumes:

○ Volume 1 incorporates the Income-tax Act, 1961 as amended by the Finance Act, 2021 & Taxation & Other Laws (Relaxation & Amendment of Certain Provisions) Act, 2020. It also contains other Allied Acts

○ Volume 2 incorporates the Income-tax Rules as amended by the Income-tax (Eighth Amendment) Rules, 2021. It also incorporates New Return Forms & Revised Rules and Forms along-with New Rules relating to Charitable Trusts. It also contains other Allied Rules

○ Volume 3 incorporates the following:

• [Schemes] All schemes relevant under the Income-tax Act, 1961

• [Words & Phrases] as defined by various Courts and Tribunals

• [Circulars, Clarifications & Notifications | 1961 – February 2021] Gist of all Circulars and Notifications which are in force

• [Case Laws | 1922 – February 2021] Digest of all landmark rulings by the Apex Court, High Courts & Tribunals

• [Models & Drafts] Specimen, models, and drafts of deeds, letters such as indemnity bond, reply to notices, etc.

Newsletter july 2016

Section 206AA – Rule 37BC

Central Board of Direct Taxes vide Notification No. 53/2016 dated 24.06.2016 has amended the Income Tax Rules, 1962 by inserting a new Rule 37BC through the IT (17th Amendment) Rules, 2016.

Taxmann's GST Manual with GST Law Guide & Digest of Landmark Rulings (Set of ...

The document is an excerpt from the Finance Minister's Budget Speech 2021 relating to proposed changes to the GST and excise duty framework in India.

Some key points:

- GST collections have reached record levels due to measures to simplify GST and crack down on tax evaders. Further measures are proposed to smoothen GST.

- Changes are proposed to various sections of the Central GST Act to facilitate taxpayers, improve compliance and enforcement, and make some technical amendments.

- Changes are also proposed to the excise duty rates specified in the Fourth Schedule of the Central Excise Act from April 2021 and January 2022.

Deductable allowances & tax credits

The document discusses various tax deductible allowances and tax credits under Pakistan tax law, including:

1) Deductible allowances for zakat, workers' welfare fund, and workers' participation fund paid by an individual.

2) Tax credits for charitable donations, investments in shares/insurance, contributions to approved pension funds, and profit on debt for housing loans.

3) Any unused tax credits cannot be refunded, carried forward, or back but an association may claim its members' excess credits under conditions.

CBDT releases draft rules

CBDT releases draft rules prescribing method of valuation of unquoted equity shares for the purpose of Sections 56(2)(x) and 50CA; CBDT invites comments and suggestions from stakeholders by May 19. Copy of Notification and draft rules are attached. Valuation of unquoted equity shares are to be calculated as per draft rules by taking into account the FMV of jewellery, artistic work, shares & securities and stamp duty value in case of immovable property and book value for the rest of the assets . As per existing 11UA rule the book value (and not the FMV / stamp duty value) is taken into consideration for determining the value of such shares.

Taxmann's GST Tariff with GST Rate Reckoner (Set of 2 Volumes)

Taxmann’s GST Tariff contains GST Tariff for Goods and Services. It provides HSN-wise and SAC-wise Tariff of all the Goods and Services.

The Present Publication is the 14th Edition, authored by Taxmann’s Editorial Board, is amended up to 1st February 2021, with the following noteworthy features:

Taxmann's series of Bestseller Books on GST Tariff

Follows the six-sigma approach, to achieve the benchmark of 'zero error'

The Present Publication is published in two volumes & divided into 6 divisions, which are listed as follows:

•GST Tariff for Goods with HSN Code

Rates Specified in other Acts

•GST Rate Reckoner for Goods/Commodity Index

•GST Tariff for Services

Services Index

•GST Tariff Notifications (Rate of Tax and Exemptions)

The details coverage of the book is as follows:

•GST Tariff for Goods with HSN Code

•Arrangement of Chapters

•GST Tariff for Goods with HSN Code

•General Rules for the Interpretation of this schedule

•Rates Specified in other Acts

•Rates specified in Central Excise Act

•National Calamity Contingent Duty

•Additional Duty on Tobacco

•Additional Duty on Motor Spirit (Petrol)

•Additional Duty on High Speed Diesel Oil

•Special Additional Excise Duty on Motor Spirit and High Speed Diesel Oil

•Road & Infrastructure Cess

•Agriculture Infrastructure and Development Cess

•GST Rate Reckoner for Goods/Commodity Index

•GST Tariff for Services

•Arrangement of Services

•Central Goods & Services Tax/State Goods & Service Tax Tariff for Services

•Integrated Goods & Services Tax Tariff for Services

•Compensation Cess

•Rate of Tax and Exemption Notifications for Services

•Reverse Charge in case of intra-State supplies of services

•Reverse Charge in case of inter-State supplies of services

•Notified categories of services the tax on intra-State/inter-State supplies of which shall be paid by electronic commerce operator

•No refund of unutilised Input Tax Credit

•Notified registered persons who shall pay tax on reverse charge basis on certain specified supplies of goods or services or both received from an unregistered supplier

•Notified rate of tax to be levied on specified first intra-State supplies of goods or services

•Latest Clarifications

•Latest Case Laws

•Explanatory Notes

•Services Index

•GST Tariff Notifications (Rate of Tax and Exemptions)

More Related Content

What's hot

Krishi kalyan cess

Discussion regarding the applicability of Krishi Kalyan Cess and various pertinent issues regarding Krishi Kalyan Cess is discussed in the presentation.

Collection and recovery.bose

This document provides an overview of tax collection and recovery provisions under the Income Tax Act of India (Sections 190-234D). It discusses general principles of deduction at source, direct payment of tax, and various types of deductions including for salaries (Section 192), interest on securities (Section 193), and dividends (Section 194). The summary focuses on high-level topics covered rather than detailed legal provisions.

Sanjeev ghai income tax

The document discusses India's Income Tax Act. It states that the Act provides that income tax is charged annually on a person's total income from the previous year at rates determined by the Finance Act. It further states that the total income is classified under various heads including salaries, house property income, business/profession profits, capital gains, and other sources. The document also notes that it aims to discuss tax provisions relevant to salaried workers, pensioners, and senior citizens.

16 part b_vilas mohanrao sanase(5)_auhps0589h_2020-21

This document is a Form 16 issued by an employer. It provides salary and tax details for an employee named VILAS MOHANRAO SANASE PAN for AY 2021-22. Key details include:

1) The employee's gross salary and other income were nil for the year.

2) The employee was eligible for no exemptions or deductions.

3) The employee's total income was nil and no tax was payable.

4) TDS of nil was deducted by the employer.

Form27 a

This document is Form 27A which is used to furnish information for tax deducted at source statements filed on computer media. The form includes sections for:

1) Basic identifying information like tax deduction account number, PAN, financial year, etc.

2) Particulars of the deductor such as name, address and contact details.

3) Name and contact details of the person responsible for tax deduction.

4) Control totals including the number of deductee records, amounts paid and taxes deducted/collected.

5) Verification signed by the person responsible for tax deduction.

Gst compensation-to-states-act

This document is the Goods and Services Tax (Compensation to States) Act, 2017 from India. It provides compensation to States for loss of revenue due to the implementation of GST for a period of 5 years. The key points are:

1) It establishes the base year as 2016-2017 and projects a nominal growth rate of 14% per year to calculate projected revenue for States.

2) The compensation amount is calculated as the difference between the projected revenue and actual revenue collected by the State as certified by auditors.

3) A GST compensation cess is levied on certain goods and services to fund the compensation amount payable to States.

Procedues (collection and recovery)

This document outlines procedures for the collection and recovery of tax in Pakistan, including:

- Due dates for tax payment and options for installment plans or extensions.

- Recovery methods for unpaid taxes such as attaching and selling property, appointing receivers, or arresting the taxpayer for up to 6 months.

- Specific provisions for private companies, associations of persons, bankruptcies, non-residents, ships/aircrafts, and persons leaving the country to ensure taxes can still be recovered.

- Powers given to the Commissioner and District Officers to certify unpaid taxes and recover them as if they were civil debts or land revenue.

FORM GSTR-3 PPT

This document is a GSTR-3 form for monthly GST return filing. It requests information about a business's turnover, outward and inward supplies, input tax credit, tax liability, payments and refunds. The form is divided into sections for supply details, tax calculation, payments, refunds and declarations. It requires information about taxable supplies, exemptions, amendments and reverse charge supplies to accurately determine the tax liability and payments for the reporting period.

Tax alert employee taxation - tds

The document summarizes changes made by the CBDT to Income Tax Rules regarding employee taxation and TDS. Key changes include:

1) Employees must now furnish evidence of tax deductions claimed on Form 12BB instead of self-declaration, including PAN of landlord for HRA claims over Rs. 1 lakh and evidence of travel/investment expenditures.

2) Due dates for filing TDS statements have been amended, requiring filing within 30 days for Section 194IA deductions and by 30 April/15 days after quarter-end for other TDS.

3) Form 12BB collects employee name, address, PAN and details of claims and evidence for tax deductions.

Step by Step Guide to File GSTR 9A Annual Composition Form

Check out step by step guide to file GSTR 9A Annual Composition form for the composition scheme dealer for all quarterly transactions in the financial year.

sales act-government-of-pakistan-updated-up-to-july-2014

This document summarizes the Sales Tax Act of 1990 in Pakistan, which consolidates and amends laws relating to taxation on the sale, import, export, production, manufacture, or consumption of goods. Some key points:

- It establishes the legal framework for sales tax in Pakistan, including definitions, tax rates, penalties, and offences.

- Recent amendments have updated various definitions, such as expanding the definition of the term "Commissioner" and establishing the Appellate Tribunal for tax-related appeals.

- The Act aims to simplify and standardize sales tax laws in Pakistan through this consolidated legislation. It provides the primary legal basis for sales tax collection and administration in the country.

Brazil - Fiscal recovery regime (Item4b)

Presentation delivered during the 13th Annual Meeting of the OECD Network on Fiscal Relations Across Levels of Government, 23-24 November 2017, Paris, France.

Office 3499 bsp tower 1 & 3

The document outlines various payment plans and prices for units in Tower 1 and 3 of a residential development. It provides details of the basic sale price (BSP) and installment amounts and due dates for four payment plans: a down payment plan (BSP Rs. 3499/sqft), 12% monthly return plan (BSP Rs. 4899/sqft), construction link plan (BSP Rs. 4699/sqft), and flexi payment plan (BSP Rs. 4099/sqft). It also lists other charges such as parking, service tax, and interest free maintenance security.

Retail blcok b

This document outlines various payment plans and associated basic sale prices (BSP) for units in Retail Block B. The plans include a one-time down payment plan with a BSP of Rs. 7999/- per square foot, a 12% monthly return plan with a BSP of Rs. 10199/- per square foot, a construction link plan with a BSP of Rs. 9999/- per square foot, and a flexi payment plan with a BSP of Rs. 9199/- per square foot. The payment plans detail installment amounts and due dates. Other charges including maintenance, parking, interest-free security deposits, and service tax are also provided. Notes provide additional details on pricing, areas, plans, and

GST Series 1 by ourCAgang

This document provides an overview and history of Goods and Service Tax (GST) law in India. It discusses key points:

1) The Constitution (One Hundred and First) Amendment Act 2016 enabled the implementation of GST and amended various articles of the Constitution relating to tax powers.

2) GST is to be levied on supply of goods and services in the course of inter-state and intra-state trade or commerce. The GST Council was established to make recommendations on GST-related issues.

3) The document outlines the history of GST in India from 2000 when an empowered committee was set up through its passage in Parliament and implementation in 2016-2017. It also provides a

FORM GSTR-4 PPT

If you have any Query you can contact Us

Mail id:- ca.sanjiv.nanda@gmail.com

Youtube Channel :- https://www.youtube.com/channel/UCmmx2GFXeoF-DNtNjwnpYJA

Website :- http://www.sanjivnanda.com/

Facebook link :- https://www.facebook.com/ca.sanjivnanda919/

Twitter :- https://twitter.com/

Taxmann's Direct Taxes Manual (Set of 3 Volumes) - 2021

Taxmann’s Direct Taxes Manual is a compilation of annotated, amended and updated:

• Income-tax Act, 1961

• Income-tax Rules, 1962

• Circulars & Notifications

• Allied Laws

• Law Lexicon

• Gist of Landmark Rulings

The Present Publication is the 51st Edition, comes in a set of 3 volumes, that incorporates all changes made by the following:

• Volume 1 – The Finance Act, 2021 & the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020

• Volume 2 – The Income-tax (Eighth Amendment) Rules, 2021

• Volume 3 – Law stated is amended up to 1st March, 2021

Taxmann’s Direct Taxes Manual incorporates the following noteworthy features:

• [Bestseller Series] Taxmann's series of Bestseller Books for more than Five Decades

• [Zero Error] Follows the six-sigma approach, to achieve the benchmark of 'zero error'

Published in three volumes:

○ Volume 1 incorporates the Income-tax Act, 1961 as amended by the Finance Act, 2021 & Taxation & Other Laws (Relaxation & Amendment of Certain Provisions) Act, 2020. It also contains other Allied Acts

○ Volume 2 incorporates the Income-tax Rules as amended by the Income-tax (Eighth Amendment) Rules, 2021. It also incorporates New Return Forms & Revised Rules and Forms along-with New Rules relating to Charitable Trusts. It also contains other Allied Rules

○ Volume 3 incorporates the following:

• [Schemes] All schemes relevant under the Income-tax Act, 1961

• [Words & Phrases] as defined by various Courts and Tribunals

• [Circulars, Clarifications & Notifications | 1961 – February 2021] Gist of all Circulars and Notifications which are in force

• [Case Laws | 1922 – February 2021] Digest of all landmark rulings by the Apex Court, High Courts & Tribunals

• [Models & Drafts] Specimen, models, and drafts of deeds, letters such as indemnity bond, reply to notices, etc.

Newsletter july 2016

Section 206AA – Rule 37BC

Central Board of Direct Taxes vide Notification No. 53/2016 dated 24.06.2016 has amended the Income Tax Rules, 1962 by inserting a new Rule 37BC through the IT (17th Amendment) Rules, 2016.

Taxmann's GST Manual with GST Law Guide & Digest of Landmark Rulings (Set of ...

The document is an excerpt from the Finance Minister's Budget Speech 2021 relating to proposed changes to the GST and excise duty framework in India.

Some key points:

- GST collections have reached record levels due to measures to simplify GST and crack down on tax evaders. Further measures are proposed to smoothen GST.

- Changes are proposed to various sections of the Central GST Act to facilitate taxpayers, improve compliance and enforcement, and make some technical amendments.

- Changes are also proposed to the excise duty rates specified in the Fourth Schedule of the Central Excise Act from April 2021 and January 2022.

Deductable allowances & tax credits

The document discusses various tax deductible allowances and tax credits under Pakistan tax law, including:

1) Deductible allowances for zakat, workers' welfare fund, and workers' participation fund paid by an individual.

2) Tax credits for charitable donations, investments in shares/insurance, contributions to approved pension funds, and profit on debt for housing loans.

3) Any unused tax credits cannot be refunded, carried forward, or back but an association may claim its members' excess credits under conditions.

What's hot (20)

16 part b_vilas mohanrao sanase(5)_auhps0589h_2020-21

16 part b_vilas mohanrao sanase(5)_auhps0589h_2020-21

Step by Step Guide to File GSTR 9A Annual Composition Form

Step by Step Guide to File GSTR 9A Annual Composition Form

sales act-government-of-pakistan-updated-up-to-july-2014

sales act-government-of-pakistan-updated-up-to-july-2014

Taxmann's Direct Taxes Manual (Set of 3 Volumes) - 2021

Taxmann's Direct Taxes Manual (Set of 3 Volumes) - 2021

Taxmann's GST Manual with GST Law Guide & Digest of Landmark Rulings (Set of ...

Taxmann's GST Manual with GST Law Guide & Digest of Landmark Rulings (Set of ...

Similar to Draft Notification INCOME-TAX

CBDT releases draft rules

CBDT releases draft rules prescribing method of valuation of unquoted equity shares for the purpose of Sections 56(2)(x) and 50CA; CBDT invites comments and suggestions from stakeholders by May 19. Copy of Notification and draft rules are attached. Valuation of unquoted equity shares are to be calculated as per draft rules by taking into account the FMV of jewellery, artistic work, shares & securities and stamp duty value in case of immovable property and book value for the rest of the assets . As per existing 11UA rule the book value (and not the FMV / stamp duty value) is taken into consideration for determining the value of such shares.

Taxmann's GST Tariff with GST Rate Reckoner (Set of 2 Volumes)

Taxmann’s GST Tariff contains GST Tariff for Goods and Services. It provides HSN-wise and SAC-wise Tariff of all the Goods and Services.

The Present Publication is the 14th Edition, authored by Taxmann’s Editorial Board, is amended up to 1st February 2021, with the following noteworthy features:

Taxmann's series of Bestseller Books on GST Tariff

Follows the six-sigma approach, to achieve the benchmark of 'zero error'

The Present Publication is published in two volumes & divided into 6 divisions, which are listed as follows:

•GST Tariff for Goods with HSN Code

Rates Specified in other Acts

•GST Rate Reckoner for Goods/Commodity Index

•GST Tariff for Services

Services Index

•GST Tariff Notifications (Rate of Tax and Exemptions)

The details coverage of the book is as follows:

•GST Tariff for Goods with HSN Code

•Arrangement of Chapters

•GST Tariff for Goods with HSN Code

•General Rules for the Interpretation of this schedule

•Rates Specified in other Acts

•Rates specified in Central Excise Act

•National Calamity Contingent Duty

•Additional Duty on Tobacco

•Additional Duty on Motor Spirit (Petrol)

•Additional Duty on High Speed Diesel Oil

•Special Additional Excise Duty on Motor Spirit and High Speed Diesel Oil

•Road & Infrastructure Cess

•Agriculture Infrastructure and Development Cess

•GST Rate Reckoner for Goods/Commodity Index

•GST Tariff for Services

•Arrangement of Services

•Central Goods & Services Tax/State Goods & Service Tax Tariff for Services

•Integrated Goods & Services Tax Tariff for Services

•Compensation Cess

•Rate of Tax and Exemption Notifications for Services

•Reverse Charge in case of intra-State supplies of services

•Reverse Charge in case of inter-State supplies of services

•Notified categories of services the tax on intra-State/inter-State supplies of which shall be paid by electronic commerce operator

•No refund of unutilised Input Tax Credit

•Notified registered persons who shall pay tax on reverse charge basis on certain specified supplies of goods or services or both received from an unregistered supplier

•Notified rate of tax to be levied on specified first intra-State supplies of goods or services

•Latest Clarifications

•Latest Case Laws

•Explanatory Notes

•Services Index

•GST Tariff Notifications (Rate of Tax and Exemptions)

Taxmann's GST Ready Reckoner

Taxmann’s Ultimate Best-Seller for Indirect Taxes – ‘GST Ready Reckoner', is a ready referencer for all provisions of the GST Law. It covers all important topics of GST along with relevant Case Laws, Notifications, Circulars, etc.

The Present Publication is the 15th Edition, authored by Mr. V.S. Datey & Updated till 1st February 2021. This book follows the Six-Sigma approach to achieve the benchmark of ‘zero-error’.

The book has been divided into 55 chapters in respect of all-important-provisions of GST, including the following:

•GST – An Overview

•IGST, CGST, SGST and UTGST

•Taxable Event in GST

•Supply of Goods or Services or both

•Classification of Goods and Services

•Value of Taxable Supply of Goods or Services or both

•Valuation Rules if value for GST not ascertainable

•VAT concept and its application in GST

•Input Tax Credit

•Input Tax Credit – Other Issues

•Input Tax Credit when exempted as well as taxable supplies made

•Input Service Distributor

•Persons liable to tax

•Place of supply of goods or services or both other than exports or impacts

•Place of supply in case of export or import of goods or services or both

•Exports and Imports

•Special Economic Zones and EOU

•Time of Supply of Goods and Services

•Reverse Charge

•Exemption from GST by issue of Notification

•Concession to small enterprises in GST

•Construction and Works Contract Services

•Real Estate Services relating to residential and commercial apartments

•TDR/FSI/Upfront amount in long term lease in real estate transactions

•Distributive Trade Services

•Passenger Transport Services

•Financial and related services

•Leasing or rental services and licensing services

•Software and IPR Services

•Business and production services

•Job Work

•Telecommunication, broadcasting and information supply

Community social, personal and other services

Government related activities

•Basic procedures in GST

•Registration under GST

•Tax Invoice, Credit and Debit Notes

•E-way Bill for transport of goods

•Payment of taxes by cash and through input tax credit

Returns under GST

•Assessment and Audit

•Demands and recovery

•Refund in GST

•Powers of GST Officers

•Offences and penalties

•First Appeal and revision in GST

•Appeal before Appellate Tribunal

•Appeals before High Court and Supreme Court

•Prosecution and compounding

•Provisions relating to evidence

•Electronic Commerce

•Miscellaneous issues in GST

•GST Compensation Cess

•Transitory Provisions

•Constitutional Background of GST

Also Available

[15th Edition] of Taxmann’s GST Manual with GST Law Guide & Digest of Landmark Rulings

[14th Edition] of Taxmann’s GST Tariff with GST Rate Reckoner

[10th Edition] of Taxmann’s GST How to Meet Your Obligations

[2nd Edition] of Taxmann’s GST Case Laws Digest (A Section-wise Case Book of 1,900+ Judgements)

Budget 2020 tp proposals analysis

BUDGET 2020-TP PROPOSALS ANALYSIS

Key Highlights:

1. As per amended provisions, Form 3CEB filing date is 31st October 2020 for FY 2019-20.

2. Dispute Resolution Panel forum is now not limited to Transfer Pricing disputes only but also allowed to non residents for all disputes.

3. Provisions of interest limitation (Section 94B) would not apply to the interest paid to an Indian PE i.e. branch of a non-resident bank.

4. Advance Pricing Agreement (Section 92CC) and Safe Harbour Rules (Section 92CB) include the determination of attribution of profit to PE /business connection.

Draft_GST_Compensation_Law

This document is a bill that proposes to provide compensation to states for any loss of revenue from the implementation of GST for a period of five years. It defines key terms and outlines how the base year revenue will be calculated for each state. It also describes how the projected revenue and compensation amounts will be determined annually. States will receive provisional compensation amounts quarterly with final amounts calculated after audited revenue figures are available. A GST Compensation Cess will be levied on certain supplies to fund the compensation, and returns and payments will generally follow CGST procedures. Proceeds will go to a GST Compensation Fund to pay states as per the calculations, with unused funds transferred after five years.

Newsletter july 2016

This document is the July 2016 issue of Tax Quest, an e-newsletter from K. Vaitheeswaran & Co. advocating tax law. It summarizes recent changes to international taxation, income tax, service tax, central excise, VAT, and CENVAT. For international taxation, it discusses relaxations to TDS for non-residents without PAN, the precedence of DTAAs over section 206AA, and new rules for foreign tax credit. For income tax, it covers the Income Declaration Scheme and recent circulars, as well as expansions to the scope of tax collection at source.

Set off and carry forward of losses.bose

This document discusses provisions around carry forward and set off of accumulated losses and unabsorbed depreciation allowances for companies undergoing amalgamation or demerger according to the Income Tax Act of 1961. It provides details on the conditions that must be met, such as the amalgamating company being financially unviable and the amalgamation being in the public interest. It also discusses similar provisions for firm successions and changes in constitution, as well as restrictions for certain types of companies.

Discuss the Self Assessment Scheme in detail under the income tax audience of...

This document discusses Pakistan's Self Assessment Scheme for income tax assessment year 2001-2002. Some key points:

- The scheme allows taxpayers to self-assess their income tax as long as certain conditions are met, such as fully paying tax and filing on time.

- Certain types of returns are not eligible for self-assessment and will undergo a full audit, such as those with declared losses or lump sum additions.

- Eligible returns must include detailed documents supporting income sources like business financial statements, salary certificates, property tax payments.

- 20% of returns will be randomly selected for a full audit to verify self-reported income and tax payments. Assessors can make adjustments if deficiencies are found

Budget 2017 - Clause by clause analysis of amendments to direct tax laws (Par...

The document provides a clause by clause analysis of amendments to India's direct tax laws as part of Budget 2017. Some key points:

1. Section 43 is amended to clarify how depreciation will be calculated if an asset previously used for a business covered under Section 35AD is later used for regular business.

2. Section 43B is amended to allow interest deduction on an actual payment basis for cooperative banks from assessment year 2018-19.

3. Threshold limits for maintenance of books of accounts by individuals and HUFs are increased under Section 44AA.

4. Presumptive income rate under Section 44AD is reduced to 6% for receipts via banking channels vs. 8% otherwise.

TDS NEW SYSTEM

The notification provides amendments to certain rules under the Income Tax Act of 1961 relating to time and mode of payment of tax deducted at source (TDS) or collected at source (TCS), certificates for TDS and TCS, and quarterly statement filings. Key changes include:

1) TDS/TCS to be paid within a prescribed time period from the month of deduction/collection electronically through specified modes.

2) Revised forms for TDS certificates and due dates for issuance aligned with different cases.

3) Introduction of quarterly statement of TDS/TCS details to be filed electronically.

POJK NO. 3 POJK.02 2014 EV

This regulation establishes procedures for collecting fees by the Financial Services Authority (OJK) of Indonesia. It outlines the types of fees OJK charges, including license fees, annual regulatory fees, and penalties. It specifies deadlines and processes for fee payments. If fees are not paid by deadlines, OJK can issue warnings and impose penalties of up to 48% of unpaid fees. After 1 year of non-payment, unpaid fees will be designated as non-performing receivables and handed over to the State Receivables Committee for collection.

Analysis of Finance Act,2020 vis a-vis GST

Analysis of Finance Act, 2020 vis-à-vis GST

The Finance Act, 2020 has made several amendments to the CGST Act, 2017 and corresponding amendments to the IGST Act, 2017 and UTGST Act, 2017. We have attempted to analyse the provision wise amendment made by the Finance Act, 2020 to the CGST Act, 2017.

Changes to ir act 13.08.2021

The document compares sections of the original Inland Revenue Act No. 24 of 2017 and amendments made in the Inland Revenue Amendment Act No. 11 of 2021. It lists each section number and outlines the key changes made, such as changing effective dates of certain items, adding/modifying definitions, and making technical corrections. Tables A and B at the end of the document specify effective dates for various amendments.

.pptx

1. The document discusses key provisions related to the levy and collection of Goods and Services Tax (GST) in India as per the Central GST Act, including:

2. CGST will be levied on all intra-state supplies of goods/services at rates up to 20% as notified by the government. CGST on petroleum products will be levied from a future notified date.

3. The tax liability in some cases like composite/mixed supplies is determined based on the principal/highest taxed supply.

4. Tax can be payable on a reverse charge basis in certain notified categories of supply. Unregistered suppliers must pay tax which registered recipients collect.

5.

income tax.pdf

This circular from the Government of India's Ministry of Finance provides guidance on tax deduction at source from salaries during the financial year 2021-22 under Section 192 of the Income Tax Act of 1961.

It defines key terms like salary, perquisites and profit in lieu of salary. It outlines the applicable income tax rates and surcharges. It provides details on calculating average income tax, tax deductions for multiple employments, tax relief for arrears/advances, and information to be provided regarding other income heads.

It specifies the responsibilities and procedures for deducting tax, depositing deducted amounts, issuing certificates, and furnishing statements. It also covers computation of income under the head 'Salaries' including exemptions

Budget updates 2019

Dear Professional Colleagues,

Sharing with you "Budget Updates-2019". A brief analysis of:

1. Transfer Pricing Amendments

2. Individual Taxation-Tax Incentives

3. Tax Rates

Hope you will find it useful and informative too.

Regards

CA. Reetika G Agarwal

Depreciation

This document provides guidance on accounting for depreciation in companies according to the Companies Act of India. It discusses the methods of charging depreciation allowed under the Act, the applicability of depreciation rates prescribed in Schedule XIV, adoption of different depreciation methods for different asset types, changing depreciation methods, and other related topics. The key points are:

1) Section 205 of the Companies Act prescribes the methods for charging depreciation, including straight line and written down value methods.

2) Schedule XIV provides minimum depreciation rates that must be used, but companies can use higher rates if justified.

3) Companies have flexibility to use different depreciation methods for different

The new Companies Law 2013 (India) - Chapter 11: Appointment and Qualificatio...

This notification outlines new rules related to the appointment and qualifications of directors of companies in India as per the Companies Act of 2013. Some key points include:

- It defines terms like Director Identification Number (DIN), independent director, and small shareholders' director.

- It requires certain classes of listed and large unlisted public companies to appoint at least one woman director.

- It specifies the qualifications required for independent directors and the process for creating and maintaining a databank of individuals willing to serve as independent directors.

- It provides rules for the appointment, tenure and qualifications of a small shareholders' director.

- It details the process for applying for and obtaining a DIN, including the required

Nca rules chapter11

This notification outlines new rules related to the appointment and qualifications of directors of companies in India as per the Companies Act of 2013. Some key points include:

- It defines terms like Director Identification Number (DIN), independent director, and small shareholders' director.

- It requires certain classes of listed and large unlisted public companies to appoint at least one woman director.

- It specifies the qualifications required for independent directors and the process for maintaining a databank of individuals willing to serve as independent directors.

- It provides the process for small shareholders to elect a small shareholders' director to represent them on the board.

- It outlines the process for individuals to apply for and be allotted a

Procedues (collection and recovery)

The document outlines procedures for the collection and recovery of tax in Pakistan. It discusses:

- Due dates for tax payment and options for installment plans or extensions.

- Recovery of unpaid taxes through attachment of property, appointment of receivers, or arrest of taxpayers.

- Recovery assistance from district revenue officers, bankruptcy estates, private companies, and persons holding money for taxpayers.

- Specific procedures for non-resident ship owners, aircraft owners, and persons about to leave the country.

Similar to Draft Notification INCOME-TAX (20)

Taxmann's GST Tariff with GST Rate Reckoner (Set of 2 Volumes)

Taxmann's GST Tariff with GST Rate Reckoner (Set of 2 Volumes)

Discuss the Self Assessment Scheme in detail under the income tax audience of...

Discuss the Self Assessment Scheme in detail under the income tax audience of...

Budget 2017 - Clause by clause analysis of amendments to direct tax laws (Par...

Budget 2017 - Clause by clause analysis of amendments to direct tax laws (Par...

The new Companies Law 2013 (India) - Chapter 11: Appointment and Qualificatio...

The new Companies Law 2013 (India) - Chapter 11: Appointment and Qualificatio...

More from Karan Puri

India Signs the Multilateral Convention to Implement Tax Treaty Related Measu...

India Signs the Multilateral Convention to Implement Tax Treaty Related Measures to

Prevent Base Erosion and Profit Shifting at Paris

CBDT has notified cost inflation index (CII) for FY 2017-18 with new base yea...

CBDT has notified cost inflation index (CII) of 272 for FY 2017-18. Further, CII for FY 2001-02 to FY 2017-18 have also been specified with new base year as FY 2001-02 pursuant to amendment to base year as made by Finance Act 2017. Notification shall come into force with effect from 1st April, 2018 and shall accordingly apply to the AY 2018-19 and subsequent years.

Renewal of Registrations of NGO's

Public Notice for immediate compliance re renewal of registration of NGOs under Foreign Contribution (Regulation) Act, 2010. Visit: www.fcraonline.nic.in

Finalized Draft of ITAT Rules 2017

The document outlines draft rules for the Income Tax Appellate Tribunal in India. It defines key terms related to appeals, applications, benches, members, registrars and more. It also describes the powers and duties of registrars, deputy registrars and assistant registrars in receiving, processing and managing appeals, applications and records on behalf of the Tribunal.

Clarification on removal of Cyprus from the list of notified jurisdictional a...

CBDT has clarified - removal of Cyprus from list of notified jurisdictional areas u/s 94A is w.e.f. 1 Nov 2013 i.e. the date of issue of Notification No. 86 of 2013 which specified Cyprus as NJA. Puts to rest controversy as in certain cases Revenue took a view that rescission of 2013 Notification was not with retrospective effect from 1 Nov 2013.

CBDT clarifies - lease rentals in industrial park/ SEZ to be treated as busin...

CBDT clarifies - lease rentals in industrial park/ SEZ to be treated as business income

Guidance note

This document provides guidance on accounting for derivative contracts in 3 sentences:

1) It establishes uniform accounting principles for accounting of derivative contracts consistent with international practices in the absence of authoritative Indian accounting standards on derivatives.

2) The guidance note covers recognition of derivatives at fair value on the balance sheet, hedge accounting principles, presentation and disclosure requirements in financial statements, and transitional provisions.

3) It aims to bring consistency in practice as diverse accounting methods were being used previously for derivatives resulting in lack of comparability of financial statements.

GST Newsletter

The document is the first newsletter from the Institute of Chartered Accountants of India (ICAI) on GST. It provides updates on GST-related events hosted by ICAI across India, key developments regarding GST legislation and rules, and articles on various aspects of GST such as valuation, composition levy, input tax credit, and the impact of GST on the textile industry. It also includes information on ICAI's GST-related publications, website, and upcoming events. The newsletter is intended to keep ICAI members and other stakeholders informed about developments related to the rollout of GST in India.

Budget 2017 takes Steps to discourage Cash transactions & curb Black Money

The document summarizes steps taken in the Budget 2017 to discourage cash transactions and curb black money in India. Key points include:

1) New sections 269ST and 271DA were introduced to restrict cash transactions over Rs. 2 lakhs and impose penalties for violations.

2) Capital expenditures over Rs. 10,000 and revenue expenditures over Rs. 10,000 made in cash will not be eligible for tax deductions or investment benefits.

3) The presumptive tax rate was reduced to 6% for small businesses receiving payments through digital modes to promote cashless transactions.

CBDT Issues Dreaft Notification for Taxability on Non-stt-shares

CBDT Requests for Stakeholder's comments on Draft Notification to be issued Under Section 10(38) of the Income-tax Act, 1961.

Gst list of changes

The document summarizes key changes made to GST bills introduced in the Lok Sabha. Some of the key points include:

- GST will not apply to the state of Jammu and Kashmir. Certain supplies by employers to employees up to Rs. 50,000 will also be exempt.

- Sale of land and existing buildings will not be considered supply of goods or services except for under-construction buildings.

- The upper limit of GST rates has been increased to 20% for CGST and 40% for IGST.

- Composition scheme has been expanded to the restaurant sector at 2.5% and reduced rates for manufacturers and traders.

DPNC News Flash

The Finance Minister proposed various amendments to the Finance Bill 2017 that affect several laws including the Income Tax law. Over 30 amendments were proposed related to income tax, including excluding FIIs and FPIs from indirect transfer tax provisions and making Aadhaar mandatory for applying for PAN and filing tax returns. The amendments also proposed merging 7 tribunals and implementing uniform appointment rules.

Finance bill 2017 amendments

This document contains proposed amendments to the Finance Bill 2017 from Shri Arun Jaitley. It lists 32 proposed amendments by clause number and provides the text of each proposed amendment. The amendments range from changes to sections of the Income Tax Act to the Customs Act, Securities Contracts Act, Depositories Act, and Companies Act.

FEMA Second Amendment Regulations

The Reserve Bank of India issued Notification No. FEMA.385/2017-RB to amend the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) Regulations, 2000. The amendments allow a person or entity resident outside India, other than citizens of Pakistan or Bangladesh, to contribute foreign capital to an Indian limited liability partnership (LLP) through capital contribution or acquisition of profit shares, subject to certain terms and conditions. The notification substitutes Schedule 9 of the regulations to provide details on eligible investors, investments, eligible LLPs, pricing, mode of payment and reporting for foreign direct investment in LLPs.

India 2017-oecd-economic-survey ppt

- The document summarizes the 2017 OECD Economic Survey of India.

- It finds that major reforms in India are boosting growth, but growth could be more inclusive and regional inequality remains high.

- Key recommendations include comprehensive tax reform to raise more revenue, reducing corporate taxes to attract more investment, and increasing social spending and access to infrastructure to strengthen inclusive growth across regions.

More from Karan Puri (20)

India Signs the Multilateral Convention to Implement Tax Treaty Related Measu...

India Signs the Multilateral Convention to Implement Tax Treaty Related Measu...

CBDT has notified cost inflation index (CII) for FY 2017-18 with new base yea...

CBDT has notified cost inflation index (CII) for FY 2017-18 with new base yea...

Clarification on removal of Cyprus from the list of notified jurisdictional a...

Clarification on removal of Cyprus from the list of notified jurisdictional a...

CBDT clarifies - lease rentals in industrial park/ SEZ to be treated as busin...

CBDT clarifies - lease rentals in industrial park/ SEZ to be treated as busin...

Budget 2017 takes Steps to discourage Cash transactions & curb Black Money

Budget 2017 takes Steps to discourage Cash transactions & curb Black Money

CBDT Issues Dreaft Notification for Taxability on Non-stt-shares

CBDT Issues Dreaft Notification for Taxability on Non-stt-shares

CBDT notice-to-taxpayers re cash-deposit-verifications

CBDT notice-to-taxpayers re cash-deposit-verifications

Recently uploaded

Letter-from-ECI-to-MeiTY-21st-march-2024.pdf

भारत सरकार द्वारा बड़े पैमाने पर व्हाट्सएप अभियान चलाए जाने से डेटा गोपनीयता, नैतिकता और चुनावों की निष्पक्षता पर सवाल उठते हैं।

EED - The Container Port PERFORMANCE INDEX 2023

El Puerto de Algeciras continúa un año más como el más eficiente del continente europeo y vuelve a situarse en el “top ten” mundial, según el informe The Container Port Performance Index 2023 (CPPI), elaborado por el Banco Mundial y la consultora S&P Global.

El informe CPPI utiliza dos enfoques metodológicos diferentes para calcular la clasificación del índice: uno administrativo o técnico y otro estadístico, basado en análisis factorial (FA). Según los autores, esta dualidad pretende asegurar una clasificación que refleje con precisión el rendimiento real del puerto, a la vez que sea estadísticamente sólida. En esta edición del informe CPPI 2023, se han empleado los mismos enfoques metodológicos y se ha aplicado un método de agregación de clasificaciones para combinar los resultados de ambos enfoques y obtener una clasificación agregada.

What Ukraine Has Lost During Russia’s Invasion

An astonishing, first-of-its-kind, report by the NYT assessing damage in Ukraine. Even if the war ends tomorrow, in many places there will be nothing to go back to.

Essential Tools for Modern PR Business .pptx

Discover the essential tools and strategies for modern PR business success. Learn how to craft compelling news releases, leverage press release sites and news wires, stay updated with PR news, and integrate effective PR practices to enhance your brand's visibility and credibility. Elevate your PR efforts with our comprehensive guide.

04062024_First India Newspaper Jaipur.pdf

Find Latest India News and Breaking News these days from India on Politics, Business, Entertainment, Technology, Sports, Lifestyle and Coronavirus News in India and the world over that you can't miss. For real time update Visit our social media handle. Read First India NewsPaper in your morning replace. Visit First India.

CLICK:- https://firstindia.co.in/

#First_India_NewsPaper

Gabriel Whitley's Motion Summary Judgment

Here is Gabe Whitley's response to my defamation lawsuit for him calling me a rapist and perjurer in court documents.

You have to read it to believe it, but after you read it, you won't believe it. And I included eight examples of defamatory statements/

Acolyte Episodes review (TV series)..pdf

Acolyte Episodes review (TV series) The Acolyte. Learn about the influence of the program on the Star Wars world, as well as new characters and story twists.

Recently uploaded (10)

Draft Notification INCOME-TAX

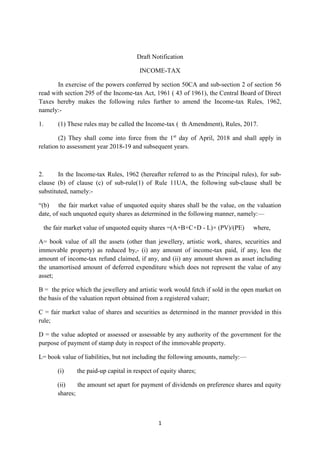

- 1. 1 Draft Notification INCOME-TAX In exercise of the powers conferred by section 50CA and sub-section 2 of section 56 read with section 295 of the Income-tax Act, 1961 ( 43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:- 1. (1) These rules may be called the Income-tax ( th Amendment), Rules, 2017. (2) They shall come into force from the 1st day of April, 2018 and shall apply in relation to assessment year 2018-19 and subsequent years. 2. In the Income-tax Rules, 1962 (hereafter referred to as the Principal rules), for sub- clause (b) of clause (c) of sub-rule(1) of Rule 11UA, the following sub-clause shall be substituted, namely:- “(b) the fair market value of unquoted equity shares shall be the value, on the valuation date, of such unquoted equity shares as determined in the following manner, namely:— the fair market value of unquoted equity shares =(A+B+C+D - L)× (PV)/(PE) where, A= book value of all the assets (other than jewellery, artistic work, shares, securities and immovable property) as reduced by,- (i) any amount of income-tax paid, if any, less the amount of income-tax refund claimed, if any, and (ii) any amount shown as asset including the unamortised amount of deferred expenditure which does not represent the value of any asset; B = the price which the jewellery and artistic work would fetch if sold in the open market on the basis of the valuation report obtained from a registered valuer; C = fair market value of shares and securities as determined in the manner provided in this rule; D = the value adopted or assessed or assessable by any authority of the government for the purpose of payment of stamp duty in respect of the immovable property. L= book value of liabilities, but not including the following amounts, namely:— (i) the paid-up capital in respect of equity shares; (ii) the amount set apart for payment of dividends on preference shares and equity shares;

- 2. 2 (iii) reserves and surplus, by whatever name called, even if the resulting figure is negative, other than those set apart towards depreciation; (iv) any amount representing provision for taxation, other than amount of income- tax paid, if any, less the amount of income-tax claimed as refund, if any, to the extent of the excess over the tax payable with reference to the book profits in accordance with the law applicable thereto; (v) any amount representing provisions made for meeting liabilities, other than ascertained liabilities; (vi) any amount representing contingent liabilities other than arrears of dividends payable in respect of cumulative preference shares; PE = total amount of paid up equity share capital as shown in the balance-sheet; PV= the paid up value of such equity shares;” 3. In the principal rules, in Chapter H, after Rule 11UA, the following Rule shall be inserted, namely:- “11UAA. For the purposes of section 50CA, the fair market value of the share, not being a quoted share, shall be determined in the manner provided in sub-clause (b) of clause (c) of sub-rule(1) of Rule 11UA .”