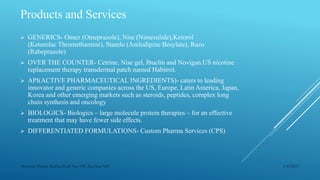

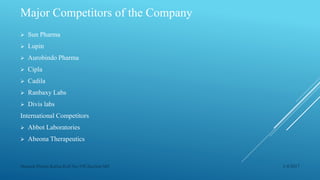

Dr. Reddy's Laboratories is a major Indian pharmaceutical company founded in 1984 and headquartered in Hyderabad. It has over 190 medications and 60 active pharmaceutical ingredients. The company has a global workforce of over 20,000 employees and a commercial presence in 26 countries. Dr. Reddy's Laboratories aims to bring new medicines to India at affordable prices. It has several subsidiaries and joint ventures around the world. The company produces generic medicines, APIs, differentiated formulations, and biosimilars. Its major competitors include Sun Pharma, Lupin, Aurobindo Pharma, and Cipla.