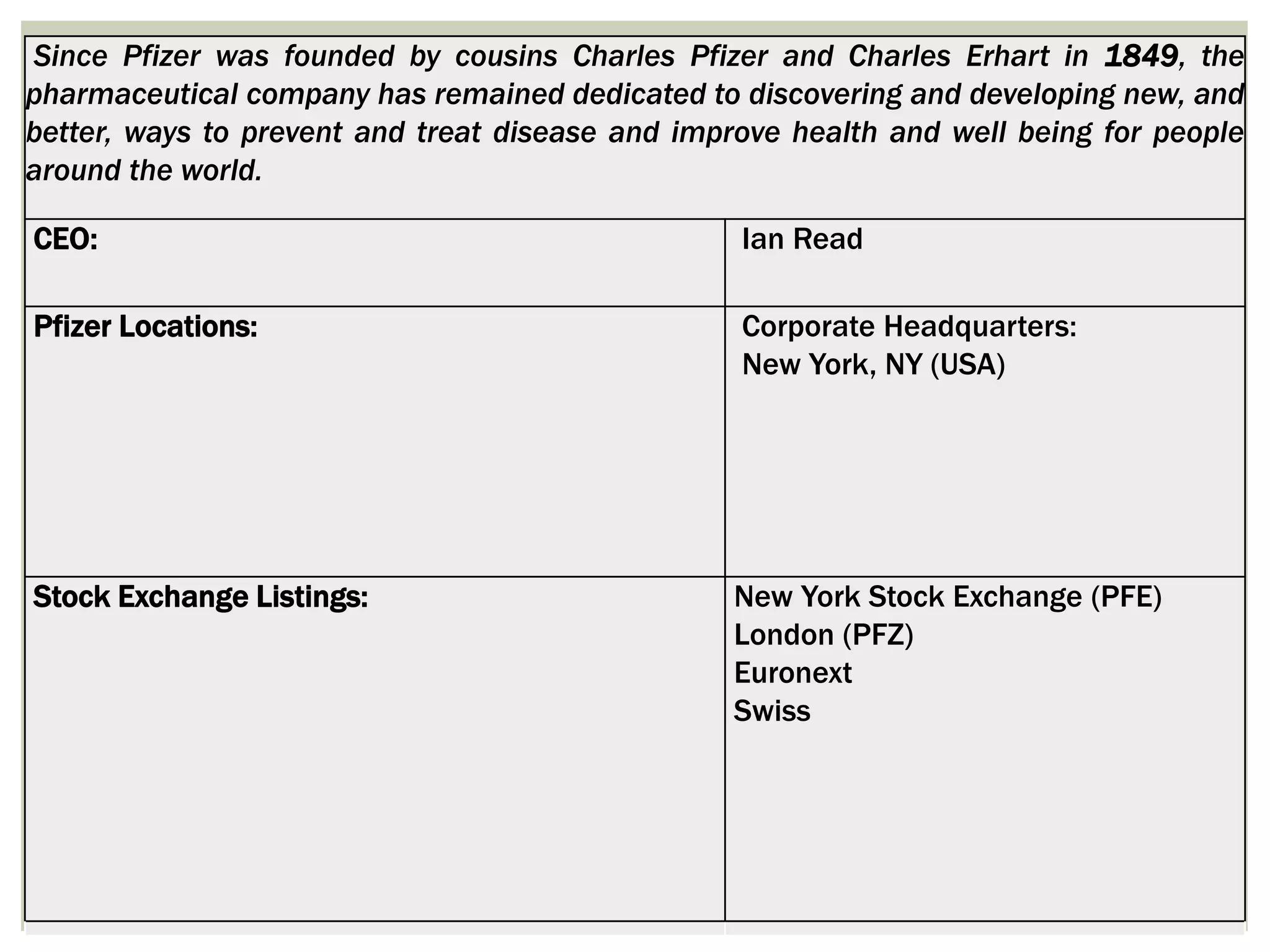

The document discusses the global pharmaceutical industry. It provides data showing steady growth in global pharmaceutical sales from 2003-2012, with the US market accounting for the largest share. The top 10 pharmaceutical companies are also listed. R&D spending and trends in major markets like the US, Europe, and Japan are examined. Details are also provided about the large and growing pharmaceutical industries in India and their competitive advantages in generics manufacturing.