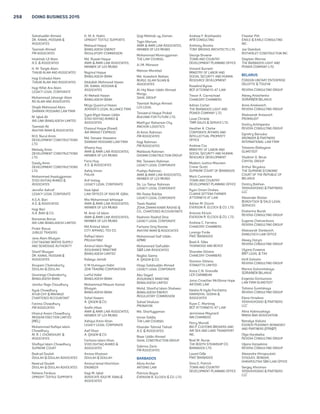

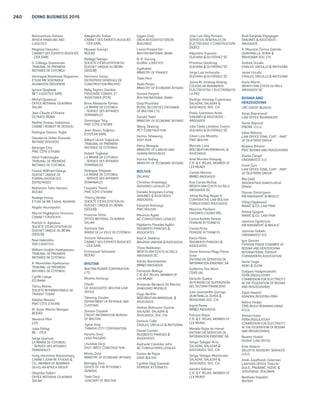

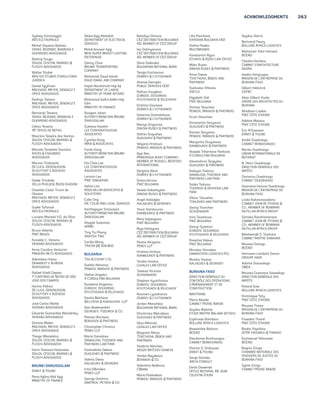

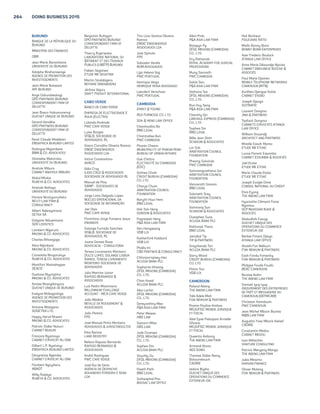

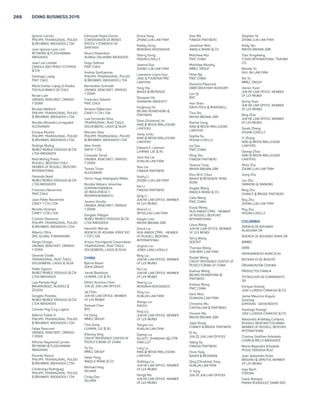

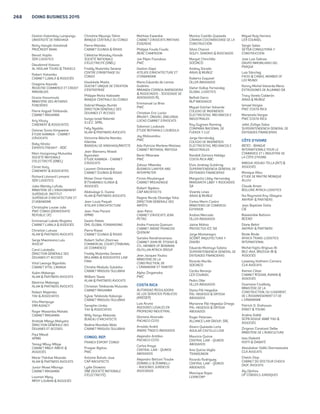

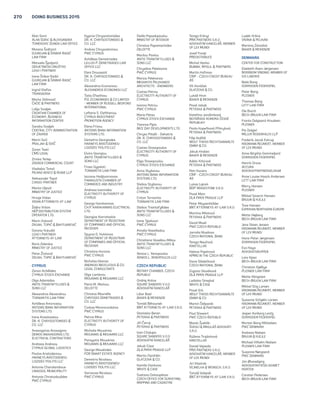

This document is the introduction to the 12th edition of the World Bank Group's annual Doing Business report. It provides an overview of the report, which measures regulations affecting 11 areas of business across 189 economies. Specifically, it measures regulations on starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency. The introduction emphasizes that while fiscal and monetary policy receive more attention, the business regulatory environment is equally or more important for economic success. It positions the Doing Business report as an important resource for understanding the business regulations that underlie economic development.

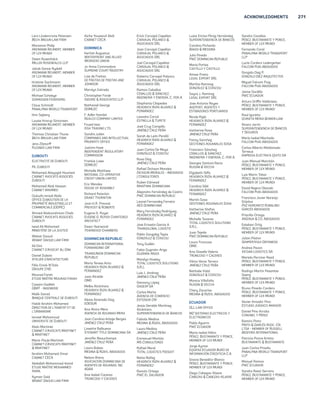

![REFERENCES 113

Rathinam, Francis Xavier. 2014.

“Procedural Law and Bank Lending to

Private Sector: Evidence from India.”

Paper presented at the conference

“Doing Business: Past, Present and

Future of Business Regulation,”

Washington, DC, February 20–21.

Schaffner, Philip, and Jake Waxman. 2009.

“Environmental Policy Green Zoning:

Creating Sustainable Communities

through Incentive Zoning.” Harvard

Kennedy School, Cambridge, MA.

http://www.hks.harvard.edu/var

/ezp_site/storage/fckeditor/file/pdfs

/centers-programs/centers/rappaport

/paes/schaffner

_waxman.pdf.

Schneider, Friedrich. 2005. “The Informal

Sector in 145 Countries.” Department of

Economics, University Linz, Linz.

Scott, Robert E. 2002. “The Rise and Fall

of Article 2.” Louisiana Law Review 62:

1009–64.

Sen, Amartya. 1977. “On Weights and

Measures: Informational Constraints in

Social Welfare Analysis.” Econometrica

49 (7): 1539–72.

Shapiro, David L. 1988. “Courts,

Legislatures and Paternalism.” Virginia

Law Review 74: 519–74.

Stam, Erik, David B. Audretsch and

Joris Meijaard. 2006. “Renascent

Entrepreneurship.” ERIM Report Series

17, Erasmus Research Institute of

Management, Erasmus University

Rotterdam.

Stiglitz, Joseph E., Amartya Sen and

Jean-Paul Fitoussi. 2009. “Report by

the Commission on the Measurement

of Economic Performance and Social

Progress.” http://www.stiglitz-sen

-fitoussi.fr/documents/rapport

_anglais.pdf.

Study Group on a European Civil Code

and Research Group on EC Private

Law (Acquis Group). 2009. Principles,

Definitions and Model Rules of European

Private Law: Draft Common Frame

of Reference. Vol. 6. Oxford: Oxford

University Press.

Swedish National Board of Housing,

Building and Planning. 2013. The

Housing Shortage and Rent Setting

System: A Knowledge Base. Market

Report. Stockholm.

Tajti, Tibor. 2013. “Post-1990 Secured

Transaction Law Reforms in Central

and Eastern Europe.” Szegedi Közjegyzői

Közlöny 2 (3): 14–21; 2 (4): 18–26.

Transparency International. 2011.

“Corruption in the Land Sector.”

Working Paper 4. Berlin.

Turner, Michael, Robin Varghese, Patrick

Walker and Katrina Dusek. 2009. Credit

Reporting Customer Payment Data:

Impact on Customer Payment Behavior

and Furnisher Costs and Benefits. Chapel

Hill, NC: PERC Press.

U.K. Companies House. 2013a. Companies

House Annual Report Accounts 2012/13.

London: The Stationery Office.

. 2013b. Companies Register

Activities 2012–2013. London:

Companies House.

UNCITRAL (United Nations Commission

on International Trade Law). 2004.

Legislative Guide on Insolvency Law. New

York: United Nations.

. 2007. Legislative Guide on Secured

Transactions. New York: United Nations.

UNECE (United Nations Economic

Commission for Europe). 2012. Policy

Framework for Sustainable Real Estate

Markets: Principles and Guidance for the

Development of a Country’s Real Estate

Sector. Geneva: UNECE.

UN-Habitat (United Nations Human

Settlements Programme). 2012.

Managing Urban Land Information:

Learning from Emergent Practices.

Nairobi: UN-Habitat.

. 2013. Tools to Support

Transparency in Land Administration.

Nairobi: UN-Habitat.

U.S. Securities and Exchange Commission.

2012. “Work Plan for the Consideration

of Incorporating International Financial

Reporting Standards into the Financial

Reporting System for U.S. Issuers.”

Final Staff Report, U.S. Securities and

Exchange Commission, Washington,

DC. http://www.sec.gov/spotlight

/globalaccountingstandards

/ifrs-work-plan-final-report.pdf.

Weber, David P. 2013. “Restricting the

Freedom of Contract: A Fundamental

Prohibition.” Yale Human Rights

Development Law Journal 16: 51–141.

Wehrmann, Babette. 2008. Land Conflicts:

A Practical Guide to Dealing with

Land Disputes. Eschborn, Germany:

Deutsche Gesellschaft für Technische

Zusammenarbeit.

Wille, John R., Karim O. Belayachi,

Numa de Magalhaes and Frédéric

Meunier. 2011. “Leveraging Technology

to Support Business Registration

Reform: Insights from Recent Country

Experience.” Investment Climate in

Practice Note 17, Investment Climate

Department, World Bank Group,

Washington, DC.

World Bank. 1989. World Development Report

1989: Financial Systems and Development.

New York: Oxford University Press.

. 2006. Doing Business in 2006:

Creating Jobs. Washington, DC: World

Bank.

. 2011a. General Principles for Credit

Reporting. Washington, DC: World Bank.

. 2011b. Principles for Effective

Insolvency and Creditor/Debtor Regimes.

Revised. Washington, DC: World Bank.

http://siteresources.worldbank.org

/EXTGILD/Resources

/5807554-1357753926066

/ICRPrinciples-Jan2011[FINAL].pdf.

. 2012. World Development Report

2013: Jobs. Washington, DC: World

Bank.

. 2013a. Doing Business 2013:

Smarter Regulations for Small and

Medium-Size Enterprises. Washington,

DC: World Bank.

. 2013b. Doing Business 2014:

Understanding Regulations for Small and

Medium-Size Enterprises. Washington,

DC: World Bank.

. 2014a. A Measured Approach to

Ending Poverty and Boosting Shared

Prosperity: Concepts, Data, and the

Twin Goals. Policy Research Report.

Washington, DC: World Bank.

. 2014b. Sweden’s Business Climate:

Opportunities for Entrepreneurs through

Improved Regulations. Washington, DC:

World Bank.

. 2014c. World Development

Indicators 2014. Washington, DC: World

Bank.

. Forthcoming. World Development

Report 2015: Mind and Society: How a

Better Understanding of Human Behavior

Can Improve Development Policy.

Washington, DC: World Bank.

World Bank and IMF (International

Monetary Fund). 2014. Global Monitoring

Report 2014/2015: Ending Poverty and

Sharing Prosperity. Washington, DC:

World Bank.

World Bank Group, Investment Climate

Advisory Services. 2009. How Many

Stops in a One-Stop Shop? A Review

of Recent Developments in Business

Registration. Washington, DC: World

Bank Group.

. 2013. “Sustaining Investment

Climate, and Making Rwanda a

Favorite Business Destination.” World

Bank Group, Washington, DC.

World Bank Group, Investment Climate

Department. 2013. Good Practices for

Construction Regulation and Enforcement

Reform: Guidelines for Reformers.

Washington, DC: World Bank Group.

Yang, Judy S. 2014. “The Business Climate,

Innovation, and Firm Profitability.”

Paper presented at the conference

“Doing Business: Past, Present and

Future of Business Regulation,”

Washington, DC, February 20–21.](https://image.slidesharecdn.com/doingbusiness2015-141029105447-conversion-gate02/85/Doing-business-2015-124-320.jpg)