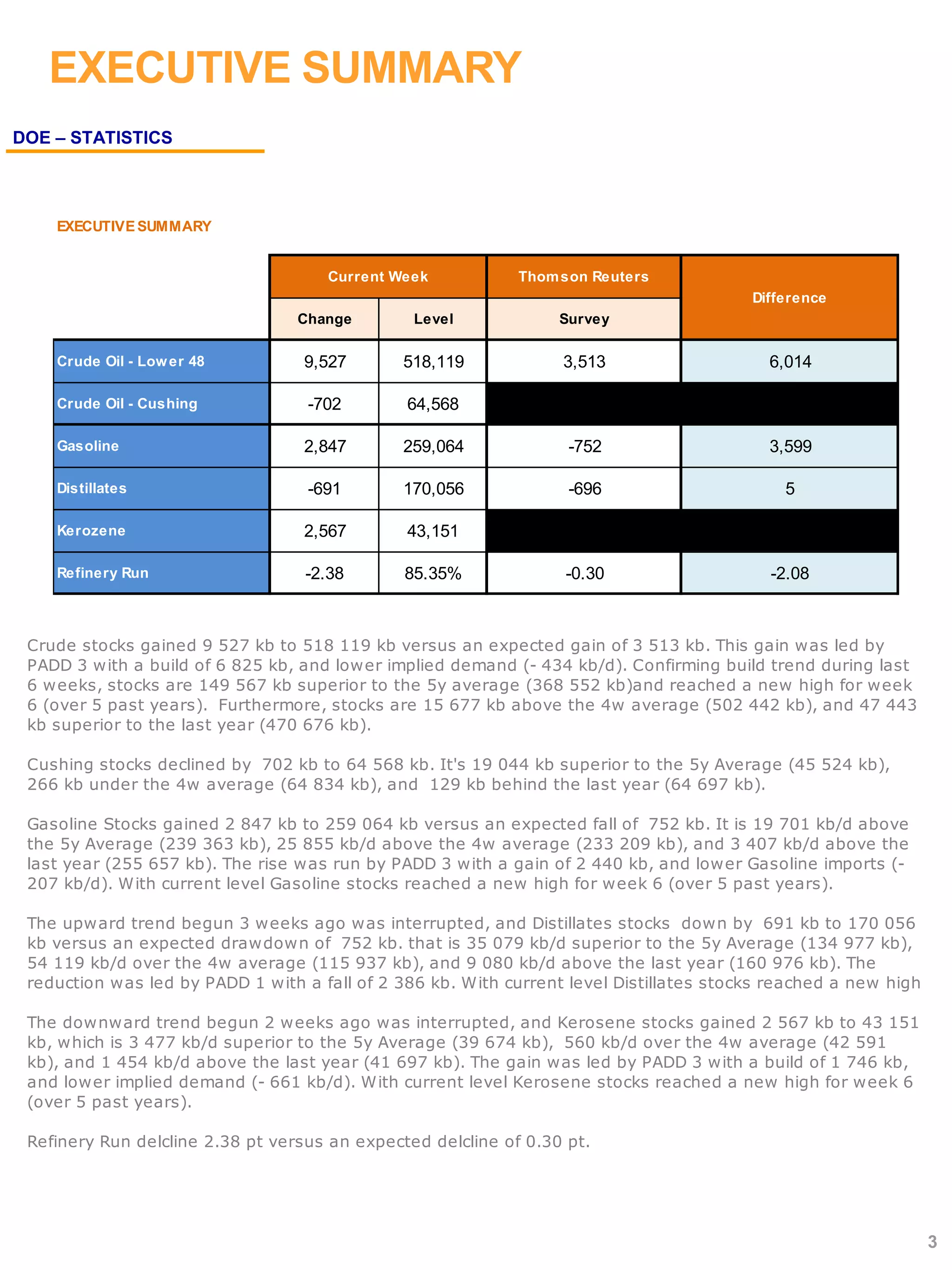

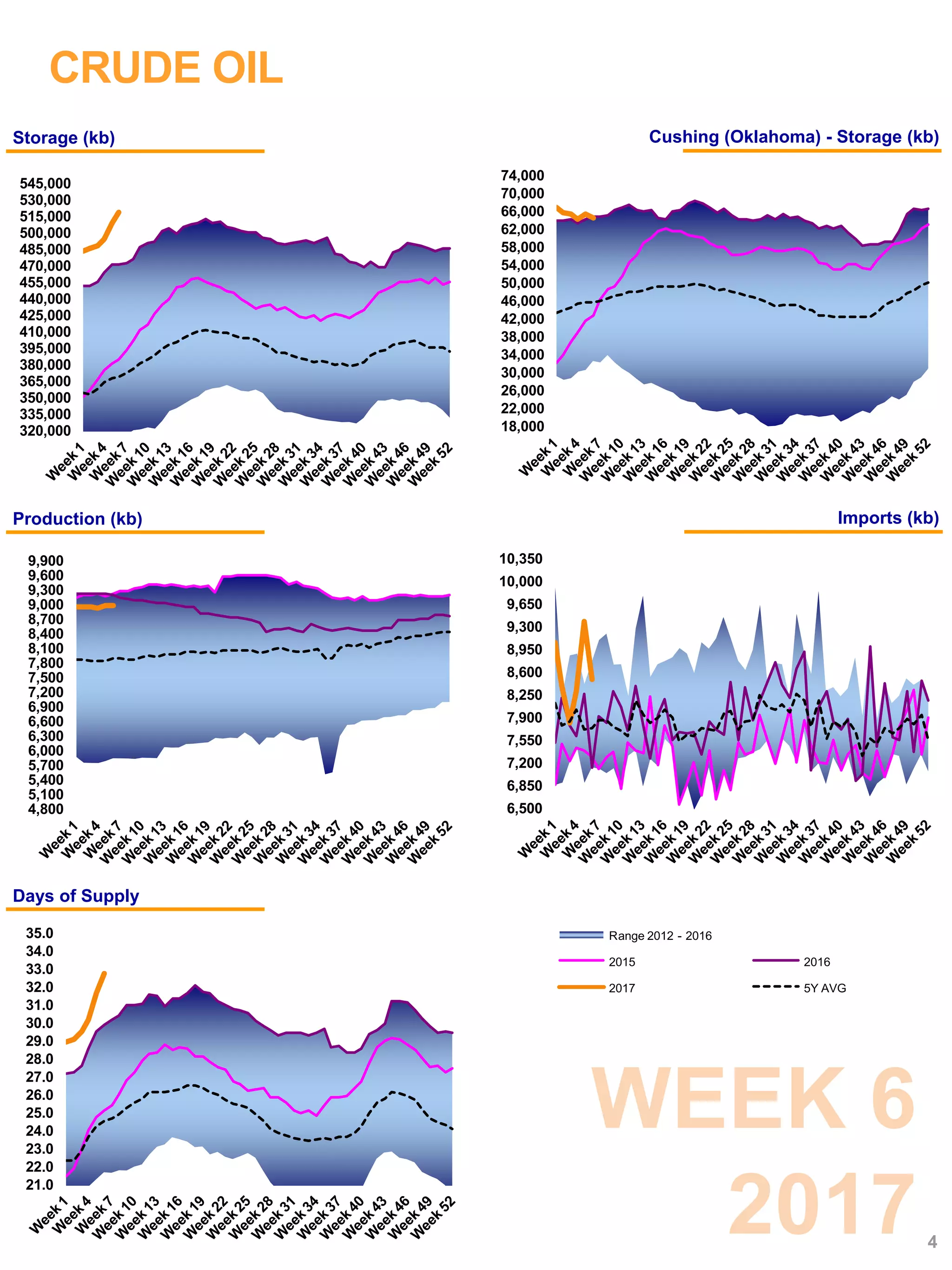

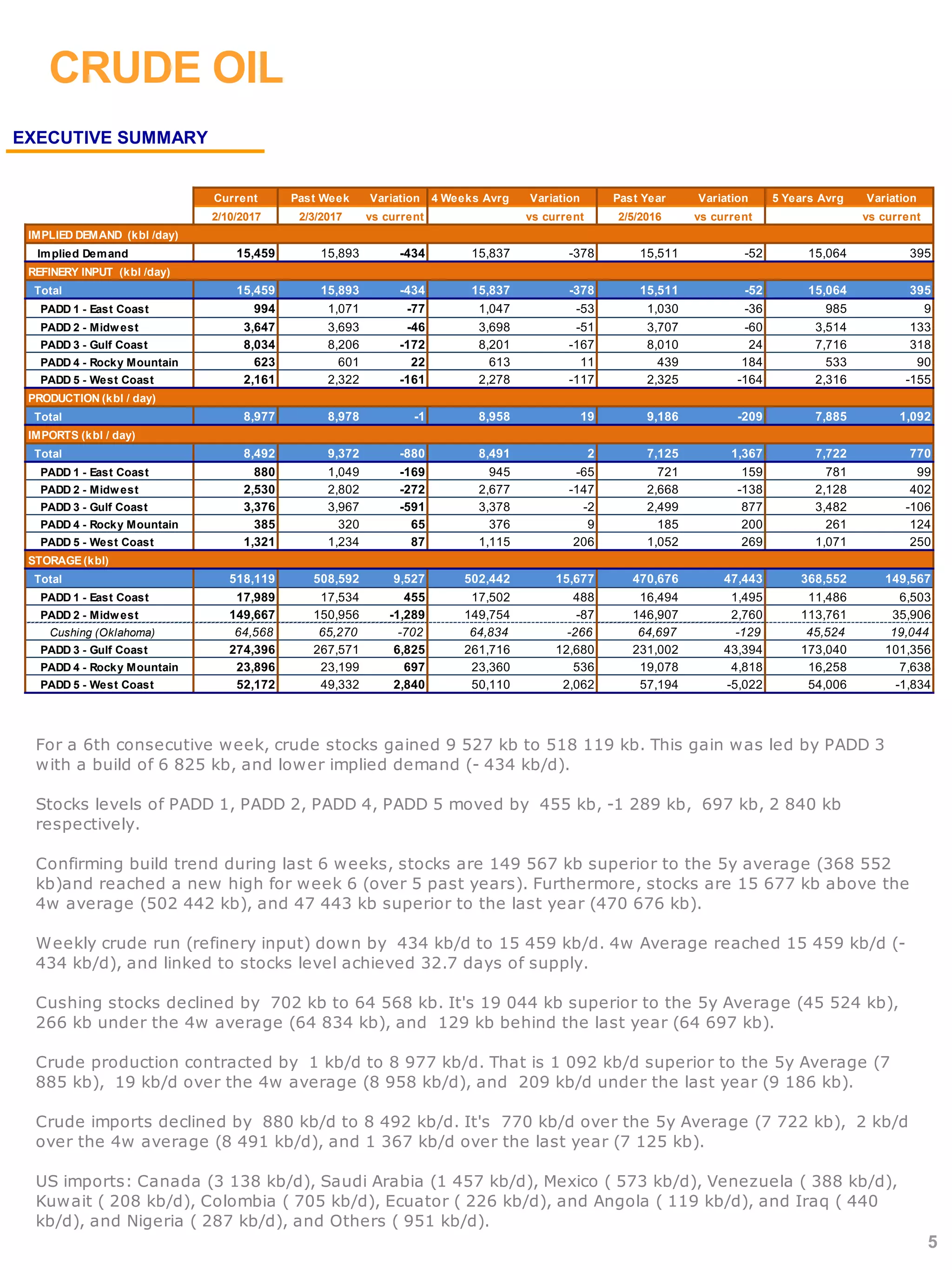

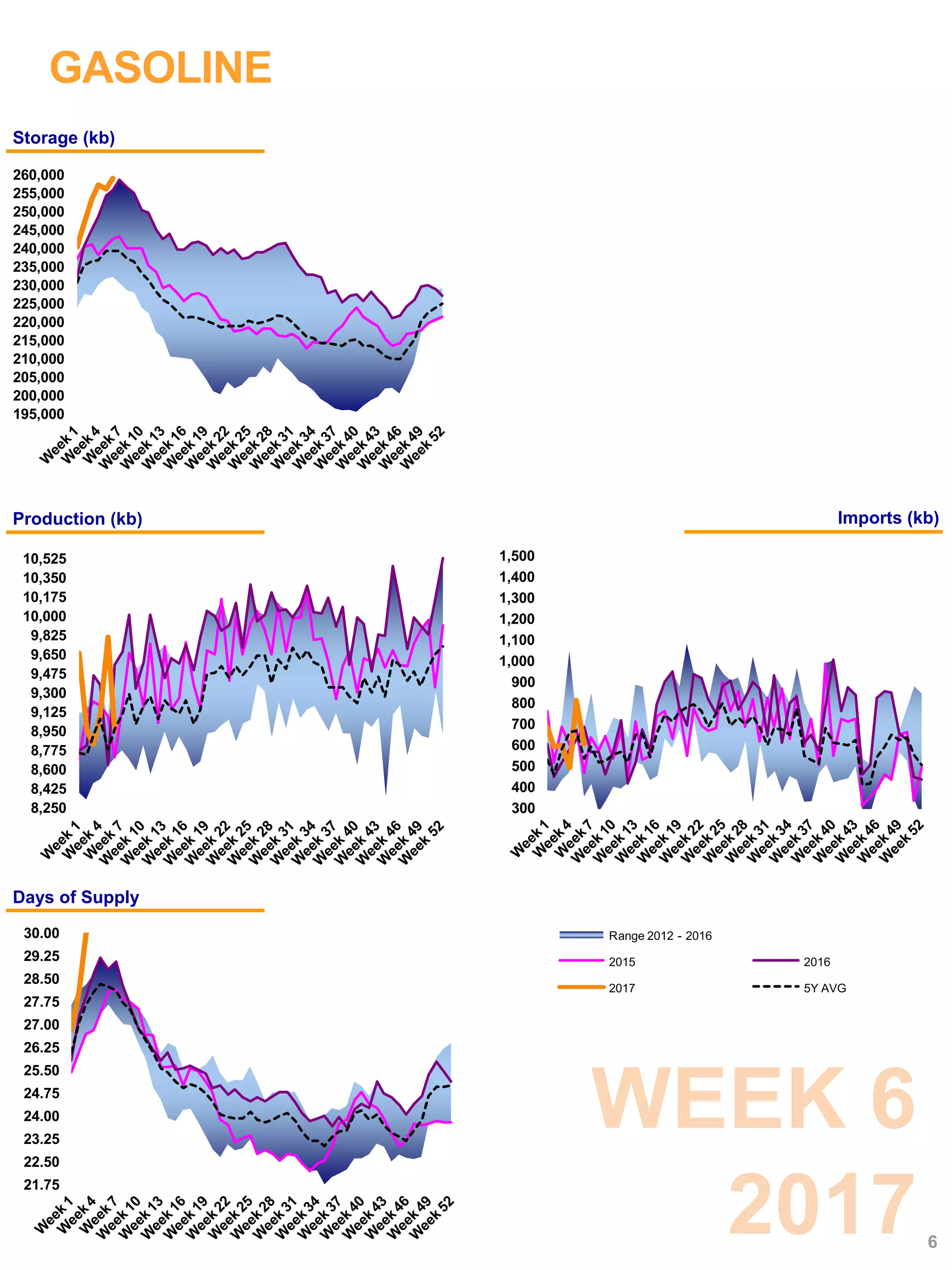

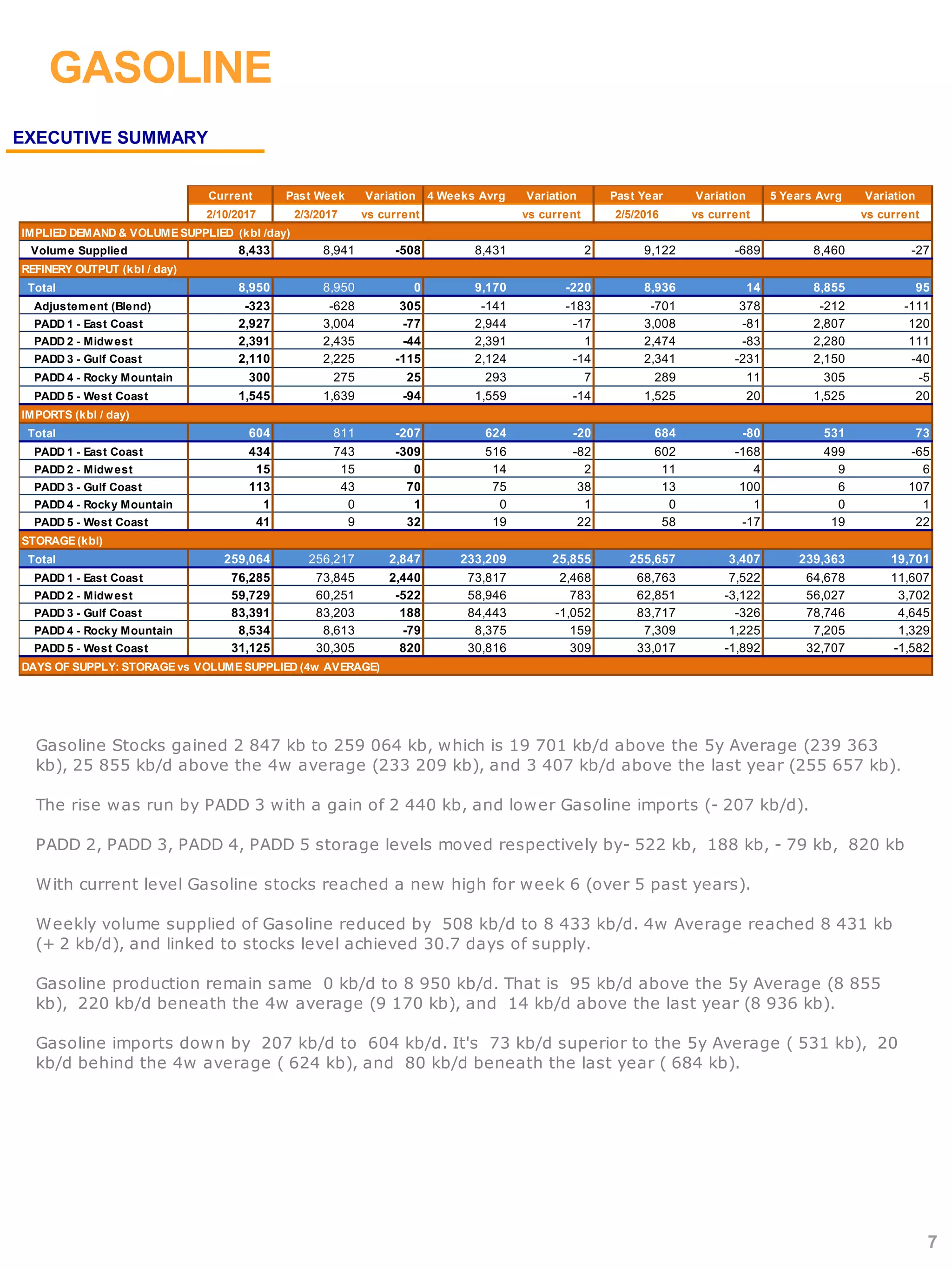

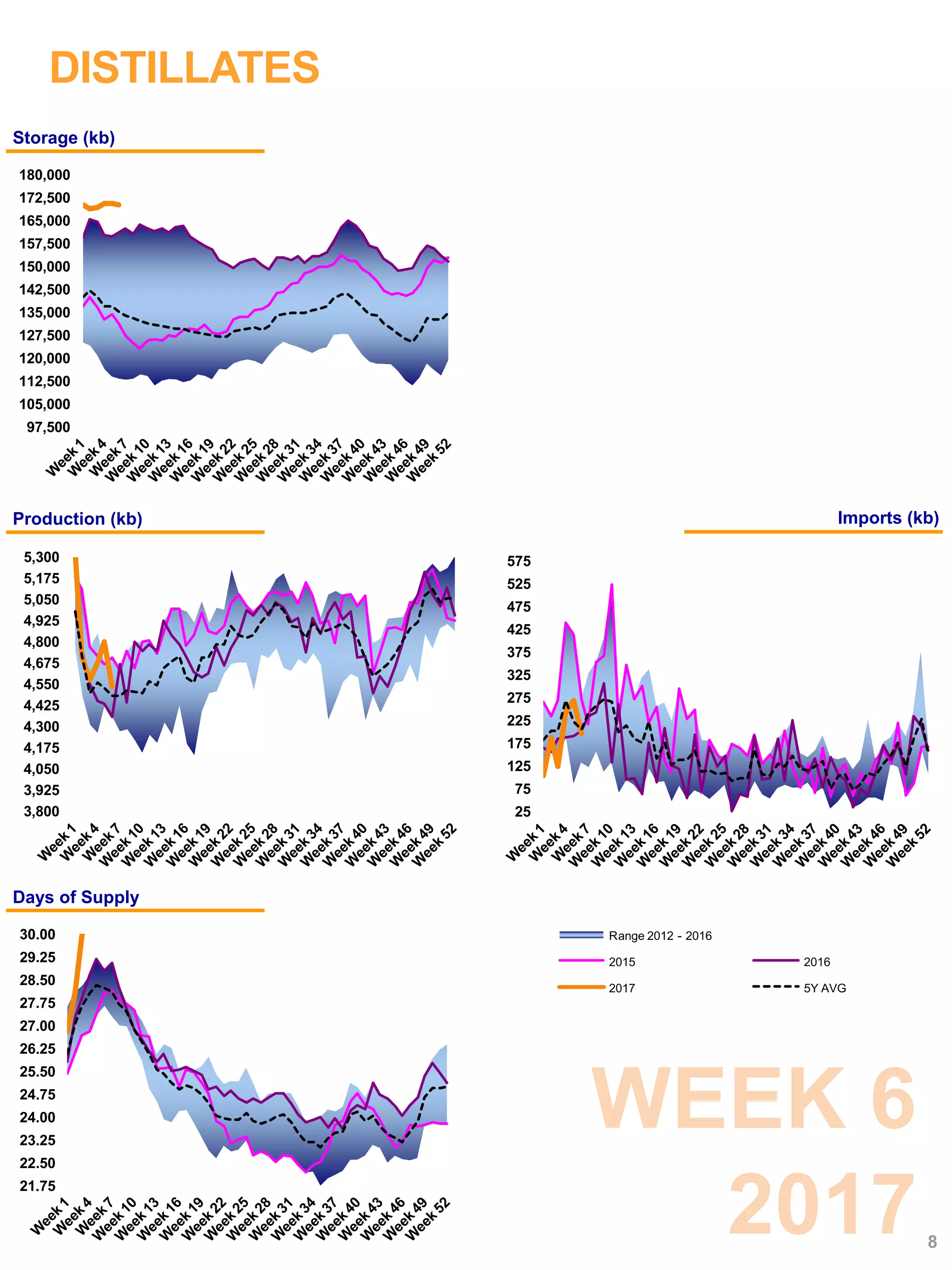

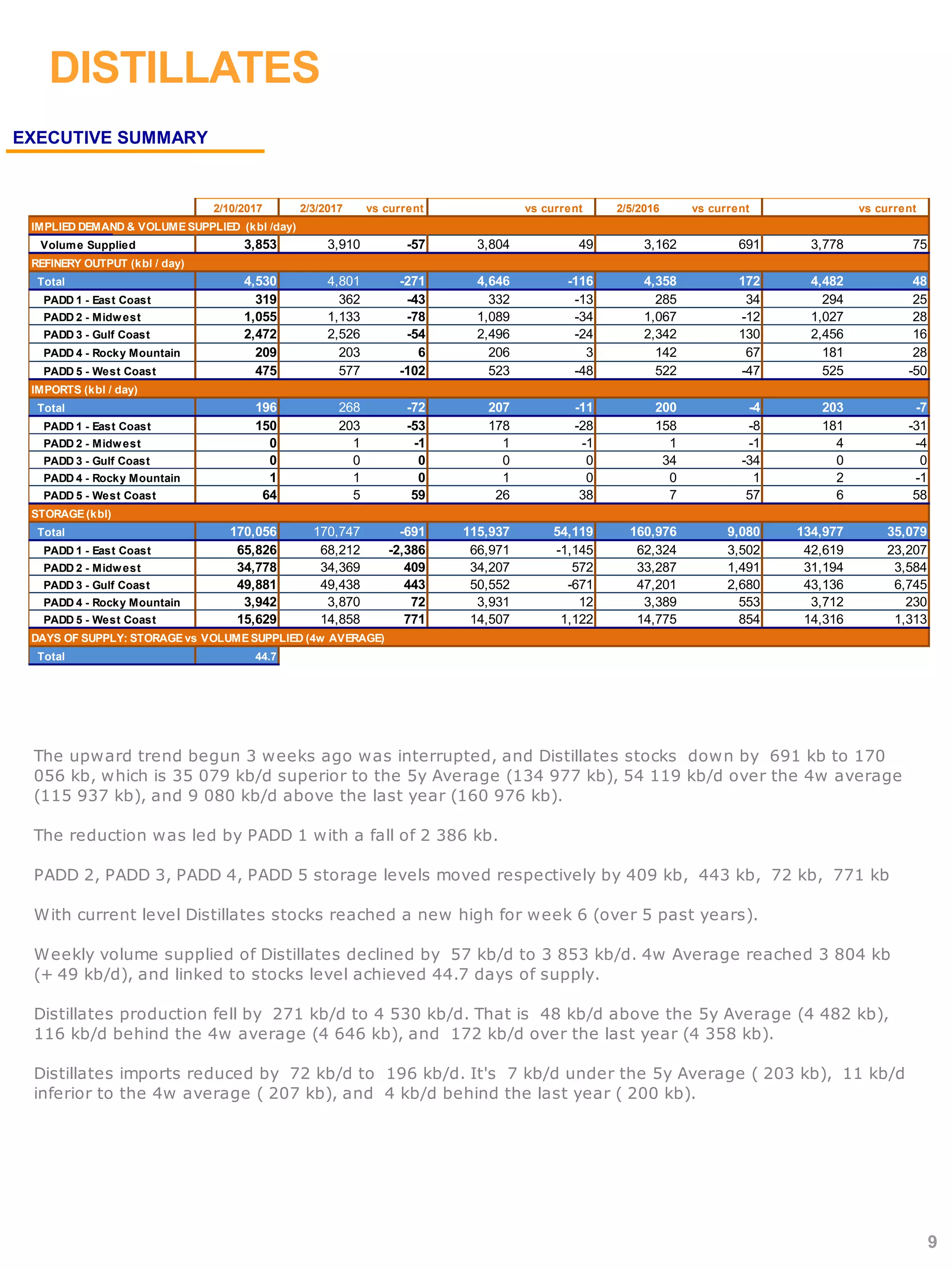

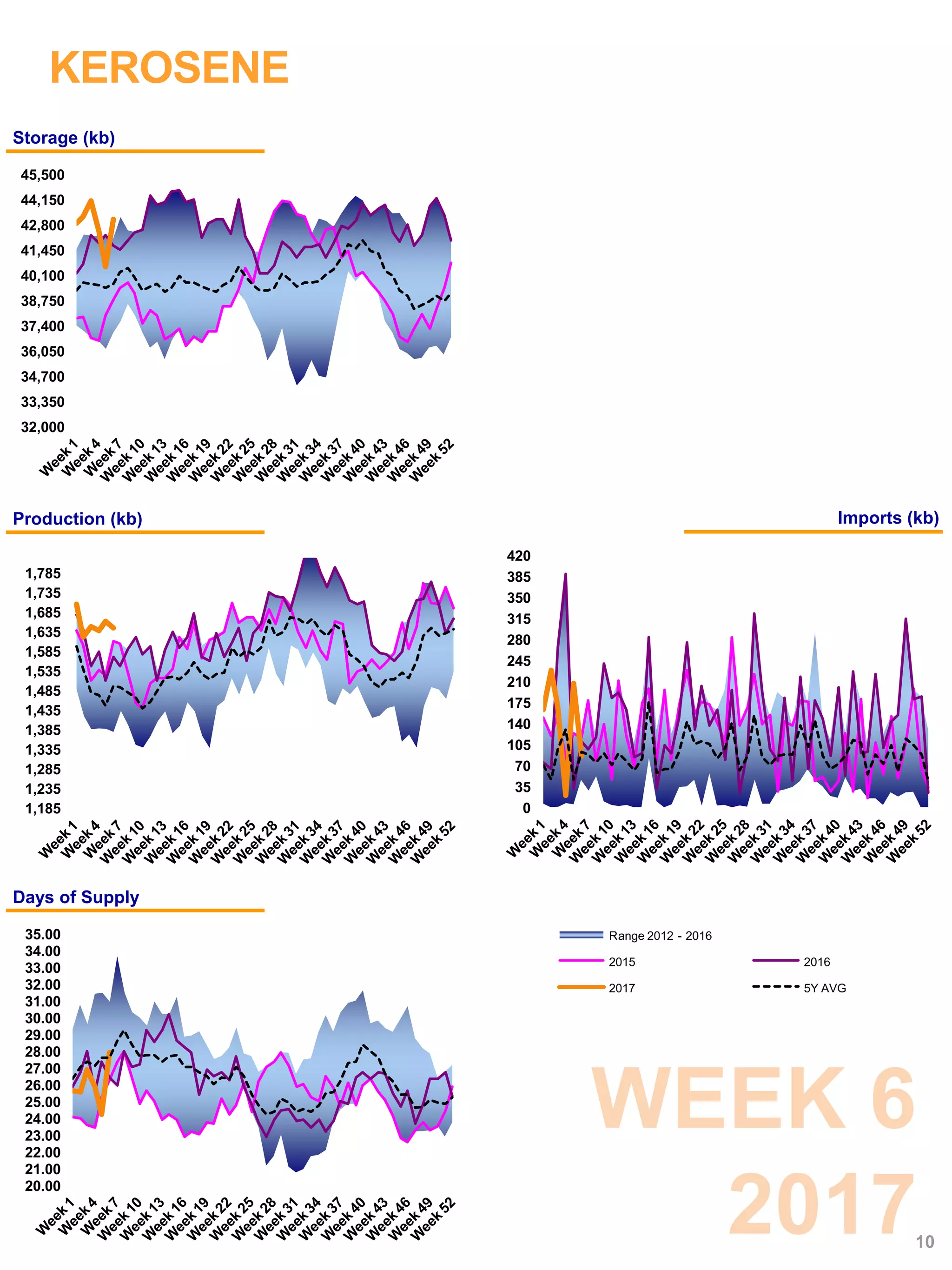

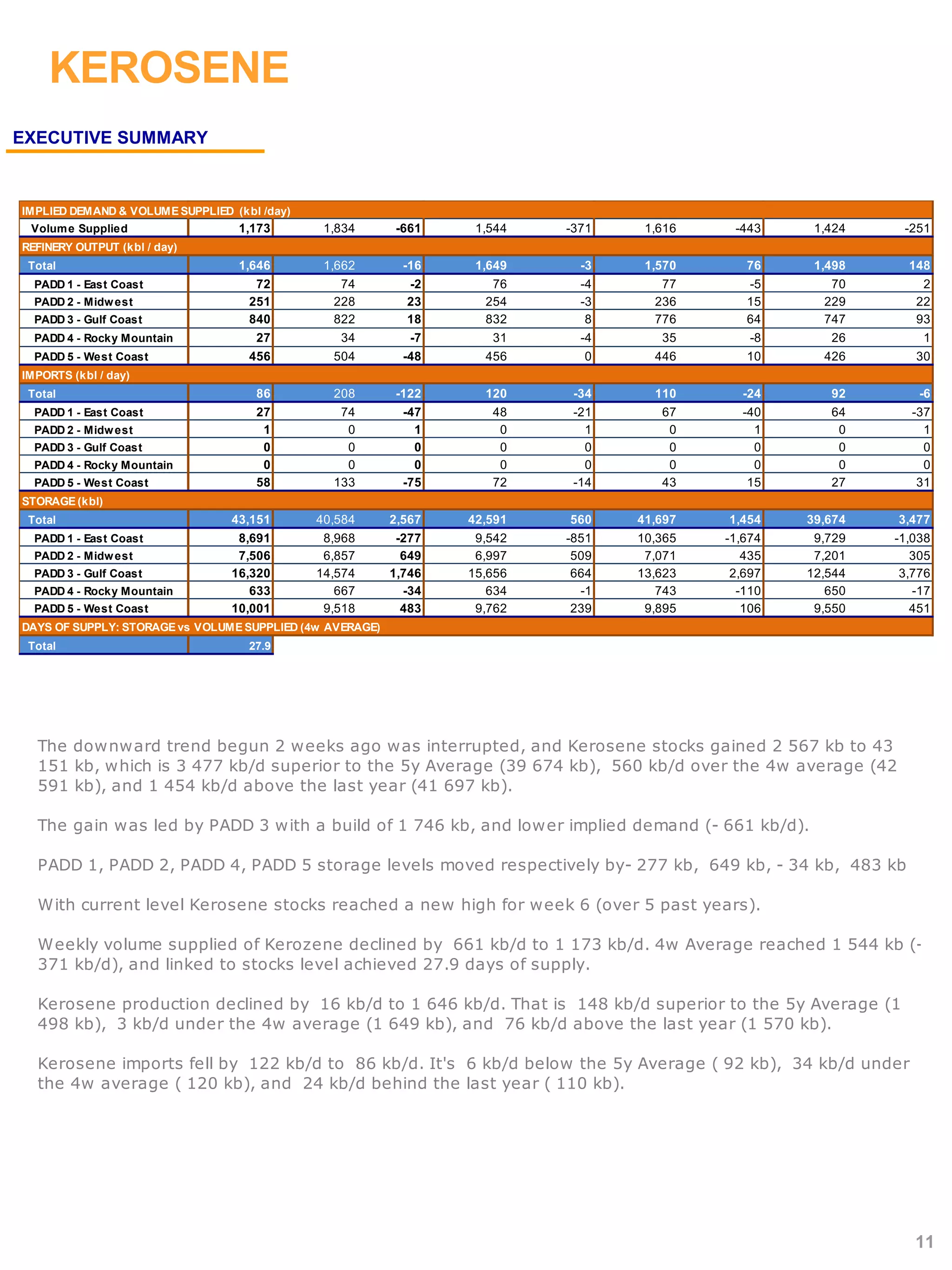

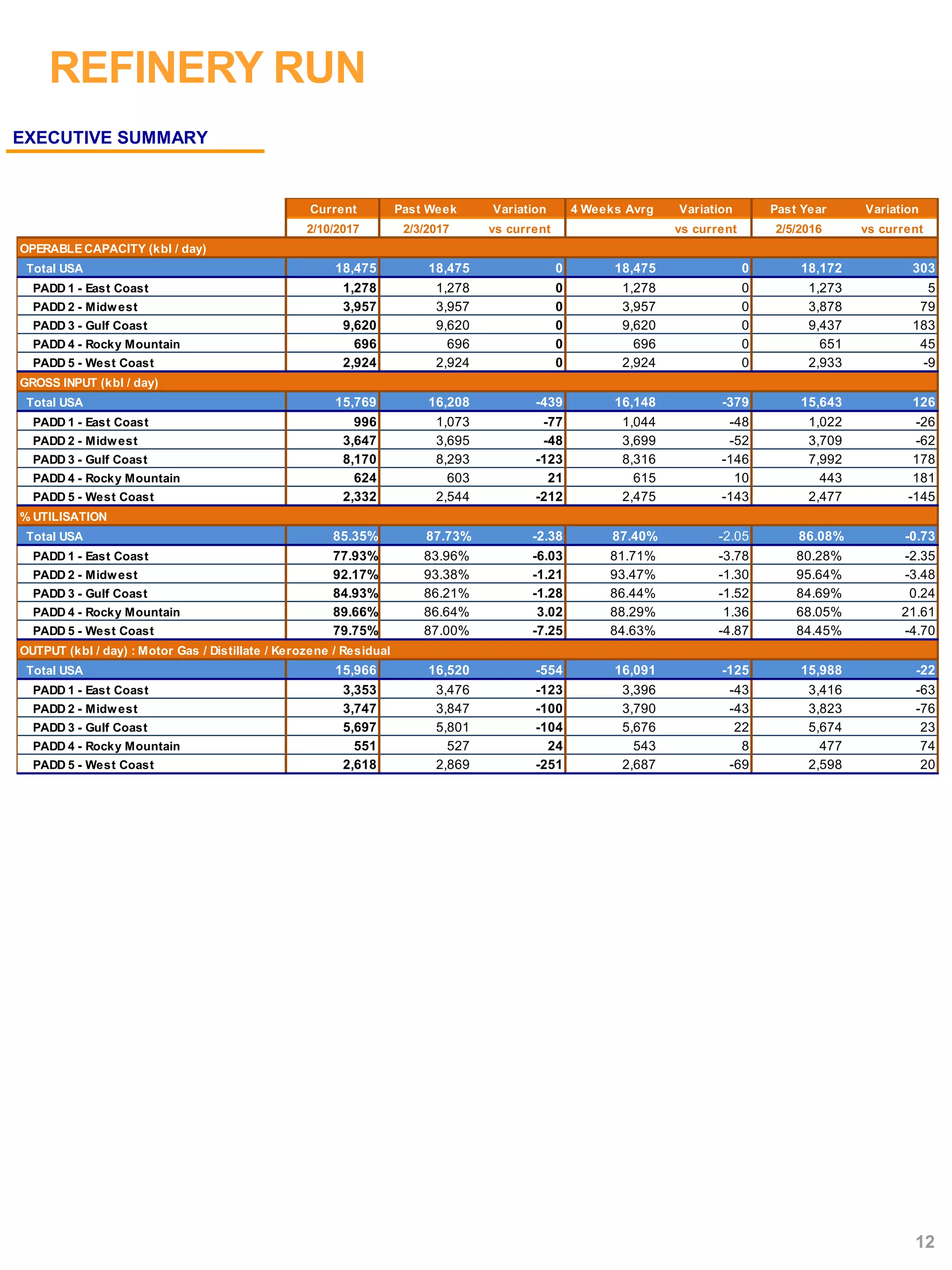

Crude oil stocks gained 9,527 kb to 518,119 kb, led by a build of 6,825 kb in PADD 3 and lower implied demand. Stocks are at record high levels for week 6 over the past 5 years. Gasoline stocks rose 2,847 kb to 259,064 kb, driven by a gain of 2,440 kb in PADD 3 and lower imports. Distillate stocks fell 691 kb against expectations, led by a drop of 2,386 kb in PADD 1. Kerosene stocks increased 2,567 kb to a new high for week 6 over 5 years on a build of 1,746 kb in PADD 3 and lower implied demand. Refinery runs declined 2