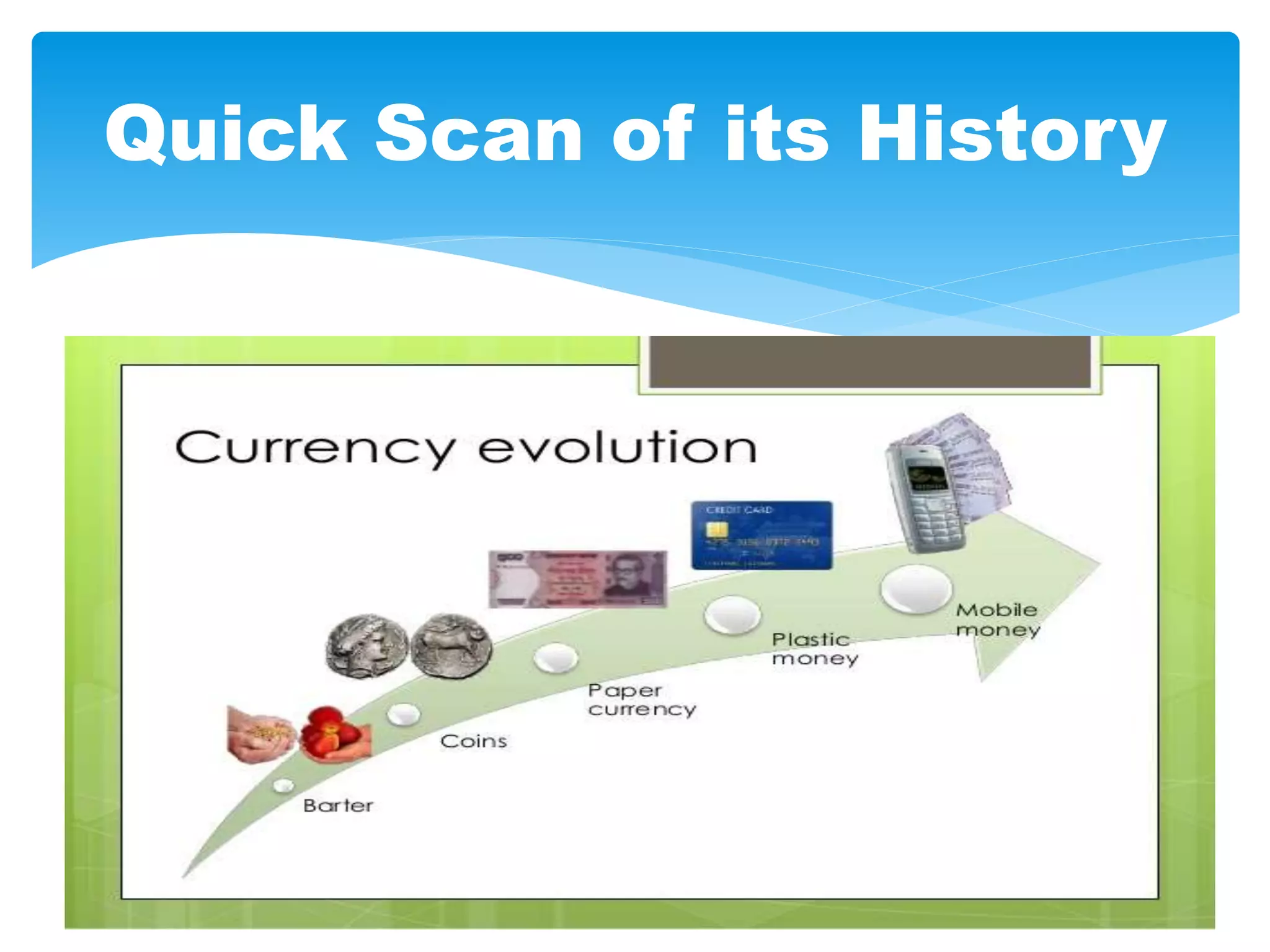

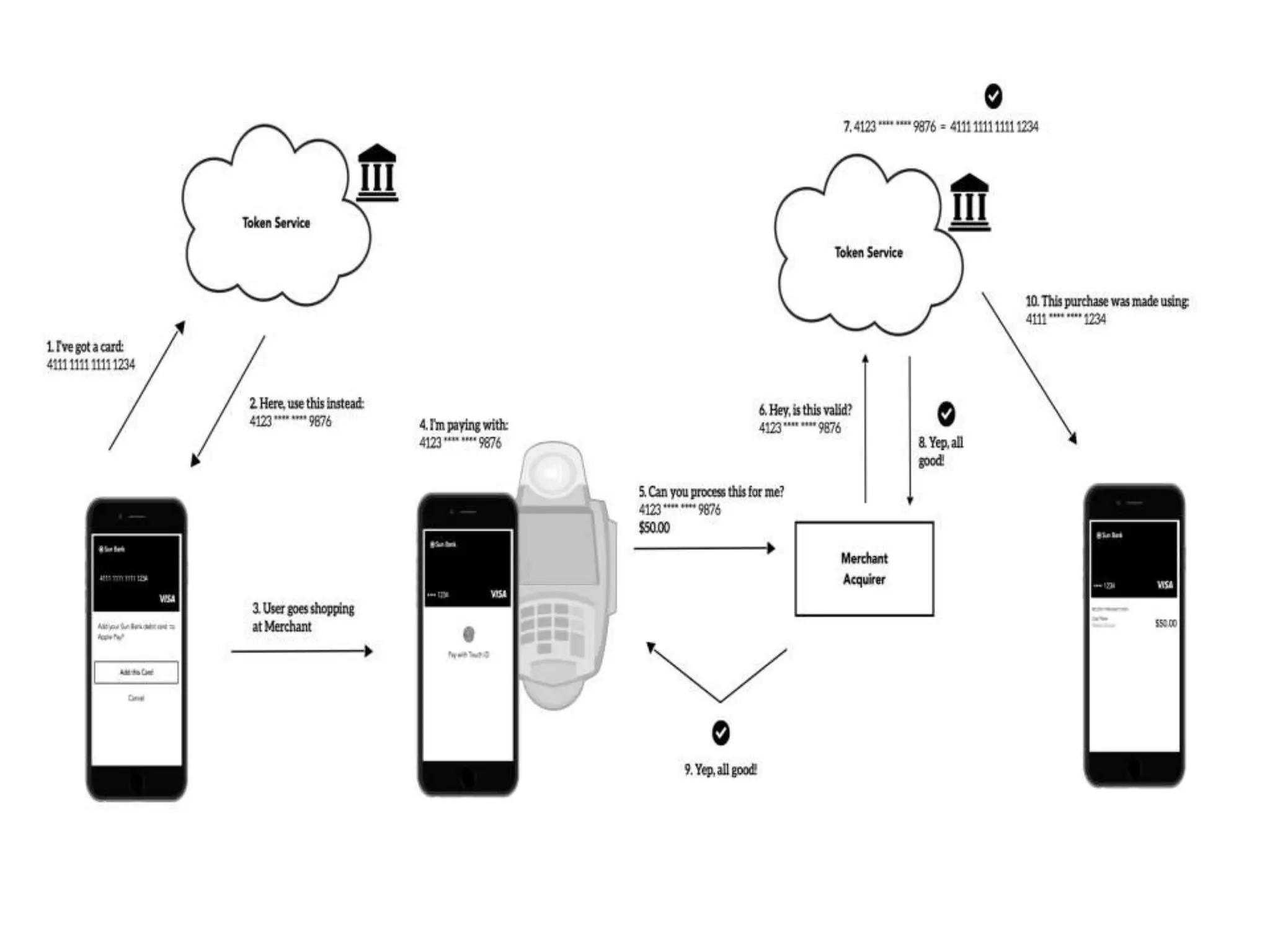

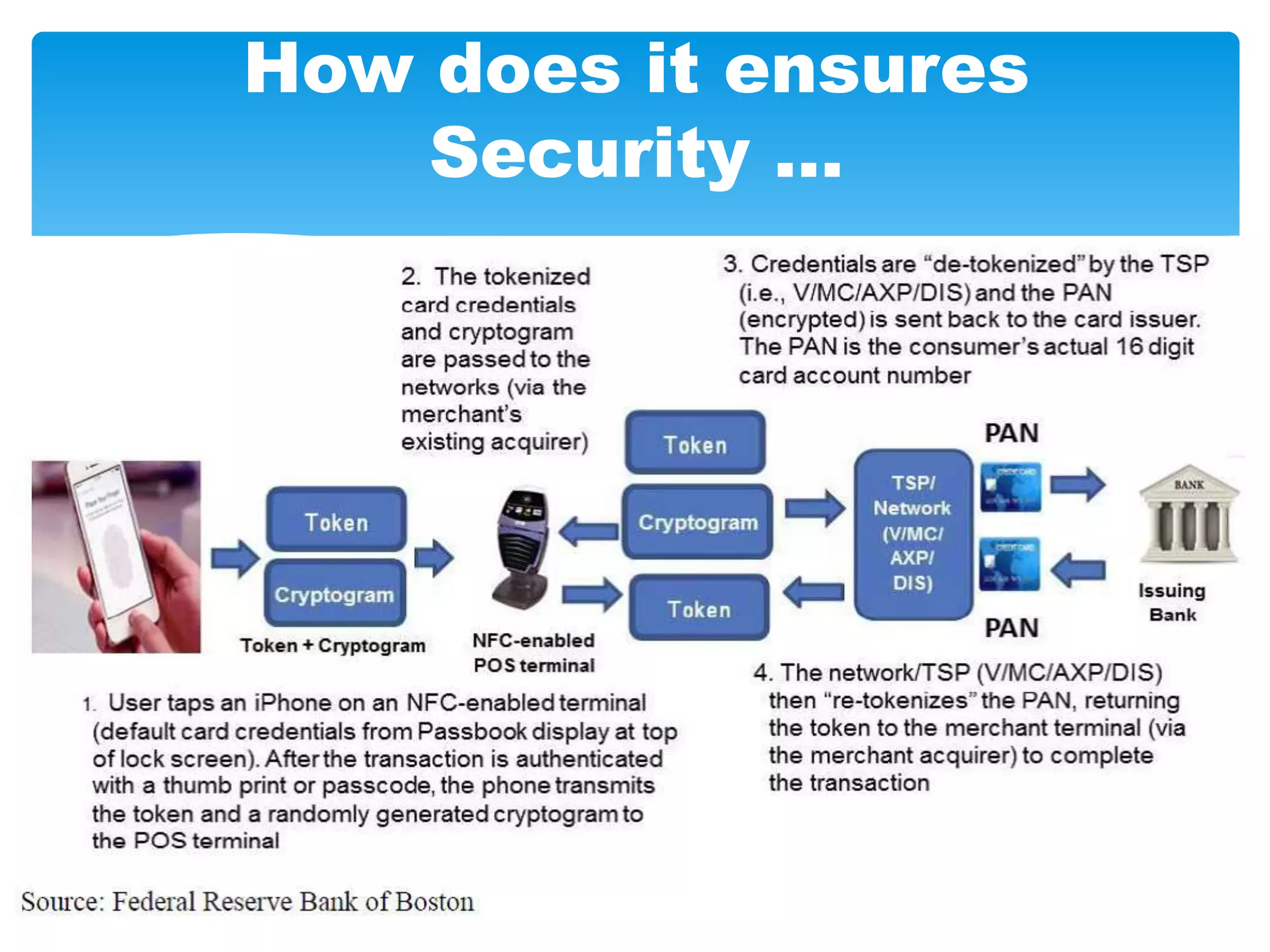

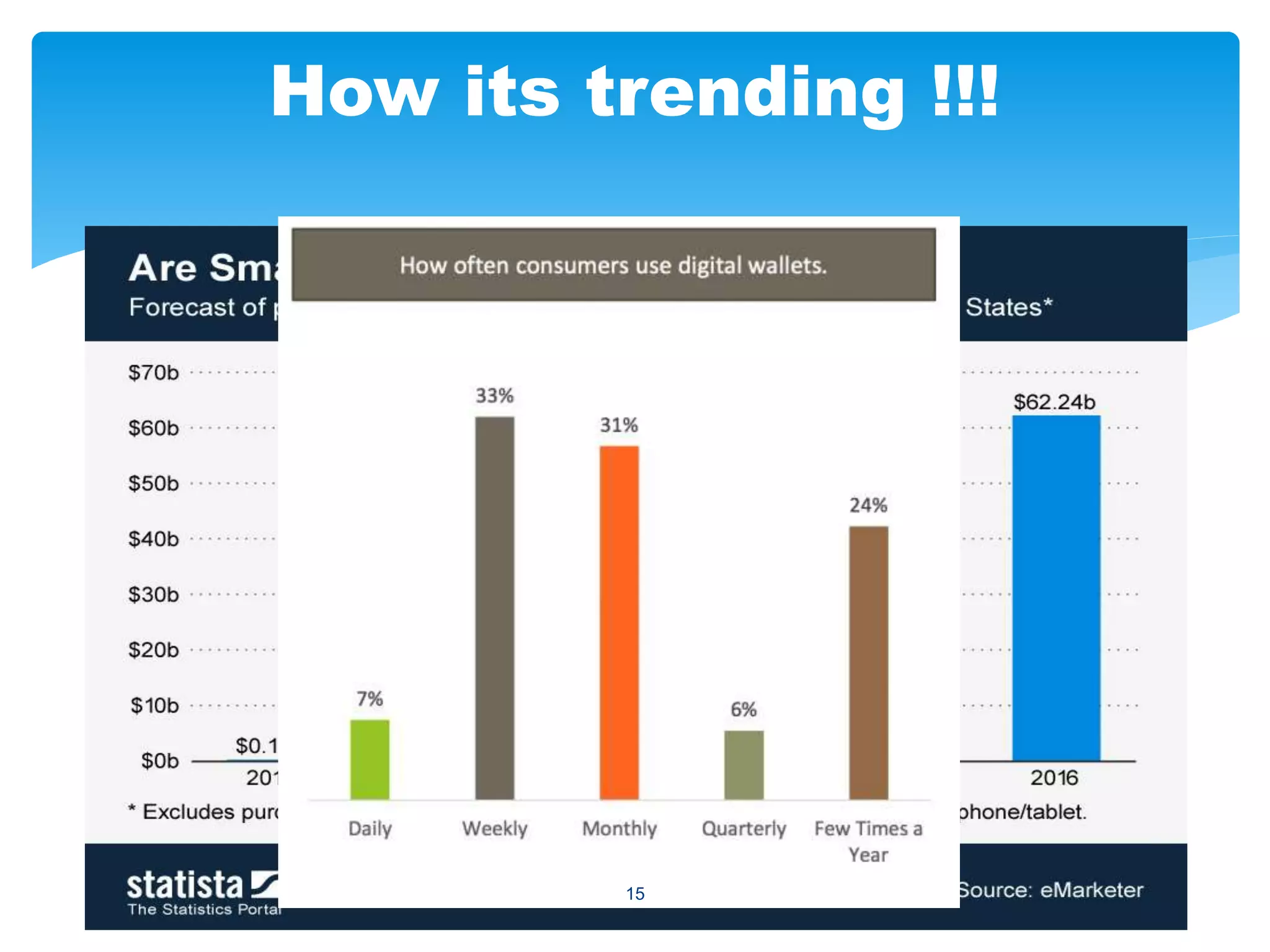

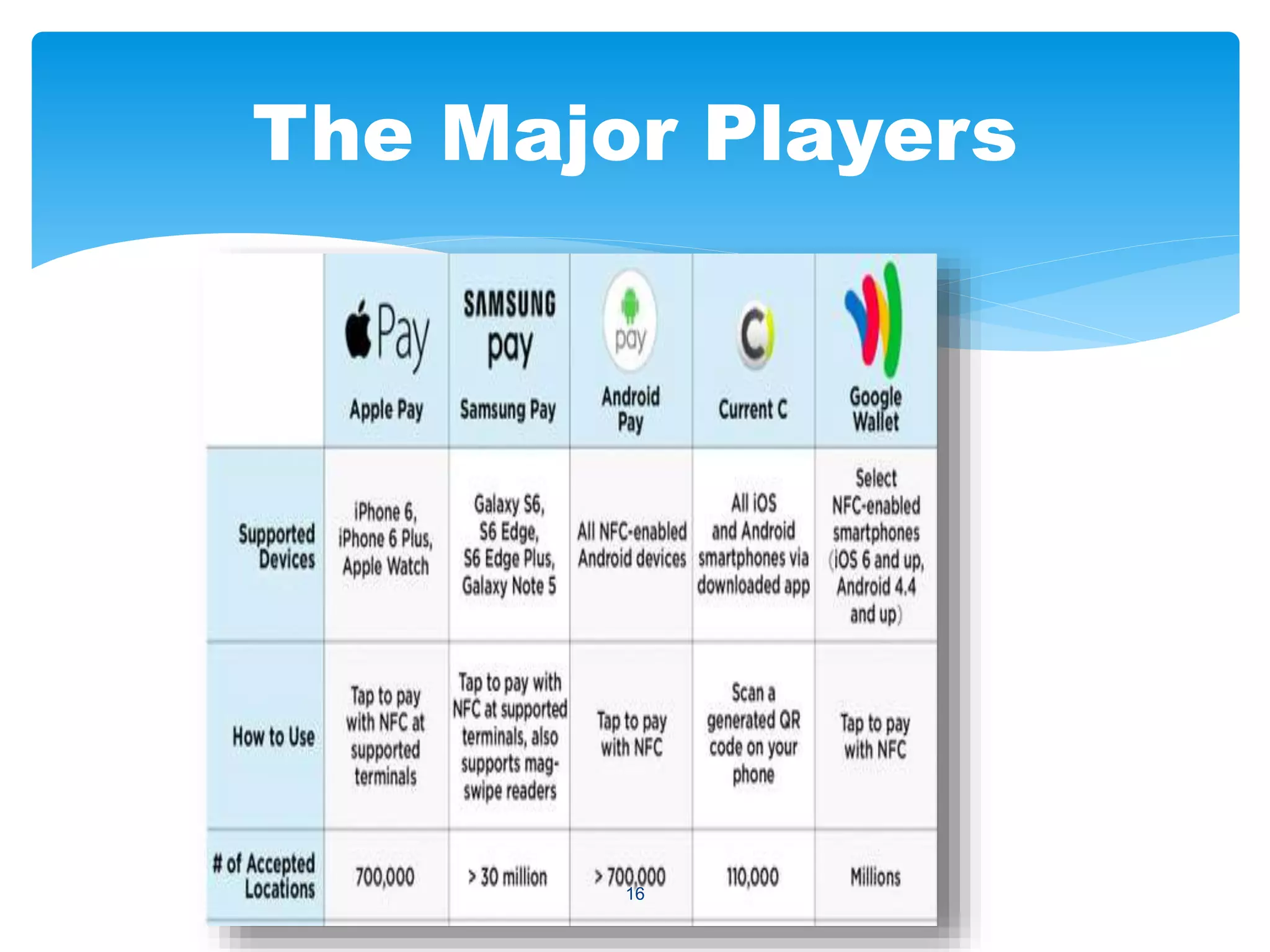

The seminar presentation discusses digital wallets as electronic devices that manage payment methods and provide secure transactions, evolving from traditional wallets. It categorizes digital wallets into closed, semi-closed, and open types while highlighting their components, technologies, benefits, and security measures. The conclusion emphasizes the importance of securing digital wallets as reliance on mobile payments increases.