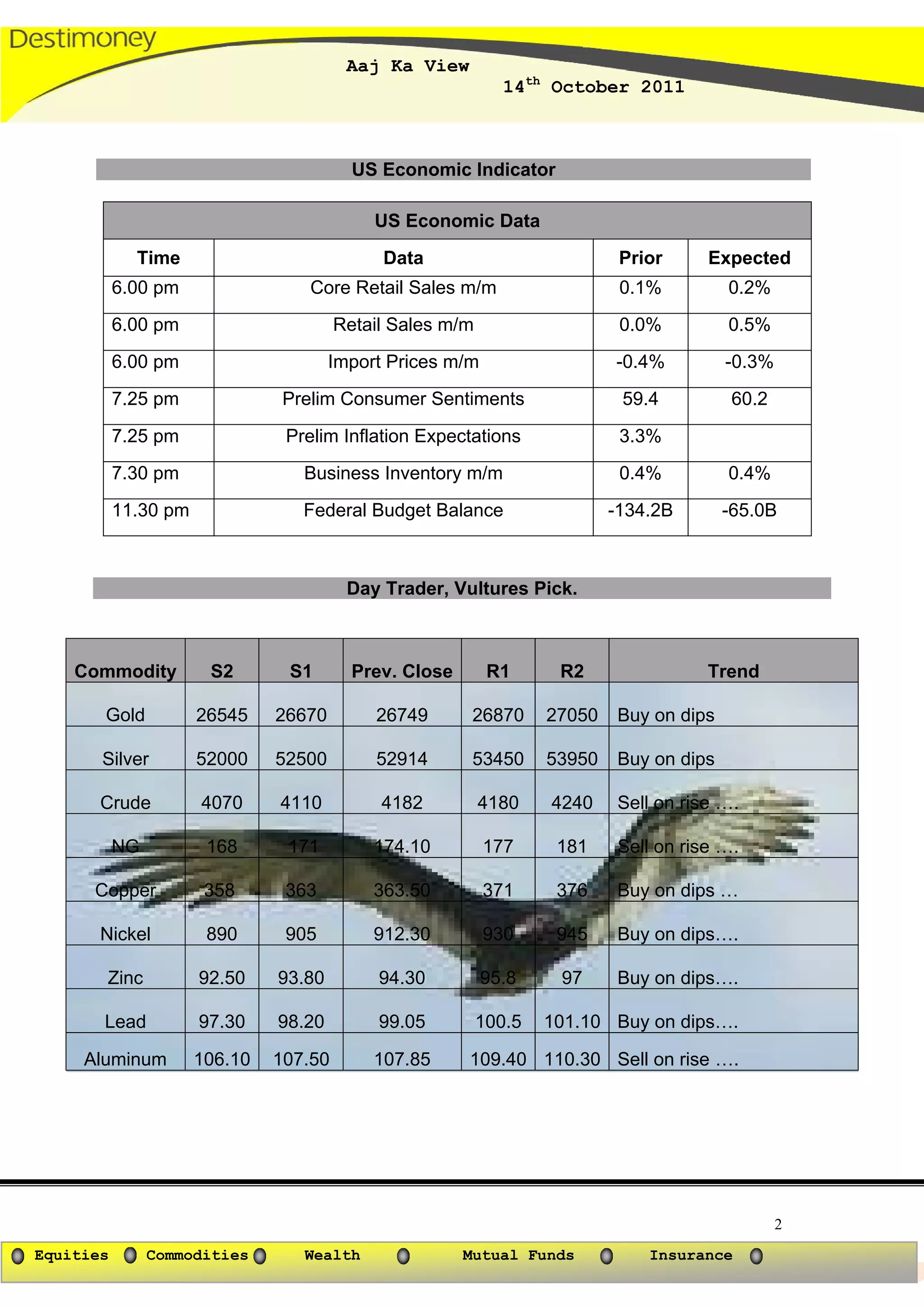

- US unemployment claims were slightly lower than expected at 404k. Crude oil inventories rose more than expected.

- S&P downgraded Spain's credit rating due to high unemployment and economic slowdown in Europe.

- Slovakia approved the EFSF bailout fund, making it the last EU nation to do so. Bullions and metals were expected to trade sideways.