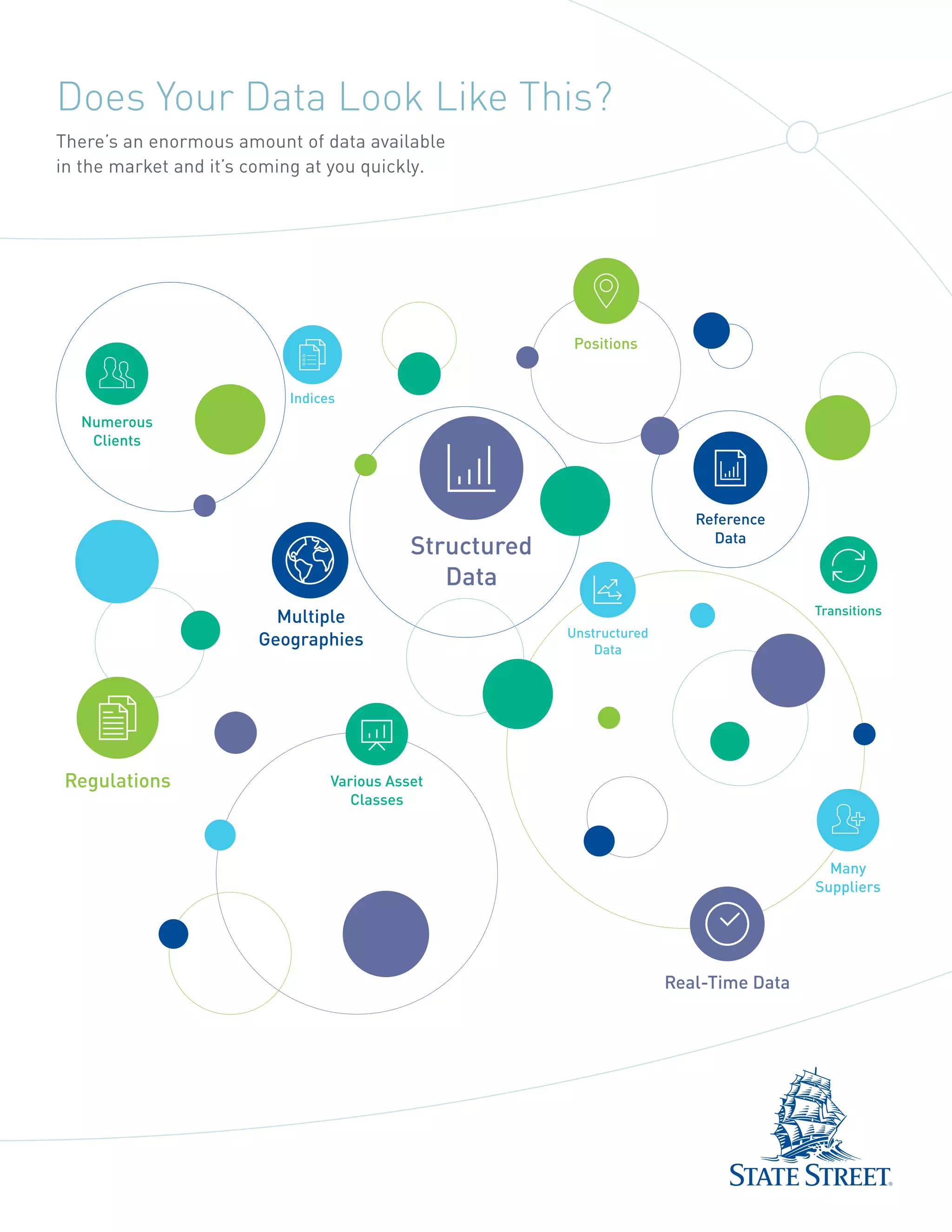

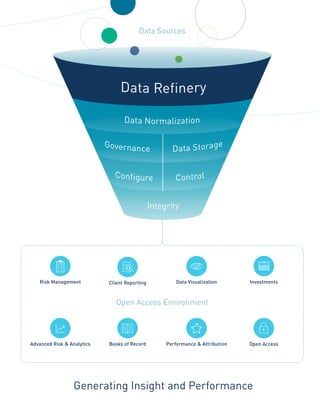

The document discusses State Street's data management solution that acts as a data refinery to help organizations deal with large amounts of data from numerous sources in different formats. It offers a hosted data-as-a-service platform called DataGX that provides a complete view of investments from a single source. State Street also provides full data outsourcing services using DataGX to help clients optimize data, improve accuracy and integrity, and better manage risk. The solution provides capabilities for performance measurement, attribution analysis, compliance monitoring, and risk analytics.