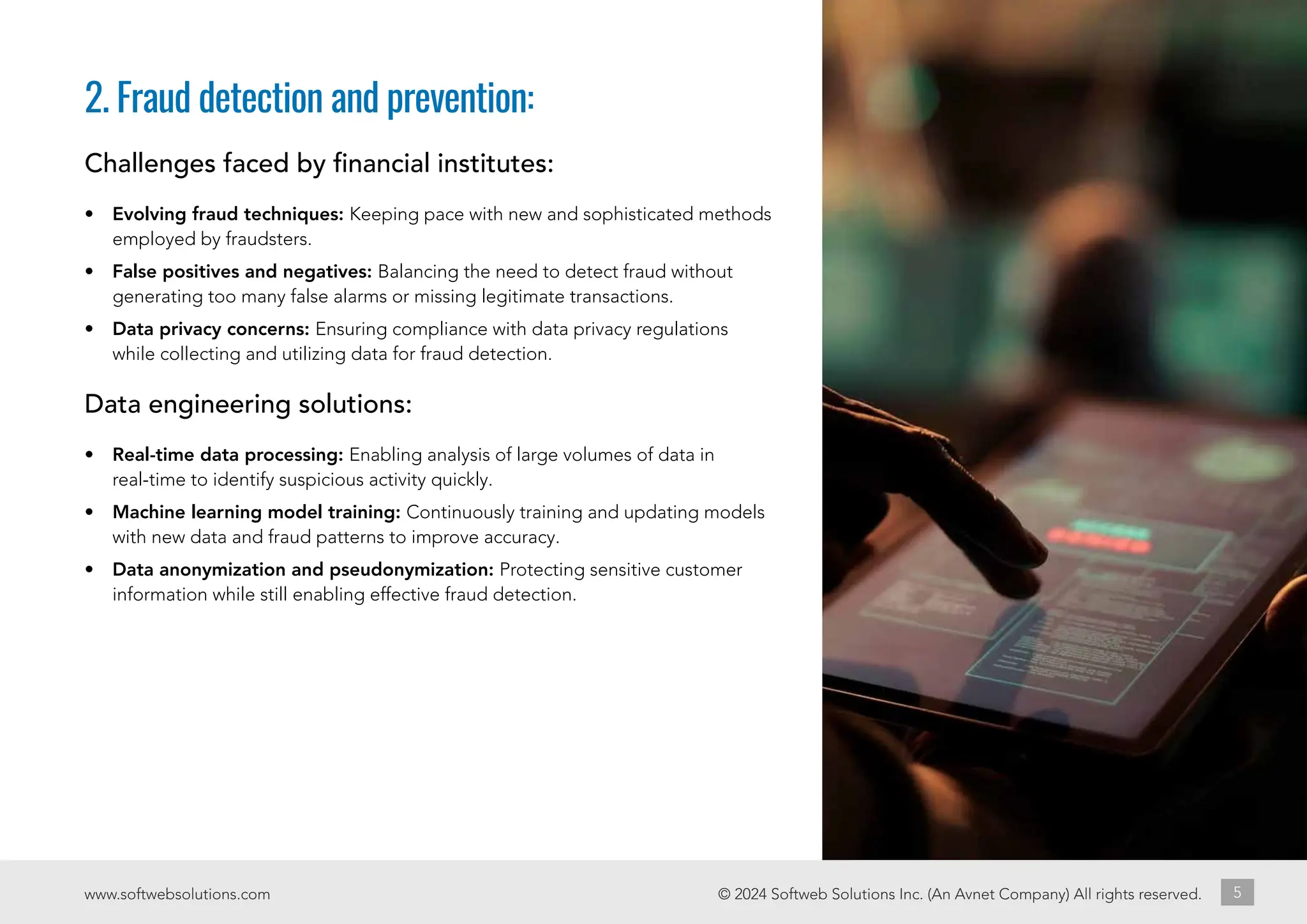

The document outlines five key data engineering use cases in the financial industry for 2024, including risk management, fraud detection, customer relationship management, algorithmic trading, and regulatory compliance. It discusses the challenges faced in each area, the data engineering solutions implemented, and the benefits realized by organizations like JP Morgan Chase, PayPal, American Express, and Wells Fargo. By employing robust data architectures, financial enterprises can enhance analytics capabilities, improve risk insights, and ensure compliance while fostering better customer experiences.