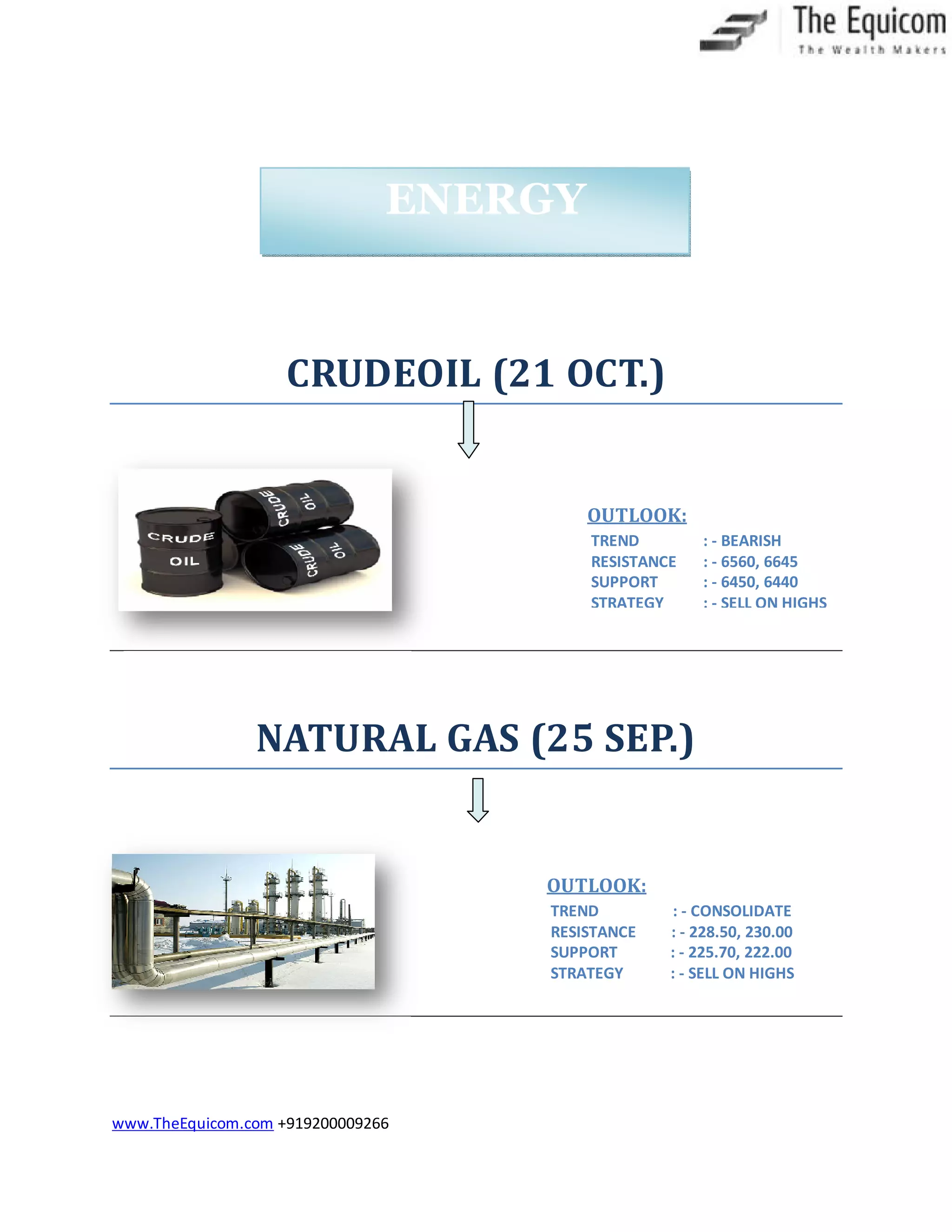

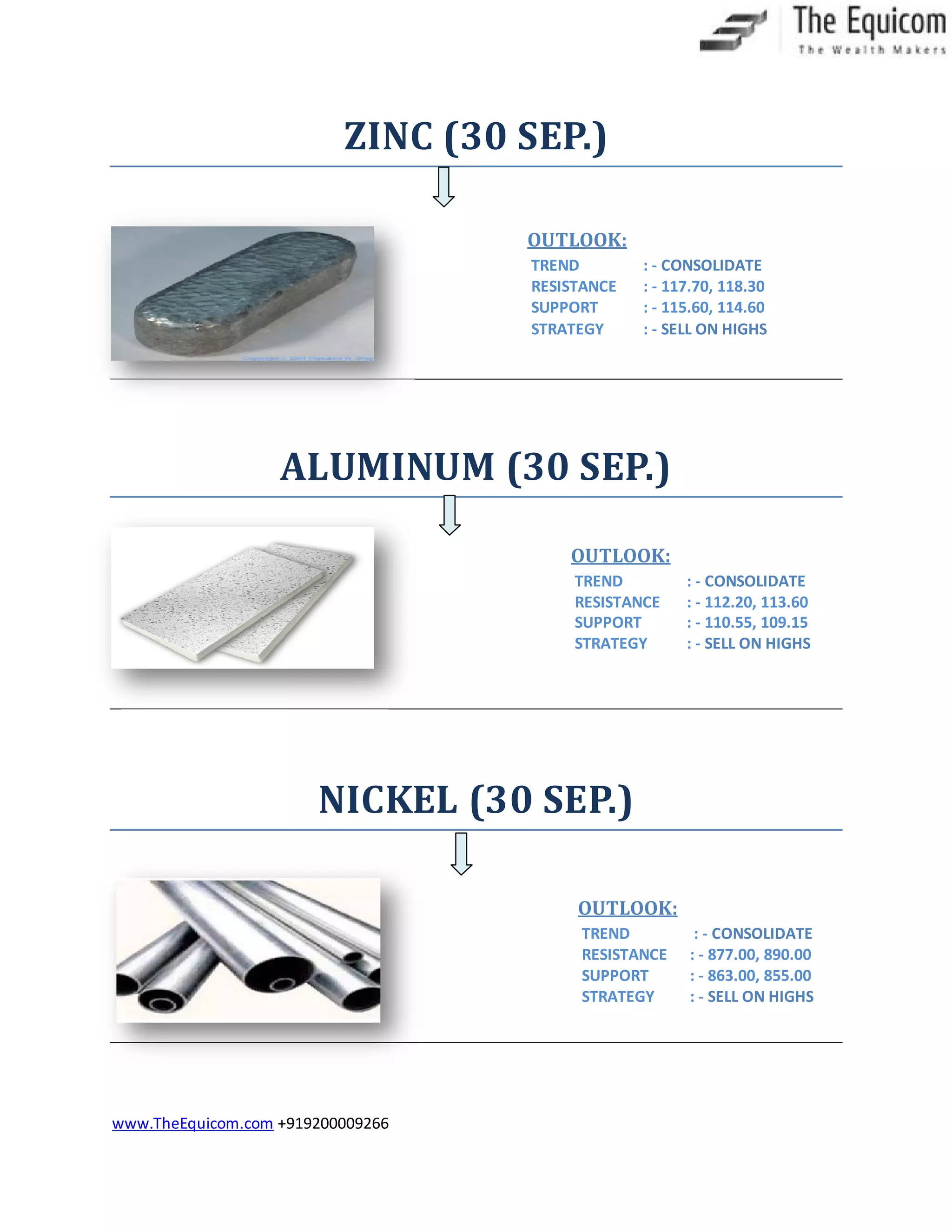

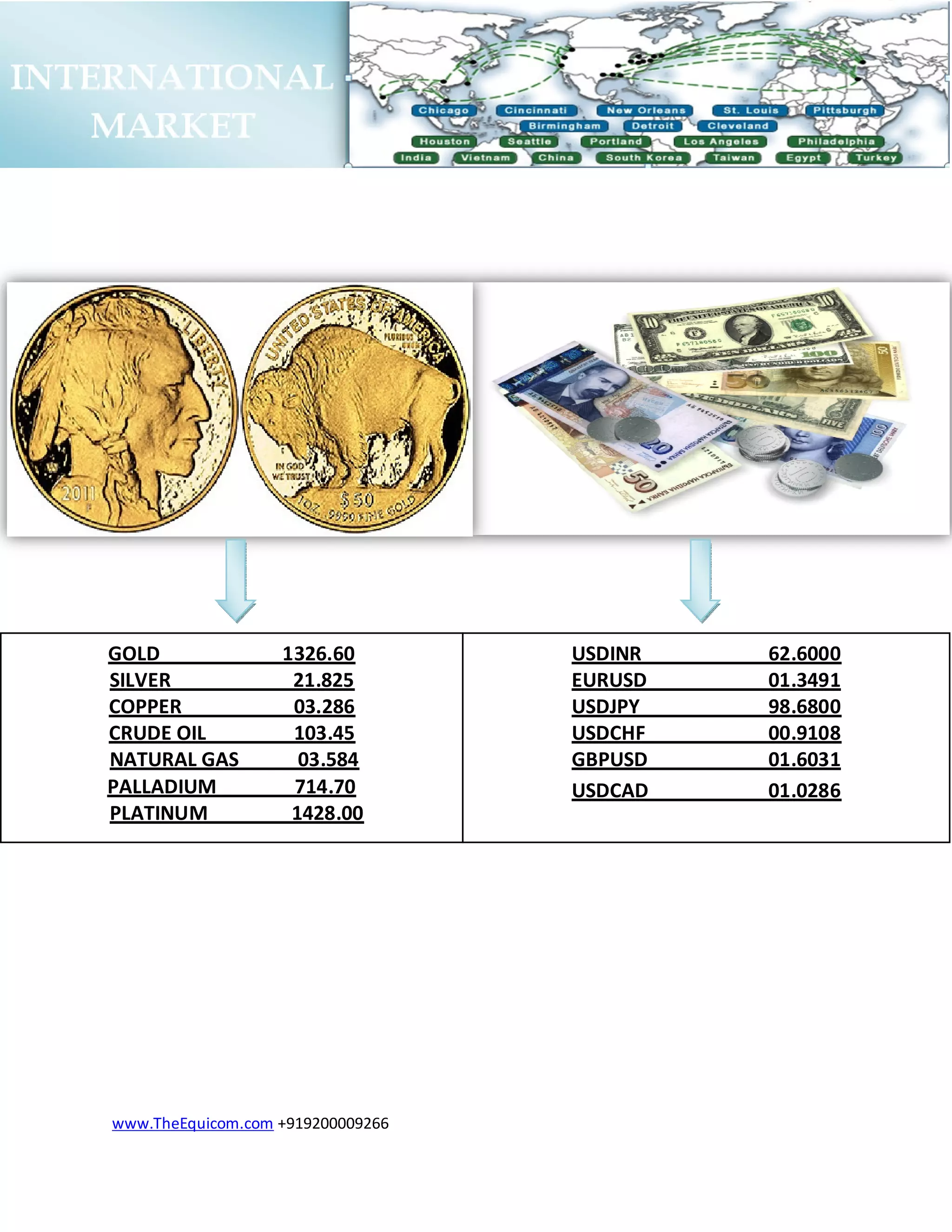

The document provides an overview of recent trends in commodity markets, highlighting a decline in gold prices influenced by global economic recovery and US monetary policy. Crude oil shows slight gains amidst positive data from China and Europe, though concerns about potential US stimulus cuts loom. The document includes technical outlook and trading strategies for various commodities, along with a disclaimer about the accuracy and reliability of the provided information.