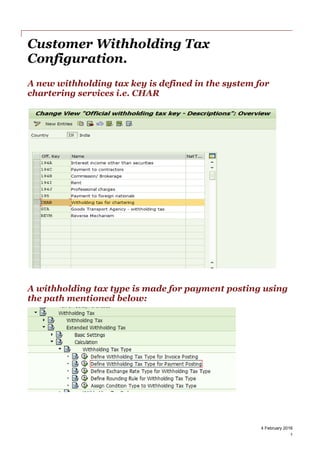

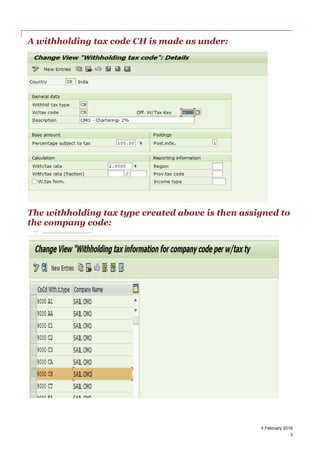

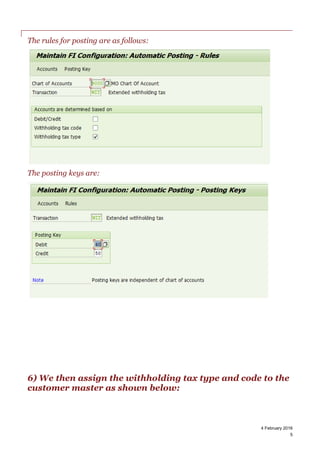

A new withholding tax key and type were defined for chartering services called CHAR. The withholding tax code CH was created and assigned to company codes to be available for customer master data. General ledger accounts were assigned to the withholding tax type CH using transaction OBWW so that withholding tax could be posted for chartering service payments. The withholding tax type and code CH were then assigned to customer masters.