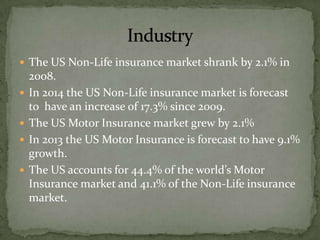

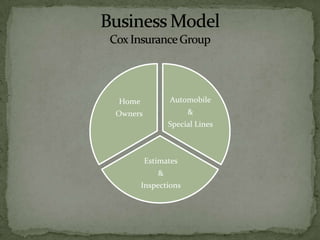

Cox Insurance Group is a licensed insurance agency established in 2004 in Hillsborough County, Florida. Their mission is to provide the highest standard of professionalism and service to clients. Their target market includes homeowners with multiple lines of business in Elite, Preferred, and Standard markets. The document provides an analysis of the US and Florida insurance markets, Cox Insurance Group's competitors, strengths, weaknesses, opportunities, threats and business model.