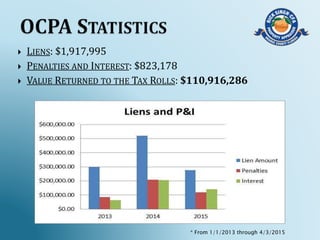

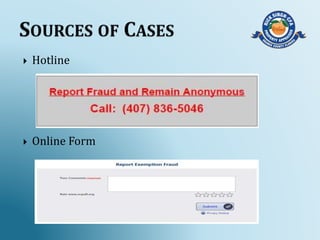

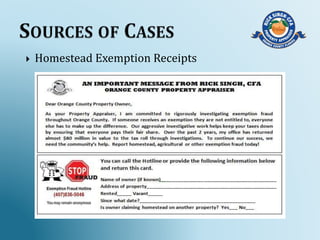

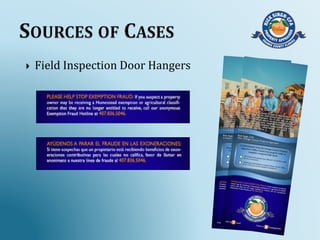

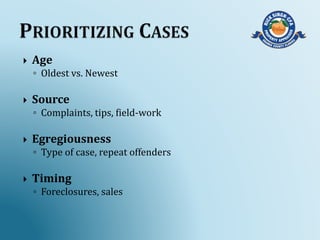

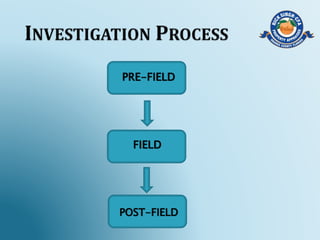

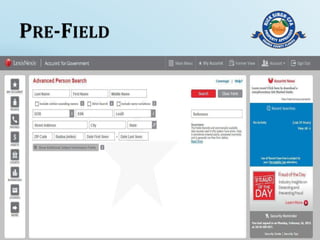

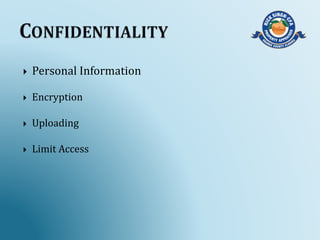

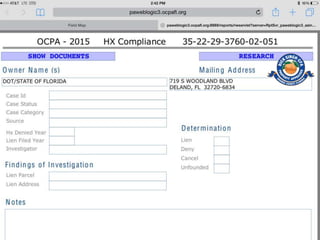

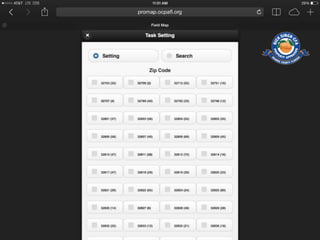

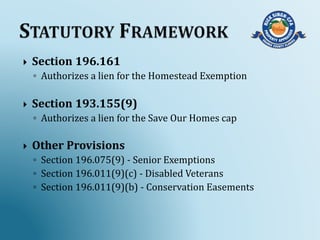

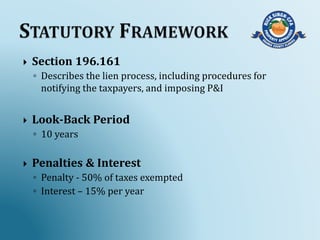

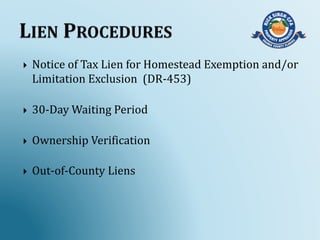

This document outlines best practices for detecting, investigating, and addressing exemption fraud. It discusses building a program from the ground up with an emphasis on community buy-in and customer service. Key aspects of the program include establishing multiple reporting methods, thorough investigator training, a standardized investigation process with pre-field, field and post-field stages, secure data management, and pursuit of liens and penalties as authorized by law. The goal is to balance fraud investigations with customer service while returning improperly exempted value to the tax rolls.