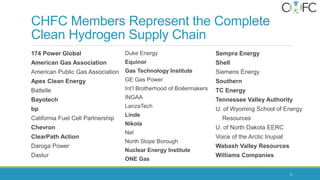

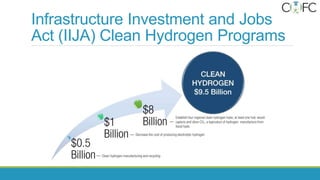

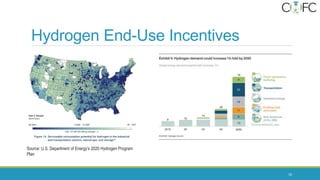

This document discusses U.S. federal policy on building a hydrogen future according to the Clean Hydrogen Future Coalition. It outlines the Coalition's foundational principles of clean hydrogen being critical to decarbonization, and investments across the full supply chain being necessary. It also emphasizes fuel and technology neutral policies focused on carbon intensity. The document then provides information on Coalition members, the complex supply chain and policy needs, major use cases and technologies, infrastructure funding programs, hydrogen production hubs, the hydrogen production tax credit, and other incentives to support the development of a hydrogen economy.