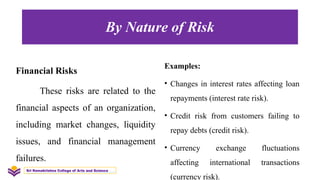

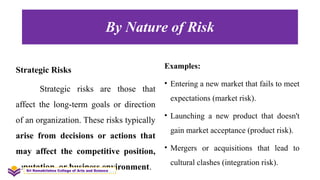

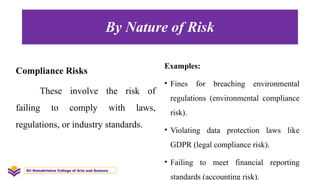

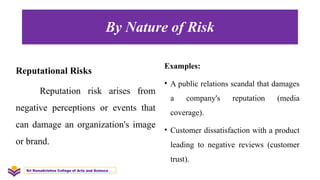

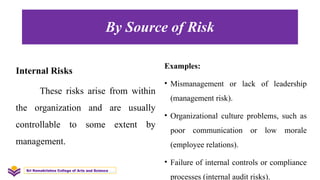

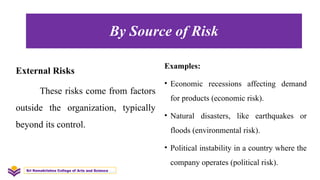

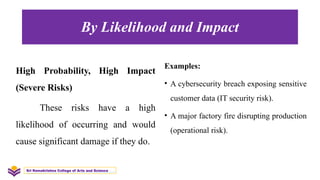

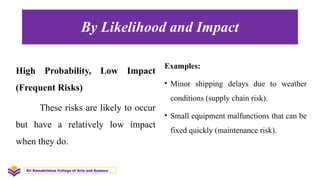

Classifications of Risk involve grouping risks based on their nature, source, impact, and controllability. Risks can be internal or external, financial, strategic, operational, or reputational. They may also be categorized by likelihood and impact, such as high probability or catastrophic risks. Understanding risk types helps businesses in planning effective mitigation strategies. It's essential for sound decision-making and organizational resilience.