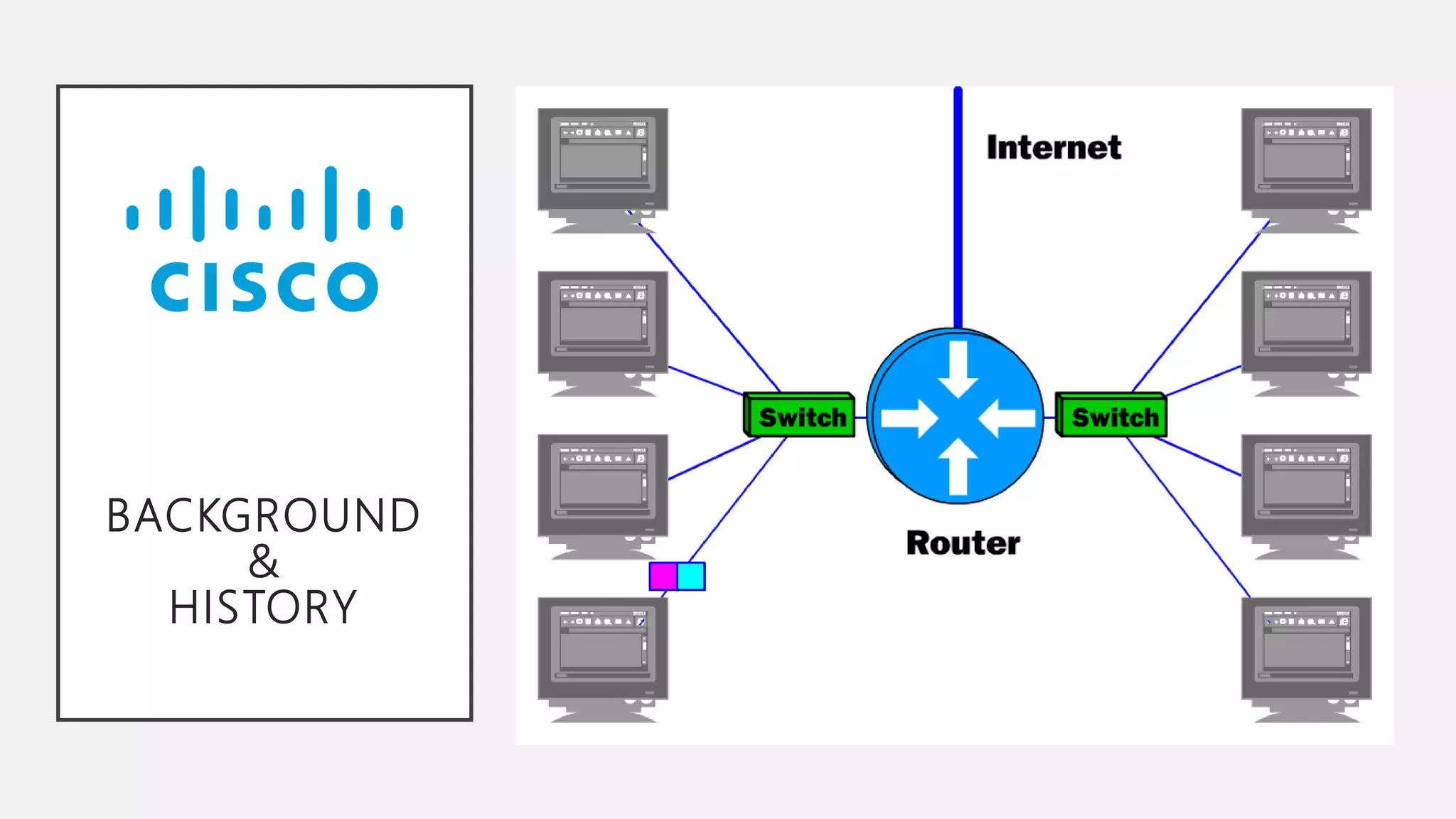

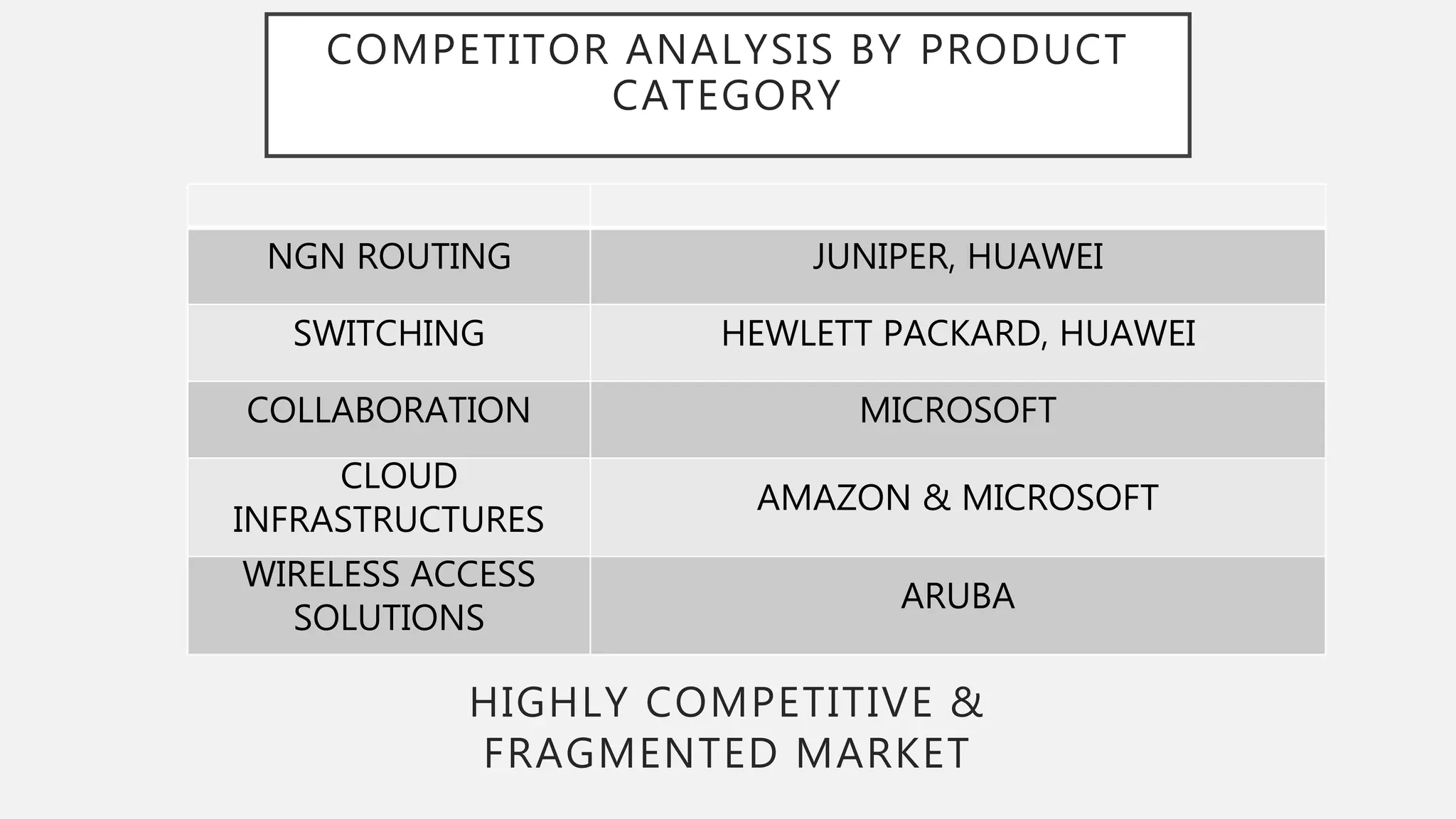

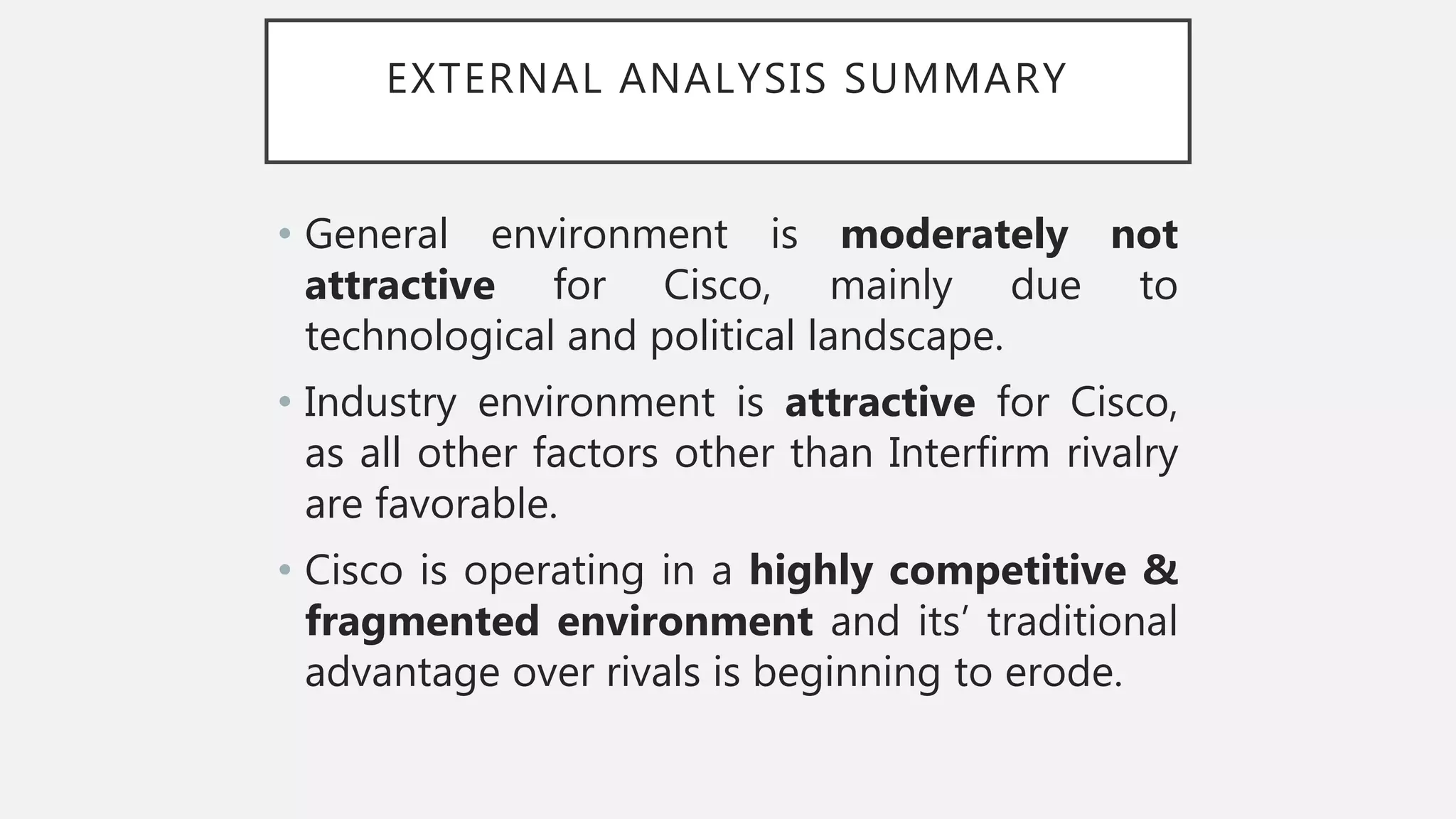

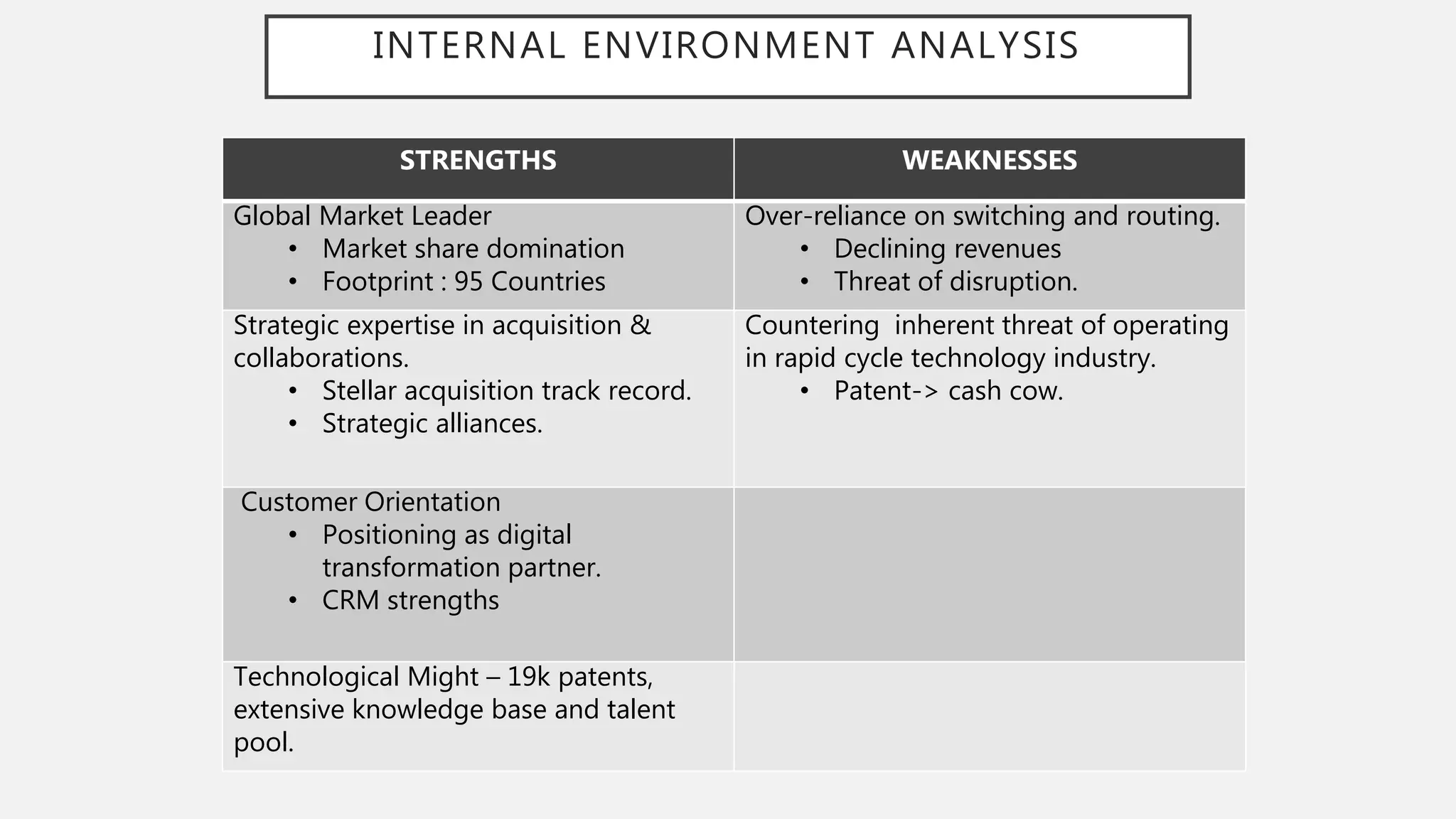

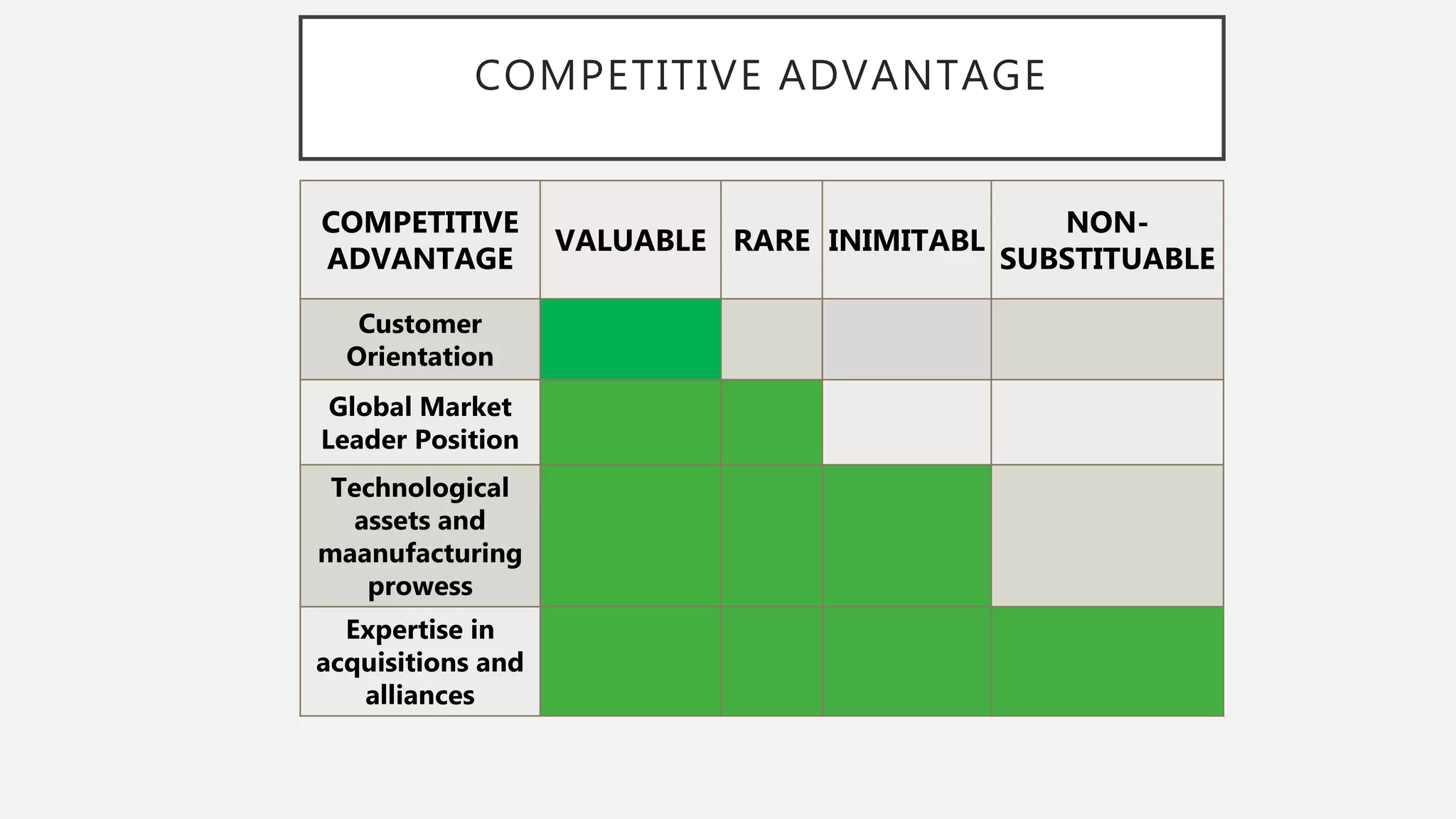

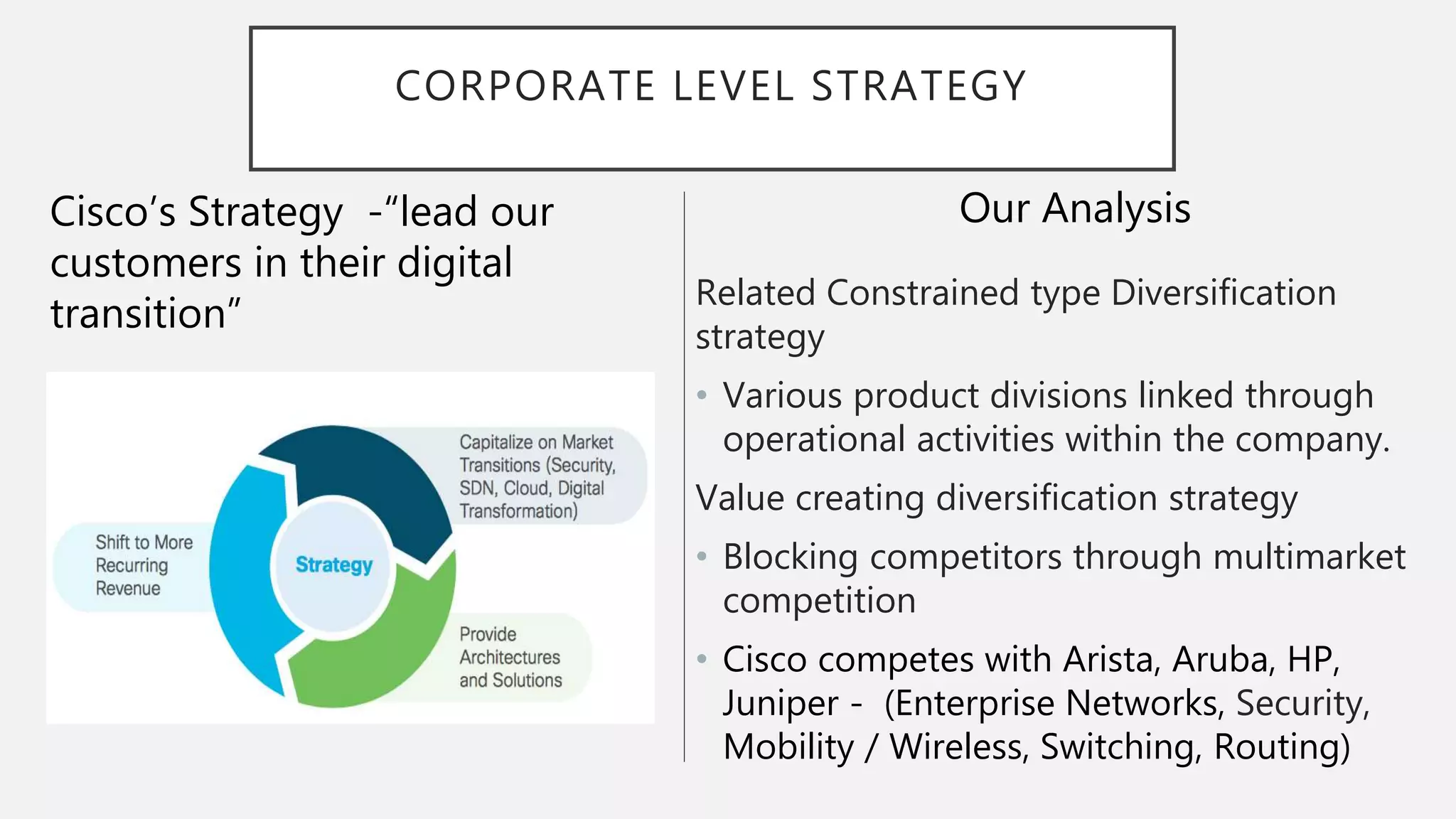

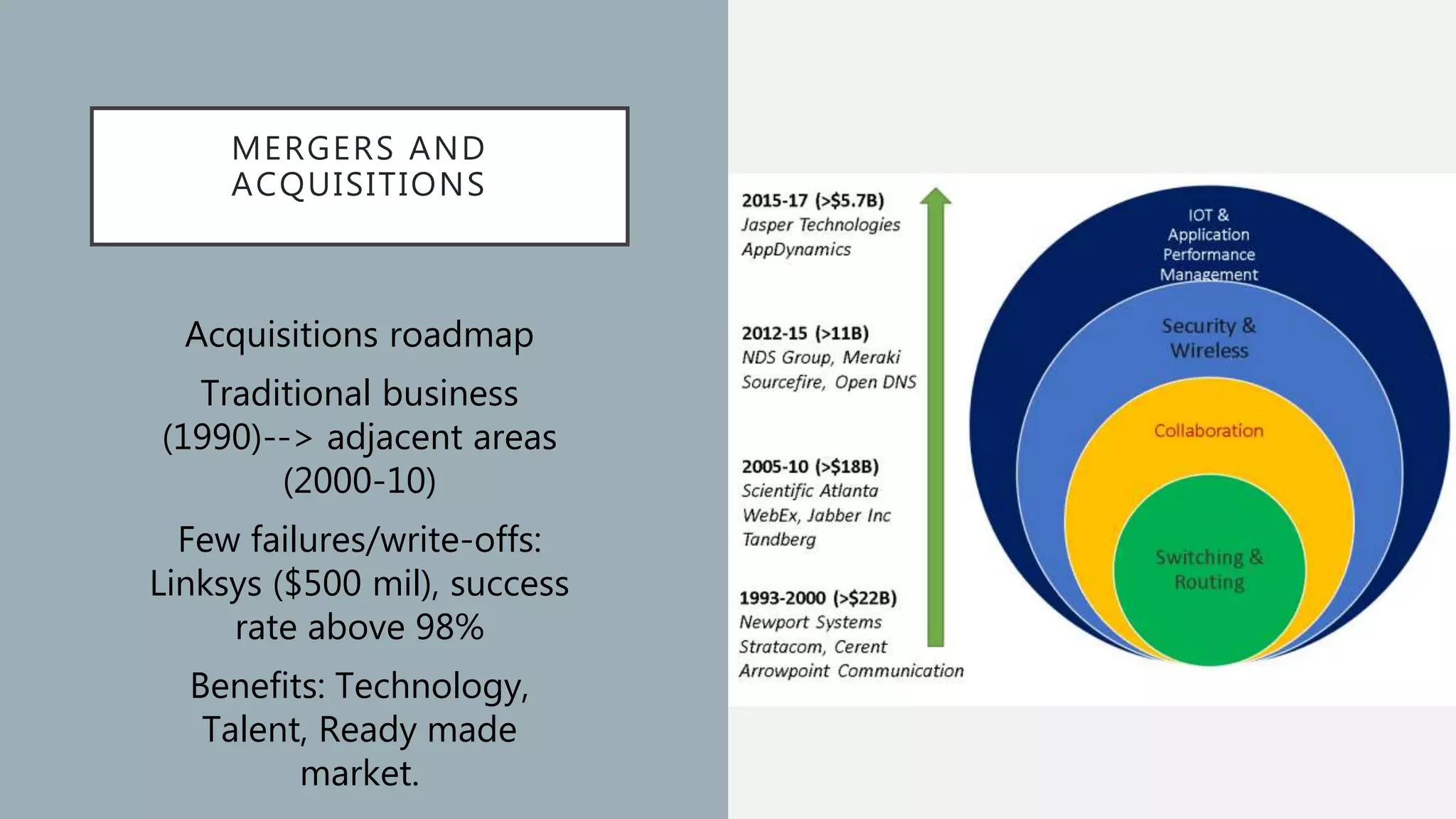

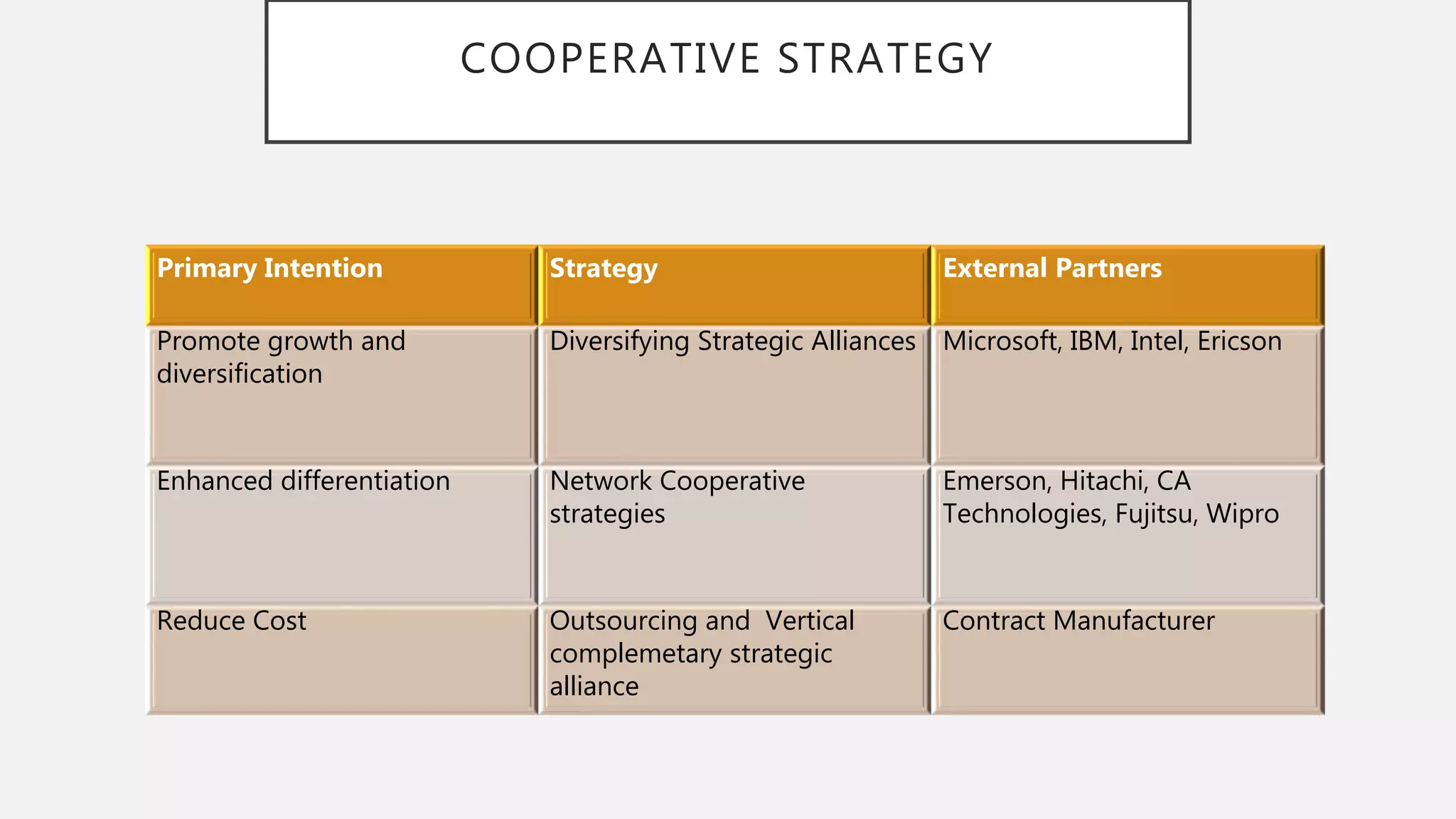

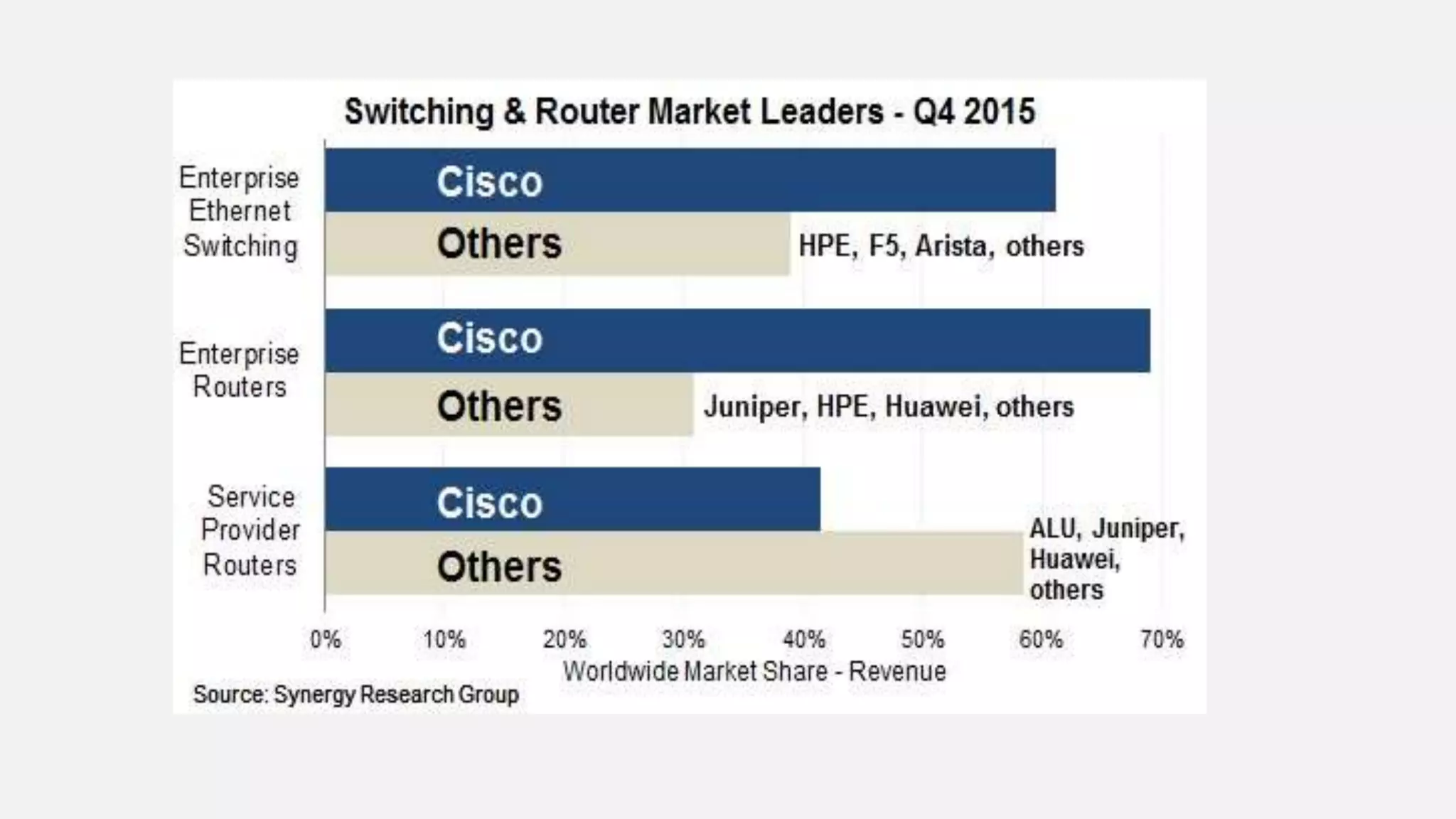

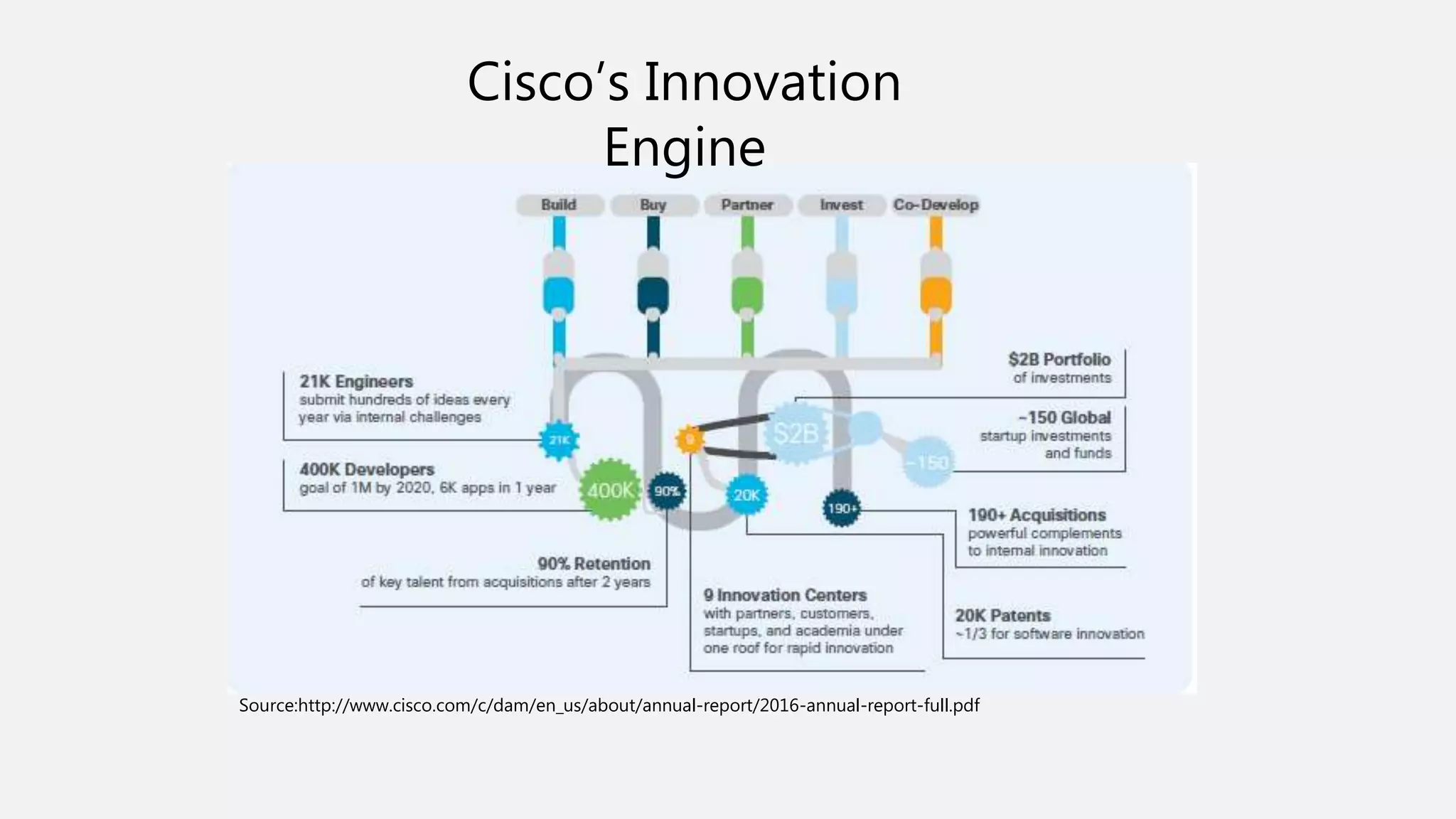

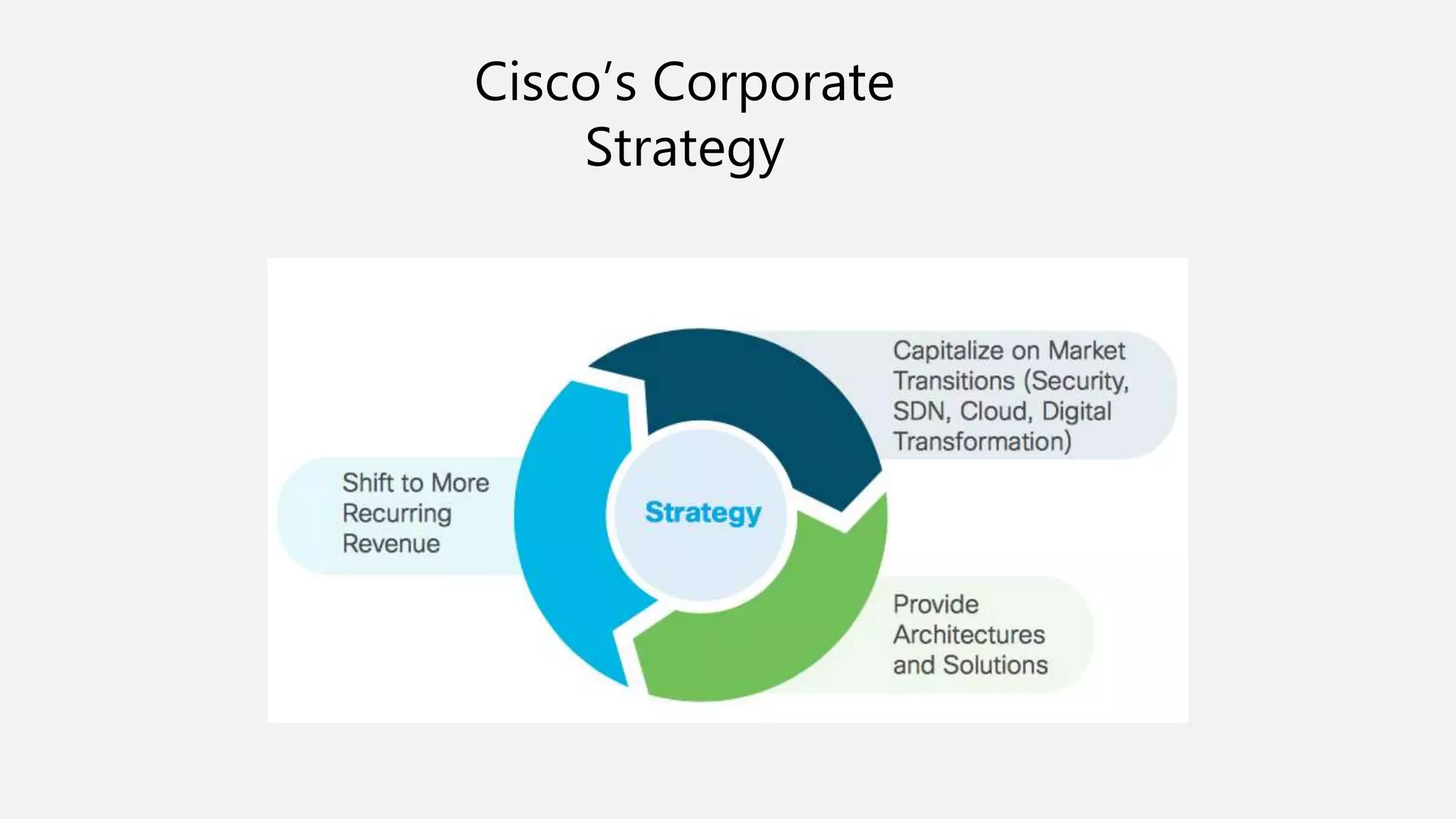

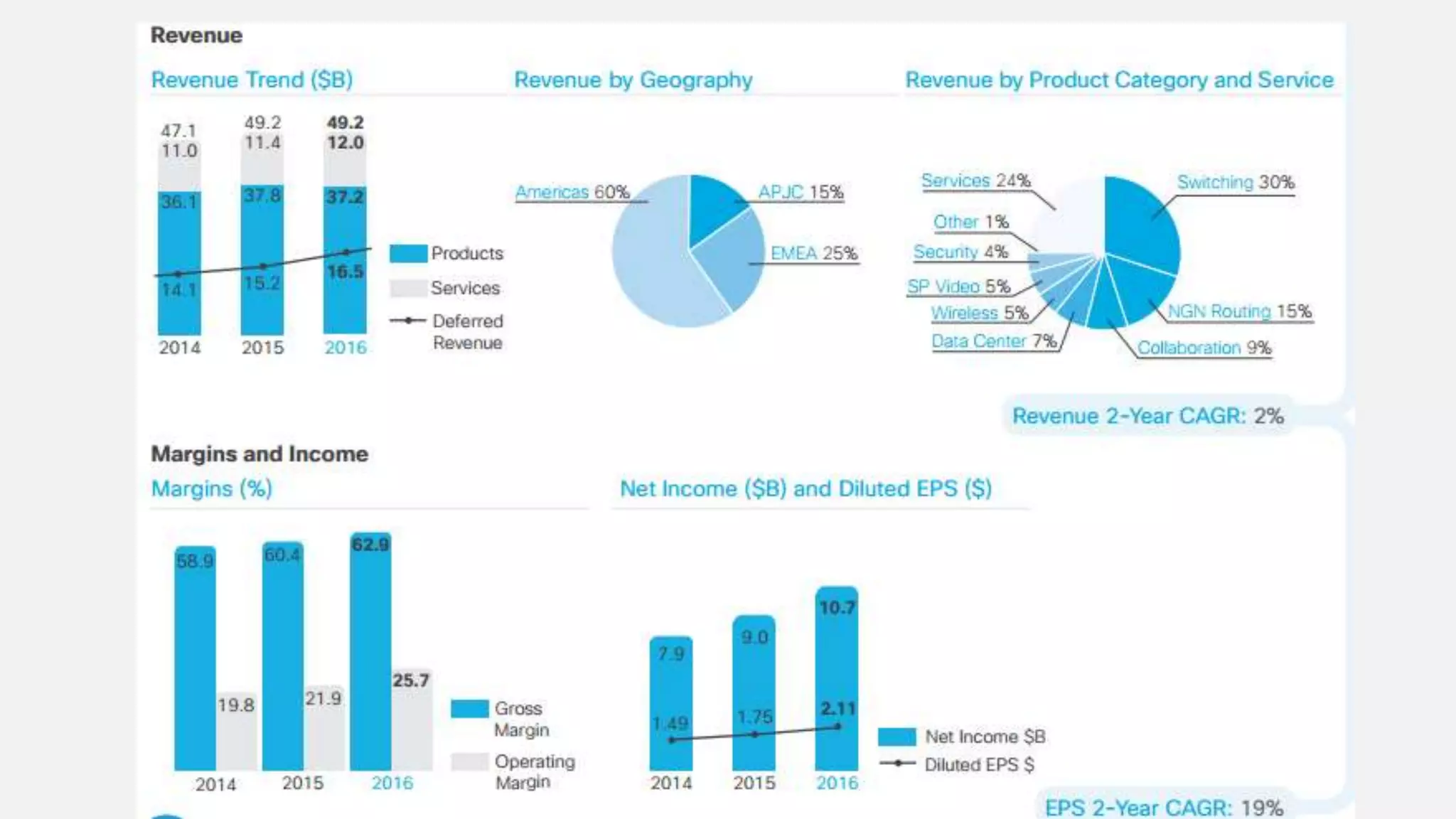

Cisco's corporate strategy focuses on diversification through related acquisitions. It has pursued over 180 acquisitions in different but related fields like collaboration, security, and wireless. This allows it to compete across multiple markets and block competitors. Its strategy is also to lead customers in digital transition through strategic expertise in M&A and alliances. It aims to address weaknesses in switching/routing through diversification and new opportunities in areas like cloud and security. Managing competitive threats in a changing industry remains a key challenge.