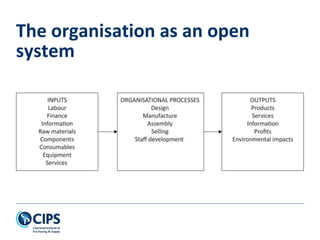

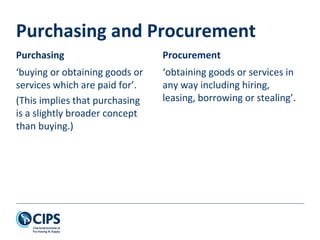

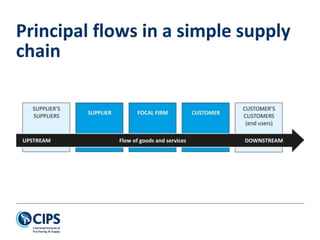

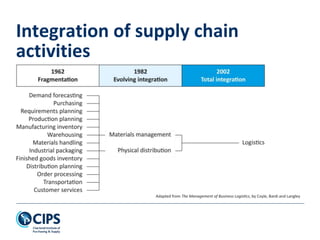

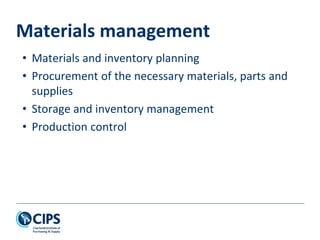

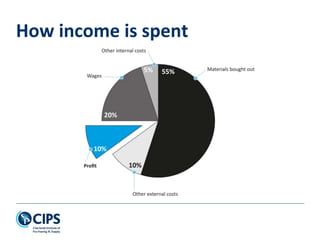

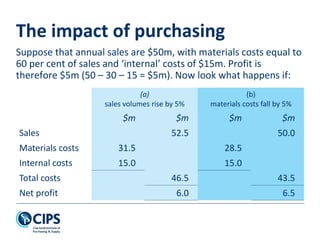

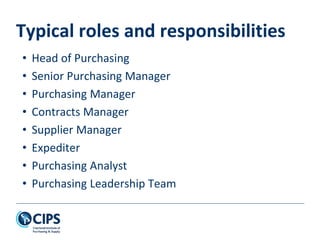

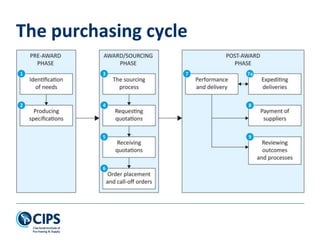

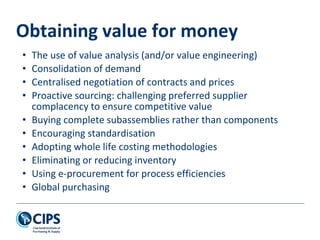

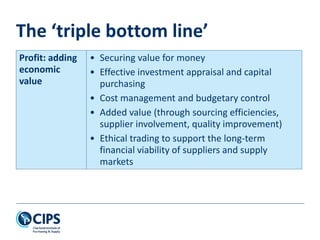

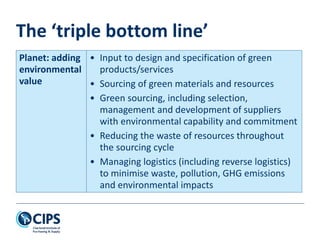

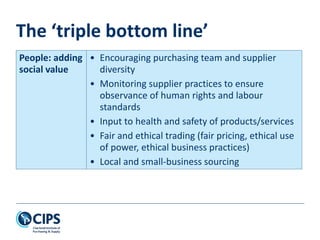

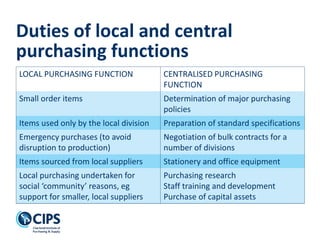

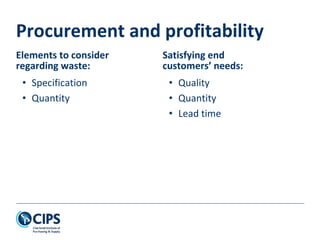

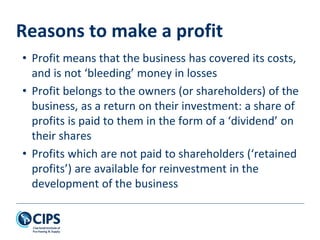

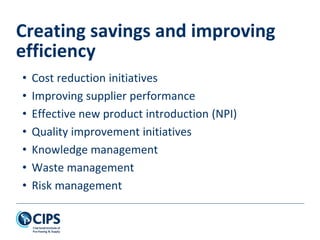

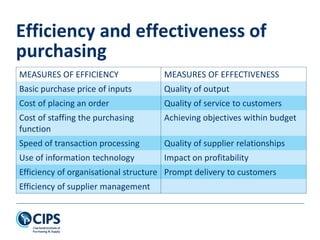

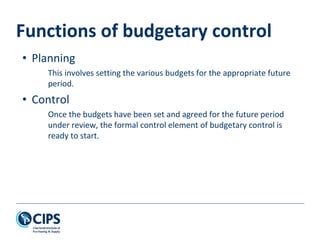

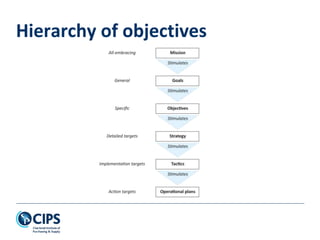

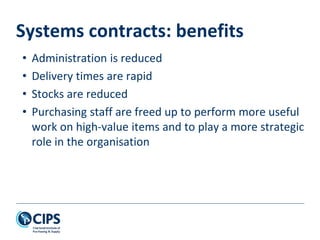

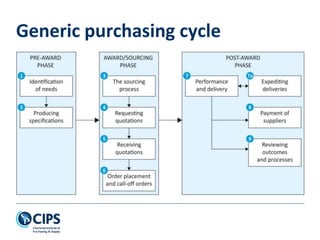

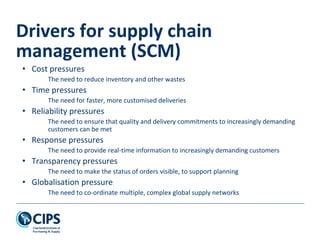

This document discusses key concepts in procurement and supply chain management. It covers organizational buying, purchasing as a discipline, contracts, materials management, trends in service supply chains, the purchasing cycle, defining value for money, and relating procurement to profitability and budgetary control. The key ideas are that procurement involves acquiring resources efficiently and professionally while developing supplier relationships, focusing on the triple bottom line of profit, planet and people, and translating high-level corporate objectives into specific purchasing goals.