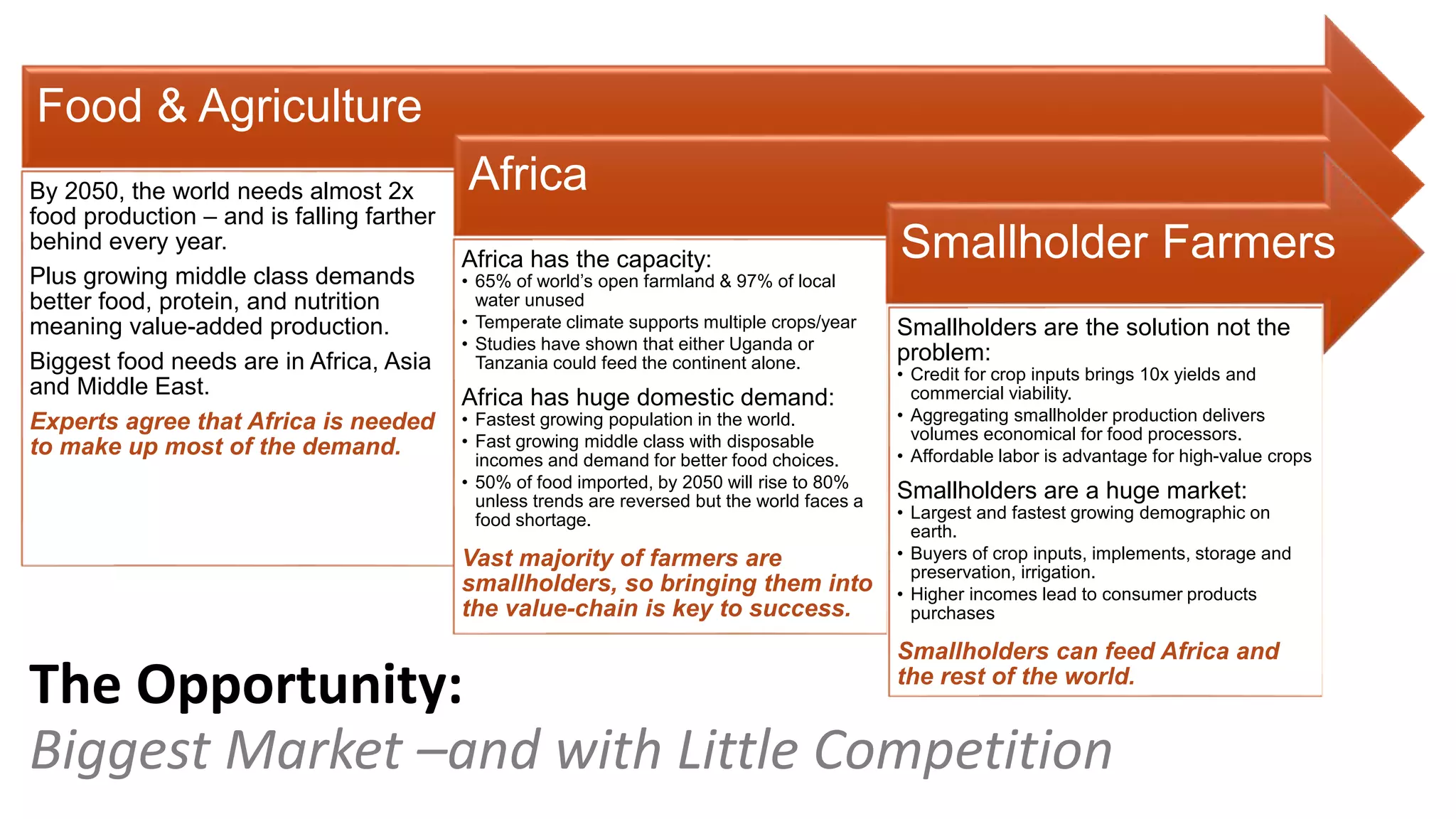

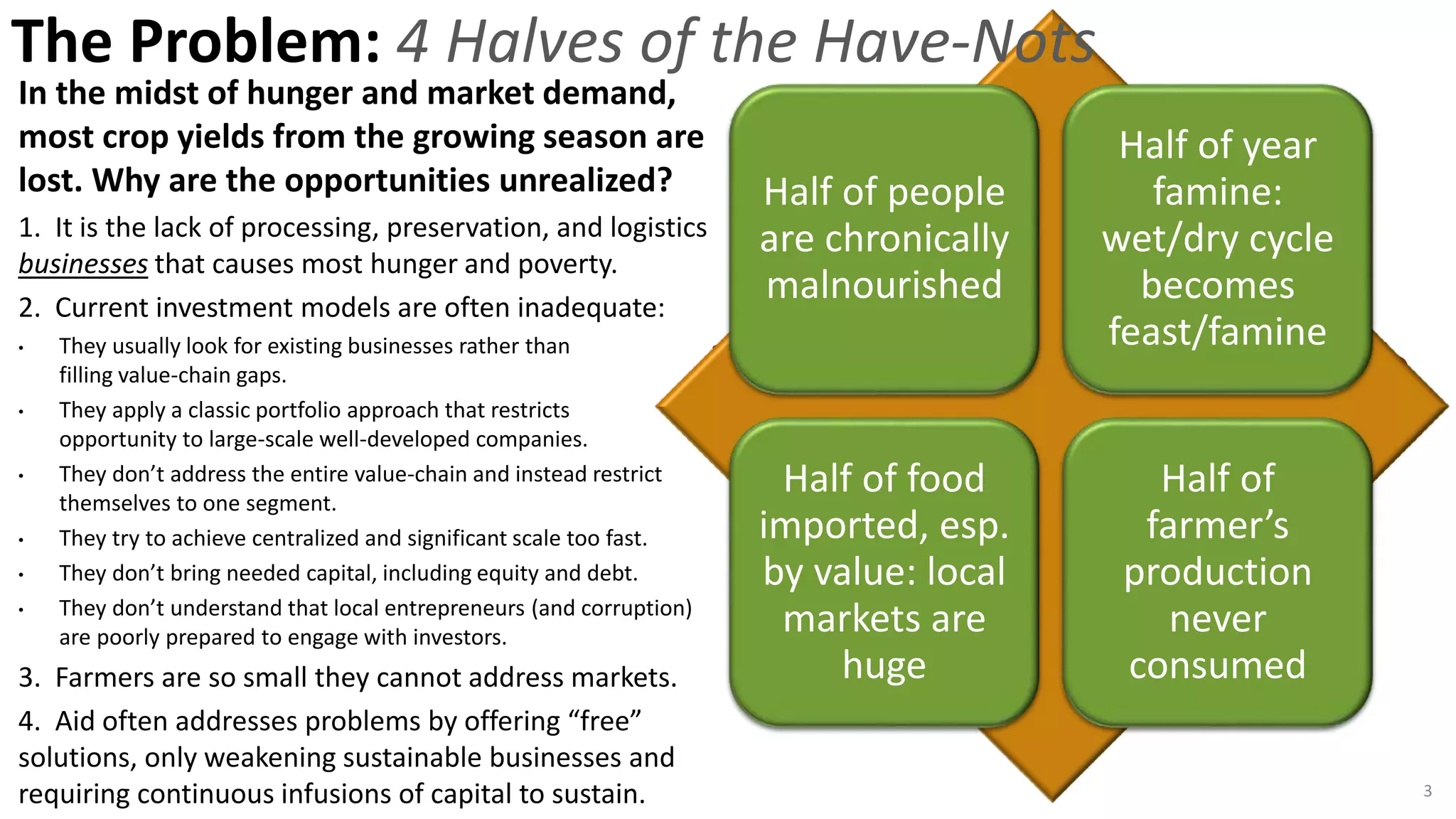

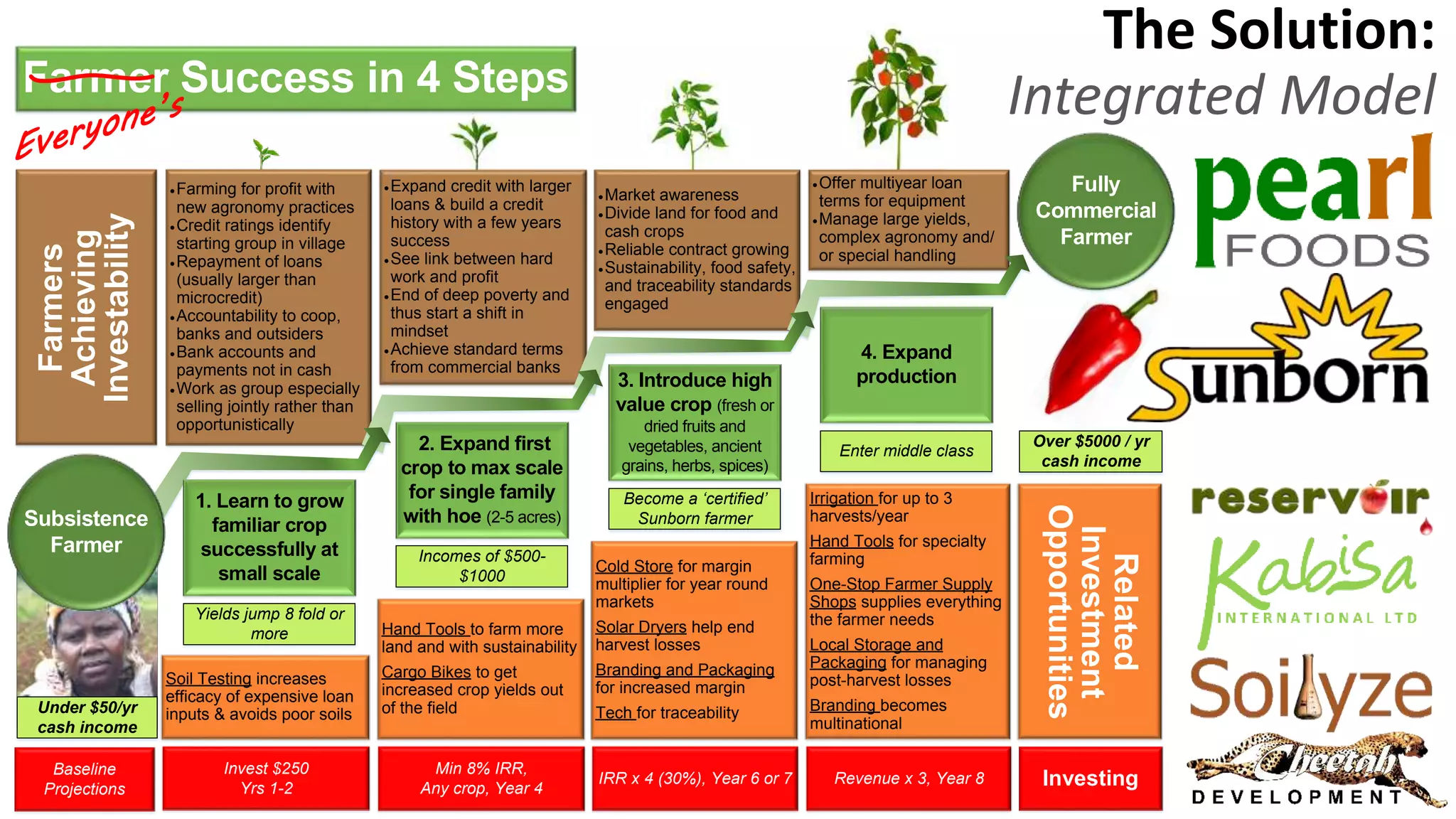

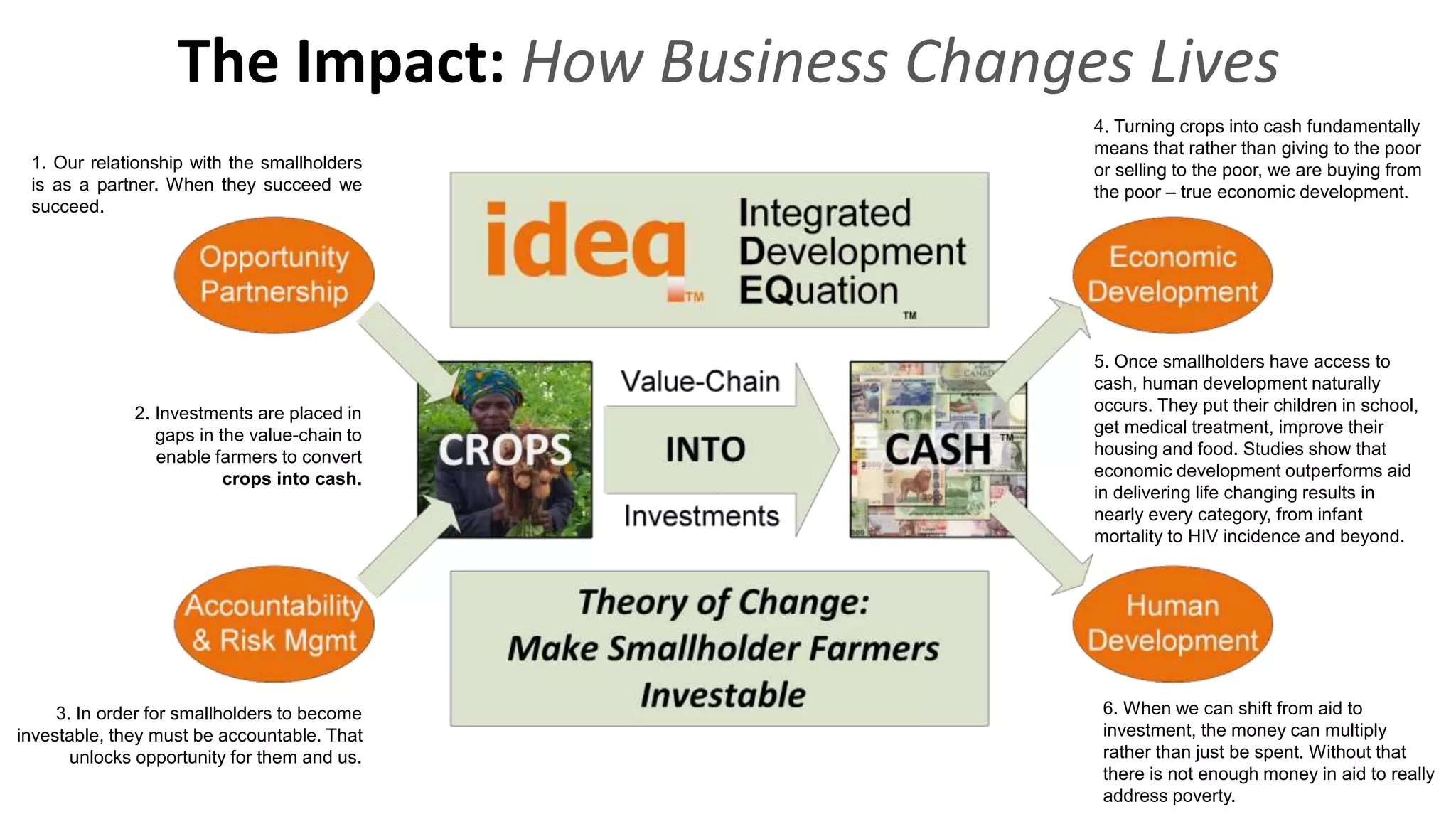

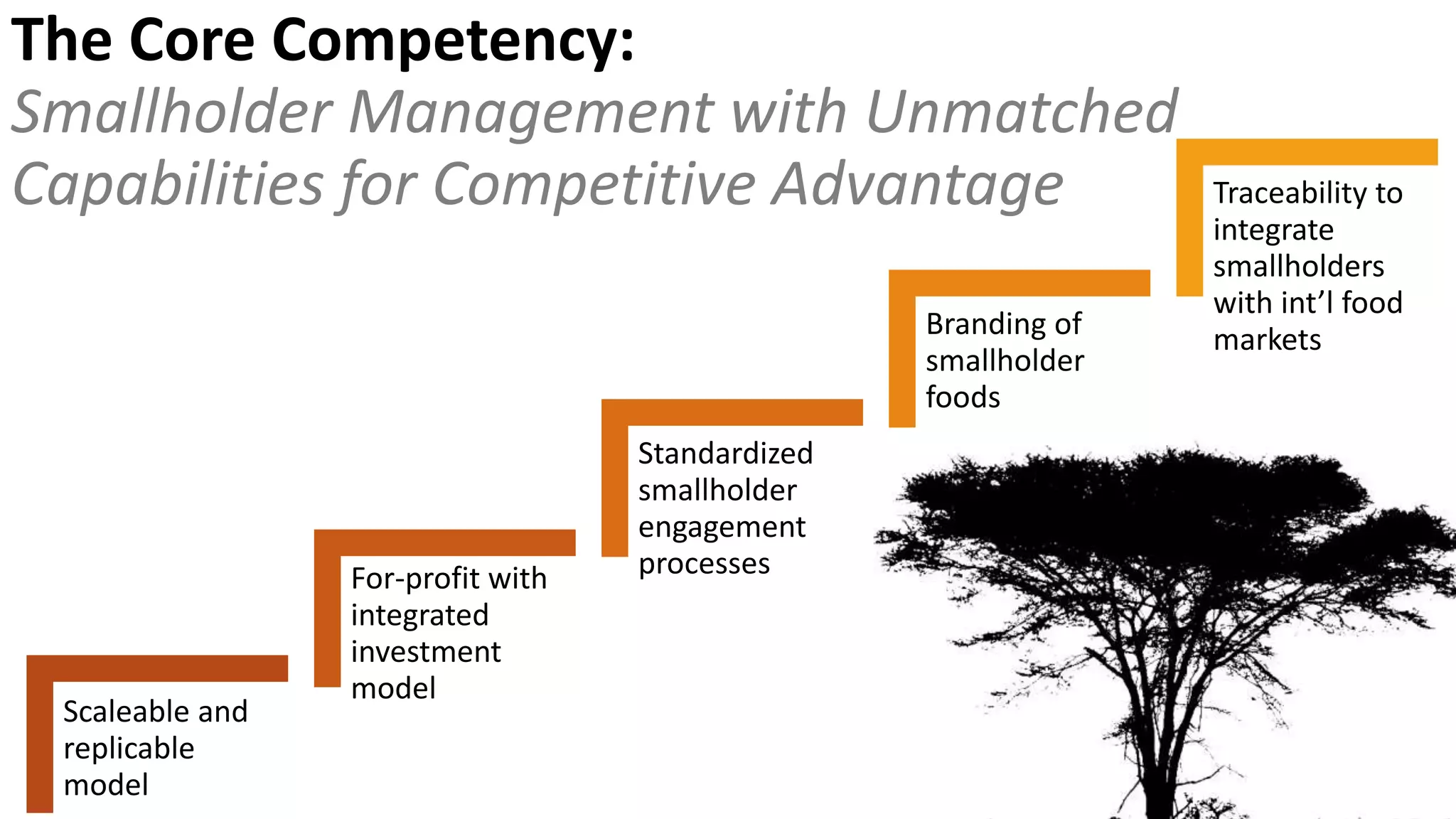

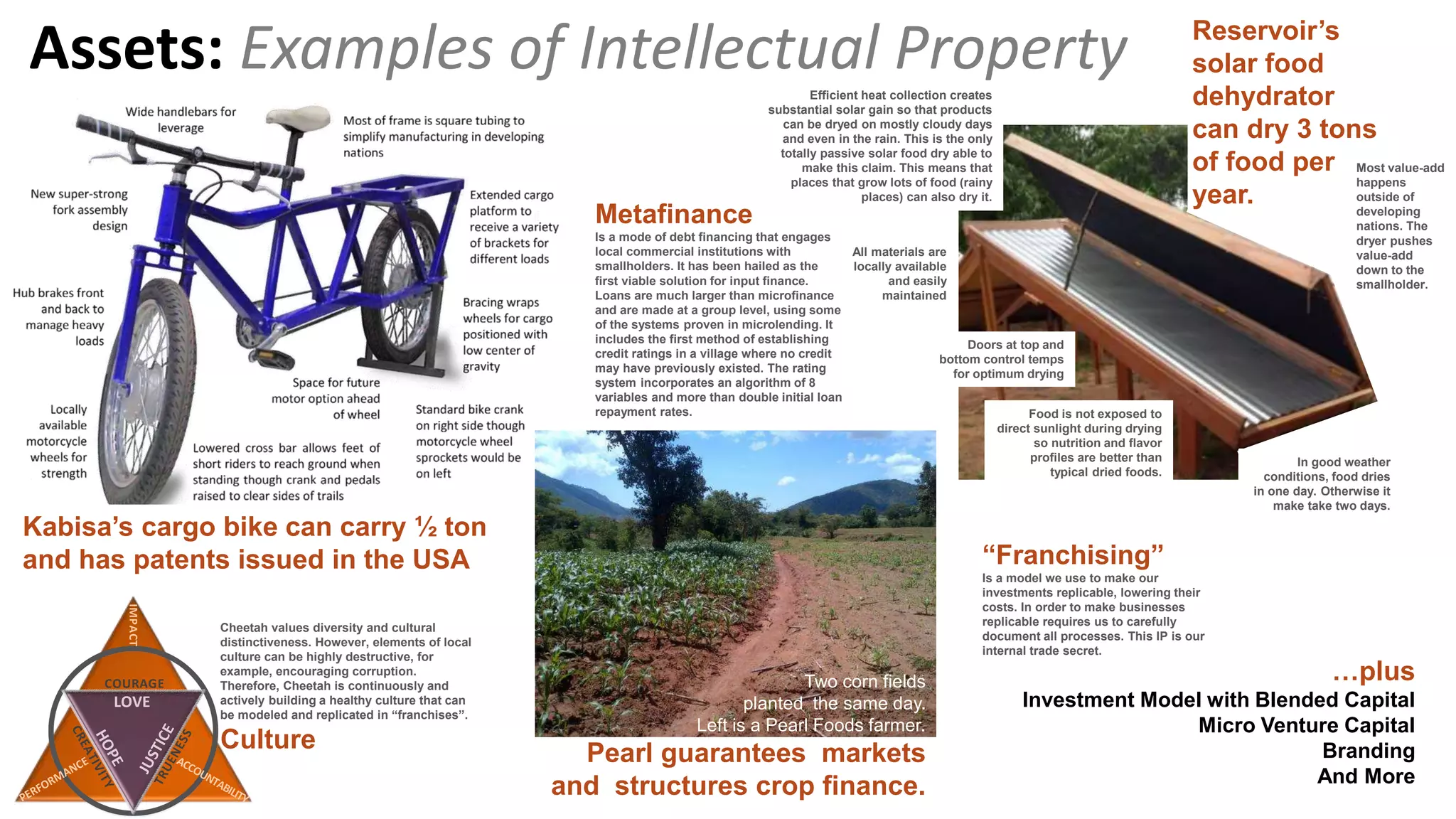

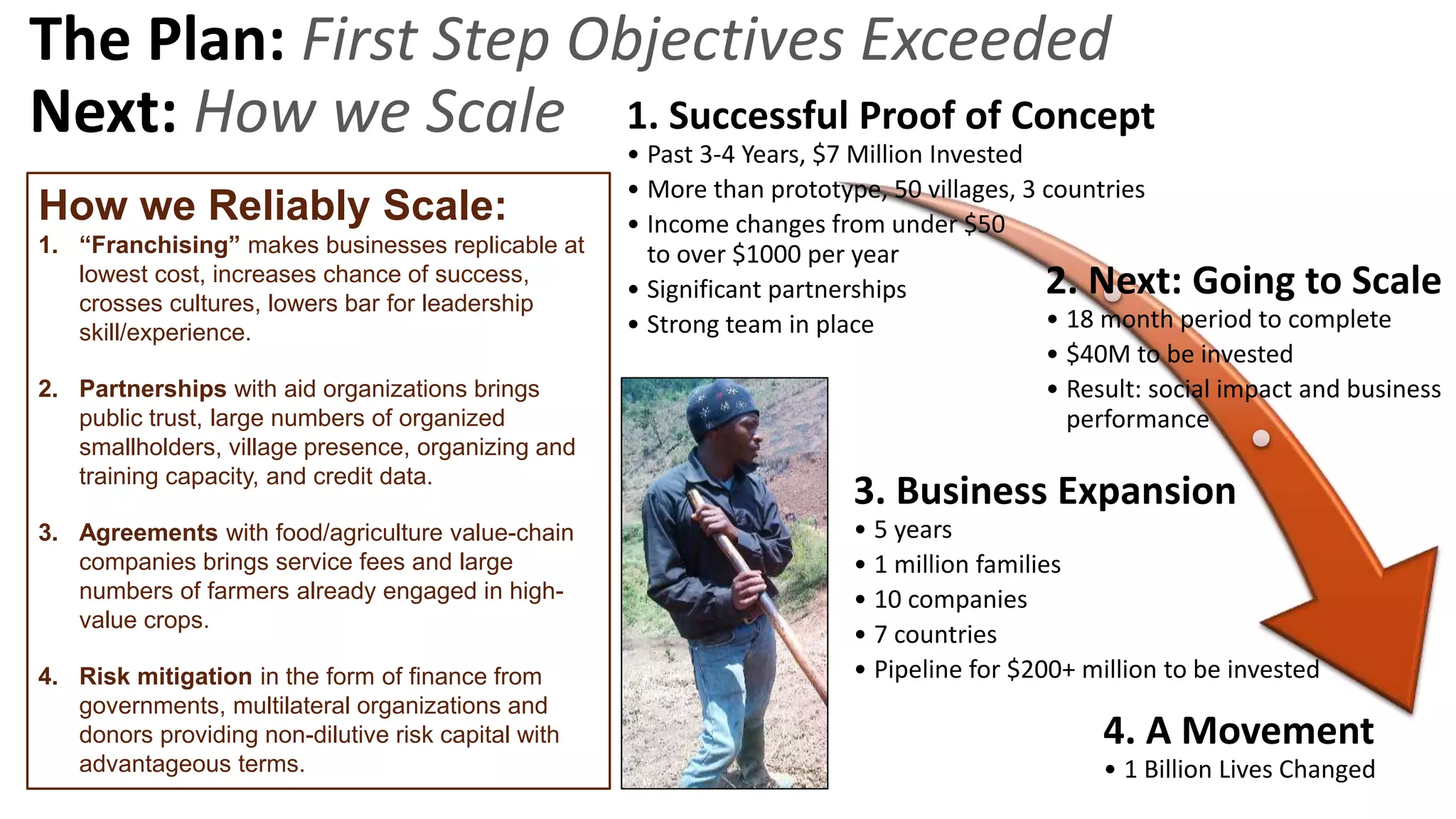

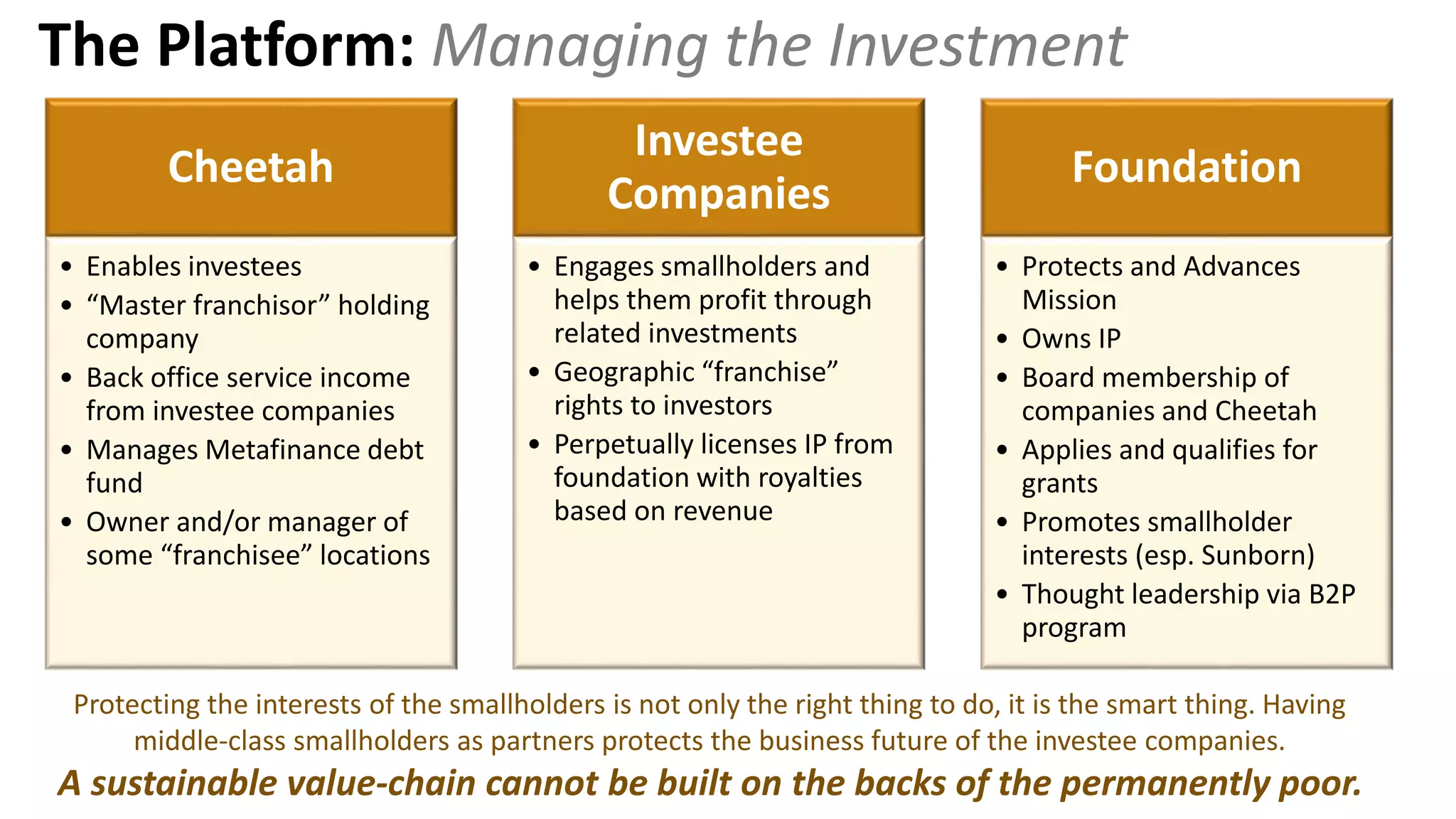

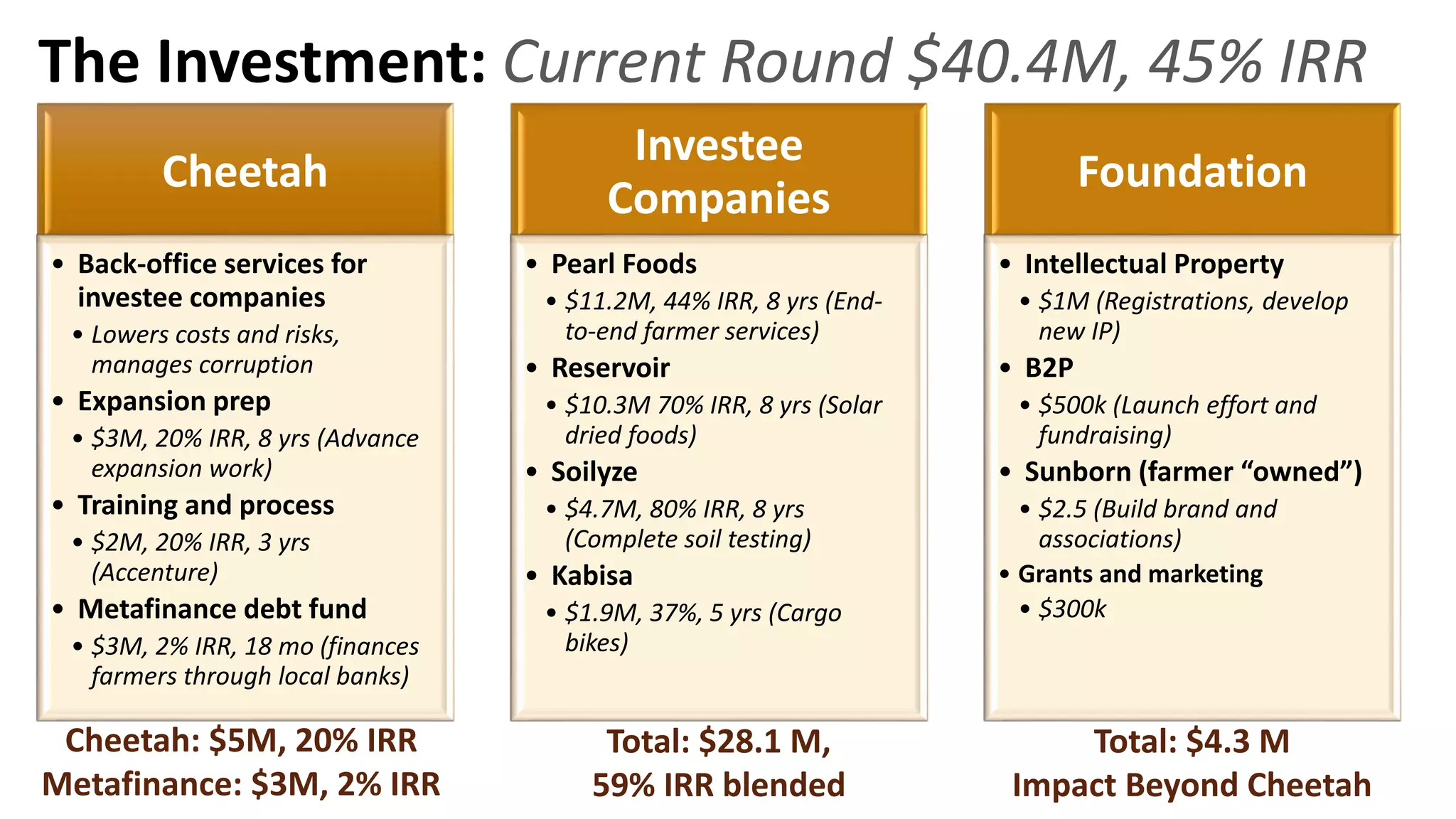

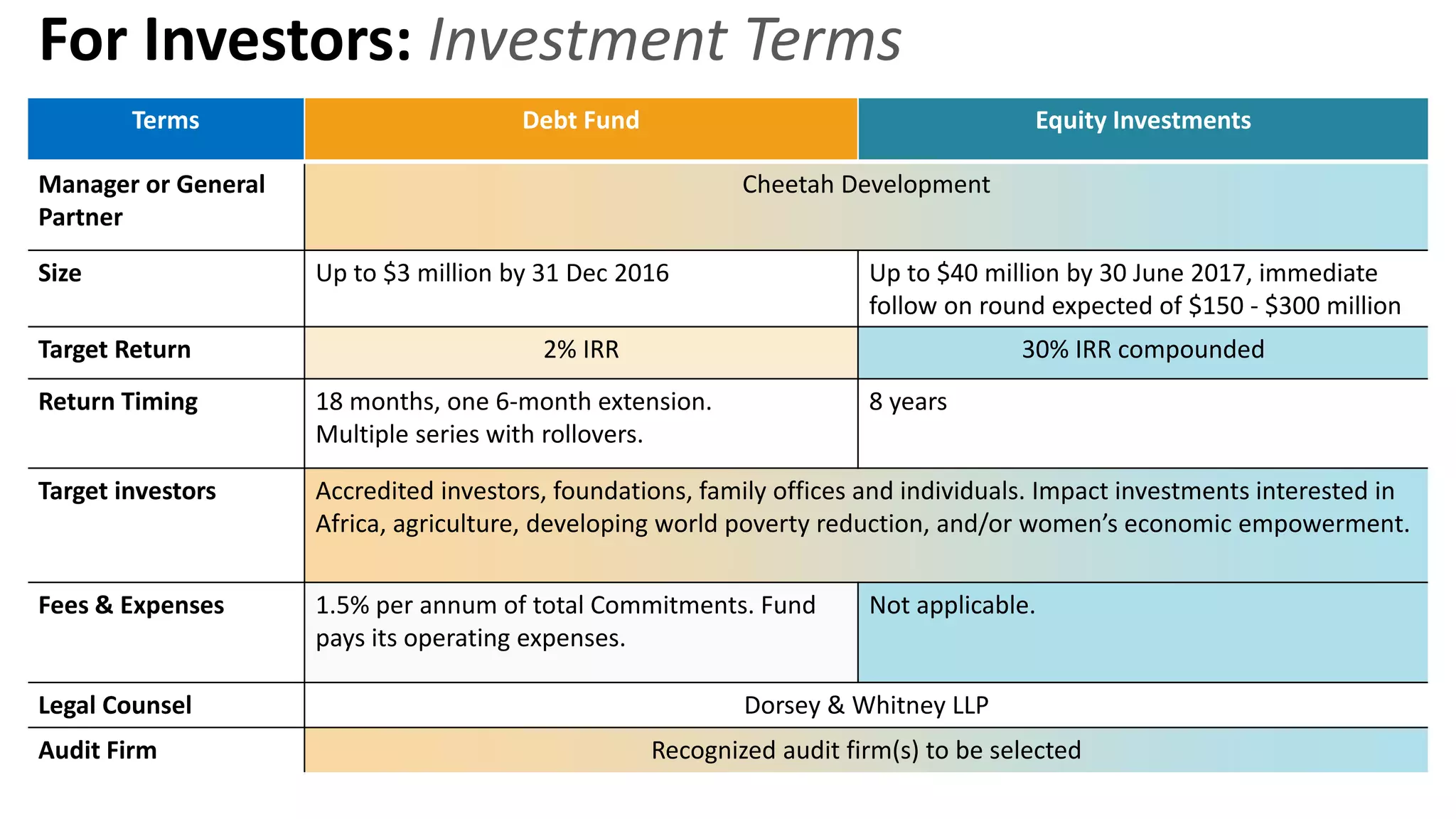

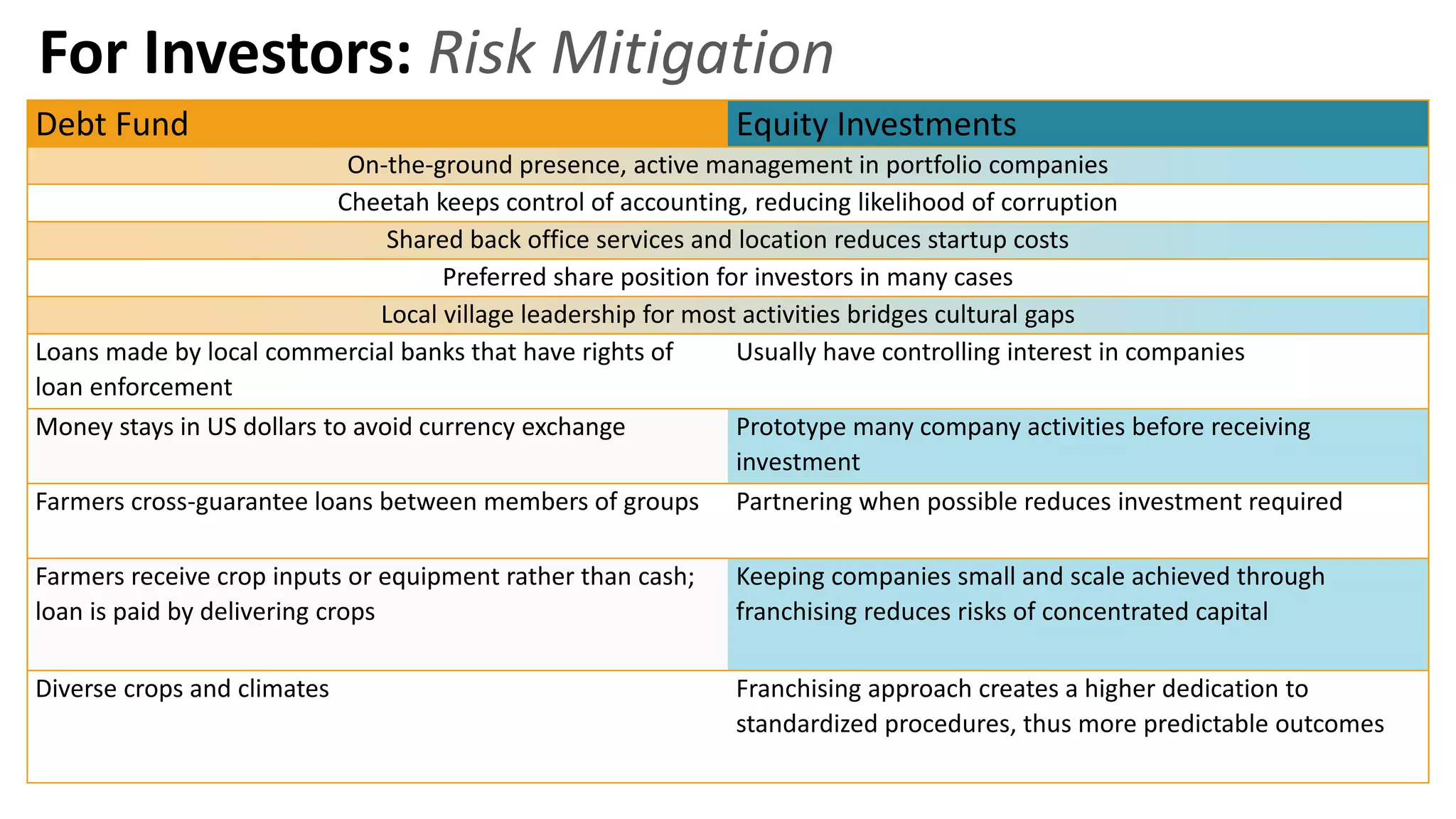

This document discusses opportunities for investing in smallholder farmers in Africa to address food insecurity and poverty. It notes that Africa has significant untapped agricultural potential but currently imports half its food and half of farmers' production is lost. Smallholder farmers are key to success if given access to credit, inputs, and markets. The model proposes integrating investments across agricultural value chains to link farmers to processors and international food markets. It has had early success improving incomes and aims to scale its impact through franchising models, partnerships, and risk mitigation finance. The goal is to transition millions of families out of poverty in a sustainable way that protects smallholder interests.