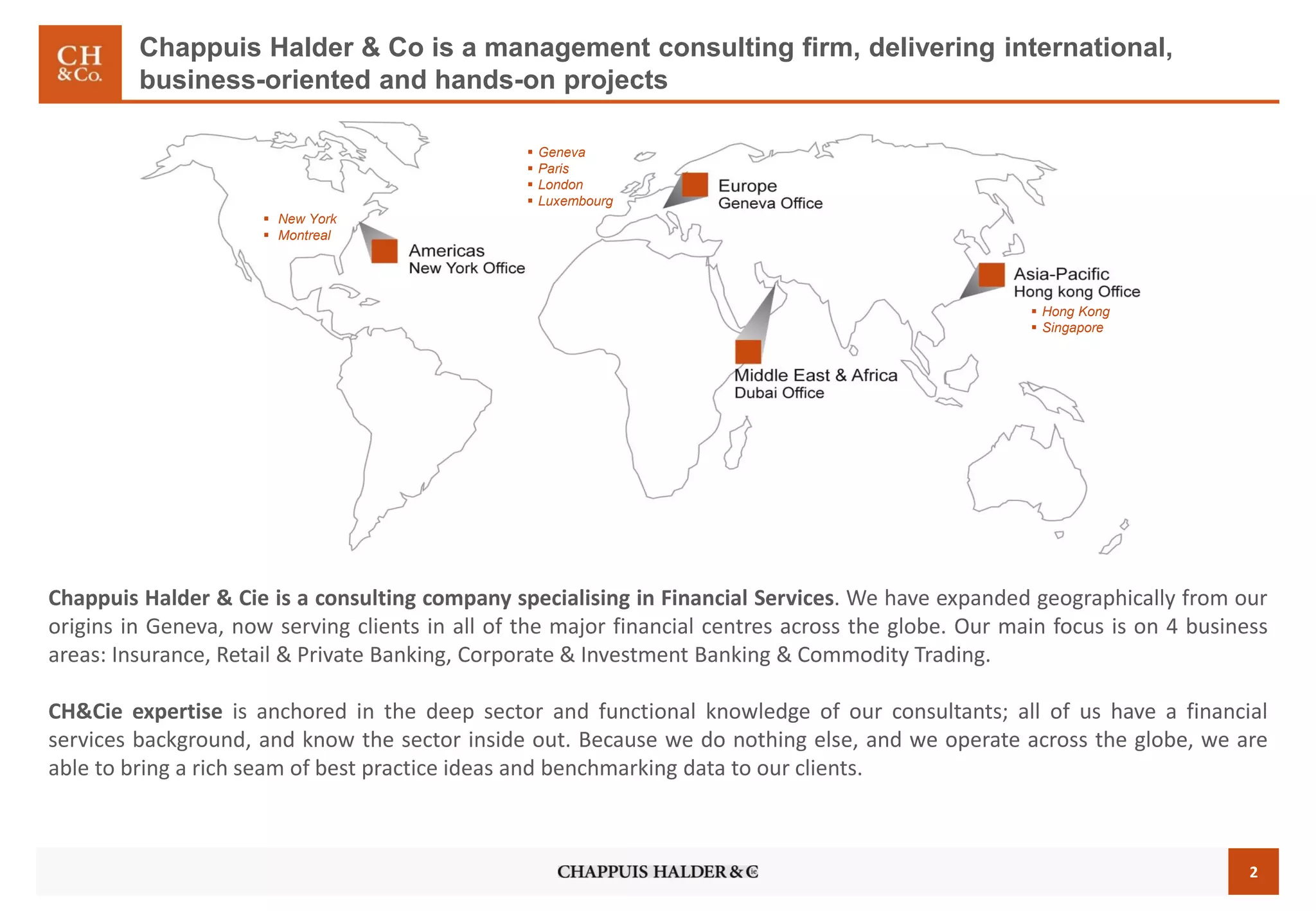

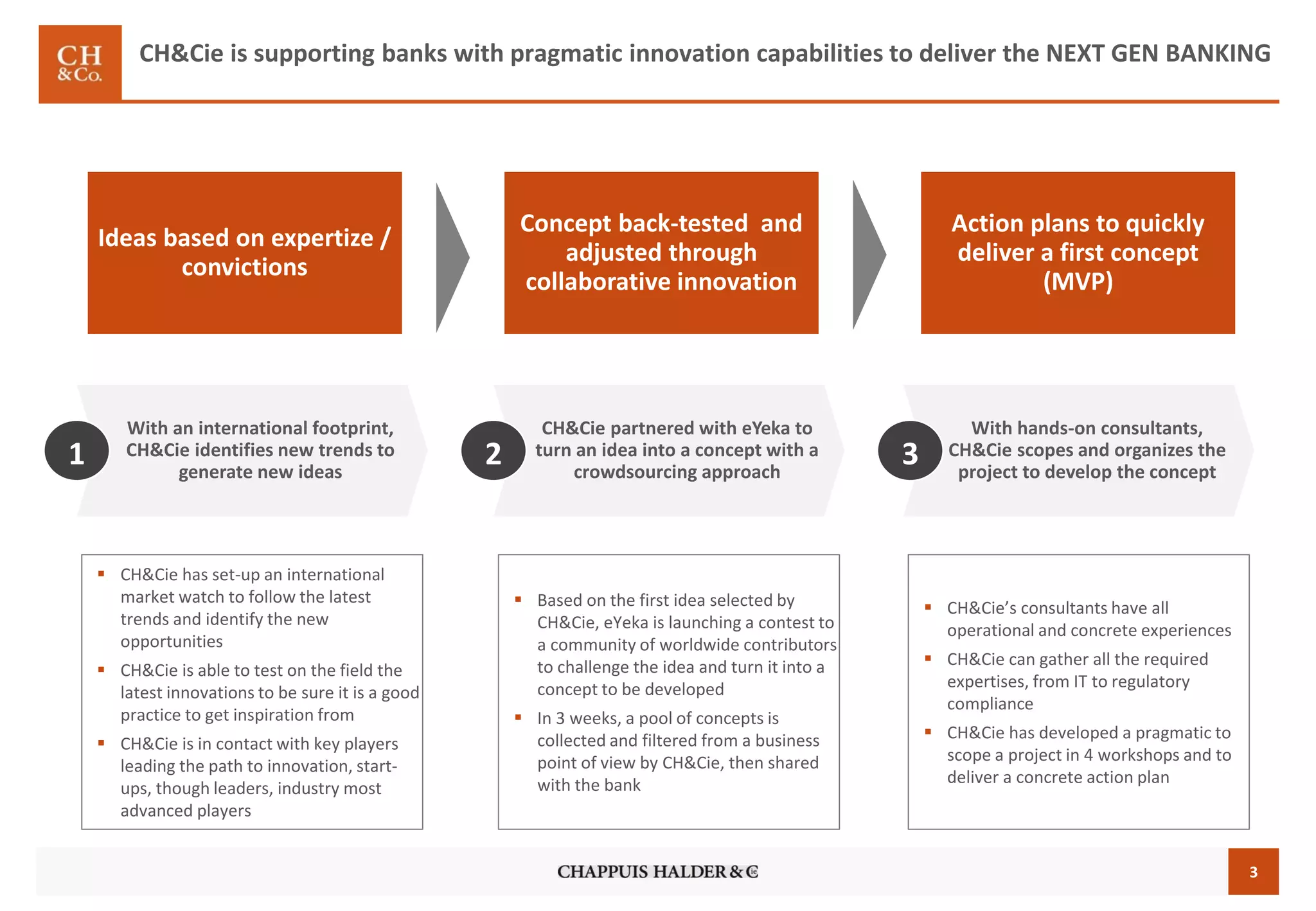

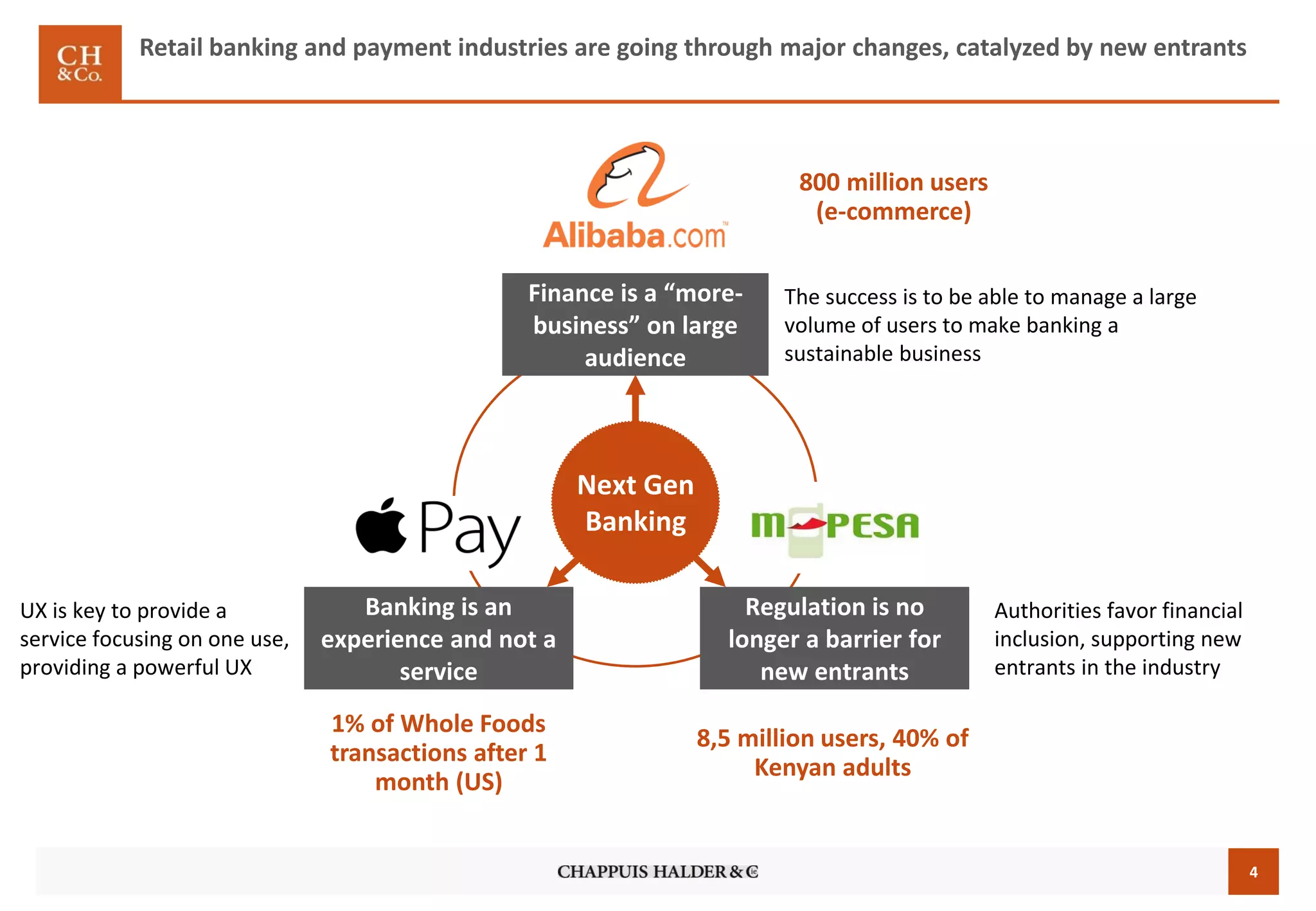

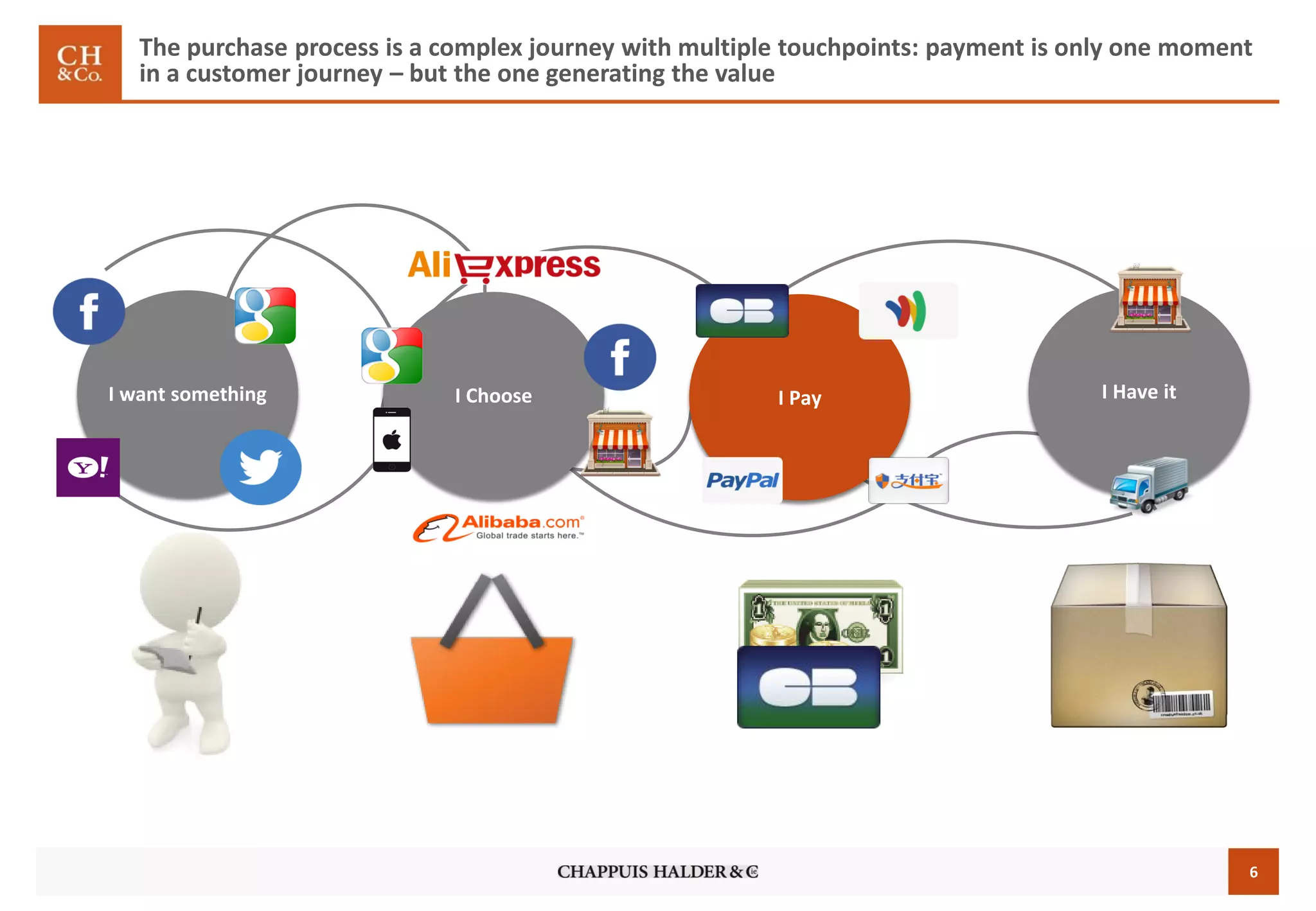

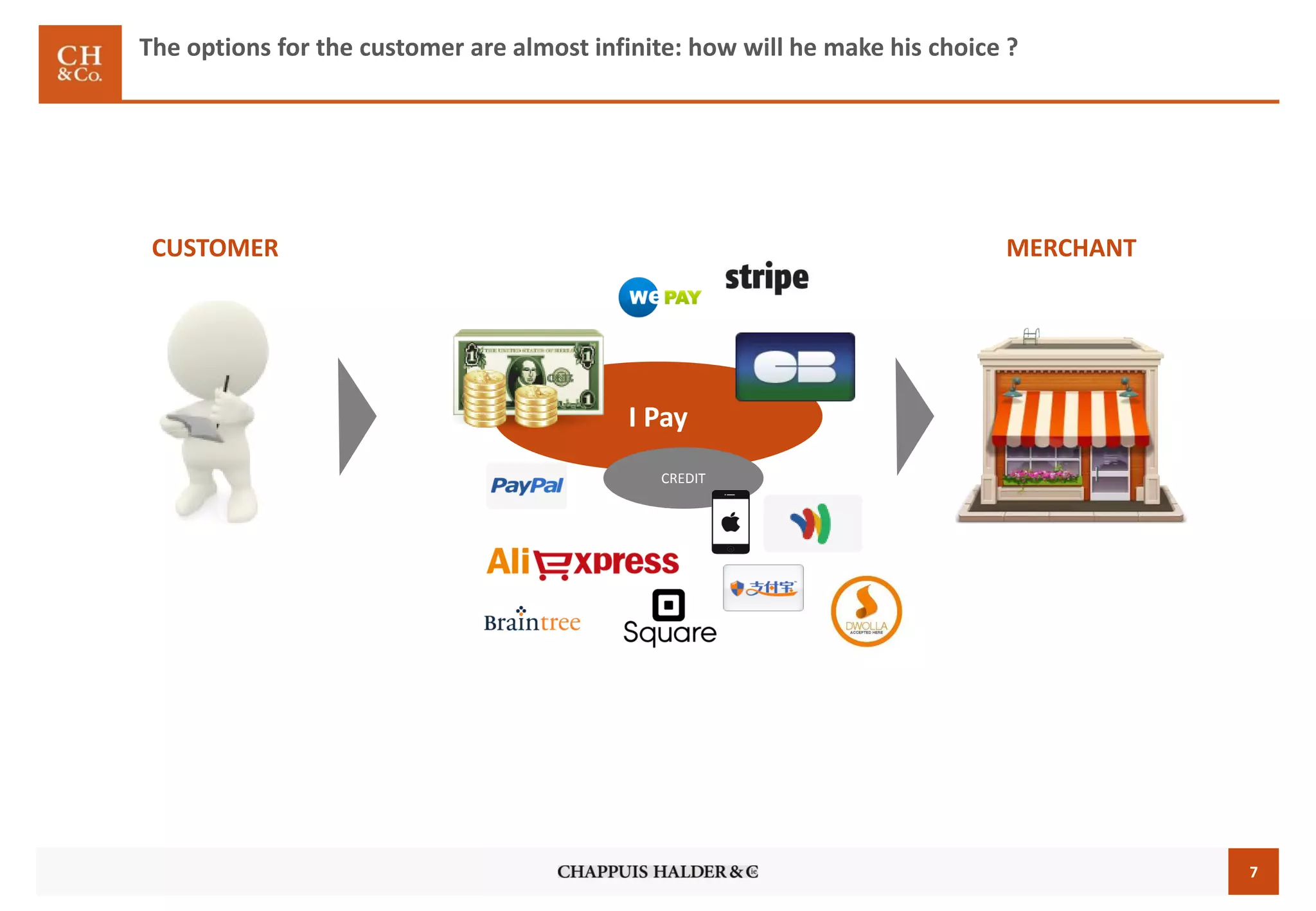

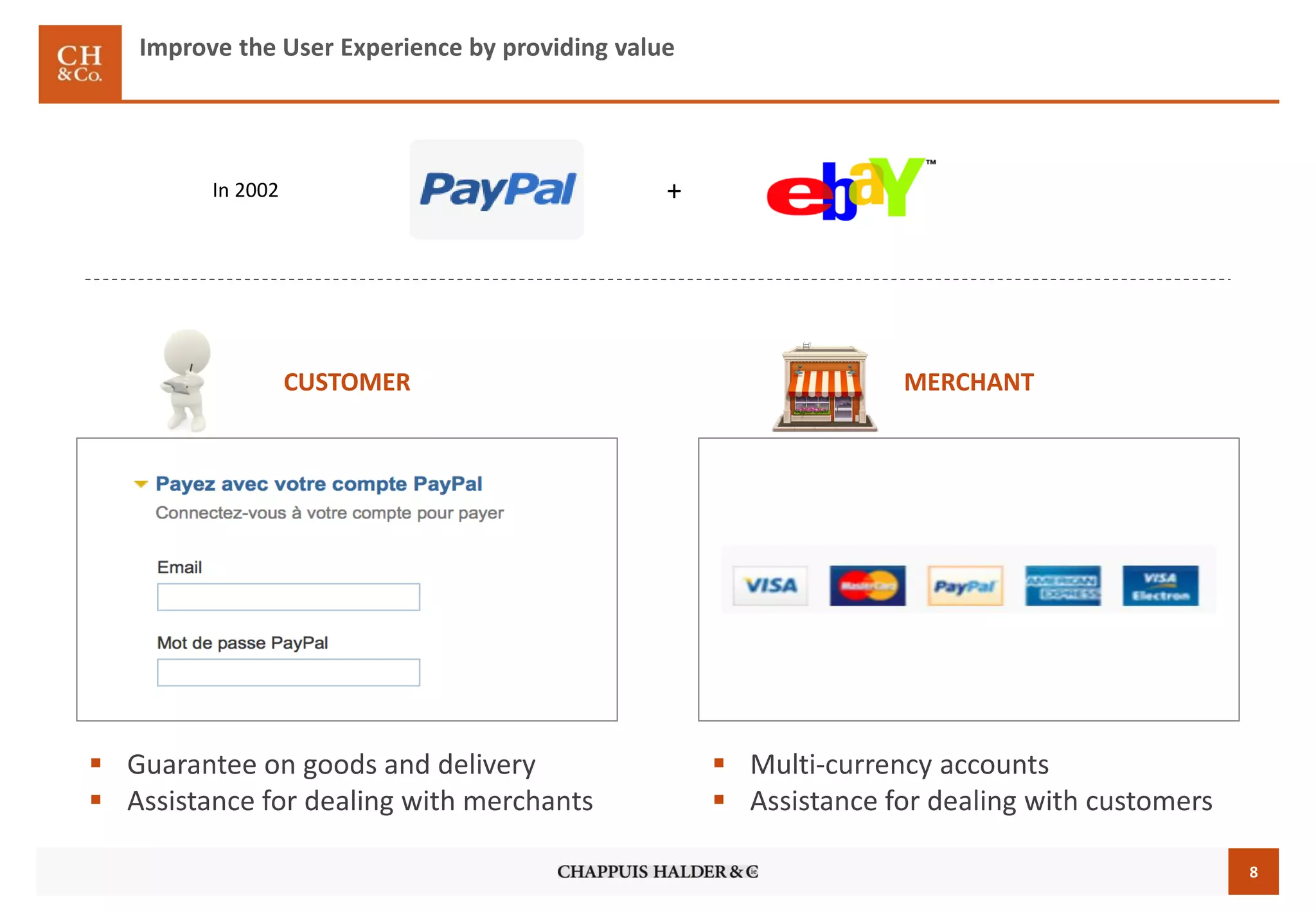

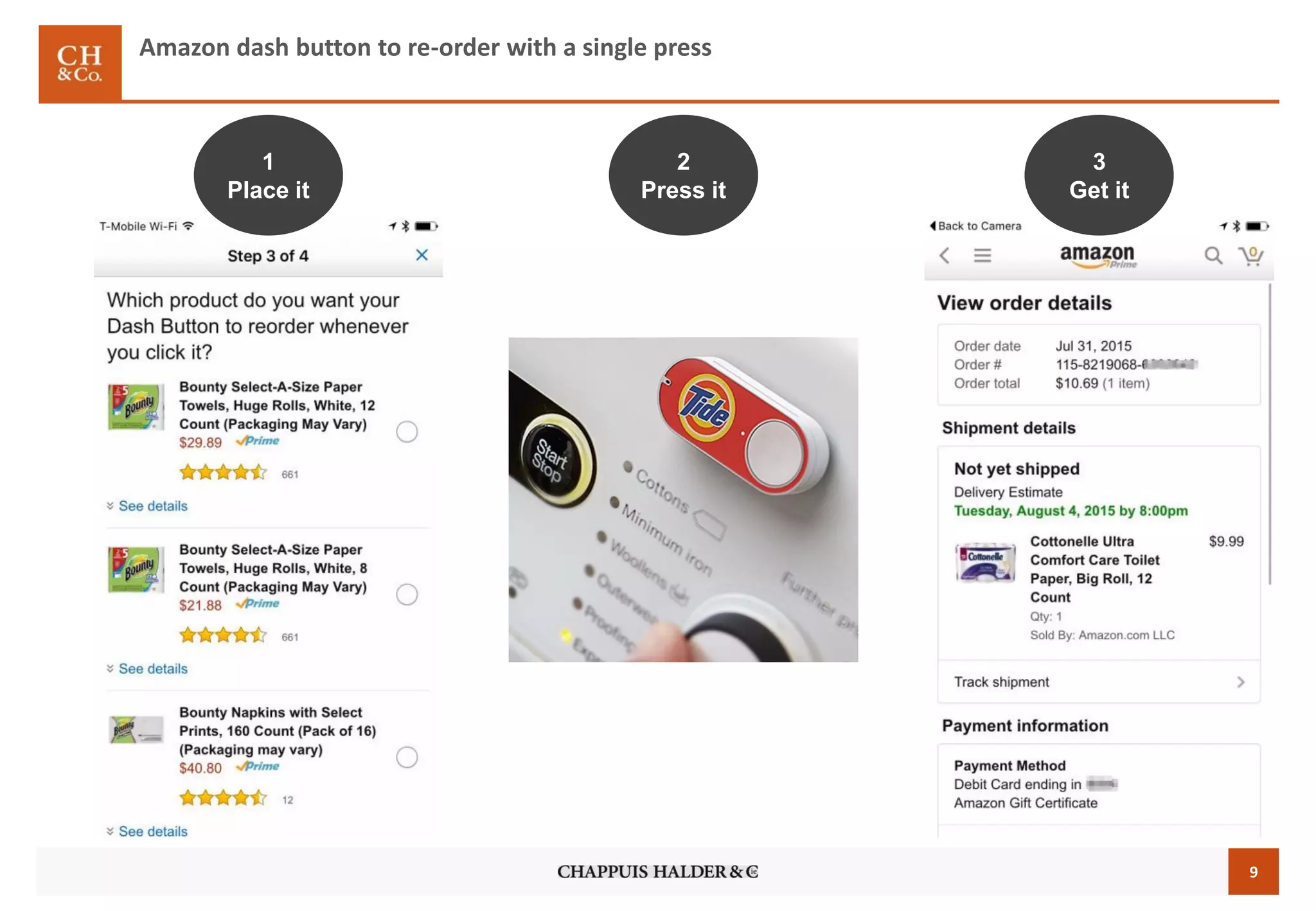

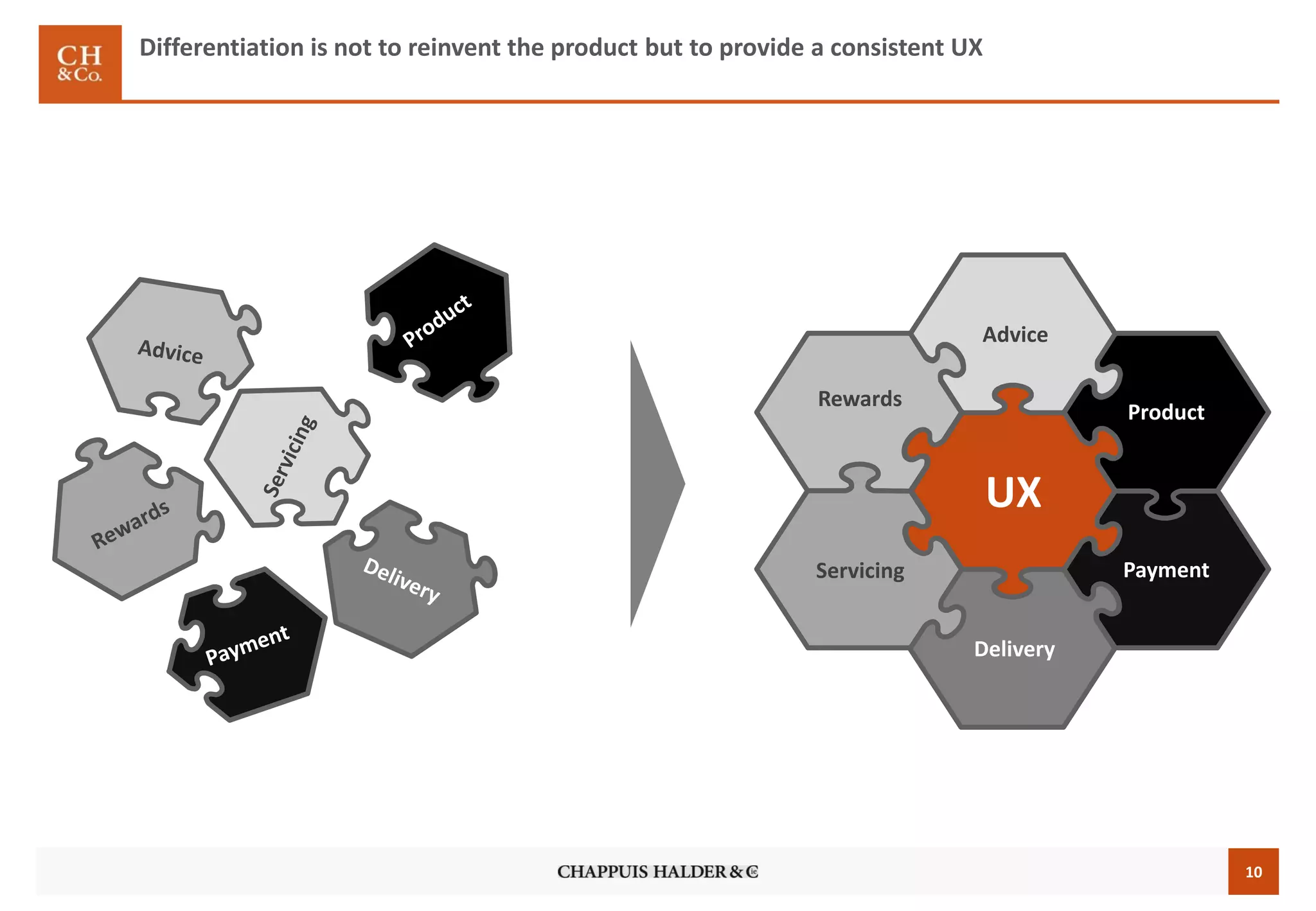

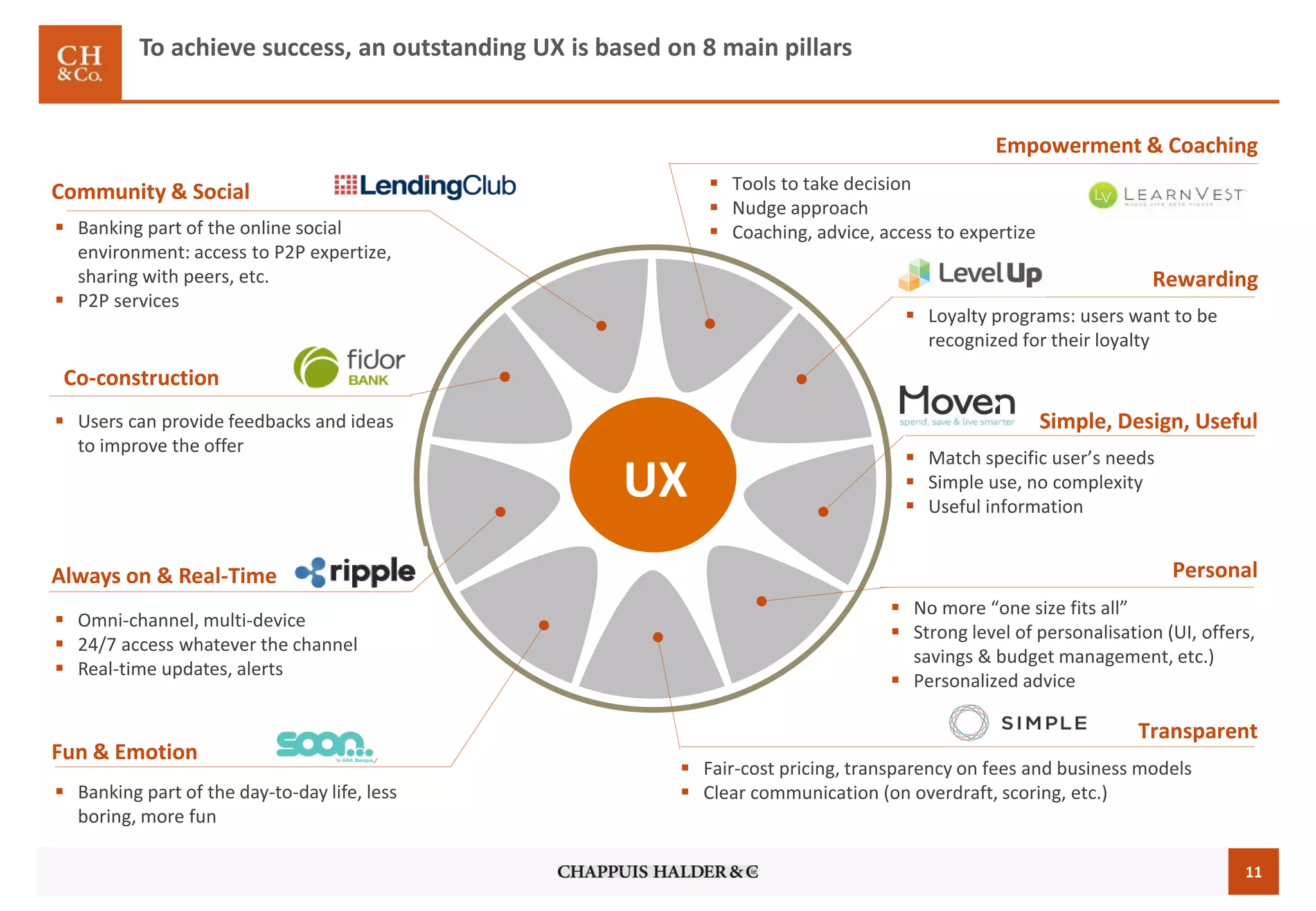

The document discusses the importance of user experience (UX) and digital transformation in banking and payments, highlighting how new entrants and changing consumer expectations are reshaping the industry. It emphasizes that successful banking is now centered around providing exceptional UX and managing large user volumes, with customer experience becoming a key differentiator in a competitive market. The consultancy firm Chappuis Halder & Co. supports banks in innovating and implementing effective UX strategies through collaborative projects and benchmarking best practices.