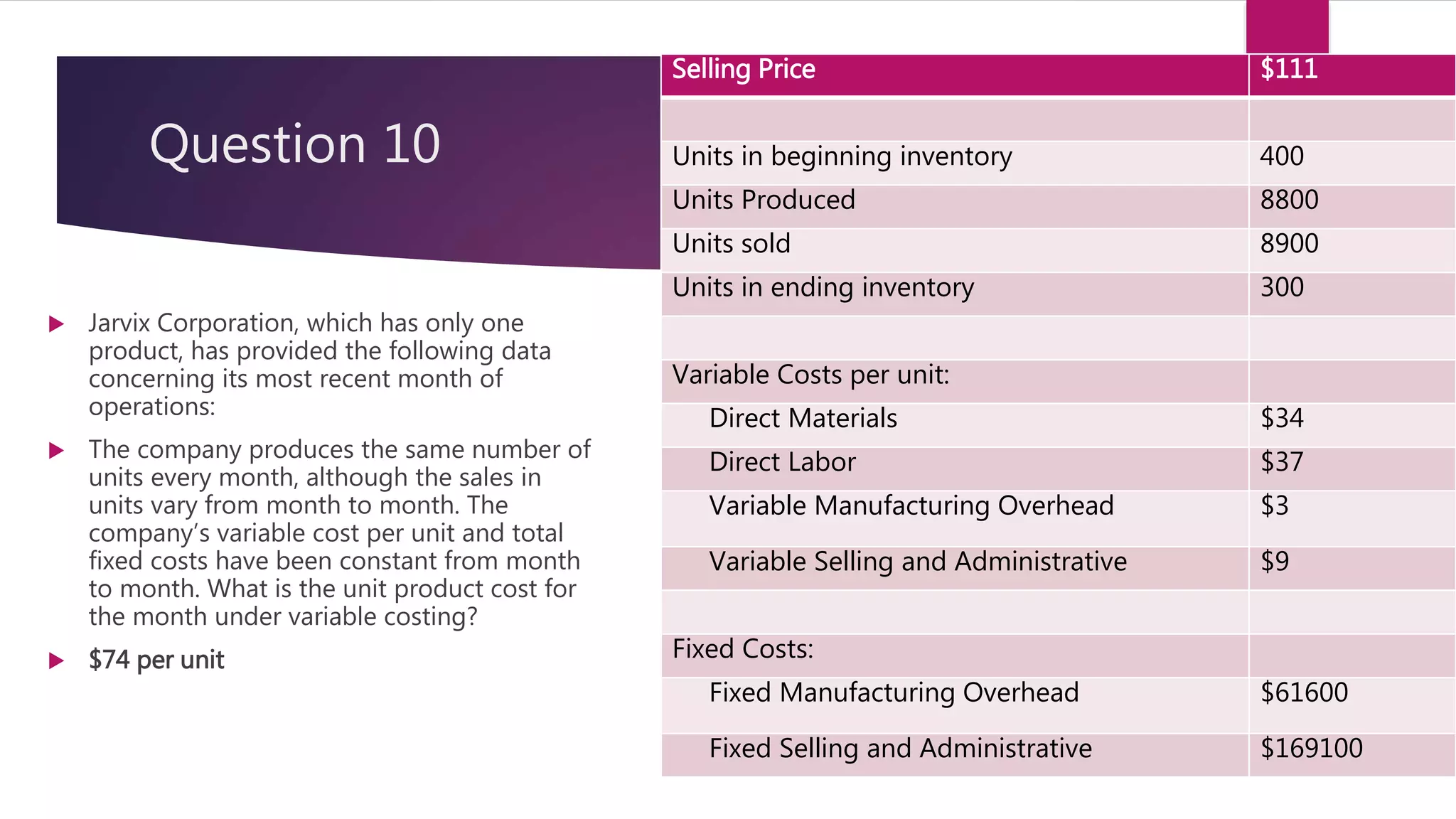

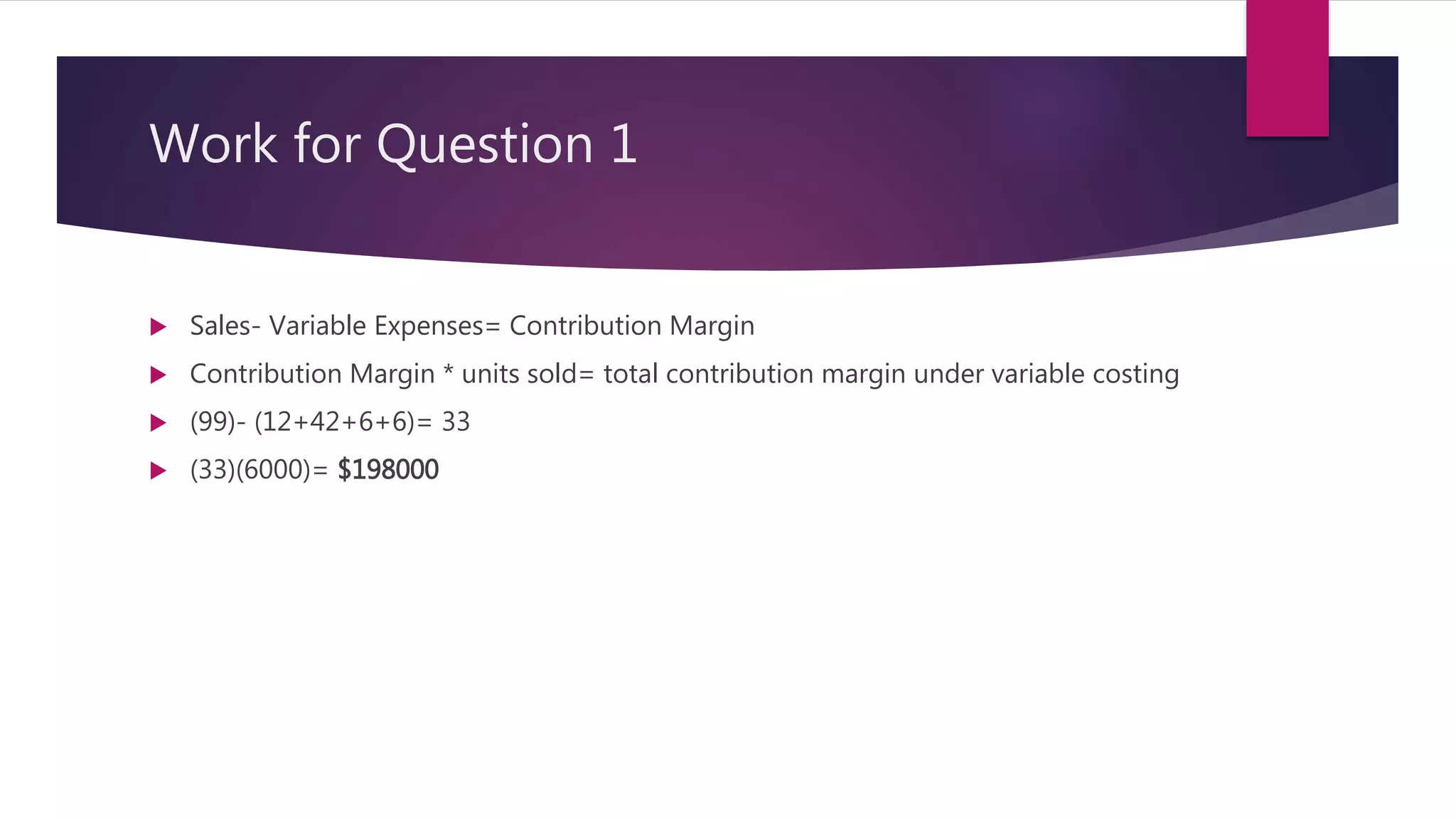

1. Aaker Corporation reported a total contribution margin of $198,000 for the most recent month. The contribution margin was calculated as (Selling Price - Variable Costs) x Units Sold.

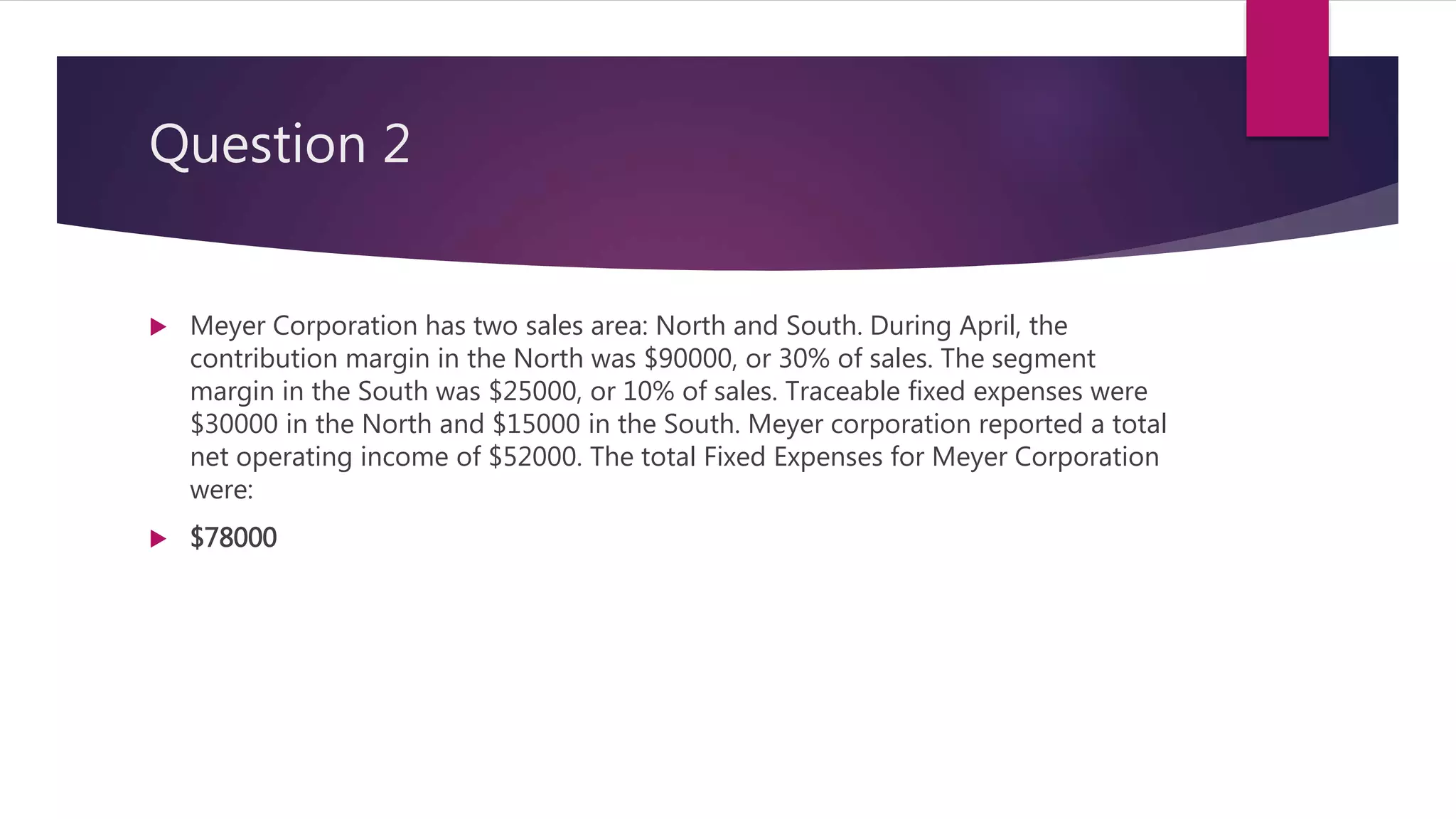

2. Meyer Corporation reported total fixed expenses of $78,000. This was calculated by adding the traceable fixed expenses of $45,000 and the common fixed expenses of $33,000.

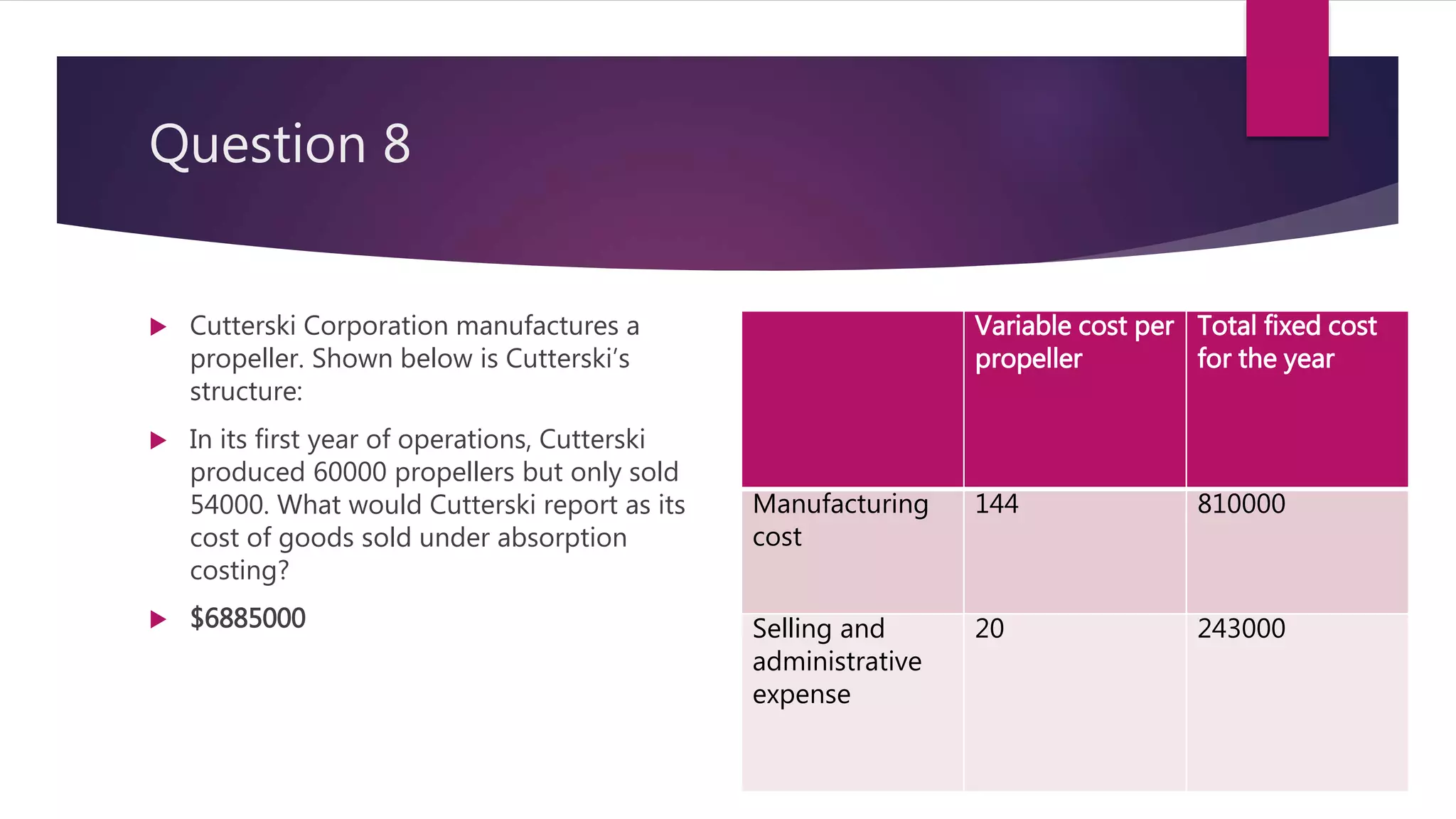

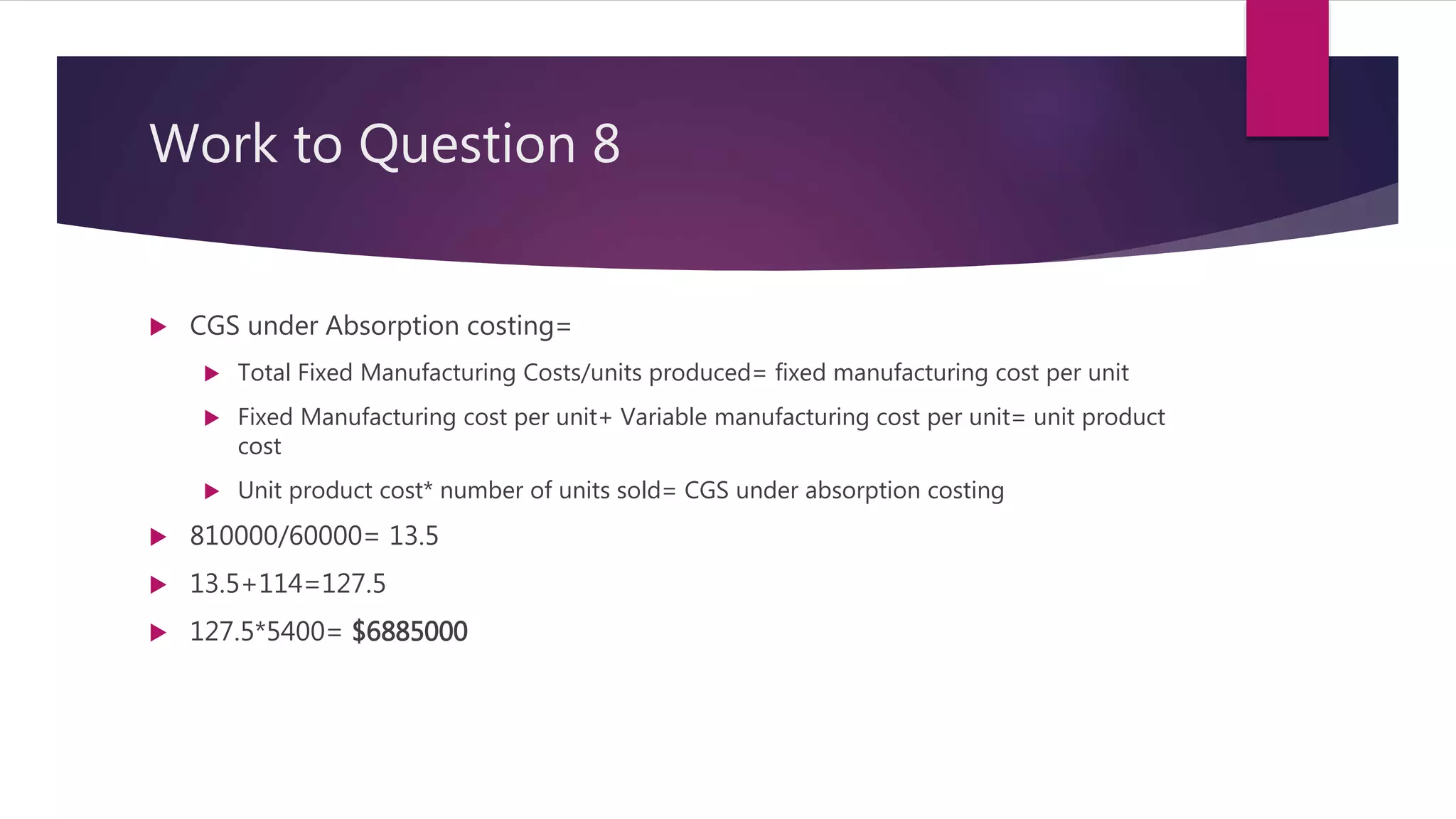

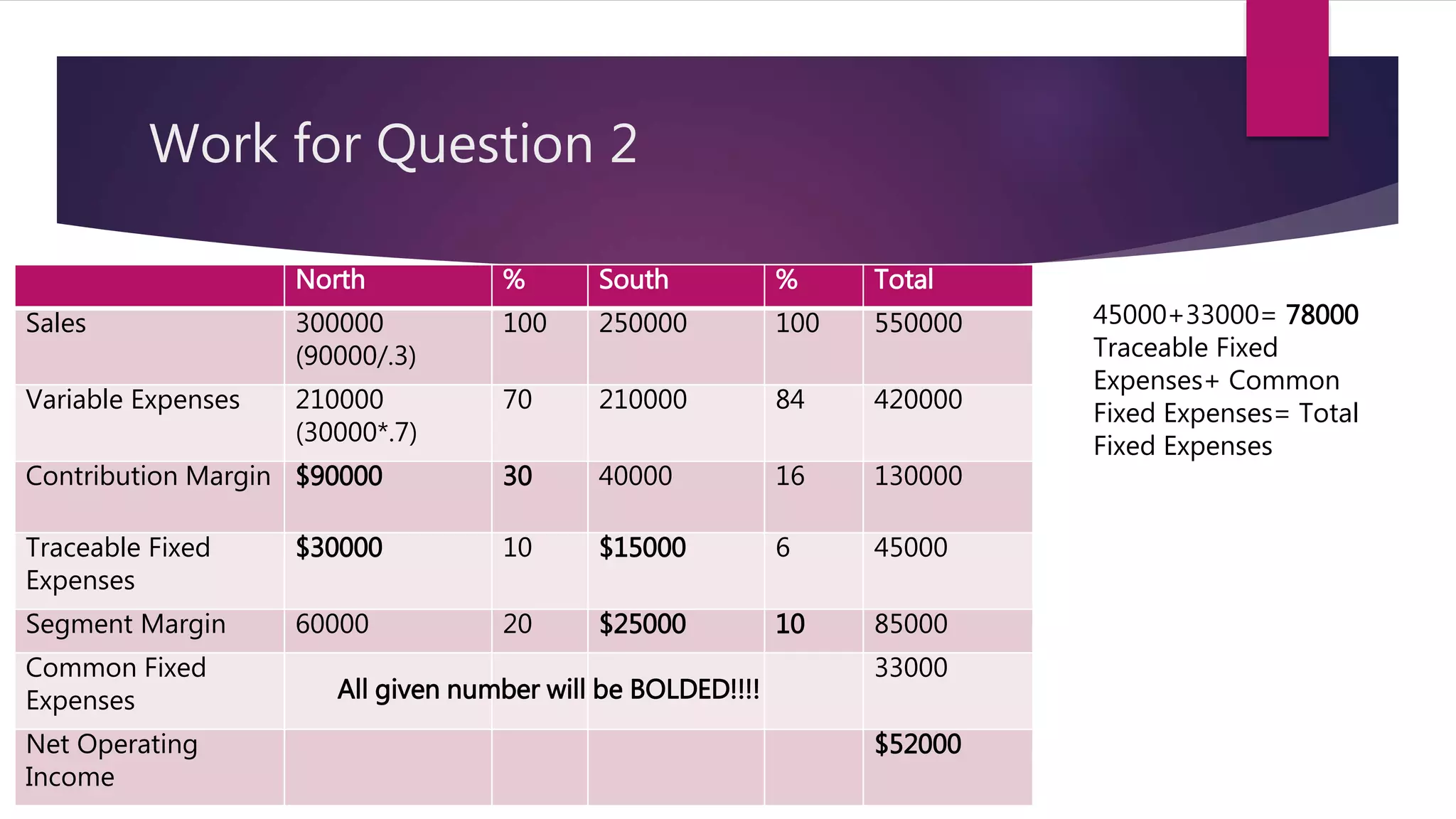

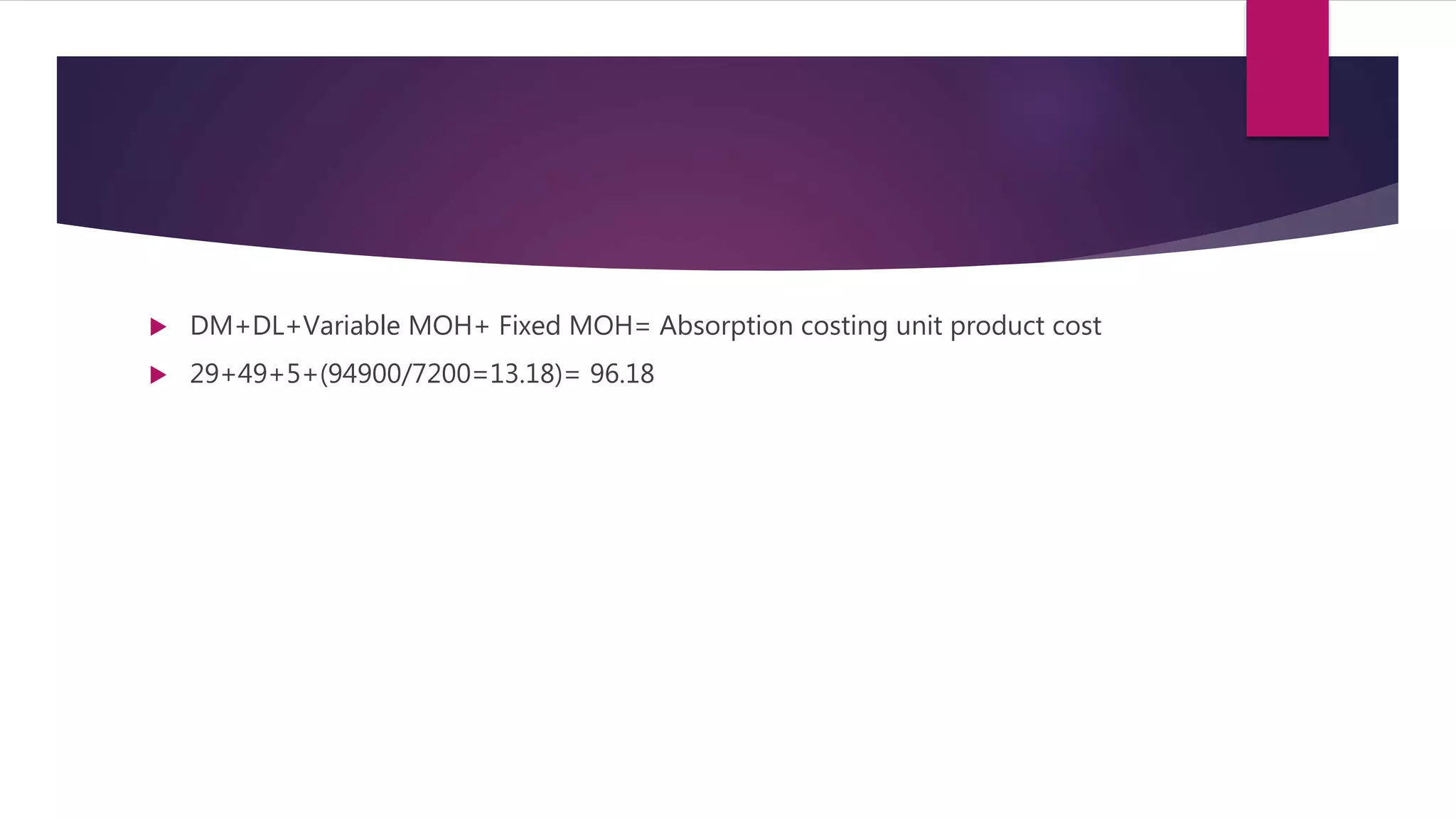

3. For a manufacturing company, the absorption costing unit product cost for the month was $96 per unit. This was calculated by taking the variable costs per unit plus the fixed manufacturing overhead costs allocated on a per unit basis.

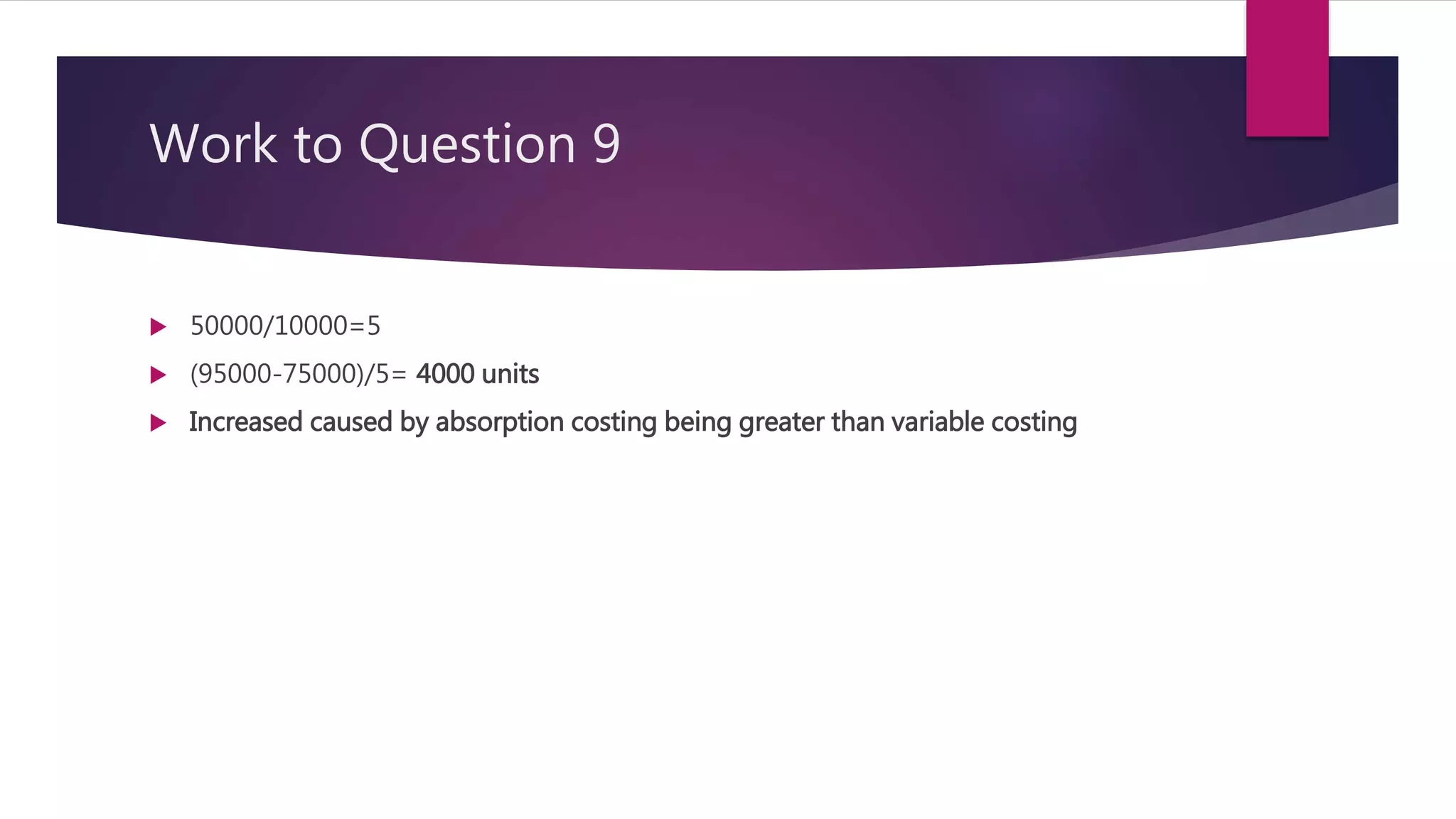

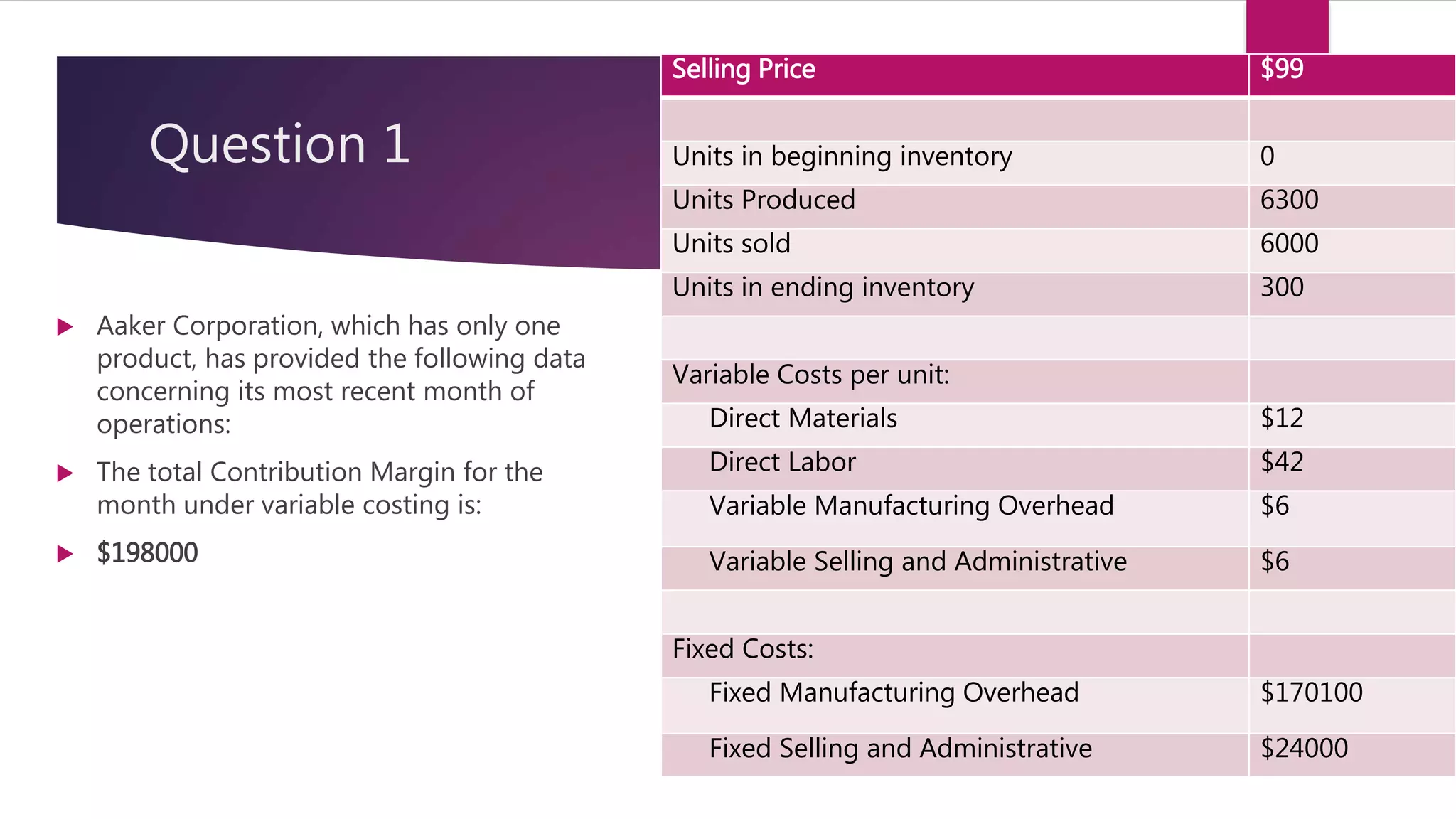

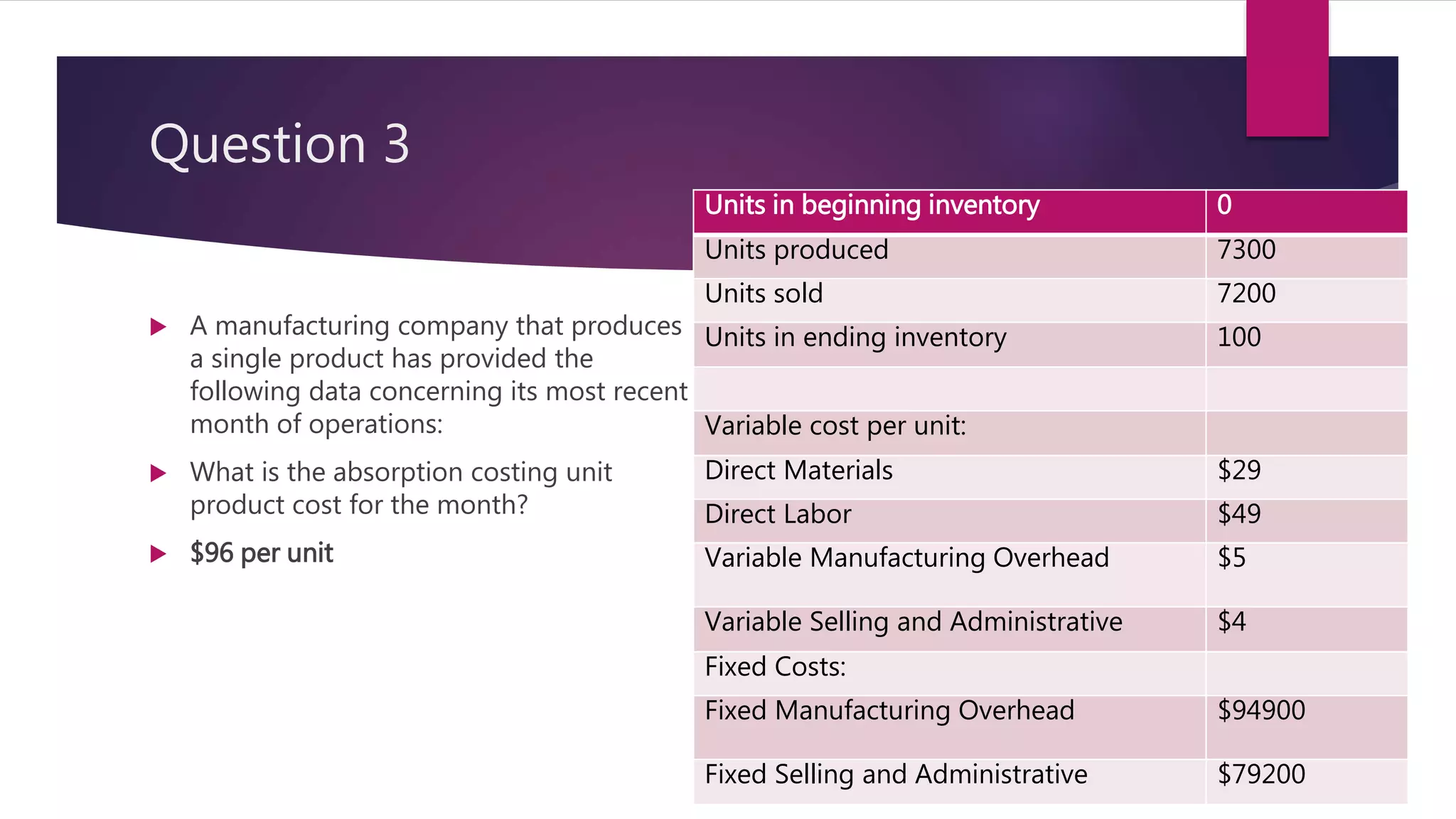

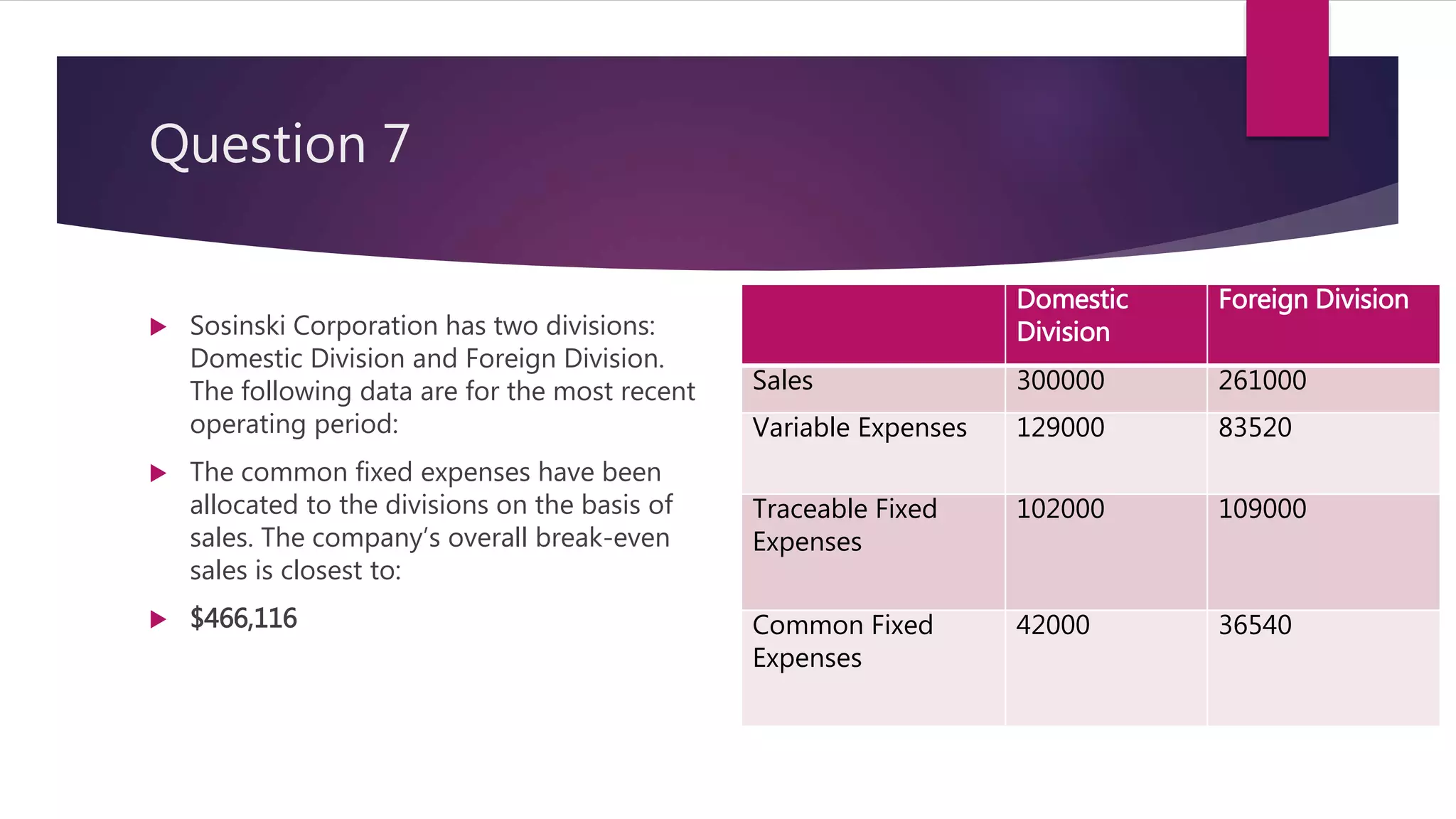

![Work to Question 7

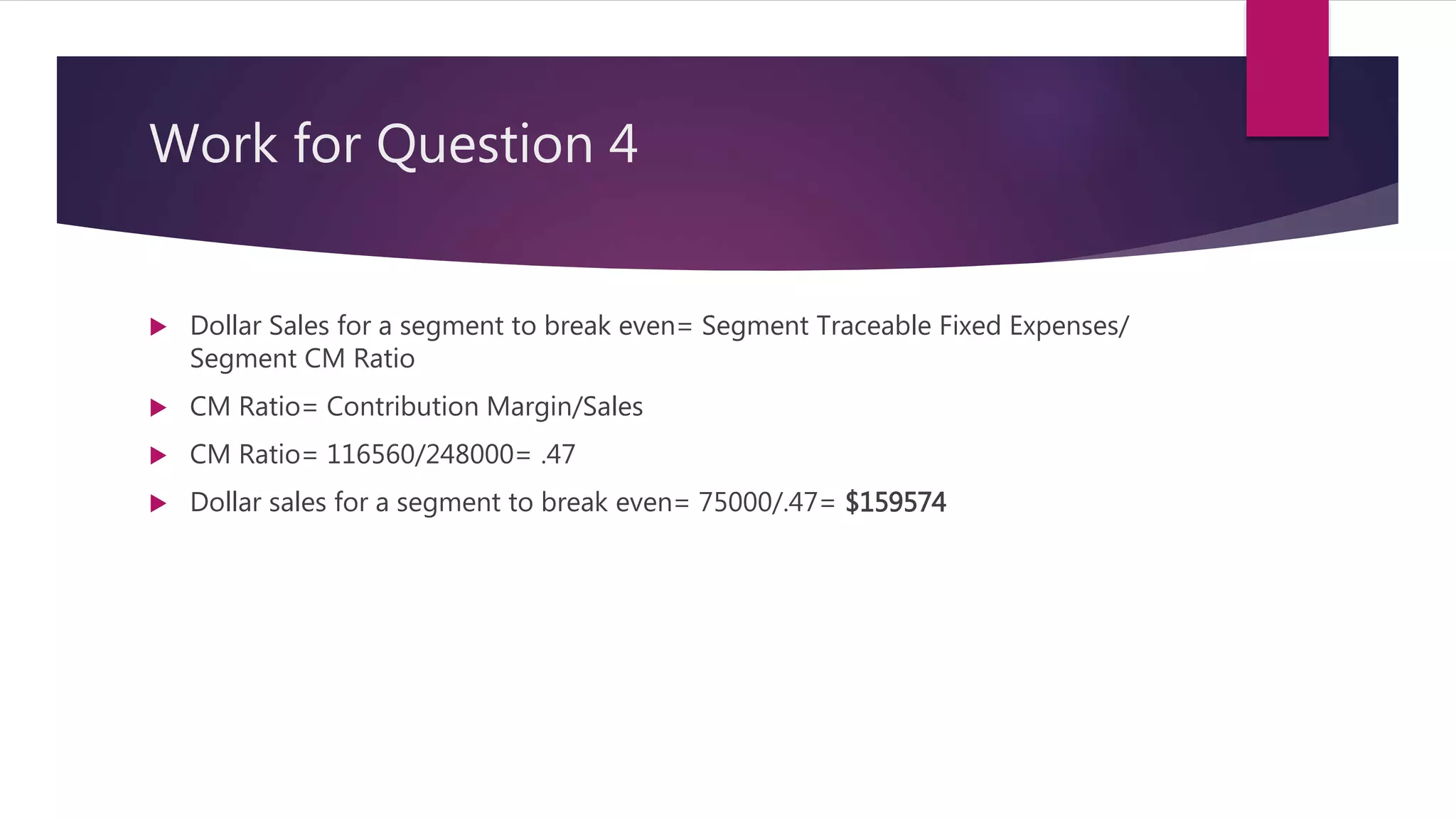

Dollar sales for company to Break Even=

(Traceable Fixed Costs+ Common Fixed Costs)/Overall CM Ratio

Overall CM Ratio= (Sales- Variable Expenses)/Sales

Overall CM Ratio= [(300000+261000)-(129000+83520)]/(300000+261000)

(561000-212520)/561000

.62

Break Even= [(102000+1090000)+(42000+36540)]/.62

(211000+78540)/.62

$466116](https://image.slidesharecdn.com/chapter6connectquiz-160316000730/75/Chapter-6-Connect-Quiz-Variable-Costing-and-Segment-Reporting-Tools-for-Management-14-2048.jpg)