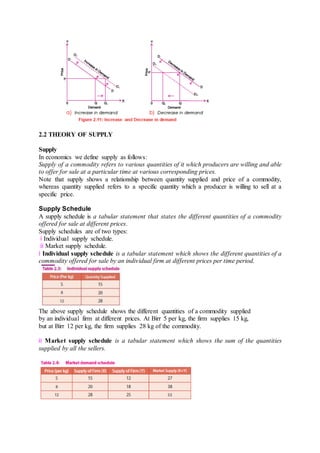

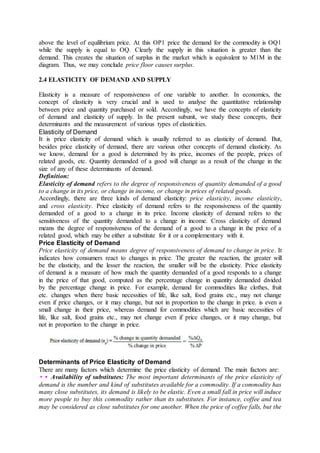

This document discusses demand, supply, and elasticity. It defines demand as the quantity of a good that consumers are willing and able to purchase at a given price. Supply is defined as the quantity of a good that producers are willing to sell at a given price. The law of demand states that, assuming other factors are constant, quantity demanded increases when price decreases and decreases when price increases. Supply curves normally slope upward, indicating that higher prices lead to greater quantity supplied. Determinants of demand and supply include price, income, prices of substitutes and complements, tastes and preferences, expectations, and others.