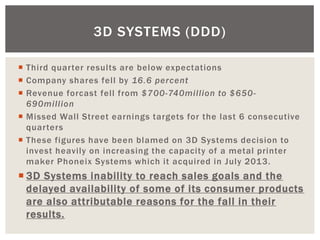

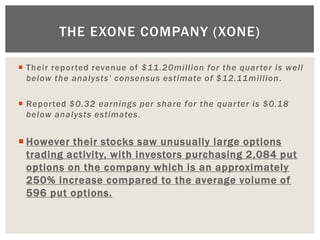

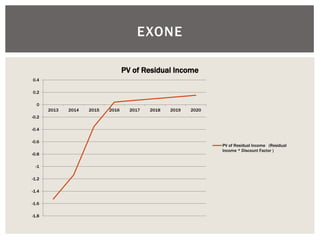

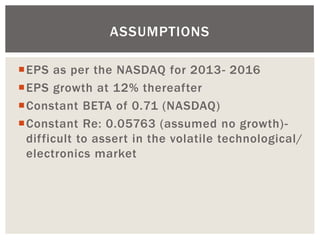

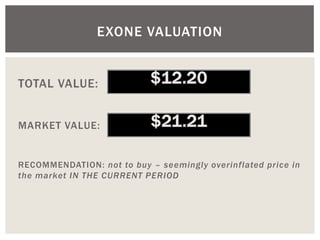

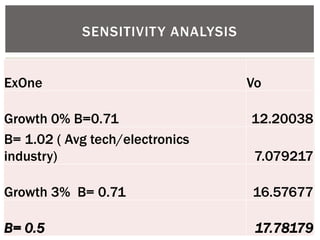

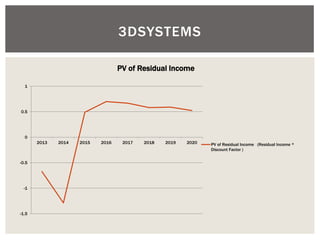

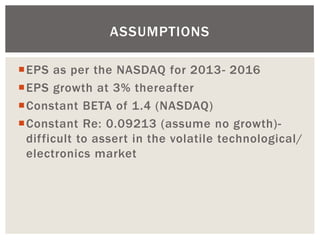

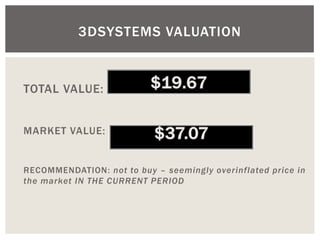

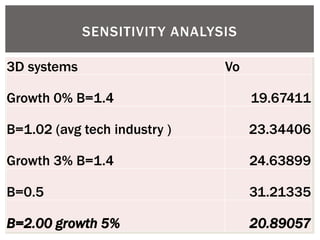

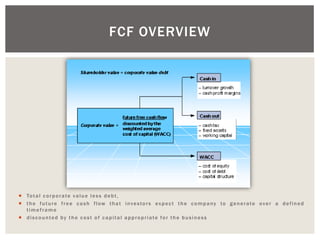

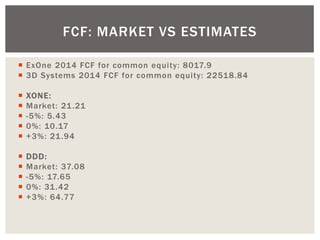

This document contains an investor report analyzing 3D printing companies 3D Systems and The ExOne Company. It provides financial information on both companies, including quarterly results, revenue forecasts, and reasons for missing earnings targets. It also includes two students' analyses of the companies, using the residual income model and discounted cash flow models to calculate intrinsic value and make investment recommendations. Both students recommend not investing currently as share prices appear overinflated compared to intrinsic value.