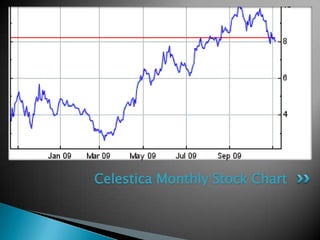

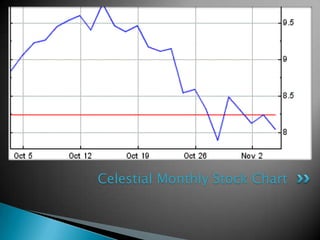

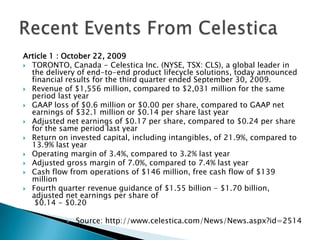

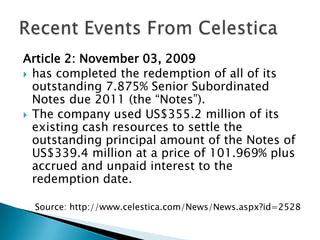

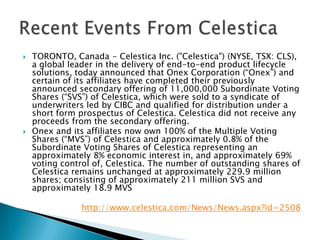

Celestica is a global electronics manufacturing services company headquartered in Toronto, Canada. It operates over 40 manufacturing sites across the Americas, Europe, and Asia. Celestica provides end-to-end product design, manufacturing, repair, and supply chain solutions for OEM customers in industries such as computing, communications, healthcare, industrial, and clean technology. In recent years, Celestica has redeemed outstanding bonds, completed a secondary offering of shares, and continued to expand its global manufacturing footprint.